Collagen and Gelatin Market

Collagen and Gelatin Market Size, Share & Trends Analysis Report bySource (Bovine and Porcine), by Application (Orthopedic, Wound Care, Dental, Cosmetics, Surgical and Cardiovascular Disease), and by End-User (Hospitals and Surgical Centers) Forecast Period (2024-2031)

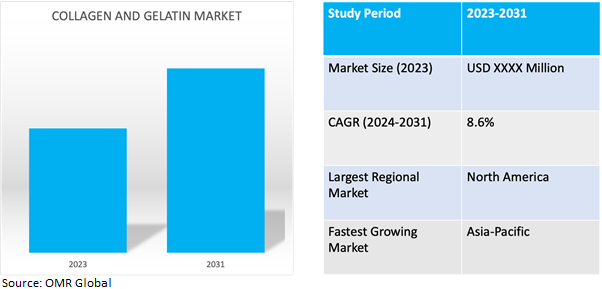

Collagen and gelatin market is anticipated to grow at a considerable CAGR of 8.6% during the forecast period (2024-2031). Collagen and gelatin are protein-based substances derived from animal sources, primarily connective tissues, bones, and skin. They are widely used across various industries, including food and beverage, pharmaceuticals, cosmetics, and healthcare.

Market Dynamics

Innovative Solutions: Advancing the Collagen and Gelatin Market through Technological Breakthroughs

In the collagen and gelatin market, technological advancements drive innovation, shaping the development of new products and production methods. Advanced processing techniques enable the creation of collagen peptides with enhanced properties, expanding their applications in various industries. Sustainable production practices, facilitated by novel extraction methods, promote environmental responsibility while meeting growing demand. Additionally, technological innovation supports quality control measures, ensuring product safety and compliance with regulatory standards throughout the manufacturing process. For instance, in January 2023, TELA Bio, Inc. unveiled the NIVIS Fibrillar Collagen Pack, a novel absorbent matrix of Type I and Type III bovine collagen designed for managing moderately to heavily exudating wounds and controlling minor bleeding.

Elevating Wellness: The Surge in Demand for Collagen and Gelatin Products Driven by Consumer Awareness

Rising consumer awareness of health, wellness, and sustainability is driving demand for collagen and gelatin-based products. Consumers seek clean-label, natural ingredients, prompting manufacturers to develop products that align with these preferences. Collagen and gelatin are increasingly recognized for their beneficial effects on skin health, joint function, and overall vitality, appealing to health-conscious consumers. Effective marketing strategies and educational efforts further enhance consumer understanding of the benefits and applications of collagen and gelatin, contributing to market growth and expansion. For instance, in May 2022, Vital Proteins captured attention with the launch of a new brand campaign featuring Chief Creative Officer Jennifer Aniston and the introduction of VITAL PROTEINS & JENNIFER ANISTON BARS, enticing consumers to embrace health-enhancing products.

Market Segmentation

Our in-depth analysis of the global Collagen and Gelatin market includes the following segments by source, application, and end-user:

- Based on source, the market is sub-segmented into bovine and porcine.

- Based on application, the market is sub-segmented into orthopaedic, wound care, dental, cosmetics, surgical and cardiovascular disease.

- Based on end-user, the market is sub-segmented into hospitals and surgical centres.

Orthopaedic is Projected to Emerge as the Largest Segment

Based on the application, the global collagen and gelatin market is sub-segmented into orthopaedic, wound care, dental, cosmetics, surgical and cardiovascular disease. Among these, the orthopaedic sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing prevalence of musculoskeletal disorders and injuries globally. Orthopaedic applications of collagen and gelatin, such as bone grafts, cartilage repair, and wound healing, are crucial in addressing conditions such as osteoarthritis, fractures, and ligament injuries. As the ageing population grows and lifestyles become more sedentary, the incidence of orthopaedic conditions rises, driving demand for collagen and gelatin-based orthopaedic solutions.

Hospitals Sub-segment to Hold a Considerable Market Share

The Hospitals sub-segment holds a significant market share in the global collagen and gelatin market due to its pivotal role as a primary healthcare provider. With a high volume of patients seeking specialized treatments, hospitals rely extensively on collagen and gelatin-based products for surgical procedures, wound care, and trauma management. Equipped with advanced medical technologies and staffed by skilled healthcare professionals, hospitals offer efficient utilization of these materials, ensuring safe and effective patient care. For instance, in March 2022, Pura Collagen, a UK-based supplement producer, unveiled Pura Collagen Protect, featuring Bioactive Collagen Peptides Immupept to provide consumers with immune support, reduce fatigue, and enhance cognitive function through high-strength vitamins and minerals.

Regional Outlook

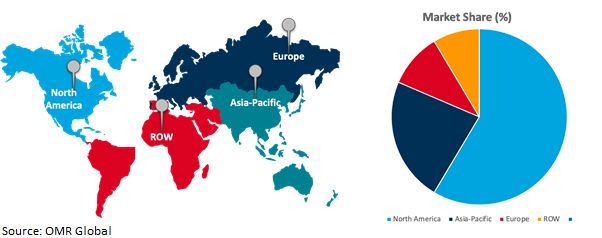

The globalcollagen and gelatinmarket is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific to Exhibit the Highest CAGR

Asia-Pacific is the fastest-growing market in the global collagen and gelatin industry due to its burgeoning population, particularly in countries like China and India, that drives substantial demand for collagen and gelatin-based products across various sectors. As lifestyles evolve and disposable incomes rise, consumers prioritize health and wellness, propelling the demand for natural ingredients like collagen and gelatin. Urbanization and changing dietary preferences further boost the consumption of collagen and gelatin-enriched products in Asia-Pacific. Additionally, the region's expanding healthcare infrastructure and ageing population contribute to the demand for collagen and gelatin-based medical solutions. For instance, In November 2022, Chennai-based skincare retailer CHOSEN launched TOR Beaut Fish Collagen, a potent collagen powder with the added benefit of enhancing skin hydration and reducing wrinkles to promote clearer skin.

Global Collagen and Gelatin Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share due to its well-established food and beverage industry, where collagen and gelatin are extensively used for their functional properties. Additionally, North America's sophisticated healthcare infrastructure drives demand for collagen and gelatin in pharmaceutical and medical applications. High consumer awareness of health and wellness further boosts demand for collagen and gelatin-based supplements and skincare products. For instance, in October 2022, Collagen Matrix made strides by acquiring Polyganics B.V. and expanding its repertoire of bioresorbable solutions and technology platforms tailored for bone and tissue repair applications.

Market Players

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global collagen and gelatin market includeZimmer Biomet, Ashland Inc., DSM, Integra LifeSciences Corp., Colllnt Biotechnologies Ltd., and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in October 2022, Darling Ingredients Inc. made significant strides by acquiring Genex, an ingredients manufacturer specializing in collagen production from grass-fed cattle, positioning itself as a leading provider of collagen products valued at $1.2 billion for the skincare and supplement industries.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global collagen and gelatin market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Ashland Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. DSM

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Zimmer Biomet

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Collagen and Gelatin Market by Source

4.1.1. Bovine

4.1.2. Porcine

4.2. Global Collagen and Gelatin Market by Application

4.2.1. Orthopedic

4.2.2. Wound Care

4.2.3. Dental

4.2.4. Cosmetics

4.2.5. Surgical

4.2.6. Cardiovascular Disease

4.3. Global Collagen and Gelatin Market by End-User

4.3.1. Hospitals

4.3.2. Surgical Centers

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.5. Latin America

5.6. The Middle East & Africa

6. Company Profiles

6.1. Collagen Solutions (US) LLC

6.2. Colllnt Biotechnologies Ltd.

6.3. Geistlich Pharma AG

6.4. Gelita AG

6.5. Integra LifeSciences Corp.

6.6. Jellagen

6.7. Matricel GMBH

6.8. Nitta Gelatin Inc.

6.9. Tessenderlo Group nv

6.10. Darling Ingredients International Holding B.V.

6.11. SYMATESE GROUP

6.12. SAS GelatinesWeishardt

6.13. Xiamen Hyfine Gelatin (LUOHE HONGPU GELATIN CO., LTD.)

1. GLOBAL COLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

2. GLOBAL BOVINE BASED COLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL PORCINE BASED COLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL COLLAGEN AND GELATIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

5. GLOBAL COLLAGEN AND GELATIN FOR ORTHOPEDICMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBALCOLLAGEN AND GELATINFOR WOUND CAREMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL COLLAGEN AND GELATIN FOR DENTALMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL COLLAGEN AND GELATIN FOR COSMETICSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL COLLAGEN AND GELATIN FOR SURGICALMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL COLLAGEN AND GELATIN FOR CARDIOVASCULAR DISEASEMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL COLLAGEN AND GELATIN MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

12. GLOBAL HOSPITALS IN COLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL SURGICAL CENTERS IN COLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL COLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN COLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN COLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN COLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN COLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY END-USER,2023-2031 ($ MILLION)

19. EUROPEAN COLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. EUROPEAN COLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

21. EUROPEAN COLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

22. EUROPEAN COLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC COLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. ASIA-PACIFICCOLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

25. ASIA-PACIFICCOLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

26. ASIA-PACIFICCOLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

27. REST OF THE WORLD COLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD COLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

29. REST OF THE WORLD COLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD COLLAGEN AND GELATINMARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL COLLAGEN AND GELATINMARKETSHARE BY SOURCE, 2023 VS 2031 (%)

2. GLOBAL BOVINE BASED COLLAGEN AND GELATINMARKETSHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL PORCINE BASED COLLAGEN AND GELATINMARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL COLLAGEN AND GELATINMARKET SHAREBY APPLICATION, 2023 VS 2031 (%)

5. GLOBAL COLLAGEN AND GELATINFOR ORTHOPEDICMARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBALCOLLAGEN AND GELATINFOR WOUND CAREMARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL COLLAGEN AND GELATIN FOR DENTALMARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL COLLAGEN AND GELATIN FOR COSMETICSMARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL COLLAGEN AND GELATIN FOR SURGICALMARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL COLLAGEN AND GELATIN FOR CARDIOVASCULAR DISEASE MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL COLLAGEN AND GELATINMARKET SHAREBY END-USER, 2023 VS 2031 (%)

12. GLOBAL HOSPITALS IN COLLAGEN AND GELATINMARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL SURGICAL CENTERS INCOLLAGEN AND GELATINMARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL THERMOCHEMICAL IN COLLAGEN AND GELATINMARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL COLLAGEN AND GELATINMARKETSHARE BY REGION, 2023 VS 2031 (%)

16. US COLLAGEN AND GELATINMARKET SIZE, 2023-2031 ($ MILLION)

17. CANADA COLLAGEN AND GELATINMARKET SIZE, 2023-2031 ($ MILLION)

18. UK COLLAGEN AND GELATINMARKET SIZE, 2023-2031 ($ MILLION)

19. FRANCE COLLAGEN AND GELATINMARKET SIZE, 2023-2031 ($ MILLION)

20. GERMANY COLLAGEN AND GELATINMARKET SIZE, 2023-2031 ($ MILLION)

21. ITALY COLLAGEN AND GELATINMARKET SIZE, 2023-2031 ($ MILLION)

22. SPAIN COLLAGEN AND GELATINMARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF EUROPE COLLAGEN AND GELATINMARKET SIZE, 2023-2031 ($ MILLION)

24. INDIA COLLAGEN AND GELATINMARKET SIZE, 2023-2031 ($ MILLION)

25. CHINA COLLAGEN AND GELATINMARKET SIZE, 2023-2031 ($ MILLION)

26. JAPAN COLLAGEN AND GELATINMARKET SIZE, 2023-2031 ($ MILLION)

27. SOUTH KOREA COLLAGEN AND GELATINMARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF ASIA-PACIFIC COLLAGEN AND GELATINMARKET SIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICACOLLAGEN AND GELATINMARKET SIZE, 2023-2031 ($ MILLION)

30. MIDDLE EAST AND AFRICACOLLAGEN AND GELATINMARKET SIZE, 2023-2031 ($ MILLION)