Cold Storage Construction Market

Cold Storage Construction Market Size, Share & Trends Analysis Report by Type (Production Stores, Bulk Stores, and Ports), and by Application (Food and Beverages, Medical, Chemicals, and Others) Forecast Period (2022-2030) Update Available - Forecast 2025-2035

Cold storage construction market is anticipated to grow at a CAGR of 10.6% during the forecast period. The rise in trade of perishable products across the globe acts as one of the major factors driving the growth of the cold storage construction market. When utilized to store perishable foods, cold storage has various benefits, such as reducing the rate at which perishable foods deteriorate, regulating temperature, lowering the risk of food poisoning, reducing the hassle of cooking regularly, and enabling longer-term storage of food. Hence, the rise in the number of warehouses globally, coupled with the rapid growth of the transportation and logistics industry, boost the market growth. For instance, in December 2021, the National Highways Authority of India (NHAI) under the public-private partnership (PPP) model, constructed warehousing zones on a revenue-sharing basis or for a fixed fee. The fast-moving consumer goods (FMCG) companies along with steel and cement makers will benefit from the warehousing zones as they will be able to stock inventory efficiently near major hubs. The storage facilities are built on the outskirts of major cities to avoid traffic congestion within city limits.

Segmental Outlook

The global cold storage construction market is segmented based on its type, and application. Based on type, the market is segmented into production stores, bulk stores, ports, and others. Based on application the market is categorized into food and beverages, medical, chemicals, and others.

The Food and Beverages Sub-Segment to Hold a Significant Market Share

Among the application segment, the food and beverages sub-segment is expected to grow at a significant rate during the forecast period. Fruits, vegetables, meat, fish, and dairy goods all fall under the category of perishable food items. The growing demand for perishable food products through online channels and physical stores and outlets, along with the presence of major market players drive the segment growth. For instance, in April 2022, Great Western Industrial Park (GWIP), a 3,000-acre master planned development owned and operated by The Broe Group, has selected as the site of JBS Foods' newest global food supply chain hub. Lineage Logistics, purchased the 14.86 acre GWIP parcel for the new project from The Broe Group's transportation affiliate, OmniTRAX. The new Lineage parcel will house a next-generation cold storage facility custom-built for global food leader JBS Foods. OmniTRAX will design, build and operate a custom rail solution for the new Lineage facility that unlocks bulk shipment export efficiency and enables worldwide reach.

Regional Outlooks

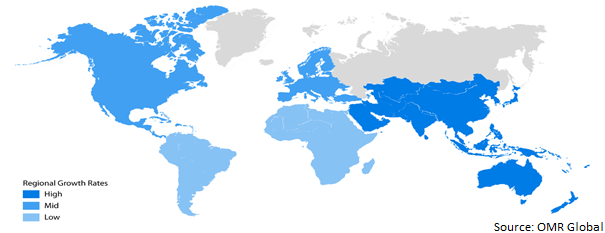

The global cold storage construction market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa and Latin America). Among these, the Asia-Pacific region is expected to hold a significant share of the market. Increasing spending on cold storage by regulatory bodies in developing economies such as China, India, and Japan, along with an increase in the manufacturing sector is bolstering the drives the market growth in the Asia-Pacific region.

Global Cold Storage Construction Market Growth, by Region 2023-2030

North America is Anticipated to Hold a Significant Share in the Global Cold Storage Construction Market

Among these regions, North America is expected to grow at a favourable rate during the projected timeperiod. The factor driving the market growth includes the increasing trade of perishable goods globally and rapid development in the frozen food sector across the region. For instance, according to the US Department of Agriculture, in 2022 the US imports $2,721.4 million worth dairy products, vegetables worth $15,754.3 million and fruits of $27,083.8 million. In addition, the increasing application of cold storage among pharmaceuticals and medical institutes to store medical devices and equipment will further boost the regional market growth. For instance, in January 2022, Ember Technologies, Inc. (Ember®) and Cardinal Health partnered to offer the self-refrigerated, cloud-based shipping box–the Ember Cube. Ember and Cardinal Health collaborated to deliver a cold chain solution that ensures product integrity and security throughout the supply chain, while significantly reducing shipping waste in the transport of temperature-sensitive medicines.

Market Players Outlook

The major companies serving the global cold storage construction market include Americold Realty Trust, Burries Logistics, Emergent Cold Management LLC, Hansen Cold Storage Construction, Lineage Logistics Holdings, LLC, NewCold, Primus Builders, Inc., Tippmann Group, and VersaCold Logistics Services and others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in July 2022, Americold Realty Trust, inaugrated its new facility in Dunkikr, New York with 181,000 square feet of cold storage and operational space. The facility has been certified by the LEED rating system (U.S. Green Building Council) with features including 25,000 pallet positions to support cold storage demand in the western New York.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cold storage construction market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Americold Realty Trust, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Hansen Cold Storage Construction LLC

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Nichirei Group

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Cold Storage Construction Market by Type

4.1.1. Production Stores

4.1.2. Bulk Stores

4.1.3. Ports

4.2. Global Cold Storage Construction Market by Application

4.2.1. Food and Beverages

4.2.2. Medical

4.2.3. Chemicals

4.2.4. Others (Industrial)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Agro Merchants Group, LLC

6.2. Burris Logistics

6.3. Dreisbach Enterprises

6.4. Emergent Cold LatAm Management LLC

6.5. Frialsa Frigoríficos S.A. de C.V.

6.6. Gruppo Marconi Logistica E Trasporti Srl

6.7. Henningsen Cold Storage Co.

6.8. Interstate Cold Storage Inc.

6.9. Kloosterboer Group B.V

6.10. Lineage Logistics Holdings, LLC

6.11. Millard Refrigerated Services, LLC

6.12. NewCold

6.13. Nordic Logistics and Warehousing, LLC

6.14. Preferred Meals

6.15. Primus Builders, Inc.

6.16. Tippmann Group

6.17. United States Cold Storage, Inc.

6.18. VersaCold Logistics Services

1. GLOBAL COLD STORAGE CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

2. GLOBAL PRODUCTION STORES IN COLD STORAGE CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL BULK STORES IN COLD STORAGE CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL PORTS IN COLD STORAGE CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL COLD STORAGE CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

6. GLOBAL COLD STORAGE CONSTRUCTION FOR FOOD AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL COLD STORAGE CONSTRUCTION FOR MEDICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL COLD STORAGE CONSTRUCTION FOR CHEMICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL COLD STORAGE CONSTRUCTION FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL COLD STORAGE CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. NORTH AMERICAN COLD STORAGE CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

12. NORTH AMERICAN COLD STORAGE CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

13. NORTH AMERICAN COLD STORAGE CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

14. EUROPEAN COLD STORAGE CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. EUROPEAN COLD STORAGE CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

16. EUROPEAN COLD STORAGE CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

17. ASIA-PACIFIC COLD STORAGE CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

18. ASIA-PACIFIC COLD STORAGE CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

19. ASIA-PACIFIC COLD STORAGE CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

20. REST OF THE WORLD COLD STORAGE CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

21. REST OF THE WORLD COLD STORAGE CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

22. REST OF THE WORLD COLD STORAGE CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL COLD STORAGE CONSTRUCTION MARKET SHARE BY TYPE, 2022 VS 2030 (%)

2. GLOBAL PRODUCTION STORES IN COLD STORAGE CONSTRUCTION MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL BULK STORES IN COLD STORAGE CONSTRUCTION MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL PORTS IN COLD STORAGE CONSTRUCTION MARKET SHARE REGION, 2022 VS 2030 (%)

5. GLOBAL COLD STORAGE CONSTRUCTION MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

6. GLOBAL COLD STORAGE CONSTRUCTION FOR FOOD AND BEVERAGES MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL COLD STORAGE CONSTRUCTION FOR MEDICAL MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL COLD STORAGE CONSTRUCTION FOR CHEMICALS MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL COLD STORAGE CONSTRUCTION FOR OTHER APPLICATIONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL COLD STORAGE CONSTRUCTION MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. US COLD STORAGE CONSTRUCTION MARKET SIZE, 2022-2030 ($ MILLION)

12. CANADA COLD STORAGE CONSTRUCTION MARKET SIZE, 2022-2030 ($ MILLION)

13. UK COLD STORAGE CONSTRUCTION MARKET SIZE, 2022-2030 ($ MILLION)

14. FRANCE COLD STORAGE CONSTRUCTION MARKET SIZE, 2022-2030 ($ MILLION)

15. GERMANY COLD STORAGE CONSTRUCTION MARKET SIZE, 2022-2030 ($ MILLION)

16. ITALY COLD STORAGE CONSTRUCTION MARKET SIZE, 2022-2030 ($ MILLION)

17. SPAIN COLD STORAGE CONSTRUCTION MARKET SIZE, 2022-2030 ($ MILLION)

18. REST OF EUROPE COLD STORAGE CONSTRUCTION MARKET SIZE, 2022-2030 ($ MILLION)

19. INDIA COLD STORAGE CONSTRUCTION MARKET SIZE, 2022-2030 ($ MILLION)

20. CHINA COLD STORAGE CONSTRUCTION MARKET SIZE, 2022-2030 ($ MILLION)

21. JAPAN COLD STORAGE CONSTRUCTION MARKET SIZE, 2022-2030 ($ MILLION)

22. SOUTH KOREA COLD STORAGE CONSTRUCTION MARKET SIZE, 2022-2030 ($ MILLION)

23. REST OF ASIA-PACIFIC COLD STORAGE CONSTRUCTION MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF THE WORLD COLD STORAGE CONSTRUCTION MARKET SIZE, 2022-2030 ($ MILLION)