Control Valve Market

Control Valve Market Size, Share & Trends Analysis Report by Component (Valve Body and Actuators), by Material (Stainless Steel, Cast Iron, Cryogenic and Alloy Based), by Type (Rotary Valves and Linear Valves), and by Process Industry (Oil & Gas, Energy & Power, Water & Wastewater Treatment, Food & Beverages, Metals & Mining, Chemicals, Pharmaceuticals, Building & Construction and Others) Forecast Period (2024-2031)

Control valve market is anticipated to grow at a moderate CAGR of 13.1% during the forecast period (2024-2031). The market growth is attributed to the increasing adoption of industrial automation with the use of smart control valves in end-use industries such as water & wastewater treatment, oil & gas, and energy & power industry. The demand for control valves is being driven by the expansion of power plants around the globe as well as the growing need for energy and power from rising economies. Nuclear power plants also use these valves, particularly in the chemical treatment, feed water, cooling water, and steam turbine control systems processes.

Market Dynamics

Increasing Adoption of Digitalization and Smart Valves

The demand for smart control valves is fueled by the expansion of the oil and gas industry and the ongoing rise in global energy demand. The requirement to comply with environmental rules and strict safety norms propels the use of modern valve control systems. In industrial operations, smart control valve positioners are devices that precisely actuate and control valve openings and closures. They guarantee precise valve positioning and react promptly to modifications in the intended valve position. Precise control over flow rates, pressure levels, and other process factors is made possible by smart control valve positioners.

Growing Industrial Internet of Things (IIoT) Integration

IIoT (Industrial Internet of Things) platforms provide remote valve position monitoring and control, resulting in enhanced process optimization and decreased maintenance expenses. Furthermore, smart control valve positioners that are integrated with cloud-based platforms provide improved features like machine learning and data analytics for asset management and predictive maintenance. Additionally, chances for market expansion are probably going to arise from the combination of smart valve positioners with digital platforms and the introduction of innovative technologies like artificial intelligence and machine learning.

Market Segmentation

Our in-depth analysis of the global control valve market includes the following segments component, material, type, and process industry.

- Based on the component, the market is sub-segmented into valve bodies and actuators.

- Based on the material, the market is sub-segmented into stainless steel, cast iron, cryogenic and alloy-based.

- Based on type, the market is sub-segmented into rotary valves and linear valves.

- Based on the process industry, the market is sub-segmented into oil & gas, energy & power, water & wastewater treatment, food & beverages, metals & mining, chemicals, pharmaceuticals, building & construction, and others (pulp & paper).

Rotary Valves is Projected to Hold the Largest Segment

Based on the type, the global control valve market is sub-segmented into rotary valves and linear valves. Among these linear valves, sub-segment is expected to hold the largest share of the market. The primary factors supporting the growth adoption of rotary valves for precise control and reliability in diverse applications including industries such as oil and gas, chemicals, and power generation, their effective flow regulation capabilities, and advancements in design and materials have accelerated the widespread adoption and prominence in the market. For instance, in September 2023, Coperion introduced a full access system for rotary valves that simplifies access and cleaning. Coperion FX (full access) extraction devices for rotary valves have been developed especially for applications with strict hygienic requirements in food production. These systems offer free, unimpeded access to the rotary valve’s interior, for fast and easy cleaning or inspection.

Chemicals Sub-segment to Hold a Considerable Market Share

Based on the process industry, the global control valve market is sub-segmented into oil & gas, energy & power, water & wastewater treatment, food & beverages, metals & mining, chemicals, pharmaceuticals, building & construction, and others (pulp & paper). Among these, the chemicals sub-segment is expected to hold a considerable share of the market. The increasing adoption of autonomous control valves in harsh settings in the chemical processing industry is contributing towards segmental growth. Modern valves are made to withstand harsh, combustible gas and air combinations that are corrosive, abrasive, possibly explosive, and other. For instance, in February 2023, Yokogawa Electric Corp. launched an autonomous control AI service for use with edge controllers. AI was used to autonomously control a facility in a chemical plant that could not be controlled using existing control methods and necessitated the manual operation of control valves based on the judgments of plant personnel.

Regional Outlook

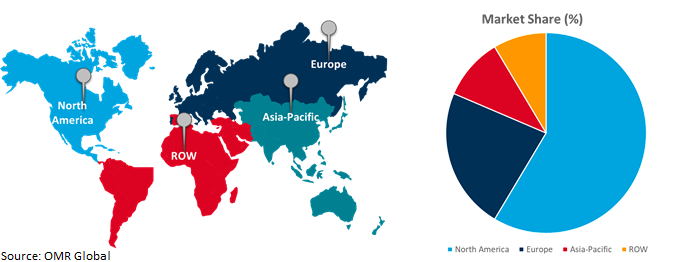

The global control valve market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Demand for Control Valve in Europe

- The regional growth is attributed to the increasing adoption of industrial automation across various sectors. Industries are using automated systems increasingly to boost output, cut expenses, and improve process management. In these automated systems, control valves are essential for controlling fluid flow, pressure, temperature, and level.

- Energy-efficient valve solutions are progressively more in demand as European firms work to lessen their impact on the environment and adhere to strict emission laws.

Global Control Valve Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent software technology companies and control valve providers in the region. The growth is mainly attributed to the increased demand for automated valve operations in the food and beverage, energy and power, pharmaceutical, and water and wastewater industries. The control valve is well suited for use in oil refineries, chemical plants, and other establishments where tight shutdown control valves are necessary even in the face of high cycle times and bidirectional flow. For instance, in June 2023, Flowserve Corp. introduced the Valtek® Valdisk™ high-performance butterfly valve that is licensor-approved for use in Pressure Swing Adsorption (PSA) applications. The Valtek Valdisk butterfly valve joins the Valtek Mark One™ globe valve and Logix™ 3800 digital positioner from Flowserve, which are already licensor-approved for PSA applications. Valtek control valves and Logix automation extend equipment life and maintain purity in PSA skids.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global control valve market include Baker Hughes, Emerson Electric Co., General Electric Company, Honeywell International Inc., and Johnson Controls among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in December 2023, Ampo Poyam Valves signed a collaborative agreement with Clarke Valve for the manufacturing, distribution, and service of zero-emissions dilating disk valves. The exclusive license covers manufacturing, distribution, and service, expanding the global market for zero-emissions dilating disk valves to projects of any size, anywhere, for the energy, chemical, power, and other major industries.

Recent Development

- In November 2022, Burkert Fluid Control Systems introduced its latest micro flapper valve, the Type 6757 Whisper Valve, which offers full media separation while measuring only 18 mm in width. The innovative valve is ideal for demanding point-of-use / point-of-care applications such as dialysis equipment and dental treatment, as well as In-vitro diagnostics, endoscope cleaning, and water analysis.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global control valve market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Baker Hughes Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Emerson Electric Co.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. General Electric Company

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Honeywell International Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Johnson Controls

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Control Valve Market by Component

4.1.1. Valve Body

4.1.2. Actuators

4.2. Global Control Valve Market by Material

4.2.1. Stainless Steel

4.2.2. Cast Iron

4.2.3. Cryogenic

4.2.4. Alloy Based

4.3. Global Control Valve Market by Type

4.3.1. Rotary Valves

4.3.2. Linear Valves

4.4. Global Control Valve Market by Process Industry

4.4.1. Oil & Gas

4.4.2. Energy & Power

4.4.3. Water & Wastewater Treatment

4.4.4. Food & Beverages

4.4.5. Metals & Mining

4.4.6. Chemicals

4.4.7. Pharmaceuticals

4.4.8. Building & Construction

4.4.9. Others (Pulp & Paper)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. ARCA Regler GmbH

6.2. Azbil Corp.

6.3. BELIMO AIRCONTROLS (CAN), Inc.

6.4. Bray International, Inc.

6.5. CIRCOR INTERNATIONAL, INC.

6.6. Crane Company

6.7. Flowserve Corp.

6.8. Goodwin International Ltd.

6.9. IMI Kynoch Ltd.

6.10. KSB SE & Co. KGaA

6.11. Pentair

6.12. Rotork plc

6.13. SAMSON AG

6.14. Schlumberger Ltd.

6.15. Spirax-Sarco Engineering plc

6.16. The Weir Group PLC.

6.17. Valmet

6.18. ValvitaliaSpA

6.19. Velan Inc.

1. GLOBAL CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

2. GLOBAL BODY CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL ACTUATORS CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

5. GLOBAL STAINLESS STEEL CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL CAST IRON CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL CRYOGENIC CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL ALLOY BASED CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

10. GLOBAL ROTARY CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL LINEAR CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY PROCESS INDUSTRY, 2023-2031 ($ MILLION)

13. GLOBAL CONTROL VALVE FOR OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL CONTROL VALVE FOR ENERGY & POWER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL CONTROL VALVE FOR WATER & WASTEWATER TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL CONTROL VALVE FOR FOOD & BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL CONTROL VALVE FOR CHEMICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL CONTROL VALVE FOR PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL CONTROL VALVE FOR BUILDING & CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. GLOBAL CONTROL VALVE FOR OTHER PROCESS INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. GLOBAL CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. NORTH AMERICAN CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. NORTH AMERICAN CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

24. NORTH AMERICAN CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

25. NORTH AMERICAN CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

26. NORTH AMERICAN CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY PROCESS INDUSTRY, 2023-2031 ($ MILLION)

27. EUROPEAN CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

28. EUROPEAN CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

29. EUROPEAN CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

30. EUROPEAN CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

31. EUROPEAN CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY PROCESS INDUSTRY, 2023-2031 ($ MILLION)

32. ASIA-PACIFIC CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

33. ASIA-PACIFIC CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

34. ASIA-PACIFIC CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

35. ASIA-PACIFIC CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

36. ASIA-PACIFIC CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY PROCESS INDUSTRY, 2023-2031 ($ MILLION)

37. REST OF THE WORLD CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

38. REST OF THE WORLD CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

39. REST OF THE WORLD CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2023-2031 ($ MILLION)

40. REST OF THE WORLD CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

41. REST OF THE WORLD CONTROL VALVE MARKET RESEARCH AND ANALYSIS BY PROCESS INDUSTRY, 2023-2031 ($ MILLION)

1. GLOBAL CONTROL VALVE MARKET SHARE BY COMPONENT, 2023 VS 2031 (%)

2. GLOBAL BODY CONTROL VALVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL ACTUATORS CONTROL VALVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL CONTROL VALVE MARKET SHARE BY MATERIAL, 2023 VS 2031 (%)

5. GLOBAL STAINLESS STEEL CONTROL VALVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL CAST IRON CONTROL VALVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL CRYOGENIC CONTROL VALVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL ALLOY BASED CONTROL VALVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL CONTROL VALVE MARKET SHARE BY TYPE, 2023 VS 2031 (%)

10. GLOBAL ROTARY CONTROL VALVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL LINEAR CONTROL VALVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL CONTROL VALVE MARKET SHARE BY PROCESS INDUSTRY, 2023 VS 2031 (%)

13. GLOBAL CONTROL VALVE FOR OIL & GAS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL CONTROL VALVE FOR ENERGY & POWER MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL CONTROL VALVE FOR WATER & WASTEWATER TREATMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL CONTROL VALVE FOR METALS & MINING MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL CONTROL VALVE FOR CHEMICALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL CONTROL VALVE FOR PHARMACEUTICALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL CONTROL VALVE FOR BUILDING & CONSTRUCTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

20. GLOBAL CONTROL VALVE FOR OTHER PROCESS INDUSTRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

21. GLOBAL CONTROL VALVE MARKET SHARE BY REGION, 2023 VS 2031 (%)

22. US CONTROL VALVE MARKET SIZE, 2023-2031 ($ MILLION)

23. CANADA CONTROL VALVE MARKET SIZE, 2023-2031 ($ MILLION)

24. UK CONTROL VALVE MARKET SIZE, 2023-2031 ($ MILLION)

25. FRANCE CONTROL VALVE MARKET SIZE, 2023-2031 ($ MILLION)

26. GERMANY CONTROL VALVE MARKET SIZE, 2023-2031 ($ MILLION)

27. ITALY CONTROL VALVE MARKET SIZE, 2023-2031 ($ MILLION)

28. SPAIN CONTROL VALVE MARKET SIZE, 2023-2031 ($ MILLION)

29. REST OF EUROPE CONTROL VALVE MARKET SIZE, 2023-2031 ($ MILLION)

30. INDIA CONTROL VALVE MARKET SIZE, 2023-2031 ($ MILLION)

31. CHINA CONTROL VALVE MARKET SIZE, 2023-2031 ($ MILLION)

32. JAPAN CONTROL VALVE MARKET SIZE, 2023-2031 ($ MILLION)

33. SOUTH KOREA CONTROL VALVE MARKET SIZE, 2023-2031 ($ MILLION)

34. REST OF ASIA-PACIFIC CONTROL VALVE MARKET SIZE, 2023-2031 ($ MILLION)

35. LATIN AMERICA CONTROL VALVE MARKET SIZE, 2023-2031 ($ MILLION)

36. MIDDLE EAST AND AFRICA CONTROL VALVE MARKET SIZE, 2023-2031 ($ MILLION)