Construction Sealants Market

Construction Sealants Market Size, Share & Trends Analysis Report by Resin Type (Acrylic, Polysulfide, Polyurethane, Silicone, and Other), by Application (Glazing, Sanitary & Kitchen, Flooring & Joining, and Others), and by End-User Industry (Residential, Commercial, Industrial, and Infrastructural), Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Construction sealants market is anticipated to grow at a CAGR of 6.2% during the forecast period (2023-2030). The construction sealants market is being driven by the increasing prevalence of sealants in new building applications such as anchoring, ductwork, and structural glazing. Construction sealants are mostly used in fields such as flooring and joining, glazing, sanitary & kitchen, among others. These uses are expanding, which is driving the market for construction sealants growth. Low-cost, high-impact sealing products are simple to overlook when considering the systems and operations of a pulp and paper company. For instance, in April 2023, John Crane launched the type SB2/SB2A USP seal, a rotating equipment solution provider of designed technologies and services to process industries. It combines the Type SB2/SB2A heavy-duty dual cartridge seal with its distinctive Upstream Pumping (USP) technology. The Type SB 2/SB2A USP seal is perfect for use with fluids that are potentially harmful to the environment, abrasive, and for other slurry duties up to 40% solids by weight and an eight Mohs solids hardness. It is frequently applied to pumps and other rotational machinery.

Segmental Outlook

The global construction sealants market is segmented on the resin type, application, and end-user industry. Based on the resin type, the market is sub-segmented into acrylic, polysulfide, polyurethane, silicone, and others (epoxy). Based on the application type, the market is sub-segmented into glazing, sanitary & kitchen, flooring & joining, and others (waterproofing & gap filling). Further, on the basis of end–user industry, the market is sub-segmented into residential, commercial, industrial, and infrastructural. Among the resin type, the polyurethane sub-segment is anticipated to hold a considerable share of the market owing to its high abrasion resistance, moderate chemical and weather resistance. Further, it has ability to be used in a wide range of joint sizes owing to its adhesion compatibility with a variety of building substrates, including stone, metal, and wood.

The Residential Sub-Segment is Anticipated to Hold a Considerable Share of the Global Construction Sealants Market

Among the application, the residential sub-segment is expected to hold a considerable share of the global construction sealants market. The increase in the effectiveness of lubricants and sealants in residential construction can be attributed to segmental growth. For residential use, manhole sealant and lubricant are used to design and improve present seals by fixing holes and flaws in the manhole cover and seat. In addition to reducing the possibility of corrosion and lubricating the manhole cover to make removal simpler and safer, it forms a water barrier between surfaces. For instance, in February 2022, Hercules® launched shutoutTM, a lubricant and sealant for manholes. The innovative new item, created in collaboration with sanitary district experts, prevents entry and lubricates manhole covers for easier removal. Shutout is a non-toxic, all-purpose manhole lubricant and sealant that lowers inflow and simplifies manhole upkeep.

Regional Outlook

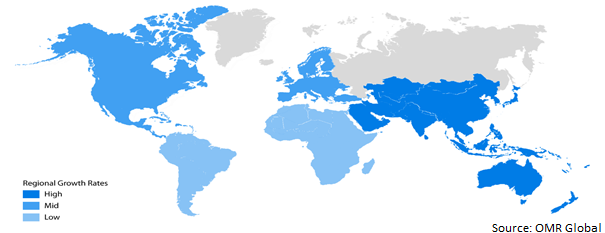

The global construction sealants market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America. Among these, North America is anticipated to hold a prominent share of the market across the globe, owing to the high concentration of the market solution vendors including Dunbar Sales & Manufacturing Co., Inc., Ellsworth Adhesives., Master Bond, Inc., Dunham Rubber & Belting Corp., Robert McKeown Co., Inc., and others.

Global Construction Sealants Market Growth by Region 2023-2030

The Asia-Pacific Region is Expected to Grow at a Significant CAGR in the Global Construction Sealants Market

Among all regions, the Asia-Pacific region is anticipated to grow at a considerable CAGR over the forecast period. Regional growth is attributed to their wide applications in the building and construction industry, including joint sealing, insulation, curtain wall, façade, glazing, and others. Polyurethane is the Largest Resin. Owing to their interior and exterior uses, polyurethane and acrylic resins hold the biggest market share in the Asia-Pacific industries for construction adhesives and sealants. By 2021, polyurethane-based products were mostly produced using sealant technology, whereas around 49% of acrylic-based construction adhesives were produced using water-borne technology.

Investment in public infrastructure is essential for the construction and real estate sectors. In the short to medium term, it appears that significant investments in China, India, Japan, and other regional leaders will accelerate the expansion of the Asia-Pacific market. All of these elements are anticipated to raise demand for construction adhesives and sealants in the area. Products made from polyurethane, acrylic, and silicon resin-based adhesives and sealants are projected to contribute to more than 50% of the demand produced by the Chinese construction sector. In this area of the adhesives and sealants industry, constructional and technological innovation is developing rapidly. Residential developments, airports, transit routes, and mining activities all underwent significant alterations to adapt to changing standards and norms.

Market Players Outlook

The major companies serving the construction sealants market include Ashland Inc., BASF SE, DuPont, H.B. Fuller Company, Merck, KGaA, Pecora Corp., Pidilite Industries Ltd., Soudal N.V., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in July 2023, The H.B. Fuller Company recently announced the acquisition of XCHEM International LLC, an adhesives manufacturer in the United Arab Emirates (UAE) that provides a variety of specialty adhesives and coatings for industrial and infrastructure applications in the rapidly expanding Middle Eastern and Northern African construction markets.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global construction sealants market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Bostik (Arkema Group)

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Dow Chemical Co.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. SABA BV

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Construction Sealants Market by Resin Type

4.1.1. Acrylic

4.1.2. Polysulfide

4.1.3. Polyurethane

4.1.4. Silicone

4.1.5. Other Resins (Epoxy)

4.2. Global Construction Sealants Market by Application

4.2.1. Glazing

4.2.2. Sanitary & Kitchen

4.2.3. Flooring & Joining

4.2.4. Others (Waterproofing & Gap Filling)

4.3. Global Construction Sealants Market by End-User Industry

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.3.4. Infrastructural

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AppNexus, Inc.

6.2. Ashland Inc.

6.3. Avery Dennison Corp.

6.4. BASF SE

6.5. DuPont

6.6. H.B. Fuller Co.

6.7. Henkel AG & Co.

6.8. Mapei S.p.A.

6.9. Merck KGaA

6.10. Pecora Corp.

6.11. Pidilite Industries Ltd.

6.12. Royal Adhesives & Sealants, LLC

6.13. RPM International Inc.

6.14. Sika AG

6.15. Soudal N.V.

6.16. Wacker Chemie AG

1. GLOBAL CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2022-2030 ($ MILLION)

2. GLOBAL ACRYLIC CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL POLYSULFIDE CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL POLYURETHANE CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL SILICONE CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL OTHER CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION TECHNOLOGY, 2022-2030 ($ MILLION)

8. GLOBAL CONSTRUCTION SEALANTS FOR GLAZING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL CONSTRUCTION SEALANTS FOR SANITARY & KITCHEN MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL CONSTRUCTION SEALANTS FOR FLOORING & JOINING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL OTHERS CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

13. GLOBAL CONSTRUCTION SEALANTS FOR RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL CONSTRUCTION SEALANTS FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL CONSTRUCTION SEALANTS FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. GLOBAL CONSTRUCTION SEALANTS FOR INFRASTRUCTURAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

17. GLOBAL CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

18. NORTH AMERICAN CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

19. NORTH AMERICAN CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2022-2030 ($ MILLION)

20. NORTH AMERICAN CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

21. NORTH AMERICAN CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

22. EUROPEAN CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

23. EUROPEAN CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2022-2030 ($ MILLION)

24. EUROPEAN CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

25. EUROPEAN CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

26. ASIA- PACIFIC CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

27. ASIA- PACIFIC CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2022-2030 ($ MILLION)

28. ASIA- PACIFIC CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

29. ASIA- PACIFIC CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

30. REST OF THE WORLD CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

31. REST OF THE WORLD CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2022-2030 ($ MILLION)

32. REST OF THE WORLD CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

33. REST OF THE WORLD CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022-2030 ($ MILLION)

1. GLOBAL CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY RESIN TYPE, 2022 VS 2030 (%)

2. GLOBAL ACRYLIC CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

3. GLOBAL POLYSULFIDE CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

4. GLOBAL POLYURETHANE CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

5. GLOBAL SILICONE CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

6. GLOBAL OTHER CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

7. GLOBAL CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION TECHNOLOGY, 2022 VS 2030 (%)

8. GLOBAL CONSTRUCTION SEALANTS FOR GLAZING MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

9. GLOBAL CONSTRUCTION SEALANTS FOR SANITARY & KITCHEN MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

10. GLOBAL CONSTRUCTION SEALANTS FOR FLOORING & JOINING MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

11. GLOBAL OTHERS CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

12. GLOBAL CONSTRUCTION SEALANTS MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2022 VS 2030 (%)

13. GLOBAL CONSTRUCTION SEALANTS FOR RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

14. GLOBAL CONSTRUCTION SEALANTS FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

15. GLOBAL CONSTRUCTION SEALANTS FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

16. GLOBAL CONSTRUCTION SEALANTS FOR INFRASTRUCTURAL MARKET RESEARCH AND ANALYSIS BY REGION, 2022 VS 2030 (%)

17. US CONSTRUCTION SEALANTS MARKET SIZE, 2022-2030 ($ MILLION)

18. CANADA CONSTRUCTION SEALANTS MARKET SIZE, 2022-2030 ($ MILLION)

19. UK CONSTRUCTION SEALANTS MARKET SIZE, 2022-2030 ($ MILLION)

20. FRANCE CONSTRUCTION SEALANTS MARKET SIZE, 2022-2030 ($ MILLION)

21. GERMANY CONSTRUCTION SEALANTS MARKET SIZE, 2022-2030 ($ MILLION)

22. ITALY CONSTRUCTION SEALANTS MARKET SIZE, 2022-2030 ($ MILLION)

23. SPAIN CONSTRUCTION SEALANTS MARKET SIZE, 2022-2030 ($ MILLION)

24. REST OF EUROPE CONSTRUCTION SEALANTS MARKET SIZE, 2022-2030 ($ MILLION)

25. INDIA CONSTRUCTION SEALANTS MARKET SIZE, 2022-2030 ($ MILLION)

26. CHINA CONSTRUCTION SEALANTS MARKET SIZE, 2022-2030 ($ MILLION)

27. JAPAN CONSTRUCTION SEALANTS MARKET SIZE, 2022-2030 ($ MILLION)

28. SOUTH KOREA CONSTRUCTION SEALANTS MARKET SIZE, 2022-2030 ($ MILLION)

29. REST OF ASIA-PACIFIC CONSTRUCTION SEALANTS MARKET SIZE, 2022-2030 ($ MILLION)

30. REST OF THE WORLD CONSTRUCTION SEALANTS MARKET SIZE, 2022-2030 ($ MILLION)