Consumer Packaging Market

Global Consumer Packaging Market Size, Share & Trends Analysis Report, by Material (Plastic, Paper, Glass, and Metal), by End-User (Food, Beverage, Healthcare, Personal Care and Cosmetics, and Household Goods) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global consumer packaging market is estimated to grow at a CAGR of 5.1% during the forecast period. The emerging demand for eco-friendly packaging and expansion of the e-commerce industry is primarily boosting the demand for consumer packaging solutions. An inclination towards online shopping has witnessed across the globe owing to the rising internet penetration and busy lifestyle. As per the Federal Statistical Office (destatis), in 2019, the internet users in Germany was 91.0%, which is growing at a significant pace. In 2019, online purchases made by internet users were 70.0%, which increased from 55.0% in 2009.

Additionally, as per the Office for National Statistics (ONS), total e-commerce sales in the UK were $877.5 billion in 2018, increased from $786.9 billion in 2017. Emerging nations have also witnessed potential demand for online retailing of food products, clothing and accessories, and personal care products. Efficient packaging design for online products can offer new marketing opportunities that can contribute to enhancing brand value. With the increasing demand for sustainable packaging, e-commerce companies have shifted their focus towards highly sustainable and recyclable solutions. For instance, in September 2019, Amazon India declared its commitment to remove single-use plastic from its packaging by June 2020.

Under the initiative, the company will introduce paper cushions, which will replace plastic dunnage such as bubble wraps and air pillows at its fulfillment centers in India. Paper cushions will be utilized to fill the void space inside packages which ensure that the product is well protected during transit. This environment-friendly and fully recyclable packaging solution has already been launched in selected fulfillment centers (FC) and will be expanded across all Amazon FCs across the country by the end of the year. Amazon ensured that its packaging material in the form of paper cushions and corrugate boxes consists of as high as 100% recycled content and is also completely recyclable.

The company is extremely focusing on the development of plastic-free alternatives for bubble bags, packaging mailers, and stretch wrap and tape utilized in the packaging that enables the company to remove all forms of plastic used in its packaging. The company has pledged to collect plastic, equivalent to all of the plastic packaging material used by the Amazon Fulfilment network in the country from September 2019. This is an extension of the initiative which has been underway in the State of Maharashtra for a year. The emerging trend towards eco-friendly packaging will boost the demand for more innovative packaging solutions in the e-commerce sector. This, in turn, is expected to offer potential opportunities for market growth.

Market Segmentation

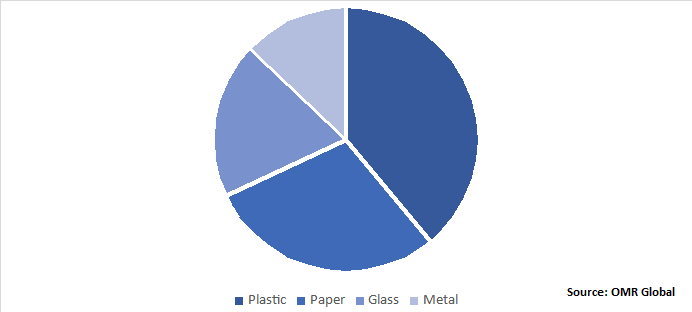

The global consumer packaging market is segmented based on material and end-user. Based on material, the market is classified into plastic, paper, glass, and metal. Based on end-user, the market is classified into food, beverage, healthcare, personal care and cosmetics, and household goods.

Plastic Finds Significant Application in Consumer Packaging

Plastic resins are used in a range of container and packaging products, including high-density polyethylene (HDPE) bottles for milk and water and polyethylene terephthalate (PET) beverage bottles. In addition, a comprehensive range of other resins is used in other plastic containers, wraps, bags, sacks, and lids. Plastics are found in all major Municipal Solid Waste (MSW) categories. As per the US Environmental Protection Agency (US EPA), in 2017, the packaging and containers category had the most plastic tonnage at more than 14 million tons in the US. This category comprises sacks and wraps, bags, HDPE natural bottles, PET bottles and jars; and other containers. This, in turn, is contributing to the significant share of plastics in the packaging sector.

Global Consumer Packaging Market Share by Material, 2019 (%)

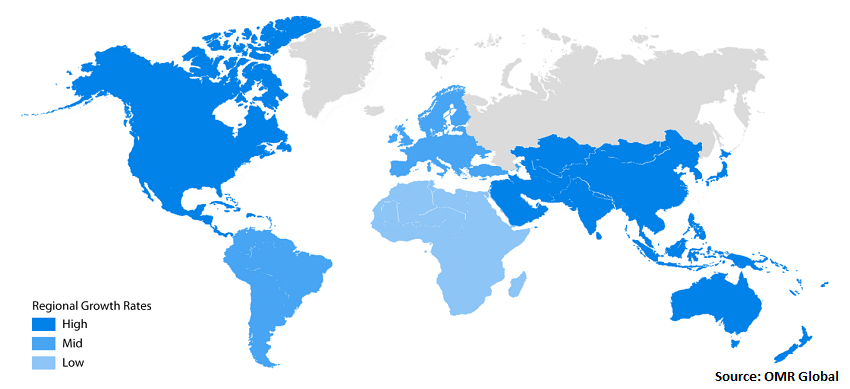

Regional Outlook

Geographically, Asia-Pacific is estimated to witness potential growth during the forecast period. A significant rise in the packaging industry is primarily contributing to the market growth in the region. As per the Federation of Indian Chambers of Commerce and Industry, the Indian packaging industry is valued at more than $32 billion and consists of over 10,000 firms. Booming e-commerce and organized retail is the major contributor to the growth of the packaging industry. Further, the increasing scope of online food retailing is encouraging the demand for effective packaging solutions in the country. Owing to the presence of online food delivery players such as Swiggy, FoodPanda, TinyOwl, and Zomato building scale through partnerships. Therefore, organized food business has immense potential in the Indian markets. This, in turn, will accelerate the demand for corrugated boxes for online food delivery in the country.

Global Consumer Packaging Market Growth, by Region 2020-2026

Market Players Outlook

The major players in the market include Amcor plc, Berry Global Group, Inc., Crown Holdings, Inc., Tetra Pak International S.A., and DS Smith Plc. Product launches, mergers and acquisitions, and partnerships and collaborations are some crucial strategies adopted by the market players to expand market share and gain a competitive advantage. For instance, in July 2019, Berry Global Group, Inc. acquired RPC Group Plc (RPC) at a price of nearly $6.5 billion. RPC is a provider of plastic packaging solutions, and the combination of Berry and RPC will enable to offer value-added protective solutions and become one of the world’s largest plastic packaging firms.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global consumer packaging market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Amcor plc

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Crown Holdings, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Berry Global Group, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Tetra Pak International S.A.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. DS Smith Plc

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Consumer Packaging Market by Material

5.1.1. Plastic

5.1.2. Paper

5.1.3. Glass

5.1.4. Metal

5.2. Global Consumer Packaging Market by End-User

5.2.1. Food

5.2.2. Beverage

5.2.3. Healthcare

5.2.4. Personal Care and Cosmetics

5.2.5. Household Goods

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Ahlstrom-Munksjö Oyj

7.2. Alpha Packaging

7.3. Amcor plc

7.4. Ball Corp.

7.5. Berry Global Group, Inc.

7.6. Cardinal Health, Inc.

7.7. Coveris Holdings S.A.

7.8. Crown Holdings, Inc.

7.9. DS Smith Plc

7.10. Gerresheimer AG

7.11. Graham Packaging Co.

7.12. Huhtamäki Oyj

7.13. Interflex Group

7.14. LLFlex, LLC

7.15. O-I Glass, Inc.

7.16. Plastipak Holdings, Inc.

7.17. Reynolds Group Holdings, Ltd.

7.18. Sealed Air Corp.

7.19. Stanpac

7.20. Takemoto Packaging, Inc.

7.21. Tetra Pak International S.A.

7.22. West Pharmaceutical Services, Inc.

7.23. Zhenghao Plastic & Mold Co., Ltd.

1. GLOBAL CONSUMER PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

2. GLOBAL PLASTIC-BASED CONSUMER PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL PAPER-BASED CONSUMER PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL GLASS-BASED CONSUMER PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL METAL-BASED CONSUMER PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL CONSUMER PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

7. GLOBAL CONSUMER PACKAGING IN FOOD MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL CONSUMER PACKAGING IN BEVERAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL CONSUMER PACKAGING IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL CONSUMER PACKAGING IN PERSONAL CARE AND COSMETICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL CONSUMER PACKAGING IN HOUSEHOLD GOODS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL CONSUMER PACKAGING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN CONSUMER PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN CONSUMER PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

15. NORTH AMERICAN CONSUMER PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

16. EUROPEAN CONSUMER PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

17. EUROPEAN CONSUMER PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

18. EUROPEAN CONSUMER PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC CONSUMER PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC CONSUMER PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC CONSUMER PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

22. REST OF THE WORLD CONSUMER PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

23. REST OF THE WORLD CONSUMER PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

1. GLOBAL CONSUMER PACKAGING MARKET SHARE BY MATERIAL, 2019 VS 2026 (%)

2. GLOBAL CONSUMER PACKAGING MARKET SHARE BY END-USER, 2019 VS 2026 (%)

3. GLOBAL CONSUMER PACKAGING MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US CONSUMER PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA CONSUMER PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

6. UK CONSUMER PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE CONSUMER PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY CONSUMER PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY CONSUMER PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN CONSUMER PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE CONSUMER PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA CONSUMER PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA CONSUMER PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN CONSUMER PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC CONSUMER PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD CONSUMER PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)