Conveyor Belt Market

Conveyor Belt Market Size, Share & Trends Analysis Report by Product Type (Cleated Belt, Flat Belt, Modular Belt, and Others), and by End-User (Food and Beverages, Manufacturing, Mining, Recycling, and Supply Chain), Forecast Period (2024-2031)

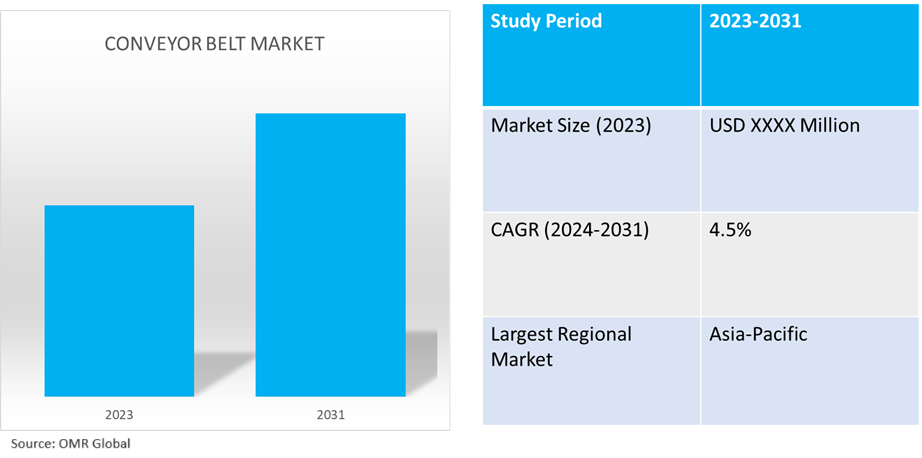

Conveyor belt market is anticipated to grow at a CAGR of 4.5% during the forecast period (2024-2031). A conveyor belt is a continuous moving strip or surface that is used for transporting objects from one place to another. The market is driven by the growing mining, food, and beverages industry. The market growth is also supported by increasing steel and cement industries. This is attributed to the rise in disposable income.

Market Dynamics

Growing Mining Industry

The mining industry is driving the global conveyor belt market due to its high-volume transportation of extracted materials like coal, iron ore, and minerals. Conveyor belts are a reliable and efficient solution for transporting these materials over long distances within mines and processing facilities. They can handle heavy loads and abrasive materials effectively, making them ideal for underground operations. Conveyor belts also facilitate continuous operation by providing a steady stream of materials, ensuring smooth operation and maximizing output. Compared to alternative methods like hauling trucks, conveyor belts are more cost-effective, requiring less manpower, lower maintenance needs, and high energy efficiency. They are versatile in applications, including sorting minerals, feeding materials into crushers, and stockpiling processed materials. As the mining industry expands to meet the growing demand for raw materials, the demand for efficient and reliable transportation solutions will continue to rise, making conveyor belts a critical component within the global mining industry and a significant driver for the conveyor belt market.

Rising Steel and Cement Industries

Globally, conveyor belts are crucial in the steel and cement industries for handling large quantities of raw materials like iron ore, limestone, and coal. They are durable and strong, designed to withstand heavy loads and harsh environments. Modern plants heavily rely on automation, making conveyor belts a key component of automated material handling systems. Infrastructure development projects, such as roads, bridges, and buildings, require vast amounts of steel and cement, increasing the demand for conveyor belts. The global rise in urbanization also fuels the demand for steel and cement in high-rise buildings and urban infrastructure, further increasing the need for conveyor belts in production facilities. As these industries grow, the demand for conveyor belts will continue to rise, solidifying their role as a crucial driver of the global conveyor belt market.

Market Segmentation

- Based on product type, the market is segmented into cleated belts, flat belts, modular belts, and others.

- Based on end-users, the market is segmented into food and beverages, manufacturing, mining, recycling, and supply chain.

Flat Belt is Projected to Emerge as the Largest Segment

The flat belt segment is expected to hold the largest share of the market due to its versatility and efficiency across various industries. Its simple design allows for multiple uses, making it cost-effective to manufacture and maintain. Flat belts can handle a wide range of materials, from lightweight boxes in packaging to bulkier items in manufacturing. They can be customized in terms of width, length, and material to suit specific needs, allowing them to integrate seamlessly into diverse conveyor systems. They excel at efficient material handling, minimizing product damage, and ensuring a steady flow of materials. Their smooth surface is easy to clean and maintain, particularly in industries like food and beverage processing. Flat belts also easily integrate with automated systems, making them ideal for modern manufacturing and processing facilities.

Food and Beverages Segment to Hold a Considerable Market Share

The food and beverages segment holds the largest share of the global conveyor belt market due to its high volume and automation, diverse applications, and high hygiene standards. Conveyor belts are crucial for handling large volumes of materials, from ingredients to finished products, ensuring efficient and continuous production. They also play a vital role in maintaining hygiene standards by creating designated paths for food items. The increasing demand for convenience foods, such as pre-packaged and ready-to-eat meals, further strengthens this industry's reliance on automated conveyor belt systems. Overall, conveyor belts are crucial in the food and beverage industry.

Regional Outlook

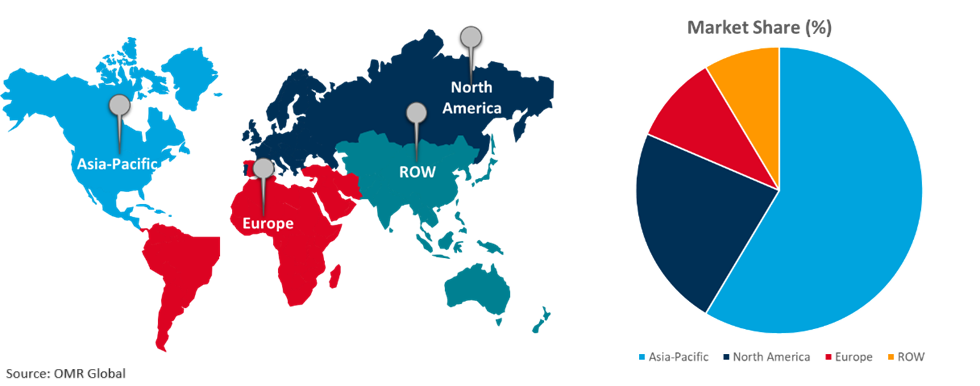

The global conveyor belt market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North American countries to invest in conveyor belt market

- The US, a major mining country, is expected to boost regional product demand due to its extensive mineral reserves and numerous mining businesses.

Global Conveyor Belt Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share due to its strong manufacturing hub, extensive infrastructure development, and growing mining activities. Countries like China, and India have a booming manufacturing sector, leading to a high demand for conveyor belts for transporting materials within factories. Governments in the APAC region invest heavily in infrastructure projects, making conveyor belts crucial for transporting construction materials. The region's rich natural resources make it essential for efficient transportation of coal, iron ore, and other minerals. As labor costs rise, industries are adopting automation to optimize processes and reduce reliance on manual labor. Conveyor belts are a key component of automated material handling systems, further driving demand.

The e-commerce boom in the Asia-Pacific region is also driving the growth of warehouse and fulfillment centers, which require conveyor belts for sorting, packaging, and efficiently moving goods. Furthermore, rising disposable income and hectic lifestyles will increase the consumption of packaged food products, propelling the demand for conveyor belts in the food & beverage industry.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global conveyor belt market include Bando Chemical Industries, Ltd., Bridgestone Corporation, Continental AG, Semperit AG Holding, Sumitomo Rubber Industries, Ltd., and The Yokohama Rubber Co., Ltd., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in January 2023, Power, LLC acquired Dunham Rubber & Belting Corporation. This acquisition helped the company cater to the requirements of the food processing, material handling, building products, pharmaceutical, and general industrial markets.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global conveyor belt market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Bando Chemical Industries, Ltd.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Bridgestone Corporation

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. ContiTech Deutschland GmbH

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Conveyor Belt Market by Product Type

4.1.1. Cleated Belt

4.1.2. Flat Belt

4.1.3. Modular Belt

4.1.4. Others

4.2. Global Conveyor Belt Market by End-User

4.2.1. Food & Beverages

4.2.2. Manufacturing

4.2.3. Mining

4.2.4. Recycling

4.2.5. Supply Chain

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. All-State Belting Company

6.2. Ammega Group BV

6.3. Continental Belting Group

6.4. Daifuku Co., Ltd.

6.5. Elcon Elastomers Pvt. Ltd.

6.6. Fenner Conveyors

6.7. Fenner Dunlop Conveyor Belting

6.8. Forbo Siegling GmbH

6.9. Intralox, L.L.C.

6.10. MRF Limited

6.11. Nitta Corporation India Private Limited

6.12. Semperit AG Holding

6.13. Siemens AG

6.14. SIG Societa Italiana Gomma SpA

6.15. Sumitomo Rubber Industries, Ltd. (SRI)

6.16. The Yokohama Rubber Co., Ltd.

6.17. Zhejiang Double, Arrow Rubber Co., Ltd.

1. GLOBAL CONVEYOR BELT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL CLEATED CONVEYOR BELT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL FLAT CONVEYOR BELT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL MODULAR CONVEYOR BELT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL OTHERS CONVEYOR BELT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL CONVEYOR BELT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

7. GLOBAL CONVEYOR BELT FOR FOOD AND BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL CONVEYOR BELT FOR MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL CONVEYOR BELT FOR MINING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CONVEYOR BELT FOR RECYCLING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CONVEYOR BELT FOR SUPPLY CHAIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL CONVEYOR BELT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN CONVEYOR BELT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN CONVEYOR BELT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

15. NORTH AMERICAN CONVEYOR BELT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

16. EUROPEAN CONVEYOR BELT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN CONVEYOR BELT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

18. EUROPEAN CONVEYOR BELT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC CONVEYOR BELT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC CONVEYOR BELT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC CONVEYOR BELT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

22. REST OF THE WORLD CONVEYOR BELT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. REST OF THE WORLD CONVEYOR BELT MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

24. REST OF THE WORLD CONVEYOR BELT MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL CONVEYOR BELT MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL CLEATED CONVEYOR BELT MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL FLAT CONVEYOR BELT MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL MODULAR CONVEYOR BELT MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL OTHERS CONVEYOR BELT MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL CONVEYOR BELT MARKET SHARE BY END-USER, 2023 VS 2031 (%)

7. GLOBAL CONVEYOR BELT FOR FOOD AND BEVERAGES MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL CONVEYOR BELT FOR MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL CONVEYOR BELT FOR MINING MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL CONVEYOR BELT FOR RECYCLING MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL CONVEYOR BELT FOR SUPPLY CHAIN MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL CONVEYOR BELT MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. US CONVEYOR BELT MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA CONVEYOR BELT MARKET SIZE, 2023-2031 ($ MILLION)

15. UK CONVEYOR BELT MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE CONVEYOR BELT MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY CONVEYOR BELT MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY CONVEYOR BELT MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN CONVEYOR BELT MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE CONVEYOR BELT MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA CONVEYOR BELT MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA CONVEYOR BELT MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN CONVEYOR BELT MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA CONVEYOR BELT MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC CONVEYOR BELT MARKET SIZE, 2023-2031 ($ MILLION)

26. LATIN AMERICA CONVEYOR BELT MARKET SIZE, 2023-2031 ($ MILLION)

27. MIDDLE EAST AND AFRICA CONVEYOR BELT MARKET SIZE, 2023-2031 ($ MILLION)