Cold pain Therapy Market

Global Cold pain Therapy Market Size, Share & Trends Analysis Report by Type (Prescription products and OTC products), By Application (Sports Medicine, Post-Trauma Therapy, Musculoskeletal Disorders, Post-Operative Therapy) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global market for cold pain therapy is estimated to have significant CAGR of XX% during the forecast period. The market is mainly driven due to increasing hip and knee replacement surgeries coupled with the aging population across the globe. According to the OECD data in Germany, the total number of hip replacements surgeries was 244,496 in 2015 and that increased to 250,661 in 2016. In UK the hip replacement surgery accounted for 118,798 in 2015 and 122,917 in 2016. Sports remain the major recreation activity across the world. Due to growing health concerns, participation in sports activities has increased substantially. Running, jogging, trail running, road biking, mountain biking, hiking, and BMX are some of the major sports activities. Participation in sports activities is increasing the number of sports injuries that further spur the demand for cold pain therapy.

Segmental Outlook

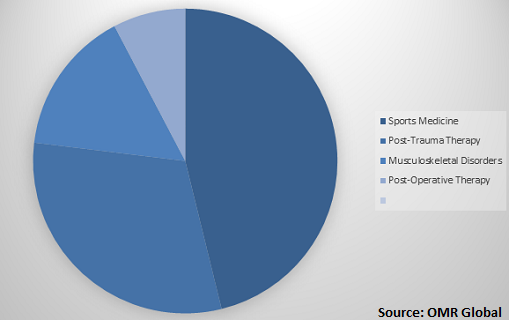

The global cold pain therapy market is segregated on the basis of type and application. On the basis of type, the market is further segmented into prescription products and OTC products. The OTC products segment is projected to have considerable growth owing to the growing demand for OTC products in gym activities and sports injuries. Based on the application, the global cold pain therapy market is further segmented into sports medicine, post-trauma therapy, musculoskeletal disorders, post-operative therapy The Sports medicine has a significant application of cold pain therapy due to the growing recreating activities such as Running, jogging, trail running, road biking, mountain biking, hiking, and BMX and others.

Global Cold pain therapy Market Share by Application, 2018(%)

Global Cold pain therapy market to be driven by Sports Medicine Application

The sports medicine application segment projected to have considerable market share in the global cold pain therapy market. The growing sports activities coupled with sports injuries further contribute to the growth of the segmental market. According to the Outdoor Foundation, the total number of people above the age of 6 years participated in sports is 142.4 million in 2015 and the number has increased to 144.4 million in 2016. As the physical activities increases, people become prone to physical injuries, thus, augmenting the demand for medical tapes and bandages. With the increasing sports activities, the market for medical cold pain therapy is estimated to grow at a substantial rate.

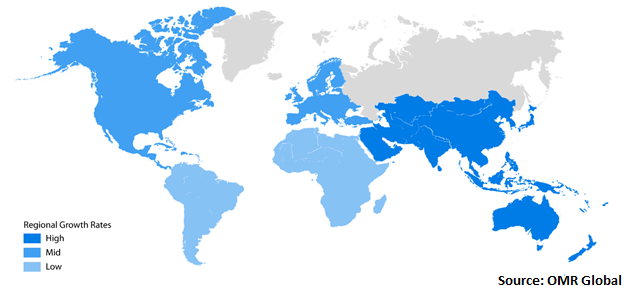

Regional Outlook

Geographically, the global cold pain therapy market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. North America is projected to have a significant market share in the global market. The growing incidence of knee and hip replacement surgeries owing to aging populations, increased per capita healthcare expenditure and the presence of major market players are driving the market in this region. US Census Bureau estimated that people aged over 65 years represented around 15% of the total population of the country in 2014. This share is further estimated to reach 21% by 2030 and 24% by 2060. Europe is one of the key contributors to the market. UK, Germany, Spain, Italy, France are the key countries that contribute to the market growth.

Global Cold pain therapy Market Growth, by Region 2019-2025

Asia-Pacific to hold a considerable growth in the global Cold pain therapy market

Geographically, Asia-Pacific is projected to have a significant market growth in the global cold pain therapy market. The major economies such as China, Australia, Japan, South Korea, India, and Singapore are significantly contributing to the growth of the market during the forecast period. An aging population coupled with the increasing number of surgeries are the major factor that contributes to the market growth. As the population of India and China grows, its expanding share of older adults is particularly notable. The United Nations Population Division projects that India’s population age 50 years and older will reach 34% by 2050. Between 2010 and 2050, the share of people aged over 65 and older is expected to increase from 5% to 14%, while the share in the oldest age group (80 and older) will triple from 1% to 3%. Furthermore, Beijing State Council Information Office is projecting that the country's aged population (above 60 years old) will reach 255 million by 2020. The country’s aging population will grow at an average rate of 6.4 million a year.

Market Players Outlook

The key players in the Cold pain therapy market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Beiersdorf AG, Breg, Inc., Bruder Healthcare Co., DJO Global, Inc. Pfizer Inc., Sanofi S.A, and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cold pain therapy market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Cold pain therapy Market by Type

5.1.1. Prescription products

5.1.2. OTC products

5.2. Global Cold pain therapy Market by Application

5.2.1. Sports Medicine

5.2.2. Post-Trauma Therapy

5.2.3. Musculoskeletal Disorders

5.2.4. Post-Operative Therapy

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Beiersdorf AG

7.2. Breg, Inc.

7.3. Bruder Healthcare Co.

7.4. DJO Global, Inc.

7.5. Erchonia Corp.

7.6. Terran, LLC (IceWraps.)

7.7. Hisamitsu Pharmaceutical Co.,Inc.

7.8. Johnson & Johnson Services, Inc.

7.9. Kinex Medical Company, LLC

7.10. Medline Industries, Inc.

7.11. Össur

7.12. Performance Health Holding, Inc.

7.13. Pfizer Inc.

7.14. Sanofi S.A

7.15. Rohto Pharmaceutical Co., Ltd.

1. GLOBAL COLD PAIN THERAPY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

2. GLOBAL PRESCRIPTION PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL OTC PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL COLD PAIN THERAPY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

5. GLOBAL COLD PAIN THERAPY IN SPORTS MEDICINE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL COLD PAIN THERAPY IN POST-TRAUMA THERAPY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL COLD PAIN THERAPY IN MUSCULOSKELETAL DISORDERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL COLD PAIN THERAPY IN POST-OPERATIVE THERAPY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL COLD PAIN THERAPY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

10. NORTH AMERICAN COLD PAIN THERAPY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN COLD PAIN THERAPY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

12. NORTH AMERICAN COLD PAIN THERAPY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

13. EUROPEAN COLD PAIN THERAPY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. EUROPEAN COLD PAIN THERAPY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

15. EUROPEAN COLD PAIN THERAPY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

16. ASIA-PACIFIC COLD PAIN THERAPY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC COLD PAIN THERAPY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC COLD PAIN THERAPY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

19. REST OF THE WORLD COLD PAIN THERAPY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

20. REST OF THE WORLD COLD PAIN THERAPY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL COLD PAIN THERAPY MARKET SHARE BY TYPE, 2018 VS 2025 (%)

2. GLOBAL COLD PAIN THERAPY MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL COLD PAIN THERAPY MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US COLD PAIN THERAPY MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA COLD PAIN THERAPY MARKET SIZE, 2018-2025 ($ MILLION)

6. UK COLD PAIN THERAPY MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE COLD PAIN THERAPY MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY COLD PAIN THERAPY MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY COLD PAIN THERAPY MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN COLD PAIN THERAPY MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE COLD PAIN THERAPY MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA COLD PAIN THERAPY MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA COLD PAIN THERAPY MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN COLD PAIN THERAPY MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC COLD PAIN THERAPY MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD COLD PAIN THERAPY MARKET SIZE, 2018-2025 ($ MILLION)