Concentrated Solar Power Market

Concentrated Solar Power Market Size, Share & Trends Analysis Report By Technology (Dish Stirling, Solar Power Tower, Parabolic Trough, and Concentrating Linear Fresnel Reflector), by Component (Solar Field, Thermal Energy Storage, and Power Generation System) and by Application (Utility, Industrial And Other (Solar Enhanced Oil Recovery (EOR)) Forecast Period (2024-2031)

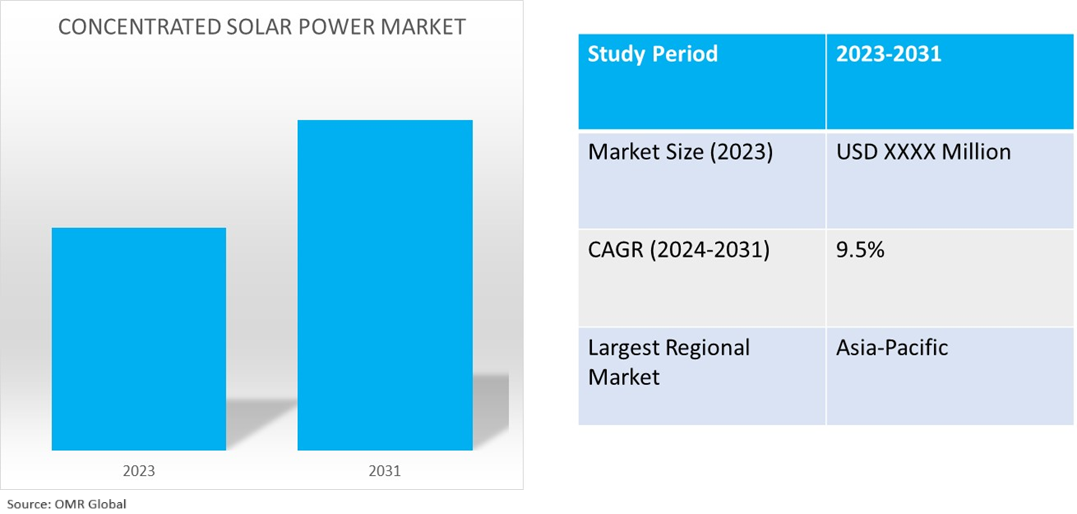

Concentrated solar power (CSP) market is anticipated to grow at a significant CAGR of 9.5% during the forecast period (2024-2031). The industry growth is attributed to the government support for the development of concentrated solar power technology, growing environmental concerns about carbon emissions and measures to reduce air pollution, and the integration of CSP systems with thermal storage systems drive the growth of the market. According to the International Solar Alliance, in 2022, 114 ISA countries (members and signatories) represented approximately 489 GW (43.0%) of the global solar PV capacity. Europe & other regions account for 56.0% of the total installed solar capacity among the ISA members followed by the Asia-Pacific (36.0%), Latin America & Caribbean, and Africa regions contributing to approximately 7% and 1% respectively.

Market Dynamics

Increasing Adoption of Advance Solar Technology

More complex and scalable solutions are being made possible by new solar technologies, which also improve renewable energy's cost and reliability. The synergy of new solar technology innovation is essential for attaining environmental standards and achieving sustainable growth as the demand for clean energy grows globally. Mirrors are used in concentrating solar power (CSP) systems to focus solar radiation and transform it into heat, which creates steam that powers a turbine to produce electricity. CSP facilities need to be located on terrain that is appropriate for producing electricity and has sufficient access to an antiquated and increasingly overloaded transmission line. To transfer electricity from the solar plant to end consumers, utility-scale solar power facilities must have access to high-voltage transmission lines.

Growing Demand for Power Tower Systems

As power tower systems employ a central receiver system, they can operate at higher temperatures and with higher efficiency. Heliostats are computer-controlled mirrors that follow two axes of the sun's path to concentrate solar energy onto a receiver located atop a tall tower. A central power generator and steam are produced by heating a transfer fluid to a temperature of more than 1,000°F using concentrated energy. These projects can readily and effectively incorporate energy storage, enabling the production of power continuously.

Market Segmentation

- Based on the technology, the market is segmented into dish stirling, solar power towers, parabolic troughs, and concentrating linear Fresnel reflectors.

- Based on the components, the market is segmented into solar fields (tower/concentrator structures, reflectors, heat collection elements (HCE), pump and heat transfer fluid and collector balance of system), thermal energy storage, and power generation systems.

- Based on the application, the market is segmented into utility, industry, and other (solar enhanced oil recovery (EOR)).

Thermal Energy Storage is Projected to Hold the Largest Segment

The primary factors supporting the growth include combining thermal energy storage (TES) with concentrated solar power (CSP) to offer integrated energy storage, which can significantly raise the capacity factor to more than 90.0%. A CSP system uses heat produced by the sun's rays reflecting off of a receiver to produce electricity that can be used right away or stored for later use. As of this, CSP plants can be dispatchable, or flexible, choices for supplying clean, renewable energy. According to the International Energy Agency (IEA), in September 2022, Solar thermal technologies deployed in around 400 million dwellings by 2030. Additionally, 170 million new solar thermal systems using standard technologies and 120 million new solar thermal systems using emerging technologies will need to be installed by 2030. Some markets in 2021 have demonstrated that significant year-on-year deployment growth rates of standard solar thermal are still achievable, with Italy, Brazil, and the US posting growth rates of 83.0%, 28.0%, and 19.0%, respectively.

Concentrated Solar Power (CSP) Projects

With time, traditional energy sources such as fossil fuels grow more costly and unsustainable. The government of India has also launched other initiatives, such as the Solar Energy Corporation of India (SECI) plans to issue a 500-megawatt (MW) tender for concentrated solar thermal capacity to promote concentrated solar power across the country. Further, according to REN21, in 2022, the first portion (200 MW) of a 600 MW parabolic trough facility came online at a large-scale hybrid CSP power plant in the United Arab Emirates. Once completed, the plant will be the global largest CSP facility at 700 MW (including the 100 MW central tower). It is spread over 77 square kilometers and combines solar PV and CSP the 266-meter solar tower, the global largest, entered commercial operations in early 2023. Additionally, most of the global CSP capacity under construction is in China. In early 2023, the first of these Chinese projects started commercial operations, a 50 MW tower CSP facility.

Regional Outlook

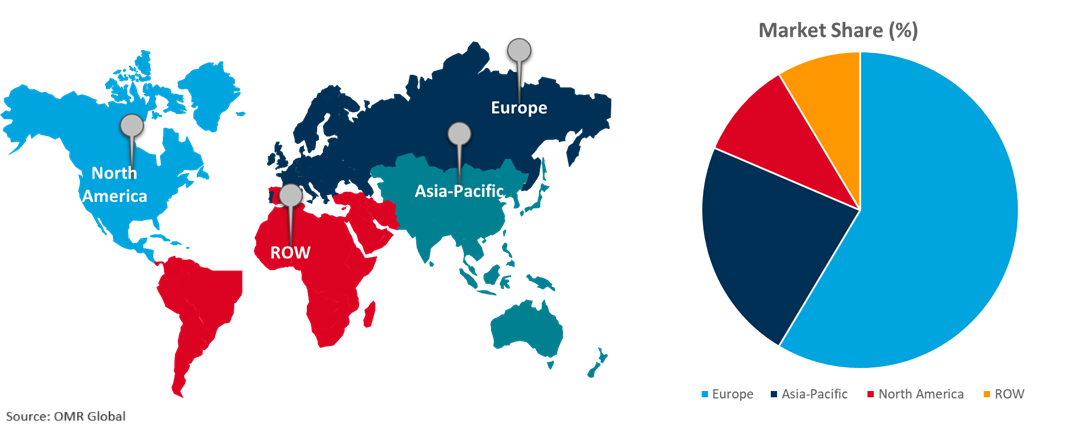

Global concentrated solar power market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Concentrated Solar Power in Asia-Pacific

The regional growth is attributed to the growing demand for continuous generation of electricity and increasing support from governments to adopt renewable technologies in key countries such as China, India, and Japan. According to the International Solar Alliance, in 2022, Japan, India, and Australia have the major installations accounting for 96.4% of the total capacity in the region. Japan market in Asia and Pacific region with 78,833 MW of solar PV capacity installed in 2022 from 49,500 MW in 2017, growing at a CAGR of 10.0%. The Japanese government developed a set of measures to expand solar PV, which include requiring 60.0% of new residential buildings to include rooftop PV and deregulating land zoning to allow PV installations on agricultural land.

Global Concentrated Solar Power Market Growth by Region 2024-2031

Europe to held Considerable Market Share

Europe holds a significant share owing to several regional companies in the concentrated solar power market, including Alfa Laval AB, MAN Energy Solutions SE Siemens AG, and others. The market growth is attributed to the growing use of renewable energy sources with increased government initiatives and the reduction of carbon emissions. Governments in the region are lowering the cost of concentrated solar power systems as countries in the region embrace concentrated solar power. In the upcoming years, these systems are anticipated to be crucial in helping numerous countries meet their green energy targets owing to their many operational benefits and high efficiency. As a result, lowering the installation cost will draw in investors, resulting in the global integration of concentrated solar power into utilities. According to the EurObserv'ER, in July 2023, the solar thermal market recovery triggered in 2021 was confirmed in 2022 with 11.9% growth in the annual installed capacity of 1660.7 MWth. This capacity equates to a collector area of almost 2.4 million m2. Only a single thermodynamic solar power plant (also known as a concentrated solar power plant) was commissioned in Europe in 2022. The SOLINPAR concentrated solar power plant is in Italy and takes the country’s concentrated solar power capacity to 12.4 MW and the European Union’s concentrated solar power capacity to 2,333.1 MW.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the concentrated solar power market include ACWA Power International, Alfa Laval AB, General Electric Co., MAN Energy Solutions SE, and Siemens AG among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Developments

- In July 2023, Alfa Laval entered into a strategic joint venture agreement with Aalborg CSP, a concentrated solar power technology company, and joined forces on the development of Long Duration Energy Storage (LDES) solutions. Alfa Laval and Aalborg CSP’s collaboration aims to enhance competence, product development, and application knowledge in molten salt heat exchanger technology to drive the advancement of long-duration energy storage heat exchanger solutions.

- In December 2022, Dow and Shanghai Electric collaborated on a global scale concentrated solar power project. Additionally, this project provides a very low levelized electricity cost of 7.3 US cents per kilowatt-hour, bringing an increasingly competitive position for CSP technology in energy generation versus other sources.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the concentrated solar power market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Global Concentrated Solar Power Market Research And Analysis By Technology, 2023 Vs 2031 (%)

2. Global Dish Stirling Concentrated Solar Power Market Share By Region, 2023 Vs 2031 (%)

3. Global Enclosed Trough Concentrated Solar Power Market Share By Region, 2023 Vs 2031 (%)

4. Global Solar Power Tower Concentrated Solar Power Market Share By Region, 2023 Vs 2031 (%)

5. Global Linear Fresnel Reflector Concentrated Solar Power Market Share By Region, 2023 Vs 2031 (%)

6. Global Concentrated Solar Power Market Share By Component, 2023 Vs 2031 (%)

7. Global Solar Field for Concentrated Solar Power Market Share By Region, 2023 Vs 2031 (%)

8. Global Thermal Energy Storage for Concentrated Solar Power Market Share By Region, 2023 Vs 2031 (%)

9. Global Power Generation System Concentrated Power Solar Power Market Share By Region, 2023 Vs 2031 (%)

10. Global Concentrated Power Generation System Solar Power Market Share By Region, 2023 Vs 2031 (%)

11. Global Concentrated Solar Power Market Share By Application, 2023 Vs 2031 (%)

12. Global Concentrated Solar Power For Industrial Market Share By Region, 2023 Vs 2031 (%)

13. Global Concentrated Solar Power For Utility Market Share By Region, 2023 Vs 2031 (%)

14. Global Concentrated Solar Power For Other End-User Market Share By Region, 2023 Vs 2031 (%)

15. Global Concentrated Solar Power Market Share By Region, 2023 Vs 2031 (%)

16. US Concentrated Solar Power Market Size, 2023-2031 ($ Million)

17. Canada Concentrated Solar Power Market Size, 2023-2031 ($ Million)

18. UK Concentrated Solar Power Market Size, 2023-2031 ($ Million)

19. France Concentrated Solar Power Market Size, 2023-2031 ($ Million)

20. Germany Concentrated Solar Power Market Size, 2023-2031 ($ Million)

21. Italy Concentrated Solar Power Market Size, 2023-2031 ($ Million)

22. Spain Concentrated Solar Power Market Size, 2023-2031 ($ Million)

23. Rest Of Europe Concentrated Solar Power Market Size, 2023-2031 ($ Million)

24. India Concentrated Solar Power Market Size, 2023-2031 ($ Million)

25. China Concentrated Solar Power Market Size, 2023-2031 ($ Million)

26. Japan Concentrated Solar Power Market Size, 2023-2031 ($ Million)

27. South Korea Concentrated Solar Power Market Size, 2023-2031 ($ Million)

28. Rest Of Asia-Pacific Concentrated Solar Power Market Size, 2023-2031 ($ Million)

29. Rest Of The World Concentrated Solar Power Market Size, 2023-2031 ($ Million)

30. Latin America Concentrated Solar Power Market Size, 2023-2031 ($ Million)

31. Middle East And Africa Concentrated Solar Power Market Size, 2023-2031 ($ Million)