Confectionery Market

Global Confectionery Market Size, Share & Trends Analysis Report by Type (Sugar Confectionery, Chocolate Confectionery, and Bakers Confectionery), by Distribution Channel (Supermarkets/ Hypermarkets, Convenience Stores, and Online Channel) Forecast Period 2020-2026 Update Available - Forecast 2025-2031

The confectionery market is anticipated to grow at a significant CAGR of 4.3% during the forecast period. Confectionery or confection products include food items that are rich in sugar and carbohydrates. Some of the widely consumed products that fall in the confectionery categories include cakes, sweets, doughnuts, candied nuts, chocolates, chewing gum among others. The growth of the market is mainly attributed to the increasing innovation by manufacturers and the rise in gifting trends. Additionally, the increasing emphasis of confectionery manufacturers to include seasonal, as well as festive touch with the addition of complementing flavors in their product offerings are also driving the adoption of confectioneries among the people.

In addition to this, the considerable shift in the consumer's preference towards the health-consciousness is also being catered by the innovation in product offerings and the introduction of low sugar products. Moreover, confectionery manufacturers are also including innovative vegan and diet-confectionery options into their product portfolio which is also expected to influence the global confectionery industry during the forecast period.

Segmental Outlook

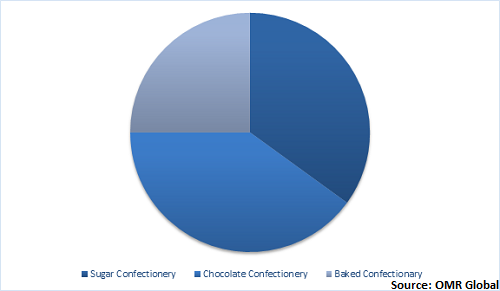

The global confectionery market is segmented based on type, and distribution channels. Based on the type, the market is sub-segmented into sugar confectionery chocolate confectionery and baker confectionery. Based on the distribution channel, the market is sub-segmented into supermarkets/ hypermarkets, convenience stores, and online channels.

The chocolate confectionery segment will grow at a considerable rate

The chocolate confectionery segment is anticipated to grow with a significant CAGR in the confectionery market during the forecast period. The high growth of the segment is mainly attributed to the high popularity of chocolates among all age groups. Additionally, the continuous innovation in the product offering by manufacturers such as new flavors, shapes, and sizes is also increasing the appeal of chocolate products across consumers. Moreover, the offering of chocolates at the festive occasion will also increase its adoption. Additionally, the introduction of organic and clean-label chocolate products is also providing new growth opportunities to the segment.

Global Confectionery Market Share by Type, 2019 (%)

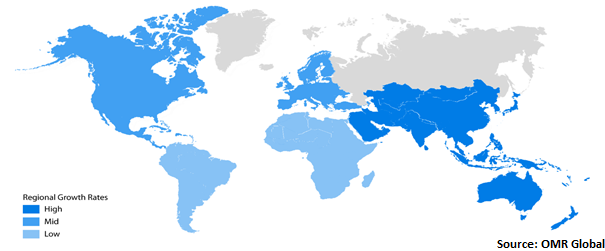

Regional Outlooks

The global confectionery market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. North America is anticipated to show significant growth in the confectionery market owing to the increasing inclination of consumers especially the younger generation and millennials towards confectionery products. The adoption of baked confectionery as dessert is also high in the region. Additionally, high purchasing power is in turn increasing the sales of premium confectionery products. In addition to this, the trend of gifting various confectionary products is significantly popular across the region. Moreover, the presence of a large number of small as well as big size confectionery manufacturing and distribution companies and shops is also influencing the region’s market growth.

Global Confectionery Market Growth, by Region 2020-2026

Asia-Pacific will have considerable growth in the global confectionery market

The Asia-Pacific is estimated to hold a considerable share with a lucrative growth in the global confectionery market during the forecast period owing to the increasing consumption of sweets and treats across the region. Asia-Pacific houses some of the globally well-recognized confectionery companies such as Meiji Holdings Co., Parle Products Pvt. Ltd., Amul among others. In addition to this, the increasing disposable income of the people coupled will also impact the growth of the market shares. Moreover, the rise in the adoption of western culture especially food habits is also fueling the confectionary market across the region.

Market Players Outlook

The key players of the confectionery market include Grupo Bimbo, Mars, Inc., Nestle S.A., The Kraft Heinz Co., Meiji Holdings Co., Ltd., Ferrero SpA, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers, and acquisitions, collaborations, funding to the start-ups, and new product launches to stay competitive in the market.

Recent Activities

- In January 2018, Ferrero Group announced the acquisition of Nestle’s US confectionery business for $2.8 billion in cash. The acquisition aids Ferrero USA Inc. to become the third-largest confectionary company in the US.

- In July 2020, Mackee food announced the plan to invest nearly $500 million through a series of expansions in Collegedale, the US over the next 15 years. The expansion will able the company to bring more jobs and more bakery capacity to its operations.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global confectionery market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. The Hershey Co.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Mars, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Meiji Holding Co. Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Nestle S.A.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.4.5. Mondelez International Inc.

3.3.4.6. Overview

3.3.4.7. Financial Analysis

3.3.4.8. SWOT Analysis

3.3.4.9. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Confectionery Market by Type

5.1.1. Sugar Confectionary

5.1.2. Chocolate Confectionary

5.1.3. Bakers Confectionary

5.2. Global Confectionery Market by Distribution Channel

5.2.1. Supermarkets/ Hypermarkets

5.2.2. Convenience Stores

5.2.3. Online Channel

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Arcor S.A.IC

7.2. Chocoladefabriken Lindt & Sprüngli AG

7.3. Chocolat Frey AG

7.4. Ferrero SpA

7.5. Flowers Foods, Inc.

7.6. Grupo Bimbo, S.A.B. de C.V.

7.7. HARIBO GmbH & Co. KG

7.8. Lotte Confectionery Co. Ltd.

7.9. Mars, Inc.

7.10. McKee Foods Corp.

7.11. Meiji Holding Co. Ltd.

7.12. Mondelez International Inc.

7.13. Monginis Foods Private Ltd.

7.14. Moonstruck Confectionary Co

7.15. Nestle S.A.

7.16. Parle Products Pvt. Ltd.

7.17. PEPPERIDGE FARM Inc.

7.18. Perfetti Van Melle Group B.V.

7.19. The Hershey Co.

7.20. The Kraft Heinz Co.

7.21. Yamazaki Baking Co., Ltd.

1. GLOBAL CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL SUGAR CONFECTIONERY MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

3. GLOBAL CHOCOLATE CONFECTIONERY MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

4. GLOBAL BAKERS CONFECTIONARY MARKET RESEARCH AND ANALYSIS 2019-2026 ($ MILLION)

5. GLOBAL CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

6. GLOBAL SUPERMARKET/ HYPERMARKET CONFECTIONARY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL CONVENIENCE STORES CONFECTIONARY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL ONLINE CONFECTIONARY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL CONFECTIONERY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

10. NORTH AMERICAN CONFECTIONARY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN CONFECTIONARY MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

12. NORTH AMERICAN CONFECTIONARY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

13. EUROPEAN CONFECTIONARY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. EUROPEAN CONFECTIONARY MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

15. EUROPEAN CONFECTIONARY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

16. ASIA-PACIFIC CONFECTIONARY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC CONFECTIONARY MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC CONFECTIONARY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

19. REST OF THE WORLD CONFECTIONARY MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

20. REST OF THE WORLD CONFECTIONARY MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2019-2026 ($ MILLION)

1. GLOBAL CONFECTIONERY MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL CONFECTIONERY MARKET SHARE BY DISTRIBUTION CHANNEL, 2019 VS 2026 (%)

3. GLOBAL CONFECTIONERY MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. GLOBAL SUGAR CONFECTIONERY MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. GLOBAL CHOCOLATE CONFECTIONERY MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

6. GLOBAL BAKERS CONFECTIONARY MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

7. GLOBAL SUPERMARKETS/ HYPERMARKETS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

8. GLOBAL CONVENIENCE STORES MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

9. GLOBAL ONLINE CHANNEL MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

10. US CONFECTIONARY MARKET SIZE, 2019-2026 ($ MILLION)

11. CANADA CONFECTIONARY MARKET SIZE, 2019-2026 ($ MILLION)

12. UK CONFECTIONARY MARKET SIZE, 2019-2026 ($ MILLION)

13. FRANCE CONFECTIONARY MARKET SIZE, 2019-2026 ($ MILLION)

14. GERMANY CONFECTIONARY MARKET SIZE, 2019-2026 ($ MILLION)

15. ITALY CONFECTIONARY MARKET SIZE, 2019-2026 ($ MILLION)

16. SPAIN CONFECTIONARY MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF EUROPE CONFECTIONARY MARKET SIZE, 2019-2026 ($ MILLION)

18. INDIA CONFECTIONARY MARKET SIZE, 2019-2026 ($ MILLION)

19. CHINA CONFECTIONARY MARKET SIZE, 2019-2026 ($ MILLION)

20. JAPAN CONFECTIONARY MARKET SIZE, 2019-2026 ($ MILLION)

21. REST OF ASIA-PACIFIC CONFECTIONARY MARKET SIZE, 2019-2026 ($ MILLION)

22. REST OF WORLD CONFECTIONARY MARKET SIZE, 2019-2026 ($ MILLION)