Compound Feed Market

Global Compound Feed Market Size, Share & Trends Analysis Report, By Animal Type (Swine, Poultry, Ruminants, Aquaculture, and Others), By Ingredient (Supplements, Cereals, Cakes & Meals, and By-Products) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global compound feed market is estimated to grow at a CAGR of nearly 4.6% during the forecast period. The major factors contributing to the growth of the market include the increasing livestock population and rising demand for meat and dairy products. A significant rise in livestock population has been reported across emerging countries. For instance, as per the National Dairy Development Board, in India, the total livestock population increased from 512.1 million in 2012 to 535.8 million in 2019. Increasing dairy farming is the major factor in the increasing focus on livestock farming in the country. This leads to the increasing demand for compound feed which is a mixture of several concentrate feed ingredients in appropriate proportion.

Some commonly used compound feed ingredients in animals include agro-industrial by-products, grains, brans, minerals and vitamins, protein meals/cakes, and chunnies. These are considered an economical source of concentrate supplements which is available in the form of cubes, mash, crumbles, pellets, and more. The compound feed is used as a supplement to other staples of the animals’ diets and meet the nutritional requirements of the target animals. It offers a good source of nutrition to cattle, poultry, swine, rabbits, horses, and other animals.

Market Segmentation

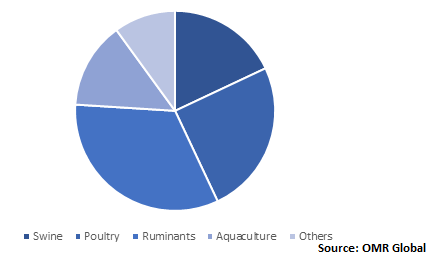

The global compound feed market is segmented based on animal type and ingredients. Based on animal type, the market is classified into swine, poultry, ruminants, aquaculture, and others. Based on the ingredient, the market is classified into supplements, cereals, cakes & meals, and by-products. Supplements are further sub-segmented into minerals and vitamins, probiotics and prebiotics, amino acids, acidifiers and enzymes, and others.

Compound feed is a major source of nutrients in ruminants

Compound feed is being significantly used for ruminants as it is a good source of nutrients for milk-producing, growing, adult, dry, and pregnant animals. Owing to the regular use of compound feed in specified quantity along with basal diet, the milk production from dairy animals can be increased, which results in the growth of net profitability of cattle farmers. Therefore, these compound feed as a crucial source of nutrients is provided to the cattle animals to ensure their better health. In addition, cattle production is emerging in several countries, which is offering an opportunity for market growth. For instance, as per the National Dairy Development Board (NDDB), in India, the cattle production has increased from 190.9 million in 2012 to 192.5 million in 2019.

Global Compound Feed Market Share by Animal Type, 2019 (%)

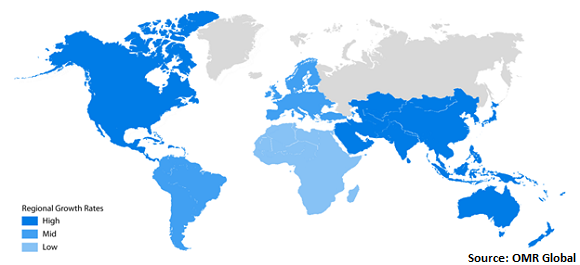

Regional Outlook

Geographically, the market is classified into four major regions, including North America, Europe, Asia-Pacific, and Rest of the World (RoW). In 2019, Asia-Pacific is estimated to witness significant growth in the market owing to the increasing animal husbandry practices in the region. As estimated by the USDA Foreign Agricultural Service, in China, the beef production will reach 7.34 million metric tons (MMT) in 2019, nearly 0.2% higher than in 2018. In 2019, the total consumption of beef will continuously increase in the country to reach 8.6 MMT, which is a year-on-year growth of 3%.

The urban middle class is continuously increasing in China, which leads to an increase in the standard of living and emerging shift towards western diet. This results in in the emerging demand for beef in the country. The increasing meat consumption is leading to increasing demand for animal feed ingredients in the country. Soybean meal that contains nearly 44% crude protein, is regarded as the most common protein source among compound feeds for dairy cattle, pigs, and poultry across the globe. It offers essential nutrients which are essential for animal health.

Global Compound Feed Market Growth, by Region 2020-2026

Market Players Outlook

The major players in the market include Cargill, Inc., Nutreco N.V., Archer Daniels Midland Co., Alltech, Inc., and Land O’Lakes, Inc. The strategies adopted by the market players include mergers and acquisitions, product launches, and partnerships and collaborations to expand market share and gain a competitive advantage. The market players are expanding their geographical reach to increase their revenue generation. For instance, in October 2019, Nutreco N.V. signed an agreement to acquire the business of Cargill’s compound feed in Portugal. After the completion of the deal, the Cargill’s compound feed business will become part of Nanta, which is the Nutreco’s Iberian animal feed business under its animal nutrition division. This will reinforce the position of Nanta in Portugal.

This acquisition is a part of Nutreco’s strategy to reinforce and increase its presence in the Iberian Peninsula. It comprises the Cargill’s compound feed production for the Portuguese market, primarily lifestyle feed and ruminant feed, which is sold through a network of dealers and retail stores and directly to professional farmers. Cargill has two plants in Portugal, one in the centre-south in Alverca and one in the North in Ovar, that will transfer to Nutreco under the agreement. This will leverage Nanta’s availability from one plant in Marco de Canaveses to three, which facilitates production optimization in Portugal.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global compound feed market. Based on the availability of data, pipeline analysis and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Cargill, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Nutreco N.V.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Archer Daniels Midland Co. (ADM)

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Alltech, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Land O’Lakes, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Compound Feed Market by Animal Type

5.1.1. Swine

5.1.2. Poultry

5.1.3. Ruminants

5.1.4. Aquaculture

5.1.5. Others

5.2. Global Compound Feed Market by Ingredient

5.2.1. Supplements

5.2.1.1. Minerals and Vitamins

5.2.1.2. Probiotics and Prebiotics

5.2.1.3. Amino Acids

5.2.1.4. Acidifiers and Enzymes

5.2.1.5. Others

5.2.2. Cereals

5.2.3. Cakes & Meals

5.2.4. By-Products

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Alltech, Inc.

7.2. Archer Daniels Midland Co. (ADM)

7.3. Ballance Agri-Nutrients Ltd.

7.4. Cargill, Inc.

7.5. Charoen Pokphand Foods Public Co. Ltd. (CPF)

7.6. ERBER AG

7.7. Feed One Co., Ltd.

7.8. ForFarmers N.V.

7.9. Guangdong HAID Group Co., Ltd.

7.10. Land O’Lakes, Inc.

7.11. Neovia Group

7.12. New Hope Group

7.13. Novus International, Inc.

7.14. Nutreco N.V.

7.15. PT Japfa Comfeed Indonesia Tbk.

7.16. Roquette Frères

7.17. Smithfield Foods, Inc.

7.18. Tyson Foods, Inc.

7.19. United Animal Health, Inc.

1. GLOBAL COMPOUND FEED MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2019-2026 ($ MILLION)

2. GLOBAL COMPOUND FEED FOR SWINE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL COMPOUND FEED FOR POULTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL COMPOUND FEED FOR RUMINANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL COMPOUND FEED FOR AQUACULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL COMPOUND FEED FOR OTHER ANIMALS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL COMPOUND FEED MARKET RESEARCH AND ANALYSIS BY INGREDIENT, 2019-2026 ($ MILLION)

8. GLOBAL COMPOUND FEED SUPPLEMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL COMPOUND FEED CEREALS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL COMPOUND FEED CAKES & MEALS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL COMPOUND FEED BY-PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL COMPOUND FEED MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN COMPOUND FEED MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN COMPOUND FEED MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2019-2026 ($ MILLION)

15. NORTH AMERICAN COMPOUND FEED MARKET RESEARCH AND ANALYSIS BY INGREDIENT, 2019-2026 ($ MILLION)

16. EUROPEAN COMPOUND FEED MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. EUROPEAN COMPOUND FEED MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2019-2026 ($ MILLION)

18. EUROPEAN COMPOUND FEED MARKET RESEARCH AND ANALYSIS BY INGREDIENT, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC COMPOUND FEED MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC COMPOUND FEED MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC COMPOUND FEED MARKET RESEARCH AND ANALYSIS BY INGREDIENT, 2019-2026 ($ MILLION)

22. REST OF THE WORLD COMPOUND FEED MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2019-2026 ($ MILLION)

23. REST OF THE WORLD COMPOUND FEED MARKET RESEARCH AND ANALYSIS BY INGREDIENT, 2019-2026 ($ MILLION)

1. GLOBAL COMPOUND FEED MARKET SHARE BY ANIMAL TYPE, 2019 VS 2026 (%)

2. GLOBAL COMPOUND FEED MARKET SHARE BY INGREDIENT, 2019 VS 2026 (%)

3. GLOBAL COMPOUND FEED MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US COMPOUND FEED MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA COMPOUND FEED MARKET SIZE, 2019-2026 ($ MILLION)

6. UK COMPOUND FEED MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE COMPOUND FEED MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY COMPOUND FEED MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY COMPOUND FEED MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN COMPOUND FEED MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE COMPOUND FEED MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA COMPOUND FEED MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA COMPOUND FEED MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN COMPOUND FEED MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC COMPOUND FEED MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD COMPOUND FEED MARKET SIZE, 2019-2026 ($ MILLION)