Connected Logistics Market

Connected Logistics Market Size, Share & Trends Analysis Report, By Solution (Asset Tracking & Management, Data Management, Network Management, Security and Others), By End-Use Industry (Food & Beverage, Healthcare, Retail, Manufacturing, Oil & Gas, and Others), By Mode (Roadway, Waterway, Railway and Airway) and Forecast 2019-2025. Update Available - Forecast 2025-2035

The global connected logistics market is estimated to grow at a CAGR of over 28% during the forecast period. The major factors contributing to the growth of the market include a significant rise in the e-commerce industry and the emerging adoption of IoT connected devices in the logistics industry. IoT has quickly changed the transportation coupled with the innovations in mobile and connectivity. IoT has made everything possible, ranging from potential road safety issues to the monitoring of the fleet management systems.

The major IoT applications and main components of connected logistics systems include safe transportation, inventory management, supply chain monitoring, process automation, and vehicle tracking. Warehousing and inventory management are considered as the most essential components of smart logistics. With the use of small cost-effective sensors, the companies can simply track inventory items and track the status of their products. With IoT technology, the companies can ensure safe storage of goods and are able to successfully prevent any losses, as well as efficiently locate an item required. Due to this efficiency, it is expected that nearly all logistics companies have been employed such kinds of IoT solutions in their work for efficient supply chain management and tracking and monitoring of warehousing activities.

Drones are being significantly adopted in logistics operations to increase speed and efficiency in the operations. Drones are useful in the logistics industry that facilitates automation of business processes by offering smart inventory tracking, immediate in-store delivery and fast transportation of goods. Owing to the increasing demand for inventory tracking and location management solutions, IoT connected devices are revolutionizing the logistics industry, which in turn, is encouraging the growth of the connected logistics market.

Segmentation

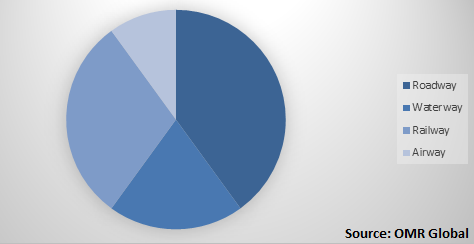

The global connected logistics market is segmented based on type, end-use industry, and mode. Based on the solution, the market is classified into asset tracking & management, data management, network management, security, and others. Based on the end-use industry, the market is classified into food & beverage, healthcare, retail, manufacturing, oil & gas, and others. Based on the mode of transportation, the market is classified into roadway, waterway, railway, and airway.

Global Connected Logistics Market Share by Mode, 2018 (%)

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global connected logistics market. Based on the availability of data, information related to products and services, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. IBM Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Cisco Systems, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Infor

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. SAP SE

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. HCL Technologies Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Connected Logistics Market by Solution

5.1.1. Asset Tracking & Management

5.1.2. Data Management

5.1.3. Network Management

5.1.4. Security

5.1.5. Others (Streaming Analytics)

5.2. Global Connected Logistics Market by End-Use Industry

5.2.1. Food & Beverage

5.2.2. Healthcare

5.2.3. Retail

5.2.4. Manufacturing

5.2.5. Oil & Gas

5.2.6. Others (Chemical)

5.3. Global Connected Logistics Market by Mode

5.3.1. Roadway

5.3.2. Waterway

5.3.3. Railway

5.3.4. Airway

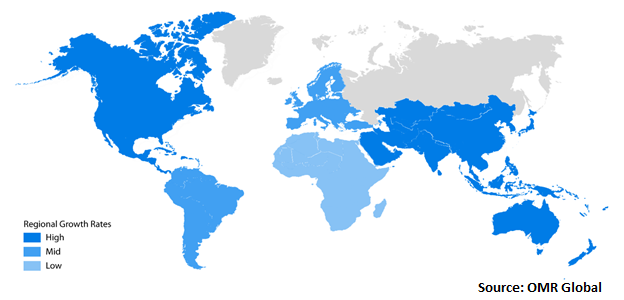

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Amazon Web Services, Inc.

7.2. AT&T, Inc.

7.3. Bosch Service Solutions GmbH

7.4. Cisco Systems, Inc.

7.5. Ericsson AB

7.6. Eurotech S.P.A.

7.7. Freightgate, Inc.

7.8. Google LLC

7.9. HCL Technologies Ltd.

7.10. Huawei Technologies Co., Ltd.

7.11. IBM Corp.

7.12. Infor

7.13. Infosys Ltd.

7.14. Intel Corp.

7.15. Microsoft Corp.

7.16. Oracle Corp.

7.17. ORBCOMM Inc.

7.18. PTC Inc.

7.19. SAP SE

7.20. SecureRF Corp.

7.21. TrackX, Inc.

7.22. Zebra Technologies Corp.

1. GLOBAL CONNECTED LOGISTICS MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2018-2025 ($ MILLION)

2. GLOBAL CONNECTED ASSET TRACKING & MANAGEMENT IN LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL CONNECTED DATA MANAGEMENT IN LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL CONNECTED NETWORK MANAGEMENT IN LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL CONNECTED SECURITY IN LOGISTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL OTHER CONNECTED LOGISTICS SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL CONNECTED LOGISTICS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2018-2025 ($ MILLION)

8. GLOBAL CONNECTED LOGISTICS IN FOOD & BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL CONNECTED LOGISTICS IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL CONNECTED LOGISTICS IN RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL CONNECTED LOGISTICS IN MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL CONNECTED LOGISTICS IN OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL CONNECTED LOGISTICS IN OTHER END-USE INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL CONNECTED LOGISTICS MARKET RESEARCH AND ANALYSIS BY MODE, 2018-2025 ($ MILLION)

15. GLOBAL CONNECTED LOGISTICS VIA ROADWAY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

16. GLOBAL CONNECTED LOGISTICS VIA WATERWAY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

17. GLOBAL CONNECTED LOGISTICS VIA RAILWAY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

18. GLOBAL CONNECTED LOGISTICS VIA AIRWAY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

19. GLOBAL CONNECTED LOGISTICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

20. NORTH AMERICAN CONNECTED LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

21. NORTH AMERICAN CONNECTED LOGISTICS MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2018-2025 ($ MILLION)

22. NORTH AMERICAN CONNECTED LOGISTICS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2018-2025 ($ MILLION)

23. EUROPEAN CONNECTED LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

24. EUROPEAN CONNECTED LOGISTICS MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2018-2025 ($ MILLION)

25. EUROPEAN CONNECTED LOGISTICS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2018-2025 ($ MILLION)

26. ASIA-PACIFIC CONNECTED LOGISTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

27. ASIA-PACIFIC CONNECTED LOGISTICS MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2018-2025 ($ MILLION)

28. ASIA-PACIFIC CONNECTED LOGISTICS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2018-2025 ($ MILLION)

29. REST OF THE WORLD CONNECTED LOGISTICS MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2018-2025 ($ MILLION)

30. REST OF THE WORLD CONNECTED LOGISTICS MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2018-2025 ($ MILLION)

1. GLOBAL CONNECTED LOGISTICS MARKET SHARE BY SOLUTION, 2018 VS 2025 (%)

2. GLOBAL CONNECTED LOGISTICS MARKET SHARE BY END-USE INDUSTRY, 2018 VS 2025 (%)

3. GLOBAL CONNECTED LOGISTICS MARKET SHARE BY MODE, 2018 VS 2025 (%)

4. GLOBAL CONNECTED LOGISTICS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US CONNECTED LOGISTICS MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA CONNECTED LOGISTICS MARKET SIZE, 2018-2025 ($ MILLION)

7. UK CONNECTED LOGISTICS MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE CONNECTED LOGISTICS MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY CONNECTED LOGISTICS MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY CONNECTED LOGISTICS MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN CONNECTED LOGISTICS MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE CONNECTED LOGISTICS MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA CONNECTED LOGISTICS MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA CONNECTED LOGISTICS MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN CONNECTED LOGISTICS MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC CONNECTED LOGISTICS MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD CONNECTED LOGISTICS MARKET SIZE, 2018-2025 ($ MILLION)