Computer-Aided Drug Discovery Market

Computer-Aided Drug Discovery Market Size, Share & Trends Analysis Report, By Type (Structure-Based Drug Design, Ligand-Based Drug Design, and Sequence-Based Approaches), By Therapeutic Area (Oncology, Neurology, Cardiovascular Disease, Respiratory Disease, and Diabetes) By End-User (Pharmaceutical Companies, Biotechnology Companies, and Research Laboratories), Forecast Period (2022-2028)

Update Available - Forecast 2025-2031

Computer-aided drug discovery market is expected to grow at a CAGR of 11.5% during the forecast period. The increasing prevalence of chronic diseases and rising drug discovery activities are some major factors contributing to the growth of the market. For instance, in January 2022, Sanofi signed a research collaboration with Exscientia, to use AI-based drug discovery methods, and attracted billions of dollars for investment in searching for new medicines significantly more efficient and less risky. The agreement between Sanofi and Exscientia together works to develop 15 new drug candidates for cancer and other diseases. The rising development of COVID-19 vaccines has led to an increased demand for drug discovery, which in turn, is further driving the market growth.

Moreover, the investment made by the pharmaceutical companies in the research of new drugs, and the increasing application of artificial intelligence in drug discovery for chemical synthesis, and polypharmacology, are expected to fortify the growth of the global computer-aided drug discovery market. According to the Congressional Budget Office, the pharmaceutical industry devoted 83 billion to R&D expenditures in 2019. Those expenditures covered a variety of activities, including discovering and testing new drugs, developing incremental innovations such as product extensions, and clinical testing for safety monitoring or marketing purposes. Moreover, as per the same source, on average, the Food and Drug Administration (FDA) approved 38 new drugs per year from 2010 through 2019 which is 60% more than the yearly average over the previous decade.

Segmental Outlook

The global computer-aided drug discovery market is segmented based on type, therapeutic area, and end-user. Based on type, the market is segmented into structure-based drug design, ligand-based drug design, and sequence-based approaches. Based on the therapeutic area, the market is segmented into oncology, neurology, cardiovascular disease, respiratory disease, and diabetes. Based on end-user the market is segmented into pharmaceutical companies, biotechnology companies, and research laboratories. Based on the therapeutic area, the oncology segment is expected to witness higher growth during the forecast period. The increasing prevalence of cancer and rising demand for personalized medicines and drug discovery activities for cancer treatment are some key factors supporting the growth of the oncology segment.

Moreover, new product development and launches by the major players such as Schrödinger, Philips, and Elekta will further aid in the growth of the oncology segment. For instance, in October 2021, Schrödinger, along with MD Anderson Cancer Center, developed a WEE1 inhibitor, a drug-like molecule that targets the WEE1 enzyme to stop cancer cells from strengthening and replicating. Oncology researchers from MD Anderson assist in identifying the patient populations—categorized by cancer type and individual genetic makeup—that are predicted to respond the best to WEE1 inhibitors. The WEE1 enzyme blocks damaged cells from replicating giving time to conduct DNA repair before proceeding with the cell division process. Inhibiting the WEE1 mechanism in cancer patients, aids in maintaining damage in tumor cells, potentially leading to DNA breakage and cell death rather than metastasis.

Regional Outlook

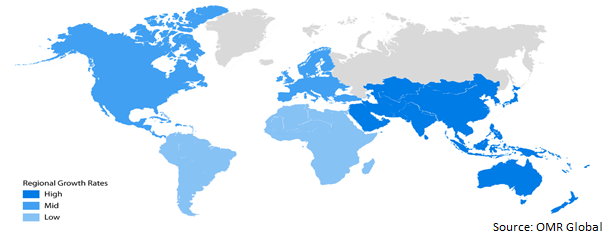

The global computer-aided drug discovery market is further segmented based on geography including North America (The US and Canada), Europe (UK, Italy, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa and Latin America). The European region holds a significant share in the global computer-aided drug discovery market. The growth in the region is mainly driven by the presence of key players such as Exscientia, Helax, and Benevolent AI along with the significant presence of major pharmaceutical firms in the region. For instance, per the European Commission, in February 2022, the EU Commission launched a new series called ‘Ensuring Equal Access for All: Cancer in Women - Europe's Beating Cancer Plan’. Under this initiative, the EU increase public awareness of the human papillomavirus (HPV) and eliminate cervical cancer by vaccinating against HPV at least 90% of the EU target population of girls and significantly increase the vaccination of boys by 2030. This, in turn, is resulting rising drug discovery for HPV therapeutics in the region and thereby driving the market growth.

Global Computer-Aided Drug Discovery Market Growth, by Region 2021-2028

North American Region to Witness Significant Growth During the Forecast Period

The major factor driving the growth of the computer-aided drug discovery market in the North American region is the well-established biotechnology and biopharmaceutical companies. An increase in the demand for advanced drug clearance products for R&D and biologics production is anticipated to influence the computer-aided drug discovery market growth in the region. Moreover, governments in the region are expanding their healthcare infrastructure which is boosting the market growth. The increasing prevalence of various chronic diseases including cancer, diabetes, and autoimmune disorders among others is supporting the demand for drug discovery in the region.

Market Players Outlook

The major companies serving the global computer-aided drug discovery market include F-Hoffman-La Roche Ltd., Bayer AG, Charles River Laboratories International Inc., Laboratory Corporation of America Holdings (Labcorp), and Schrödinger, Inc. The market players are contributing to the market growth by the adoption of various strategies including mergers and acquisitions, collaborations, and new product launches, to stay competitive in the market. For instance, in January 2020, Takeda Pharmaceutical announced a multi-year drug discovery deal with Charles River Laboratories. Charles River will use its strengths to develop potential drug candidates across Takeda’s four core therapeutic areas, including oncology, gastroenterology, neuroscience, and rare disease. In addition, by utilizing an integrated drug discovery and development approach, Charles delivered quality preclinical candidates to Takeda, assisting to drive forward innovative work in key therapeutic areas of the company.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global computer-aided drug discovery market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Recovery Scenario of Global Computer-Aided Drug Discovery Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analsysis

3.1.1. F. Hoffman-La Roche Ltd.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Bayer AG

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Charles River Laboratories International Inc.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Laboratory Corporation of America Holdings (Labcorp)

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Schrödinger, Inc.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.1.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Computer-Aided Drug Discovery Market by Type

4.1.1. Structure Based Drug Design

4.1.2. Ligand-Based Drug Design

4.1.3. Sequence-Based Approaches

4.2. Global Computer-Aided Drug Discovery Market by Therapeutic Area

4.2.1. Oncology

4.2.2. Neurology

4.2.3. Cardiovascular Disease

4.2.4. Respiratory Disease

4.2.5. Diabetes

4.3. Global Computer-Aided Drug Discovery Market by End User

4.3.1. Pharmaceutical Companies

4.3.2. Biotechnology Companies

4.3.3. Research Laboratories

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Aris Pharmaceuticals Inc.

6.2. ArrayGen Technologies Pvt. Ltd.

6.3. BioDuro- Sundia

6.4. BOC Sciences

6.5. Nimbus Therapeutics

6.6. Oxford Drug Design

6.7. Pharmaron

6.8. Profacgen

6.9. VeraChem LLC

6.10. WuXi AppTec

1. GLOBAL COMPUTER-AIDED DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL STRUCTURE BASED DRUG DESIGN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL LIGAND-BASED DRUG DESIGN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL SEQUENCE-BASED APPROACHES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL COMPUTER-AIDED DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY THERAPEUTIC AREA, 2021-2028 ($ MILLION)

6. GLOBAL COMPUTER-AIDED DRUG DISCOVERY FOR ONCOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL COMPUTER-AIDED DRUG DISCOVERY FOR NEUROLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL COMPUTER-AIDED DRUG DISCOVERY FOR CARDIOVASCUALR DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL COMPUTER-AIDED DRUG DISCOVERY FOR RESPIRATORY DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL COMPUTER-AIDED DRUG DISCOVERY FOR DIABETES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL COMPUTER-AIDED DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

12. GLOBAL COMPUTER-AIDED DRUG DISCOVERY IN PHARMACEUTICAL COMPANIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL COMPUTER-AIDED DRUG DISCOVERY IN BIOTECHNOLOGY COMPAINES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL COMPUTER-AIDED DRUG DISCOVERY IN RESEARCH LABORATRIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL COMPUTER-AIDED DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

16. NORTH AMERICAN COMPUTER-AIDED DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. NORTH AMERICAN COMPUTER-AIDED DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

18. NORTH AMERICAN COMPUTER-AIDED DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY THERAPEUTIC AREA, 2021-2028 ($ MILLION)

19. NORTH AMERICAN COMPUTER-AIDED DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

20. EUROPEAN COMPUTER-AIDED DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. EUROPEAN COMPUTER-AIDED DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

22. EUROPEAN COMPUTER-AIDED DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY THERAPEUTIC AREA, 2021-2028 ($ MILLION)

23. EUROPEAN COMPUTER-AIDED DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC COMPUTER-AIDED DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC COMPUTER-AIDED DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC COMPUTER-AIDED DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY THERAPEUTIC AREA, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC COMPUTER-AIDED DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

28. REST OF THE WORLD COMPUTER-AIDED DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

29. REST OF THE WORLD COMPUTER-AIDED DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

30. REST OF THE WORLD COMPUTER-AIDED DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY THERAPEUTIC AREA, 2021-2028 ($ MILLION)

31. REST OF THE WORLD COMPUTER-AIDED DRUG DISCOVERY MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1. GLOBAL COMPUTER-AIDED DRUG DISCOVERY MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL STRUCTURE BASED DRUG DESIGN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL LIGAND-BASED DRUG DESIGN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL SEQUENCE-BASED APPROACHES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL COMPUTER-AIDED DRUG DISCOVERY MARKET SHARE BY THERAPEUTIC AREA, 2021 VS 2028 (%)

6. GLOBAL COMPUTER-AIDED DRUG DISCOVERY FOR ONCOLOGY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL COMPUTER-AIDED DRUG DISCOVERY FOR NEUROLOGY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL COMPUTER-AIDED DRUG DISCOVERY FOR CARDIOVASCULAR DISEASE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL COMPUTER-AIDED DRUG DISCOVERY FOR RESPIRATORY DISEASE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL COMPUTER-AIDED DRUG DISCOVERY FOR DIABETES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL COMPUTER-AIDED DRUG DISCOVERY MARKET SHARE BY END-USER, 2021 VS 2028 (%)

12. GLOBAL COMPUTER-AIDED DRUG DISCOVERY IN PHARMACEUTICAL COMPANIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL COMPUTER-AIDED DRUG DISCOVERY IN BIOTECHNOLOGY COMPANIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL COMPUTER-AIDED DRUG DISCOVERY IN RESEARCH LABORATRIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL COMPUTER-AIDED DRUG DISCOVERY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. US COMPUTER-AIDED DRUG DISCOVERY MARKET SIZE, 2021-2028 ($ MILLION)

17. CANADA COMPUTER-AIDED DRUG DISCOVERY MARKET SIZE, 2021-2028 ($ MILLION)

18. UK COMPUTER-AIDED DRUG DISCOVERY MARKET SIZE, 2021-2028 ($ MILLION)

19. FRANCE COMPUTER-AIDED DRUG DISCOVERY MARKET SIZE, 2021-2028 ($ MILLION)

20. GERMANY COMPUTER-AIDED DRUG DISCOVERY MARKET SIZE, 2021-2028 ($ MILLION)

21. ITALY COMPUTER-AIDED DRUG DISCOVERY MARKET SIZE, 2021-2028 ($ MILLION)

22. SPAIN COMPUTER-AIDED DRUG DISCOVERYM ARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF EUROPE COMPUTER-AIDED DRUG DISCOVERY MARKET SIZE, 2021-2028 ($ MILLION)

24. INDIA COMPUTER-AIDED DRUG DISCOVERY MARKET SIZE, 2021-2028 ($ MILLION)

25. CHINA COMPUTER-AIDED DRUG DISCOVERY MARKET SIZE, 2021-2028 ($ MILLION)

26. JAPAN COMPUTER-AIDED DRUG DISCOVERY MARKET SIZE, 2021-2028 ($ MILLION)

27. SOUTH KOREA COMPUTER-AIDED DRUG DISCOVERY MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF ASIA-PACIFIC COMPUTER-AIDED DRUG DISCOVERY MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD COMPUTER-AIDED DRUG DISCOVERY MARKET SIZE, 2021-2028 ($ MILLION)