Consumer Foam Market

Consumer Foam Market Size, Share & Trends Analysis Report, By Type (Rigid Foam and Flexible Foam), By End-User Industry (Bedding and Furniture, Automotive, Electronics, Footwear, Packaging, and Others), Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Consumer foam market is anticipated to grow at a CAGR of 4.6% during the forecast period. The growing adoption of consumer foam across end-user industries such as bedding and furniture, electronics, automotive, and packaging, in emerging economies such as India, China, and others is a key factor driving the growth of the global consumer foam market. In July 2022, NCFI Polyurethanes announced to showcase their CoolRest line of performance bedding foams. The CoolRest Hybrid combines the properties of memory and high resilience foams, providing pressure relief without sinking. It can be used as either a comfort layer or a transition layer. CoolRest Breeze is a super soft, high airflow foam designed to provide pressure relief and maximum cooling properties. It can be used as either a comfort layer or a transition layer. Finally, CoolRest Bounce is latex-like polyurethane with super high resiliency- in excess of 65.0%. This foam is ideally suited for a transition or support layer where the goal is to keep the sleeper on top of the comfort layer. All three foams are CertiPUR-US certified. Such market developments are anticipated to drive the global consumer foam market.

Impact of COVID-19 Pandemic on the Global Consumer Foam Market

COVID-19 pandemic has negatively impacted the consumer foam market as the lockdown stopped many operations. There was a certain pause in manufacturing activities, causing interference in the production of raw materials across the globe due to the COVID- 19 pandemic, which negatively affected the market. The cancellation or delay of purchase deals lead to a decrease in demand for consumer foam thus affected the market demand. In the European region, weak demand for consumer foams from the automotive sector is a key factor for the declining demand for the consumer foam market in Europe.

Segmental Outlook

The global consumer foam market is segmented by type and end-user industry. The market segmentation based on the type includes rigid foam and flexible foam. Based on the end-user industry, the market is segmented into bedding and furniture, automotive, electronics, footwear, packaging, and others.

Bedding and Furniture Segment Holds Considerable Share in the Global Consumer Foam Market

Based on the end-user industry, the market is segmented into bedding and furniture, automotive, electronics, footwear, packaging, and others. In 2021, bedding and furniture held a considerable share in the consumer foam market. This foam is used in furniture cushioning, bedding, carpet underlay, and mattresses owing to its favorable characteristics such as low density, which considerably reduces the weight of the product which is a key factor contributing to the potential share of this segment. Many types of foam are flexible and soft, providing more comfort when used in furniture and bedding.

Regional Outlook

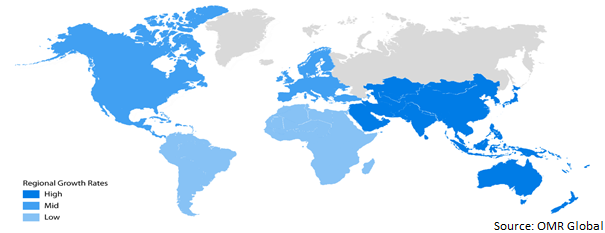

The global consumer foam market is further segmented based on geography including North America (the US and Canada), Europe (UK, Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. North America is anticipated to exhibit considerable growth in the global consumer foam market. Significant demand for consumer foam from various industries is a key contributor to the high share of the market in the region.

Global Consumer Foam Market Growth, by Region 2022-2028

Asia-Pacific to Exhibit Fastest Growth in the Global Consumer Foam Market

Asia-Pacific is estimated to grow with the fastest CAGR in the market during the forecast period. The growing production of automobiles across the region is driving the regional market growth. The automotive sector in Japan is the third-largest automotive producing industry in the world, with 78 factories in 22 prefectures and employing over 5.5 million people, it is a major pillar of the country’s economy. Automotive manufacturing takes up 89.0% of the country’s manufacturing sector auto parts suppliers have also grown a substantial part of Japan’s economy. Apart from this, the growing demand for consumer foam in the footwear and furniture industry is further contributing to the regional market growth.

Market Players Outlook

The major companies serving the global consumer foam market include Covestro AG, BASF SE, and Huntsman Corp. among others. The companies are focusing on product innovation, mergers and acquisitions, and finding a new market or innovation in their core competency to expand individual market share. For instance, in December 2021, Covestro AG planned to increase production capacity by establishing new plants for thermoplastic polyurethanes in the Shanghai site. The plant is due to be completed in 2023.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global consumer foam market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Consumer Foam Market, By Type

4.1.1. Rigid Foam

4.1.2. Flexible Foam

4.2. Global Consumer Foam Market, By End-User Industry

4.2.1. Bedding & Furniture

4.2.2. Automotive

4.2.3. Electronics

4.2.4. Footwear

4.2.5. Packaging

4.2.6. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. BASF SE

6.2. BCI Holding SA

6.3. Covestro AG

6.4. DIC Corp.

6.5. Dow Inc.

6.6. DSM N.V.

6.7. Evonik Industries AG

6.8. Huntsman Corp.

6.9. INOAC Corp.

6.10. Kuwait Polyurethane Industries WLL

6.11. Lanxess

6.12. Mitsui Chemicals Inc.

6.13. Recticel NV

6.14. Rogers Corp.

6.15. Saint-Gobain S.A.

6.16. Sekisui Chemical Co., Ltd.

6.17. Sheela Foam Ltd.

6.18. Wanhua Chemical Group Co., Ltd.

1. GLOBAL CONSUMER FOAM MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL RIGID CONSUMER FOAM MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL FLEXIBLE CONSUMER FOAM MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL CONSUMER FOAM MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2021-2028 ($ MILLION)

5. GLOBAL CONSUMER FOAM FOR BEDDING & FURNITURE MARKET RESEARCH, AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL CONSUMER FOAM FOR AUTOMOTIVE MARKET RESEARCH, AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL CONSUMER FOAM FOR ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL CONSUMER FOAM FOR FOOTWEAR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL CONSUMER FOAM FOR PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL CONSUMER FOAM FOR OTHER END-USER INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. NORTH AMERICAN CONSUMER FOAM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN CONSUMER FOAM MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

13. NORTH AMERICAN SMART SYRNGE MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2021-2028 ($ MILLION)

14. EUROPEAN CONSUMER FOAM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. EUROPEAN CONSUMER FOAM MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

16. EUROPEAN CONSUMER FOAM MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC CONSUMER FOAM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC CONSUMER FOAM MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC CONSUMER FOAM MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2021-2028 ($ MILLION)

20. REST OF THE WORLD CONSUMER FOAM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. REST OF THE WORLD CONSUMER FOAM MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

22. REST OF THE WORLD CONSUMER FOAM MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2021-2028 ($ MILLION)

1. GLOBAL CONSUMER FOAM MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL CONSUMER FOAM MARKET SHARE BY END-USER INDUSTRY, 2021 VS 2028 (%)

3. GLOBAL CONSUMER FOAM MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL RIGID CONSUMER FOAM MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL FLEXIBLE CONSUMER FOAM MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL CONSUMER FOAM FOR BEDDING & FURNITURE MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL CONSUMER FOAM FOR AUTOMOTIVE MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL CONSUMER FOAM FOR ELECTRONICS MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL CONSUMER FOAM FOR FOOTWEAR MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL CONSUMER FOAM FOR PACKAGING MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL CONSUMER FOAM FOR OTHER MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. US CONSUMER FOAM MARKET SIZE, 2021-2028 ($ MILLION)

13. CANADA CONSUMER FOAM MARKET SIZE, 2021-2028 ($ MILLION)

14. UK CONSUMER FOAM MARKET SIZE, 2021-2028 ($ MILLION)

15. FRANCE CONSUMER FOAM MARKET SIZE, 2021-2028 ($ MILLION)

16. GERMANY CONSUMER FOAM MARKET SIZE, 2021-2028 ($ MILLION)

17. ITALY CONSUMER FOAM MARKET SIZE, 2021-2028 ($ MILLION)

18. SPAIN CONSUMER FOAM MARKET SIZE, 2021-2028 ($ MILLION)

19. REST OF EUROPE CONSUMER FOAM MARKET SIZE, 2021-2028 ($ MILLION)

20. INDIA CONSUMER FOAM MARKET SIZE, 2021-2028 ($ MILLION)

21. CHINA CONSUMER FOAM MARKET SIZE, 2021-2028 ($ MILLION)

22. JAPAN CONSUMER FOAM MARKET SIZE, 2021-2028 ($ MILLION)

23. SOUTH KOREA CONSUMER FOAM MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF ASIA-PACIFIC CONSUMER FOAM MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF THE WORLD CONSUMER FOAM MARKET SIZE, 2021-2028 ($ MILLION)