Conductive Polymer Coating Market

Conductive Polymer Coating Market Size, Share & Trends Analysis Report by Type (Polyaniline, Polypyrrole and Polyacetylene) and by End-use (Electrical & Electronics, Energy, Textile, Medical & Healthcare, and Others), Forecast Period (2024-2031)

Conductive polymer coating market is anticipated to grow at a CAGR of 8.9% during the forecast period (2024-2031). Conductive polymers, such as polyaniline (PANI), polypyrrole (PPY), and polyphenylene vinylene (PPV), are generated by oxidizing monocyclic precursor polymers. These polymers are employed as electrode materials for supercapacitors. The conductive polymers' exceptional strength, durability, and electrical conductivity are driving the market expansion. Potential advantages of conductive polymers include their low cost of manufacturing and their capacity to produce thin sheets, which are utilized in the production of many electrical products.

Market Dynamics

Growing Demand for Lightweight, Lower Corrosiveness, and Better Conductive Polymers

Due to their lower weight and lower corrosiveness, conductive polymers are becoming more and more popular as metal substitutes. In the upcoming years, this continuous change may further open up new growth prospects for conducting polymers. It is used in printed circuit boards, organic electronic devices, and conductive inks in the electronics sector. The need for better-conducting polymers is being driven by the desire for flexible electronics and the shrinking of electronic components.

A Rising Need for High-Performance Energy Storage Systems

The strong electrical conductivity and electrochemical qualities of these polymers improve energy storage and delivery in super-capacitors and batteries, among other devices. The need for high-performance energy storage systems is increasing due to the expansion of renewable energy sources and electric vehicles. The adoption rate in the upcoming years is being hampered by the requirement for greater awareness regarding conducting polymers in industrial settings as opposed to standard electricity conductors. Furthermore, consumers may be incentivized to boost demand for conducting polymer replacements due to the prohibitively high cost associated with their production.

Market Segmentation

- Based on type, the market is segmented into polyaniline, polypyrrole, and polyacetylene.

- Based on end-use, the market is segmented into electrical & electronics, energy, textile, medical & healthcare, and others.

Electrical & Electronics is Projected to Emerge as the Largest Segment

The conductive polymer coating market is expanding primarily due to the influence of the electrical and electronics sectors. For shielding and anti-static applications, electrically conductive coatings are widely utilized in the electronics and electrical industries. They are composed of several coatings, such as polyesters, epoxies, and acrylics, which are renowned for their durability, chemical resistance, and scratch resistance. Furthermore, polymer coatings aid in the prevention of electromagnetic interference (EMI) and electrostatic interference. Electrically conductive coatings are also used in the aerospace industry as a result of advancements in technology and the growing need for electronic board safety. The construction sector also adopts these coatings.

Polyaniline to Hold a Considerable Market Share

Polyaniline has emerged as the largest type segment. It is a type of conductive polymer coating that is frequently used in electrical applications and is renowned for its excellent conductivity and erosion resistance. It can also be utilized in electrical components and bio-implants which frequently use conductive polymer coating, and is renowned for its strong mechanical properties and electrical conductivity.

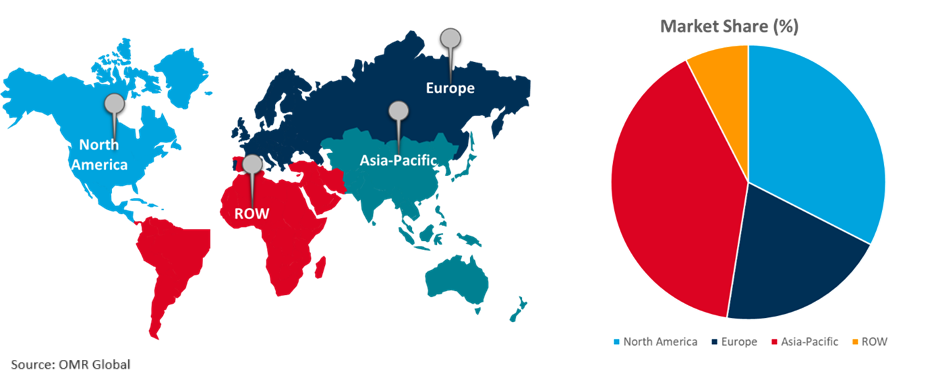

Regional Outlook

The global conductive polymer coating market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific countries to invest in electronic devices

- The Asia-Pacific market for conductive polymer coatings is expected to rise due to the increased demand for electronic devices such as calculators, phones, computers, and LCD screens.

- China is the one of leading centers for the production of electronics, its well-established supply chain, and affordable production prices, encourage the region's high conductive polymer coating usage.

Global Conductive Polymer Coating Market Growth by Region 2024-2031

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global conductive polymer coating market include Heraeus, The Dow Chemical Company, The Lubrizol Corp., ITEM, and Henkel Electronics, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in March 2024, Covestro inaugurated a new production plant for polycarbonate copolymers. It is the fifth polycarbonate production line at Antwerp. It is the world's first production of Covestro using a solvent-free melt process for a wide range of polycarbonate copolymers.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global conductive polymer coating market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. CBI Polymers Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Heraeus Holding

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. The Dow Chemical Company

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Conductive Polymer Coating Market by Type

4.1.1. Polyaniline

4.1.2. Polypyrrole (PPy)

4.1.3. Polyacetylene

4.2. Global Conductive Polymer Coating Market by End-use

4.2.1. Electrical & Electronics

4.2.2. Energy

4.2.3. Textile

4.2.4. Medical & Healthcare

4.2.5. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. 3M Co.

6.2. Agfa-Gevaert Group

6.3. AkzoNobel

6.4. AnCatt Inc.

6.5. Axalta Coating Systems, LLC

6.6. Celanese Corp.

6.7. Creative Materials Inc.

6.8. Crosslink

6.9. Henkel Electronics

6.10. IDTech EX

6.11. item Industrietechnik GmbH

6.12. NanoMarkets LLC

6.13. NSC Co. Ltd.

6.14. PPG Industries, Inc.

6.15. Shin-Etsu Chemical Co.

6.16. The Lubrizol Corpotation.

6.17. The Sherwin-Williams Company

6.18. Voltaic Coatings

1. GLOBAL CONDUCTIVE POLYMER COATING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL CONDUCTIVE POLYMER COATING FOR POLYANILINE RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CONDUCTIVE POLYMER COATING FOR POLYPYRROLE (PPY) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CONDUCTIVE POLYMER COATING FOR POLYACETYLENE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL CONDUCTIVE POLYMER COATING MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

6. GLOBAL CONDUCTIVE POLYMER COATING FOR ELECTRICAL & ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL CONDUCTIVE POLYMER COATING FOR ENERGY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL CONDUCTIVE POLYMER COATING FOR TEXTILE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL CONDUCTIVE POLYMER COATING FOR MEDICAL & HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CONDUCTIVE POLYMER COATING FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CONDUCTIVE POLYMER COATING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN CONDUCTIVE POLYMER COATING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN CONDUCTIVE POLYMER COATING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN CONDUCTIVE POLYMER COATING MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

15. EUROPEAN CONDUCTIVE POLYMER COATING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN CONDUCTIVE POLYMER COATING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

17. EUROPEAN CONDUCTIVE POLYMER COATING MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC CONDUCTIVE POLYMER COATING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC CONDUCTIVE POLYMER COATING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC CONDUCTIVE POLYMER COATING MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

21. REST OF THE WORLD CONDUCTIVE POLYMER COATING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. REST OF THE WORLD CONDUCTIVE POLYMER COATING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

23. REST OF THE WORLD CONDUCTIVE POLYMER COATING MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

1. GLOBAL CONDUCTIVE POLYMER COATING MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL CONDUCTIVE POLYMER COATING FOR POLYANILINE SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CONDUCTIVE POLYMER COATING FOR POLYPYRROLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL CONDUCTIVE POLYMER COATING FOR POLYACETYLENE MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL CONDUCTIVE POLYMER COATING MARKET SHARE BY END-USE, 2023 VS 2031 (%)

6. GLOBAL CONDUCTIVE POLYMER COATING FOR ELECTRICAL & ELECTRONICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL CONDUCTIVE POLYMER COATING FOR ENERGY MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL CONDUCTIVE POLYMER COATING FOR TEXTILE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL CONDUCTIVE POLYMER COATING FOR MEDICAL & HEALTHCARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL CONDUCTIVE POLYMER COATING FOR OTHERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL CONDUCTIVE POLYMER COATING MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. US CONDUCTIVE POLYMER COATING MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA CONDUCTIVE POLYMER COATING MARKET SIZE, 2023-2031 ($ MILLION)

14. UK CONDUCTIVE POLYMER COATING MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE CONDUCTIVE POLYMER COATING MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY CONDUCTIVE POLYMER COATING MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY CONDUCTIVE POLYMER COATING MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN CONDUCTIVE POLYMER COATING MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE CONDUCTIVE POLYMER COATING MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA CONDUCTIVE POLYMER COATING MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA CONDUCTIVE POLYMER COATING MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN CONDUCTIVE POLYMER COATING MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA CONDUCTIVE POLYMER COATING MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC CONDUCTIVE POLYMER COATING MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA CONDUCTIVE POLYMER COATING MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA CONDUCTIVE POLYMER COATING MARKET SIZE, 2023-2031 ($ MILLION)