Commercial/Corporate Card Market

Commercial/Corporate Card Market Size, Share & Trends Analysis Report by Product Type (Purchase Cards, Business Cards, Travel & Entertainment Cards, and Gift Cards), by Card Type (Open-loop Cards, and Closed-loop Cards), and by End-User (Small & Mid-sized Enterprises, and Large Enterprises) Forecast Period (2023-2029) Update Available - Forecast 2025-2035

Commercial/corporate card market is anticipated to grow at a considerable CAGR of 7.5% during the forecast period. The major factor bolstering the market growth includes the increasing number of connected and digitally active consumers. The rising adoption of smartphones and the significant rise in the number of internet users are some of the key factors that are accelerating market growth. Further, the growing investment in companies and startups offering commercial/corporate cards is anticipated to drive the market growth of the commercial/corporate card market. For instance in October 2022, Mercantile, a new fintech startup that offers credit cards to small businesses, received a $15 million funding round. Through these funds, the company aims to leverage new technologies to its business for growth.

Segmental Outlook

The global commercial/corporate card market is segmented based on its product type, card type, and end-user. Based on its product type, the market is sub-segmented into purchase cards, business cards, travel & entertainment cards, and gift cards. Based on the card type, the market is bifurcated into open-loop cards and closed-loop cards. Further, based on the end-user, the market is augmented into small & mid-sized enterprises, and large enterprises. Among the end-user segment, large enterprises are anticipated to hold a prominent market share, owing to an increased usage of commercial cards across the regions.

Among the product type, the purchase cards sub-segment is anticipated to register significant growth over the forecast period. A purchasing card (P-Card) is a type of commercial card that allows organizations to take advantage of the existing credit card infrastructure to make e-payments for a variety of business expenses (goods and services). It streamlines the procure-to-pay process, further allowing organizations to buy goods and services quickly, reduce transaction costs, track expenses, take advantage of supplier discounts, reduce or redirect staff in the purchasing and accounts payable departments, reduce or eliminate irrelevant cash, and others. Thus, all such benefits offered by the purchase cards are anticipated to propel the demand for purchase cards during the forecast period.

Regional Outlooks

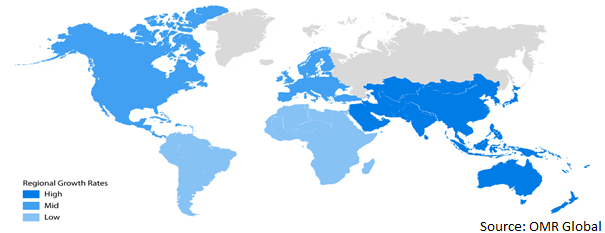

The global commercial/corporate card market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the European regional market is anticipated to cater to prominent growth over the forecast period. However, the Asia-Pacific region is projected to experience considerable growth in the commercial/corporate card market, due to the growing use of card payments for purchases made by companies and enterprises.

Global Commercial/Corporate Card Market Growth, by Region 2023-2029

North America is Anticipated to Hold a Significant Share of the Global Commercial/corporate card Market

Among these regions, North America is anticipated to account for a significant share of the commercial/corporate card market during the forecast period. The growth of the regional market is primarily driven by the presence of a large number of key players, which are continuously adopting different strategies such as mergers, acquisitions, and the launch of new products for a competitive advantage over other players. For instance, in July 2022, WEX Inc. announced to acquire Exxon Mobil Business Card program. Upon completion of the acquisition, all of ExxonMobil’s commercial card portfolio will be consolidated and administered by WEX. The Exxon Mobil BusinessPro program provides convenience, security, and control for small businesses. The program also supports a private label, revolving credit card offering which can be used at over 12,000 Exxon and Mobil locations in the US, and Canada.

Market Players Outlook

The major companies serving the global commercial/corporate card market include AirPlus International Ltd., Amazon.com, Inc., American Express Co., Bank of America Corp., Citigroup, Inc., JP Morgan Chase & Co. Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in March 2022, Private lender Axis Bank acquired Citi India’s retail assets, valuing the business at nearly $2 billion. Citi's consumer banking business comprises credit cards, retail banking, home loans, and wealth management. It has 2.9 million retail customers, 1.2 million bank accounts, and nearly 2.7 million credit cardholders in India. It operates nearly 35 branches in the country. The acquisition will support Axis bank to expand its customer base.

The Report Covers

- Market value data analysis of 2021 and forecast to 2029.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global commercial/corporate card market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Commercial/Corporate Card Market by Product Type

4.1.1. Purchase Cards

4.1.2. Business Cards

4.1.3. Gift Cards

4.1.4. Travel & Entertainment Cards

4.2. Global Commercial/Corporate Card Market by Card Type

4.2.1. Open-loop Cards

4.2.2. Closed-loop Cards

4.3. Global Commercial/Corporate Card Market by End-User

4.3.1. Small & Mid-sized Enterprises

4.3.2. Large Enterprises

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AirPlus International Ltd.

6.2. Amazon.com, Inc.

6.3. American Express CompanyCo.

6.4. Bank of America Corp.

6.5. Bank of China Ltd.

6.6. Citigroup, Inc.

6.7. Corporate Spending Innovations Enterprises, Inc.

6.8. JP Morgan Chase & Co. Inc.

6.9. NGC US, LLC

6.10. U.S. Bancorp, Wex Inc.

6.11. Wells Fargo & Co.

1. GLOBAL COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

2. GLOBAL COMMERCIAL/CORPORATE PURCHASE CARDS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL COMMERCIAL/CORPORATE BUSINESS CARDS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL COMMERCIAL/CORPORATE TRAVEL & ENTERTAINMENT CARDS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL COMMERCIAL/CORPORATE GIFT CARDS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY CARD TYPE, 2021-2028 ($ MILLION)

7. GLOBAL OPEN-LOOP COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL CLOSED-LOOP COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

10. GLOBAL COMMERCIAL/CORPORATE CARD FOR SMALL & MID-SIZED ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL COMMERCIAL/CORPORATE CARD FOR LARGE ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. NORTH AMERICAN COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

15. NORTH AMERICAN COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY CARD TYPE, 2021-2028 ($ MILLION)

16. NORTH AMERICAN COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

17. EUROPEAN COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. EUROPEAN COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

19. EUROPEAN COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY CARD TYPE, 2021-2028 ($ MILLION)

20. EUROPEAN COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY CARD TYPE, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

25. REST OF THE WORLD COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

26. REST OF THE WORLD COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

27. REST OF THE WORLD COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY CARD TYPE, 2021-2028 ($ MILLION)

28. REST OF THE WORLD COMMERCIAL/CORPORATE CARD MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. GLOBAL COMMERCIAL/CORPORATE CARD MARKET SHARE BY PRODUCT TYPE, 2021 VS 2028 (%)

2. GLOBAL COMMERCIAL/CORPORATE PURCHASE CARDS MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL COMMERCIAL/CORPORATE BUSINESS CARDS MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL COMMERCIAL/CORPORATE TRAVEL & ENTERTAINMENT CARDS BY MARKET SHARE REGION, 2021 VS 2028 (%)

5. GLOBAL COMMERCIAL/CORPORATE GIFT CARDS BY MARKET SHARE REGION, 2021 VS 2028 (%)

6. GLOBAL COMMERCIAL/CORPORATE CARD MARKET SHARE BY CARD TYPE, 2021 VS 2028 (%)

7. GLOBAL OPEN-LOOP COMMERCIAL/CORPORATE CARD MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL CLOSED-LOOP COMMERCIAL/CORPORATE CARD MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL COMMERCIAL/CORPORATE CARD MARKET SHARE BY END-USER, 2021 VS 2028 (%)

10. GLOBAL COMMERCIAL/CORPORATE CARD FOR SMALL & MID-SIZED ENTERPRISES MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL COMMERCIAL/CORPORATE CARD FOR LARGE ENTERPRISES MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL COMMERCIAL/CORPORATE CARD MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. US COMMERCIAL/CORPORATE CARD MARKET SIZE, 2021-2028 ($ MILLION)

14. CANADA COMMERCIAL/CORPORATE CARD MARKET SIZE, 2021-2028 ($ MILLION)

15. UK COMMERCIAL/CORPORATE CARD MARKET SIZE, 2021-2028 ($ MILLION)

16. FRANCE COMMERCIAL/CORPORATE CARD MARKET SIZE, 2021-2028 ($ MILLION)

17. GERMANY COMMERCIAL/CORPORATE CARD MARKET SIZE, 2021-2028 ($ MILLION)

18. ITALY COMMERCIAL/CORPORATE CARD MARKET SIZE, 2021-2028 ($ MILLION)

19. SPAIN COMMERCIAL/CORPORATE CARD MARKET SIZE, 2021-2028 ($ MILLION)

20. REST OF EUROPE COMMERCIAL/CORPORATE CARD MARKET SIZE, 2021-2028 ($ MILLION)

21. INDIA COMMERCIAL/CORPORATE CARD MARKET SIZE, 2021-2028 ($ MILLION)

22. CHINA COMMERCIAL/CORPORATE CARD MARKET SIZE, 2021-2028 ($ MILLION)

23. JAPAN COMMERCIAL/CORPORATE CARD MARKET SIZE, 2021-2028 ($ MILLION)

24. SOUTH KOREA COMMERCIAL/CORPORATE CARD MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF ASIA-PACIFIC COMMERCIAL/CORPORATE CARD MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD COMMERCIAL/CORPORATE CARD MARKET SIZE, 2021-2028 ($ MILLION)