Contact Lenses Market

Global Contact Lenses Market Size, Share & Trends Analysis Report by Design (Spherical, Toric, Multifocal, and Others) by Application (Corrective, Therapeutic, Prosthetics, and Cosmetic and Life-Style Oriented) by Material (Conventional Hard Lenses (PMMA), Rigid Gas Permeable, Hydroxyethyl Methacrylate (HEMA) Hydrogel, Silicon Hydrogel, Poly(Vinyl Alcohol) (PVA) Hydrogels, and Other (Fluorosilicone Acrylate)), Forecast Period (2019-2025)

The global contact lenses market is projected to grow at a considerable CAGR of around 5.6% during the forecast period (2019-2025). The major factors which contribute to the growth of the market are the increasing number of people with myopia, presbyopia and astigmatism. The increased consciousness of people about their appearance also drives the sales of the contact lens. The growing number of geriatric people also drives the market as eye problems are highly prevalent in the old age people. The increasing preference for the contact lenses over the prescribed eyeglasses also contributes to market growth. The increasing research and development of companies to reduce the discomfort and eye irritation caused by the contact lenses is also a major driver. The Centre for Disease Control and Prevention (CDC) estimates that currently there are more than 45 million contact lens users in the US and the average age of contact lens users is 31 years.

The number of people with eye defects is increasing which is driving the demand for contact lenses across the globe. According to the WHO World Vision report 2019, the number of people with myopia has increased from 1.95 billion in 2010 to 2.6 billion in 2020 and is expected to grow to about 3.36 billion in 2030. Thus, the increase in the number of people with eye defects would lead to an increase in the use of corrective measures and therefore the contact lenses market would see growth. The market is restrained by factors such as the side effects of the use of contact lenses such as itching and redness in the eye, dry eye disease and irritation.

Segmental Outlook

The global contact lenses market is segmented on the basis of design, application, and material. Based on the design market is segmented into spherical, toric, multifocal, and others. The spherical segment is anticipated to hold considerable market share based on lens design. The spherical lenses are the normal lenses which are used to correct eye defects such as myopia and presbyopia. These defects are most common in people. The toric lenses are shaped as the slice of the lens. The toric lenses are used to correct astigmatism which is less common than myopia. Thus, toric lenses have less share in the segment than spherical lenses.

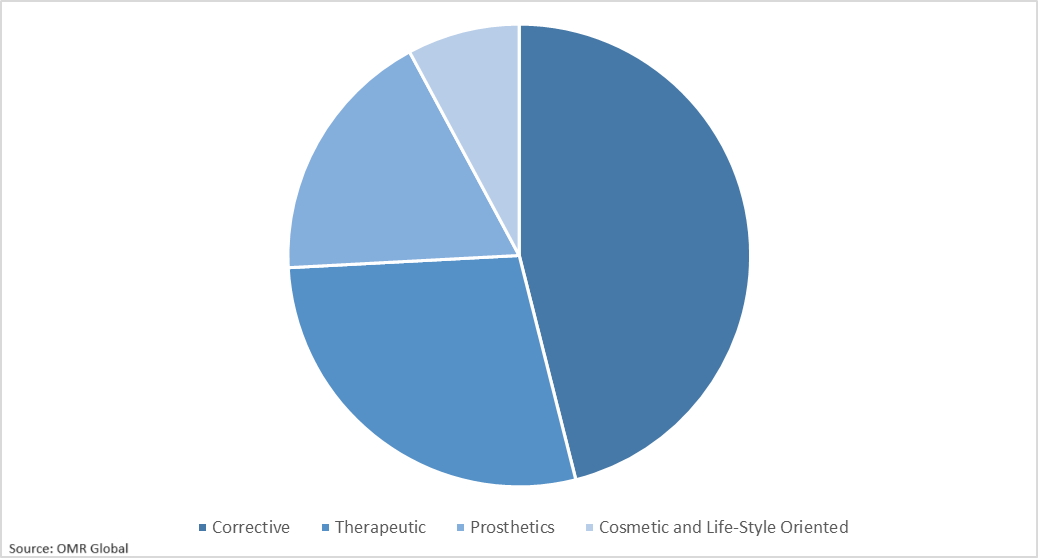

Based on application the market is segmented into corrective, therapeutic, prosthetics, and cosmetic, and lifestyle-oriented. Corrective lenses are anticipated to hold considerable market share based on application. The corrective lens is used to treat eye defects such as short-sightedness. The therapeutic contact lens is also known as the bandage lens, which is used to aid the healing of eyes. Such lenses are used to cover the cornea and retain the moisture in it. The cosmetic and life-style oriented lenses do not possess any treatment application and are used to change the eye color and look of the eye.

Global Contact Lenses Market Share by Application, 2018 (%)

The contact lenses market can also be segmented on the basis of material into conventional hard lenses (PMMA), rigid gas permeable, hydroxyethyl methacrylate (HEMA) hydrogel, silicone hydrogel, poly(Vinyl Alcohol) (PVA) hydrogels, and other (fluorosilicone acrylate). Nowadays, most of the lenses are made up of silicone hydrogel. The silicon hydrogel maintains the moisture and allows oxygen to pass. The gas-permeable lenses are hard contact lenses and they have a definite shape that cannot be changed. These lenses are one of the oldest types of lenses that are now less preferred. These lenses have advantages such as healthy oxygen flow and allow air to pass through.

Regional Outlook

The global contact lenses market is further segmented on the basis of geography including North America, Europe, Asia-Pacific, and the Rest of the World. North America is anticipated to hold a considerable market share in the market during the forecast period. The major factor for the high market share in the region is the development of health care service and acceptance of contact lenses. According to the CDC, there are more than a million contact lenses used in the US out of which two-thirds of the users are females. Moreover, the presence of major market players in the US is supporting the dominance of North America in the market by investing a significant amount in R&D activities.

Asia-Pacific will augment with the significant growth rate in the Contact Lenses market

Asia-Pacific is expected to grow at a considerable CAGR during the forecast period. The factors attributing to the growth rate of Asia-Pacific include a significant rise in the health care system and an increase in the population in China, India, and Japan. The increased purchasing power of people in developing countries of the region also aids the growth of the market. People of the region have increased the potential to buy expensive contact lenses over prescribed spectacles. The increasing consciousness of people about their looks in the countries with a high number of young populations such as India also contributes to the rapid growth in this region.

Market Players Outlook

The major companies operating in contact lenses market include Bausch and Lomb Inc., Alcon Vision LLC (A Division of Novartis AG), Carl Zeiss AG, Cooper Vision, Inc., Essilor International S.A., Johnson and Johnson Service, Inc., among others. These companies are researching and developing technology in lens manufacturing. For instance, lenses now come with blue-rays protection technology which can reflect back the blue rays emitted by the screens. Cooper Vision Inc launched its new product called Biofinity which is a multifocal toric contact lens that was approved by the FDA in February 2020.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global contact lenses market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Alcon Vision LLC (A Division of Novartis AG)

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Bausch and Lomb Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Johnson and Johnson Service, Inc .

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Carl Zeiss AG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. CooperVision Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.1. Opportunities

5. Market Segmentation

5.1. Global Contact Lenses Market by Design

5.1.1. Spherical

5.1.2. Toric

5.1.3. Multifocal Lens

5.1.4. Other

5.2. Global Contact Lenses Market by Application

5.2.1. Corrective

5.2.2. Therapeutic

5.2.3. Prosthetic

5.2.4. Cosmetic and Life-Style Oriented

5.3. Global Contact Lens Market by Material

5.3.1. Conventional Hard Lenses (PMMA)

5.3.2. Rigid Gas Permeable

5.3.3. Hydroxyethyl Methacrylate (HEMA) Hydrogel

5.3.4. Silicon Hydrogel

5.3.5. Poly(Vinyl Alcohol) (PVA) Hydrogels

5.3.6. Other (Fluorosilicone Acrylate)

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Alcon Vision LLC (A Division of Novartis AG)

7.2. Bausch and Lomb, Inc.

7.3. Blanchard Contact Lens, Inc.

7.4. Carl Zeiss AG

7.5. Conforma Laboratories, Inc.

7.6. Contamac Holdings, Ltd.

7.7. CooperVision, Inc.

7.8. Essilor International S.A.

7.9. Ginko International Co., Ltd.

7.10. Hoya Corp.

7.11. Johnson and Johnson Service, Inc.

7.12. Menicon Co., Ltd.

7.13. Seed Co., Ltd.

7.14. Sensimed AG

7.15. SynergEyes, Inc.

7.16. St. Shine Optical Co. Ltd.

7.17. STAAR Surgical Company

7.18. UltraVision CLPL

7.19. Vision Path, Inc. (Hubble)

7.20. X-Cel Specialty Contacts

1. GLOBAL CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY DESIGN, 2018-2025 ($ MILLION)

2. GLOBAL SPHERICAL CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL TORIC CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL MULTIFOCAL CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBALOTHERS CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY APPLICATION , 2018-2025 ($ MILLION)

7. GLOBAL CORRECTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL THERAPEUTIC MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL PROSTHETIC MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

GLOBAL COSMETIC AND LIFE-STYLE ORIENTED MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2018-2025 ($ MILLION)

11. GLOBAL CONVENTIONAL HARD LENSES (PMMA) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL RIGID GAS PERMEABLE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL HEMA HYDROGEL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL SILICON HYDROGEL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL PVA HYDROGELS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

16. GLOBAL OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

17. NORTH AMERICAN CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. NORTH AMERICAN CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY DESIGN, 2018-2025 ($ MILLION)

19. NORTH AMERICAN CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY APPLICATION , 2018-2025 ($ MILLION)

20. NORTH AMERICAN CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY MATERIAL , 2018-2025 ($ MILLION)

21. EUROPEAN CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

22. EUROPEAN CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY DESIGN, 2018-2025 ($ MILLION)

23. EUROPEAN CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY APPLICATION , 2018-2025 ($ MILLION)

24. EUROPEAN CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY MATERIAL , 2018-2025 ($ MILLION)

25. ASIA-PACIFIC CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

26. ASIA-PACIFIC CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY DESIGN, 2018-2025 ($ MILLION)

27. ASIA-PACIFIC CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY APPLICATION , 2018-2025 ($ MILLION)

28. ASIA-PACIFIC CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY MATERIAL , 2018-2025 ($ MILLION)

29. REST OF THE WORLD CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY DESIGN, 2018-2025 ($ MILLION)

30. REST OF THE WORLD CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY APPLICATION , 2018-2025 ($ MILLION)

31. REST OF THE WORLD CONTACT LENSES MARKET RESEARCH AND ANALYSIS BY MATERIAL , 2018-2025 ($ MILLION)

1. GLOBAL CONTACT LENSES MARKET SHARE BY DESIGN, 2018 VS 2025 (%)

2. GLOBAL CONTACT LENSES MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL CONTACT LENSES MARKET SHARE BY MATERIAL, 2018 VS 2025 (%)

4. GLOBAL CONTACT LENSES MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. THE US CONTACT LENSES MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA CONTACT LENSES MARKET SIZE, 2018-2025 ($ MILLION)

7. UK CONTACT LENSES MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE CONTACT LENSES MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY CONTACT LENSES MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY CONTACT LENSES MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN CONTACT LENSES MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE CONTACT LENSES MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA CONTACT LENSES MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA CONTACT LENSES MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN CONTACT LENSES MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC CONTACT LENSES MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD CONTACT LENSES MARKET SIZE, 2018-2025 ($ MILLION)