Contract Packaging Market

Contract Packaging Market Size, Share & Trends Analysis Report by Material (Plastics, Paper & Paperboard, Glass, Metal, and Others), by Type (Primary, Secondary, and Tertiary), By End-Use (Food & Beverage, Pharmaceutical, Personal Care & Cosmetics, Retail, E-commerce, and Others) Forecast Period (2024-2031)

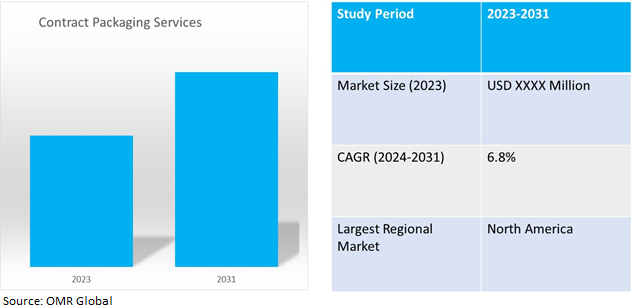

Contract packaging market is anticipated to grow at a considerable CAGR of 6.8% during the forecast period (2024-2031). Contract packaging involves the outsourcing of the packaging of products to a third party. This service is utilized by companies that may not have the necessary resources or capabilities to handle the packaging process internally. Services provided such as design and engineering, packaging production, filling and assembly, kitting and bundling, and many more.

Market Dynamics

Diversified Market

Contract packaging offers a wide range of services to different sectors such as pharmaceuticals, food and beverages, cosmetics, and many others. An increase in demand in these markets will automatically affect global contract packaging. A huge marketplace will provide more areas and regions to cover. Globally there is a need of packaging and many products are demand affected by product packing. This depicts that diversified market is the demand driver of this market.

Eco- Friendly Packaging

Many companies are providing contract eco-friendly packaging which is an innovative step in this market. This will affect positively and open new gates for the contract packing market. Eco-friendly packaging is highly needed in the food and beverage sector. Many companies are offering this type of packaging and solutions for sustainability and environment-friendly steps. This in turn driving the global market.

High Recycling Cost May Restrain Market Growth

Recycling packaging products such as plastic containers, bottles & jars, boxes, cans, bags, pouches, and other products requires high capital due to procurement cost, energy expenditure, and scrap value. Recycling plastic products such as bottles & jars, clamshells, and other products involves various steps such as collecting the package after use, repaying the scrap amount to the customer, transportation to the recycling facility, and cleaning & crushing. The high recycling costs and stringent government regulations will restrain the global contract packaging market in the years to come.

Volatility of Material cost

As raw material costs increase, contract packaging companies may need to raise their prices, which can affect their competitiveness and market growth. Packaging companies may experience margin compression if they are unable to pass increased costs onto their customers quickly enough. Global supply chain issues can exacerbate the volatility of raw material costs, leading to tight inventories and limited product availability. Competitors may take advantage of material costs and may provide better deals to clients and fit their requirements.

Market segmentation

Our in-depth analysis of the pet travel service market includes the following segments by material, type, and end-use.

- Based on material the market is sub-segmented into plastics, paper & paperboard, glass, metal, and others.

- Based on type the market is sub-segmented in primary, secondary, and tertiary.

- Based on the end-use market is sub-segmented into food & beverage, pharmaceutical, personal care & cosmetics, retail, e-commerce, and others.

Paper and Paperboard Holds Major Share in the Contract Packing Market

Based on the materials, the global contract packing market is sub-segmented into plastics, paper & paperboard, glass, metal, and others. Paper and paperboard demand is increasing for contract packaging owing to its flexible, sustainable, and customizable characteristic as per requirements. Usually, paper and paperboard are needed in the food and beverage market and retail and clothing market. With the boom in these two markets paper packaging is also increasing gradually.

Pharmaceuticals Dominate End-Use in the Contract Packaging Market

Based on end-use, the global contract packaging services market is sub-segmented into food & beverage, pharmaceutical, personal care & cosmetics, retail, e-commerce, and others. There’s a significant demand in the pharmaceutical segment, especially due to the increased emphasis on serialization and traceability to prevent counterfeiting and maintain patient safety. Global Contract Packing Services provides primary and secondary solutions for pharmaceutical companies.

Regional Outlook

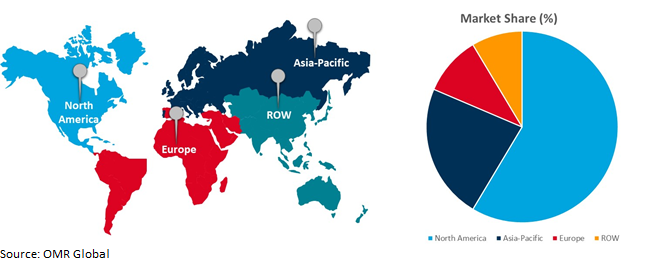

The global contract packaging market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

The dynamic landscape in the Asia-Pacific region

Asia-Pacific is an emerging market for global contract packaging market. The regional market he growth is driven by factors such as the boom in e-commerce due to COVID-19, the changing preferences of manufacturing firms, and a focus on cost optimization. China and India are significant contributors to the market growth. In China, bonded zones like Guangdong and Shanghai offer advantages such as robust trade and port networks, no customs duty for products made outside of China, and no export licensing issues. India has seen an increase in demand for contract packaging due to a surge in medication consumption and increased vaccine production from various pharmaceutical companies.

North America holds largest market share

The largest share of the global contract packaging market is held by North America. Across North America, regulatory requirements and the need for small-scale production are driving pharmaceutical companies toward contract packaging services. For instance, in October 2023Ryder to Acquire Impact Fulfillment Services and Will Add Contract Packaging and Manufacturing Capabilities.

Major Player outlook

*Note: Major Players Sorted in No Particular Order

The major companies serving in the global contract packing market include Hollings worth, Assured Edge Solutions, Jones Packaging, co-pak Packaging Corp.,DHL, Ameri Pac Inc., Assemblies Unlimited Inc., Deufol, Aaron Thomas Company Inc., Stamar Packaging, and many more. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in Oct 2023, Sharp, a global leader in commercial pharmaceutical packaging and clinical trial supply services, has acquired Berkshire Sterile Manufacturing (BSM) to expand its customer base.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global contract packaging market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Assemblies Unlimited Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Assured Edge Solutions

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Jones Packaging

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Contract Packaging Market by Type

4.1.1. Plastics

4.1.2. Paper & Paperboard

4.1.3. Glass

4.1.4. Metal

4.1.5. Others

4.2. Global Contract Packaging Market byType

4.2.1. Primary

4.2.2. Secondary

4.2.3. Tertiary

4.3. Global Contract Packaging Market by End-use

4.3.1. Food & Beverage

4.3.2. Pharmaceutical

4.3.3. Personal Care & Cosmetics

4.3.4. Retail

4.3.5. E-commerce

4.3.6. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. Aaron Thomas Company Inc.

6.2. AmeriPac Inc.

6.3. Co-Pak packaging corp.

6.4. Deufol

6.5. DHL Ltd.

6.6. Genco

6.7. Green Packaging Asia

6.8. Hollingsworth

6.9. Jones Packaging

6.10. Kelly Products Inc.

6.11. Sharp Packaging

6.12. Silgan Holdings Inc.

6.13. Sonic Packaging Industries

6.14. Stamar Packaging

6.15. Sterling Contract Packaging Inc.

6.16. Summit Container

6.17. Unicep Packaging

6.18. Wepackit Inc.

1. GLOBAL CONTRACT PACKAGING MARKET RESEARCH AND ANALYSIS BY TYPE OF TRANSPORTATION, 2023-2031 ($ MILLION)

2. GLOBAL CONTRACT PLASTIC PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CONTRACT PAPER AND PAPERBOARD PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CONTRACT GLASS PACKAGING RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL CONTRACT METAL PACKAGING RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL CONTRACT OTHER PACKAGING RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL CONTRACT PACKAGINGSERVICEMARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

8. GLOBAL CONTRACT PACKAGING IN PRIMARY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL CONTRACT PACKAGING IN SECONDARY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CONTRACT PACKAGING IN TERTIARY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CONTRACT PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

12. GLOBAL CONTRACT PACKAGING USED IN FOOD & BEVERAGEMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL CONTRACT PACKAGING USED IN PHARMACEUTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL CONTRACT PACKAGING USED IN PERSONAL CARE & COSMETICSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL CONTRACT PACKAGING USED IN RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL CONTRACT PACKAGING USED IN E-COMMERCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL CONTRACT PACKAGING USED IN OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBALCONTRACT PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. NORTH AMERICAN GLOBAL CONTRACT PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

20. NORTH AMERICAN CONTRACT PACKAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

21. NORTH AMERICAN CONTRACT PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

22. EUROPEAN CONTRACT PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. EUROPEAN CONTRACT PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

24. EUROPEAN CONTRACT PACKAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

25. EUROPEAN CONTRACT PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC CONTRACT PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC CONTRACT PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC CONTRACT PACKAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC CONTRACT PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

30. REST OF THE WORLD CONTRACT PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

31. REST OF THE WORLD CONTRACT PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

32. REST OF THE WORLD CONTRACT PACKAGING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

33. REST OF THE WORLD CONTRACT PACKAGING MARKET RESEARCH AND ANALYSIS BY END-USE, 2023-2031 ($ MILLION)

1. GLOBAL CONTRACT PACKAGING MARKET SHARE BY MATERIALS, 2023 VS 2031 (%)

2. GLOBAL CONTRACT PLASTICS PACKAGING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CONTRACT PAPER & PAPERBOARD PACKAGING MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL CONTRACT GLASS PACKAGING MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL CONTRACT METAL PACKAGING MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL CONTRACT OTHER PACKAGING MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL CONTRACT PACKAGING MARKET SHARE BY TYPE, 2023 VS 2031 (%)

8. GLOBAL CONTRACT PACKAGING IN PRIMARY MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL CONTRACT PACKAGING IN SECONDARY MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL CONTRACT PACKAGING IN TERTIARY MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL CONTRACT PACKAGING MARKET SHARE BY END-USE, 2023 VS 2031 (%)

12. GLOBAL CONTRACT PACKAGING USED IN FOOD & BEVERAGE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL CONTRACT PACKAGING USED IN PHARMACEUTICALMARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL CONTRACT PACKAGING USED IN PERSONAL CARE & COSMETICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL CONTRACT PACKAGING USED IN RETAIL MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL CONTRACT PACKAGING USED IN E-COMMERCE MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL CONTRACT PACKAGING USED IN OTHER MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBALCONTRACT PACKAGING MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. US CONTRACT PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

20. CANADA

21. GLOBAL CONTRACT PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

22. UK CONTRACT PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

23. FRANCE CONTRACT PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

24. GERMANY CONTRACT PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

25. ITALY CONTRACT PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

26. SPAIN CONTRACT PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF EUROPE CONTRACT PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

28. INDIA CONTRACT PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

29. CHINA CONTRACT PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

30. JAPAN CONTRACT PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

31. SOUTH KOREA CONTRACT PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

32. REST OF ASIA-PACIFIC CONTRACT PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

33. LATIN AMERICA CONTRACT PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)

34. MIDDLE EAST AND AFRICA CONTRACT PACKAGING MARKET SIZE, 2023-2031 ($ MILLION)