Commercial Satellite Imaging Market

Commercial Satellite Imaging Market Size, Share & Trends Analysis Report by Type (Visible Imagery, Infrared Imagery, and Water Vapor Imagery), by Application (Geospatial Data Acquisition and Mapping, Natural Resource Management, Surveillance and Security, Construction and Development, Disaster Management, Defense and Intelligence, and Others (Energy Generation), and by End User (Government, Construction, Transportation and Logistics, Military and Defense, Energy, Forestry and Agriculture, Other) Forecast Period (2022-2030) Update Available - Forecast 2025-2035

Commercial satellite imaging market is anticipated to grow at a CAGR of 11.3% during the forecast period. The increasing requirement for efficient monitoring of vast land areas is one of the key drivers for the commercial satellite imaging market. Commerical satellite imagery provide detailed data and accurate information about land use, vegetation, and other features, which is used for a wide range of applications such as agriculture, urban planning, natural resource management, and environmental monitoring. In addition, increasing the use of commercial satellite imagery for various smart city initiatives, and integration of technological advancements such as the Internet of Things (IoT), will further drive the market growth. For instance, in December 2022, the Dubai Electricity and Water Authority (DEWA) launched its first satellite DEWA-SAT1, to develop IoT terminals to support the new satellite IoT network. It is an ambitious and far-reaching project to use satellites to provide connectivity anywhere in the world to enhance the operations of water and electricity networks. This is a truly innovative initiative to revolutionise the global utilities sector.

Segmental Outlook

The global commercial satellite imaging market is segmented based on its type, application, and end user. Based on type, the market is segmented into visible imagery, infrared imagery, and water vapor imagery. Based on application, the market is categorized into geospatial data acquisition and mapping, natural resource management, surveillance and security, construction and development, disaster management, defense and intelligence, and others. Based on end user, the market is divided into government, construction, transportation and logistics, military and defense, energy, forestry and agriculture, other. Based on type, the water vapor imagery segment is anticipated to grow at a significant rate. Water vapor imagery is used to track lower tropospheric winds, identify jet streaks, monitor severe weather potential, estimate lower-level moisture, identify regions where the potential for turbulence exists.

The Geospatial Segment is Projected to Grow at a Favourable Rate

The geospatial segment is anticipated to grow at a favourable rate. Increasing satellite and geospatial images to assess various economic phenomena, including urbanization, environmental impact, infrastructure, and farming practices, drive segment growth. In addition, the market players such as Cloudeo, MDA, Planet Labs PB Care, and others are offering geospatial imagery solutions by adopting new strategies such as partnership, collaboration, and new product offerings. For instance, in March 2023, Cloudeo, partnered with Globhe, to expand its geospatial products offered through the Cloudeo marketplace. By aggregating satellite imagery and drone data into the company’s daily operations, they take direct action to mitigate risks, plan their operations and estimate projections for the future.

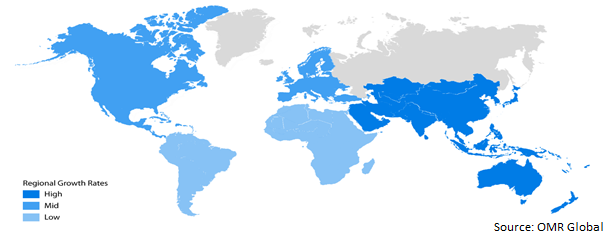

Regional Outlooks

The global commercial satellite imaging market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the North America region is expected to experience significant growth in the commercial satellite imaging market. The growth is mainly augmented owing to an increase in the adoption of commercial satellite imaging among end user industries such as by government and military authorities for map creation, military recognition, urban planning, and disaster management, among others.

Global Commercial Satellite Imaging Market Growth, by Region 2023-2030

The Asia-Pacific Region Holds a Prominent Market Share in the Global Commercial Satellite Imaging Market

Based on region, Asia-Pacific is expected to grow at a favourable rate. The market growth is driven by the integration trend of Artificial Intelligence (AI) and the increase in satellite imaging applications in sectors such as government, manufacturing, retail, transportation, defense, construction, and healthcare. For instance, in August 2021, UP42 partnered with Indian startup HyperVerge to offer satellite imagery services using change detection algorithms based on artificial intelligence (AI). The satellite imagery detects small structural changes to homes and properties for local government tax assessment and code enforcement. They will also help monitor legal and unauthorized construction of roads, buildings and artificial islands in remote regions by federal or defence agencies, and keep GIS maps updated in rapidly growing urban areas. The automated algorithms will detect these changes with a high degree of accuracy by comparing two images acquired on different dates.

Market Players Outlook

The major companies serving the global commercial satellite imaging market include Airbus SAS, MDA, Imagesat International (I.S.I) Ltd.’s and others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in December 2022, SI Imaging Services announced that it signed an MOU with Terra Cover. Through this agreement, the two companies focus on various technology businesses using satellite imagery data. The agreement aims to automate the production of DEMs (Digital Elevation Models) derived from satellite imagery and used in various fields such as administration, environment, agriculture, forestry, disaster prevention, national defense, and so on.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global commercial satellite imaging market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Airbus SAS

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. BlackSky

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Imagesat International (I.S.I) Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. MDA

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Commercial Satellite Imaging Market by Type

4.1.1. Visible Imagery

4.1.2. Infrared Imagery

4.1.3. Water Vapor Imagery

4.2. Global Commercial Satellite Imaging Market by Application

4.2.1. Geospatial Data Acquisition and Mapping

4.2.2. Natural Resource Management

4.2.3. Surveillance and Security

4.2.4. Construction and Development

4.2.5. Disaster Management

4.2.6. Defense and Intelligence

4.2.7. Others (Energy Generation)

4.3. Global Commercial Satellite Imaging Market by End User

4.3.1. Government

4.3.2. Construction

4.3.3. Transportation and Logistics

4.3.4. Military and Defense

4.3.5. Energy

4.3.6. Forestry and Agriculture

4.3.7. Other (civil engineering and archaeology)

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. European Space Imaging

6.2. Galileo Group Inc

6.3. Imagesat International (Isi) Ltd.

6.4. L3 Harris Technolgies Inc

6.5. Maxar Technologies

6.6. Planet Labs Pbc

6.7. Skywatch

6.8. Spaceknow

6.9. Telespazio France

6.10. Trimble Inc.

1. GLOBAL COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

2. GLOBAL VISIBLE IMAGERY COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL INFRARED IMAGERY COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL WATER VAPOR IMAGERY COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

6. GLOBAL COMMERCIAL SATELLITE IMAGING FOR GEOSPATIAL DATA ACQUISITION AND MAPPING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL COMMERCIAL SATELLITE IMAGING FOR NATURAL RESOURCE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL IMAGERY COMMERCIAL SATELLITE FOR SURVEILLANCE AND SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL COMMERCIAL SATELLITE IMAGING FOR CONSTRUCTION AND DEVELOPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL COMMERCIAL SATELLITE IMAGING FOR DISASTER MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL COMMERCIAL SATELLITE IMAGING FOR DEFENSE AND INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL COMMERCIAL SATELLITE IMAGING FOR OTHERS (ENERGY GENERATION) MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY END USER, 2022-2030 ($ MILLION)

14. GLOBAL COMMERCIAL SATELLITE IMAGING FOR GOVERNMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL COMMERCIAL SATELLITE IMAGING FOR CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. GLOBAL IMAGERY COMMERCIAL SATELLITE FOR TRANSPORTATION AND LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

17. GLOBAL COMMERCIAL SATELLITE IMAGING FOR MILITARY AND DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

18. GLOBAL COMMERCIAL SATELLITE IMAGING FOR ENERGY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

19. GLOBAL COMMERCIAL SATELLITE IMAGING FOR FORESTRY AND AGRICULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

20. GLOBAL COMMERCIAL SATELLITE IMAGING FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

21. GLOBAL COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

22. NORTH AMERICAN COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

23. NORTH AMERICAN COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

24. NORTH AMERICAN COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

25. NORTH AMERICAN COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY END USER, 2022-2030 ($ MILLION)

26. EUROPEAN COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

27. EUROPEAN COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

28. EUROPEAN COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

29. EUROPEAN COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY END USER, 2022-2030 ($ MILLION)

30. ASIA-PACIFIC COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

31. ASIA-PACIFIC COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

32. ASIA-PACIFIC COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

33. ASIA-PACIFIC COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY END USER, 2022-2030 ($ MILLION)

34. REST OF THE WORLD COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

35. REST OF THE WORLD COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

36. REST OF THE WORLD COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

37. REST OF THE WORLD COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

38. REST OF THE WORLD COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY END USER, 2022-2030 ($ MILLION)

1. GLOBAL COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2022 VS 2030 (%)

2. GLOBAL VISIBLE IMAGERY COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

3. GLOBAL INFRARED IMAGERY COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

4. GLOBAL WATER VAPOR IMAGERY COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

5. GLOBAL COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022 VS 2030 (%)

6. GLOBAL COMMERCIAL SATELLITE IMAGING FOR GEOSPATIAL DATA ACQUISITION AND MAPPING MARKET RESEARCH AND ANALYSIS BY REGION,2022 VS 2030 (%)

7. GLOBAL COMMERCIAL SATELLITE IMAGING FOR NATURAL RESOURCE MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

8. GLOBAL COMMERCIAL SATELLITE IMAGING FOR SURVEILLANCE AND SECURITY MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

9. GLOBAL COMMERCIAL SATELLITE IMAGING FOR CONSTRUCTION AND DEVELOPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

10. GLOBAL COMMERCIAL SATELLITE IMAGING FOR DISASTER MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

11. GLOBAL COMMERCIAL SATELLITE IMAGING FOR DEFENSE AND INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

12. GLOBAL COMMERCIAL SATELLITE IMAGING FOR OTHERS (ENERGY GENERATION) MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

13. GLOBAL COMMERCIAL SATELLITE IMAGING MARKET RESEARCH AND ANALYSIS BY END USER, 2022 VS 2030 (%)

14. GLOBAL COMMERCIAL SATELLITE IMAGING FOR GOVERNMENT MARKET RESEARCH AND ANALYSIS BY REGION,2022 VS 2030 (%)

15. GLOBAL COMMERCIAL SATELLITE IMAGING FOR CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

16. GLOBAL COMMERCIAL SATELLITE IMAGING FOR TRANSPORTATION AND LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

17. GLOBAL COMMERCIAL SATELLITE IMAGING FOR MILITARY AND DEFENSE MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

18. GLOBAL COMMERCIAL SATELLITE IMAGING FOR ENERGY MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

19. GLOBAL COMMERCIAL SATELLITE IMAGING FOR FORESTRY AND AGRICULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

20. GLOBAL COMMERCIAL SATELLITE IMAGING FOR OTHERS (CIVIL ENGINEERING AND ARCHAEOLOGY)MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

21. US COMMERCIAL SATELLITE IMAGING MARKET SIZE, 2022-2030 ($ MILLION)

22. CANADA COMMERCIAL SATELLITE IMAGING MARKET SIZE, 2022-2030 ($ MILLION)

23. UK COMMERCIAL SATELLITE IMAGING MARKET SIZE, 2022-2030 ($ MILLION)

24. FRANCE COMMERCIAL SATELLITE IMAGING MARKET SIZE, 2022-2030 ($ MILLION)

25. GERMANY COMMERCIAL SATELLITE IMAGING MARKET SIZE, 2022-2030 ($ MILLION)

26. ITALY COMMERCIAL SATELLITE IMAGING MARKET SIZE, 2022-2030 ($ MILLION)

27. SPAIN COMMERCIAL SATELLITE IMAGING MARKET SIZE, 2022-2030 ($ MILLION)

28. ROE COMMERCIAL SATELLITE IMAGING MARKET SIZE, 2022-2030 ($ MILLION)

29. INDIA COMMERCIAL SATELLITE IMAGING MARKET SIZE, 2022-2030 ($ MILLION)

30. CHINA COMMERCIAL SATELLITE IMAGING MARKET SIZE, 2022-2030 ($ MILLION)

31. JAPAN COMMERCIAL SATELLITE IMAGING MARKET SIZE, 2022-2030 ($ MILLION)

32. REST OF ASIA-PACIFIC COMMERCIAL SATELLITE IMAGING MARKET SIZE, 2022-2030 ($ MILLION)

33. REST OF THE WORLD COMMERCIAL SATELLITE IMAGING MARKET SIZE, 2022-2030 ($ MILLION)