COPD and Asthma Devices Market

Global COPD and Asthma Devices Market Size, Share & Trends Analysis by Product type (Inhaler, Nebulizer, Humidifier And Dehumidifier, Respiratory Mask, Oxygen Concentrator), by End-User (Hospitals, Home Care) ForecastPeriod (2022-2028) Update Available - Forecast 2025-2031

The global COPD and asthma devices market is anticipated to grow at a considerable CAGR of 9.7% during the forecast period. COPD and Asthma devices are used to provide medication to the lungs. They also serve the purpose to supply the proper amount of ambient air or oxygen to a patient when the patient is not able to get the proper amount of oxygen just by inhalation. To get relief from asthma and COPD at hospitals, clinics, and homes, and in emergencies, various medical devices have been developed. Inhalers and nebulizers are the most frequently used devices among others. Additionally, humidifiers & dehumidifiers, and oxygen concentrators are also used by patients to get relief from such diseases.

Major factors that are augmenting the COPD and asthma devices market includes cohesive government policies and the high prevalence of asthma and COPD disease globally. Changing lifestyles and increasing obesity are some other factors that are boosting the growth of respiratory diseases. As per the National Sleep Foundation, there are more than 18 million cases of COPD and Asthma Devices in the US alone. About 10 of the total cases of Asthma are in India. Habits such as overeating, smoking, lack of exercise, and other major lifestyle changes are causing respiratory diseases. However, there is some major restraint to the market which includes the risk of developing thrush infection and a dearth of awareness about devices in emerging economies.

Impact of COVID-19 Pandemic on Global COPD and Asthma Devices Market

The COVID-19 pandemic has had a considerable impact on the COPD and asthma devices market. The spread of COVID-19 had a detrimental influence on the market due to supply chain disruptions as a result of protracted plant closures around the world. The COVID-19 pandemic has broken out, and the situation is still uncertain. However, there are facts to consider. The impact of the impending pandemic on the biotech business was very minor in the first quarter of 2020. The most crucial indices — venture capital (VC) firm new money raised, clinical trial pace, mergers and acquisitions, and regulatory approvals (or rejections) — did not change significantly. Important dislocations happened in late March. Companies quarantined themselves (although many continued skeletal lab operations). VC firms started working from their homes. Clinical study sites, in particular, ceased activities as hospitals struggled to cope with the pandemic.

Segmental Outlook

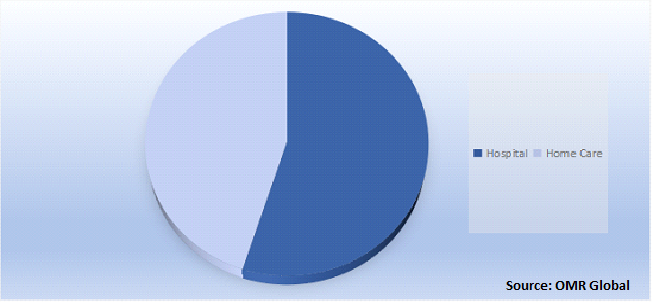

The global COPD and asthma devices market is segmented based on the product type and end-user. Based on the product type, the market is segmented into the inhaler, nebulizer, humidifier and dehumidifier, respiratory mask, oxygen concentrator. The inhaler is expected to have a major market share during the forecast period with a significant growth rate. By end-user, the market has been divided into hospitals & clinics, and home care. Homecare is expected to have a major market share due to the high usage of inhalers by the patient on regular basis.

Global COPD and Asthma Devices Market Share by End-User, 2021 (%)

The Hospital Segment is Anticipated to Hold a Prominent Share in the Global COPD and Asthma Devices Market

The hospital segment is expected to hold a prominent share. The rising prevalence of COPD and asthma cases is increasing the demand for the hospital segment. For instance, according to the WHO, COPD is the third leading cause of mortalities across the globe, in about 65 million people suffer from it, and 3 million die from it each year. About 334 million people suffer from asthma, the most common chronic disease, in which childhood affects 14% of all children globally. In addition, according to the National Institute of Health, the prevalence of asthma in 2019 was around 45.7 million Chinese adults.

Regional Outlooks

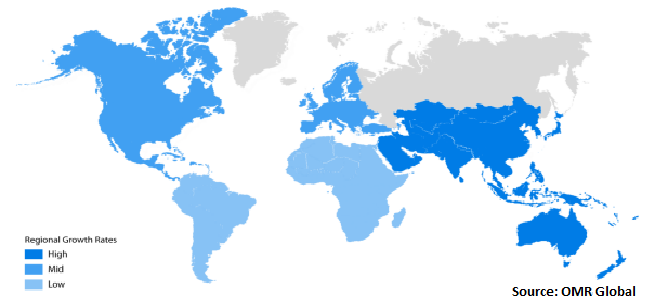

The global COPD and Asthma Devicesmarket is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the North American regional market is expected to cater to considerable growth during the forecast period.

Global COPD and Asthma Devices Market Growth, by Region 2022-2028

Asia-Pacific Region is Expected to Hold a Prominent Share in the Global COPD and Asthma Devices Market

Asia-Pacific region is expected to hold a prominent share in the global COPD and asthma devices market due to the increasing prevalence of COPD and Asthma in countries including China. As per the study conducted by National Health and Planning Commission in 2019, 30 million people in China suffered from asthma and only 28% of the people with asthma have their condition under control. In addition, emphysema is another type of COPD that affects air sacs in the lungs. The cause of emphysema includes smoking, long-term exposure to other lung irritants such as air pollution, chemical fumes and dust and second-hand smoke. Therefore, the rise in the number of incidences of COPD and asthma in China may further create the demand for their effective treatment which, in turn, contributes to the growth of the market.

Market Players Outlook

The major companies serving the global COPD and asthma devices market include 3M Co., AstraZeneca PLC, Becton Dickinson & Co., Boehringer Ingelheim International GmbH, and Teva Pharmaceuticals Industries Ltd.among others. Market players are constantly focusing on gaining major market share by adopting strategies such as mergers & acquisitions, product launches, partnerships, and collaboration. For instance, in May 2020, a product named Bevespi Aerosphere of AstraZeneca was approved in China, as a maintenance treatment to relieve symptoms in patients with COPD.

The Report Covers

Market value data analysis of 2021 and forecast to 2028.

Annualized market revenues ($ million) for each market segment.

Country-wise analysis of major geographical regions.

Key companies operating in the global COPD and asthma devices market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

Analysis of market-entry and market expansion strategies.

Competitive strategies by identifying ‘who-stands-where’ in the market.

1.Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on the Global COPD and Asthma Devices Market

- Recovery Scenario of Global COPD and Asthma Devices Market

1.1.Research Methods and Tools

1.2.Market Breakdown

1.2.1.By Segments

1.2.2.By Region

2.Market Overview and Insights

2.1.Scope of the Report

2.2.Analyst Insight & Current Market Trends

2.2.1.Key Findings

2.2.2.Recommendations

2.2.3.Conclusion

3.Competitive Landscape

3.1.Key Company Analysis

3.2.Key Strategy Analysis

3.3.Impact of Covid-19 on Key Players

4.Market Segmentation

4.1.Global COPD and Asthma Devices Market by Product Type

4.1.1.Biochips Respiratory Inhalers

4.1.2.Respiratory Nebulizers

4.1.3.Respiratory Humidifiers and Dehumidifier

4.1.4.Respiratory Oxygen Concentrators

4.1.5.Other Respiratory Products (Respiratory Masks)

4.2.Global COPD and Asthma Devices Market by End-User

4.2.1.Hospitals

4.2.2.Home Care

5.Regional Analysis

5.1.North America

5.1.1.United States

5.1.2.Canada

5.2.Europe

5.2.1.UK

5.2.2.Germany

5.2.3.Italy

5.2.4.Spain

5.2.5.France

5.2.6.Rest of Europe

5.3.Asia-Pacific

5.3.1.China

5.3.2.India

5.3.3.Japan

5.3.4.South Korea

5.3.5.Rest of Asia-Pacific

5.4.Rest of the World

6.Company Profiles

6.1.Abbott Laboratories, Inc.

6.2.3M Co.

6.3.Adamis Pharmaceuticals Corp.

6.4.Adherium Ltd.

6.5.Aradigm Corp.

6.6.Aristopharma Ltd.

6.7.AstraZeneca PLC

6.8.Boehringer Ingelheim International GmbH

6.9.Becton Dickinson & Co. (CareFusion)

6.10.ChiesiFarmaceutici SPA

6.11.Cipla Inc.

6.12.Cohero Health, Inc.

6.13.DeVilbiss Healthcare LLC

6.14.Gerresheimer AG

6.15.GE Healthcare

6.16.Gilbert Technologies BV

6.17.GlaxoSmithKline PLC

6.18.Koninklijke Philips NV

6.19.MedisolLifescience Pvt. Ltd.

6.20.Mylan NV

6.21.Novartis AG

6.22.Orion Corp.

6.23.Peptinnovate Ltd.

6.24.Smith Medical, Inc.

6.25.Sunovion Pharmaceuticals Inc.

6.26.Teicos Pharma Ltd.

6.27.Teva Pharmaceuticals Industries Ltd.

6.28.Verona Pharma PLC

1.GLOBAL COPD AND ASTHMA DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

2.GLOBALRESPIRATORY INHALERSMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3.GLOBALRESPIRATORY NEBULIZERSMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4.GLOBALRESPIRATORY HUMIDIFIERS AND DEHUMIDIFIERMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5.GLOBALRESPIRATORY OXYGEN CONCENTRATORSMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6.GLOBALOTHER RESPIRATORY PRODUCTS (RESPIRATORY MASKS)MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7.GLOBAL COPD AND ASTHMA DEVICES MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

8.GLOBAL COPD AND ASTHMA DEVICES FOR HOSPITALS MARKET RESEARCH AND ANALYSIS BYREGION, 2021-2028 ($ MILLION)

9.GLOBAL COPD AND ASTHMA DEVICES FOR HOME CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10.NORTH AMERICAN COPD AND ASTHMA DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11.NORTH AMERICAN COPD AND ASTHMA DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

12.EUROPEAN COPD AND ASTHMA DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13.EUROPEAN COPD AND ASTHMA DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

14.ASIA-PACIFIC COPD AND ASTHMA DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15.ASIA-PACIFIC COPD AND ASTHMA DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

16.REST OF THE WORLD COPD AND ASTHMA DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17.REST OF THE WORLD COPD AND ASTHMA DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

1.IMPACT OF COVID-19 ON GLOBAL COPD AND ASTHMA DEVICES MARKET, 2021-2028 ($ MILLION)

2.IMPACT OF COVID-19 ON GLOBAL COPD AND ASTHMA DEVICES MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3.RECOVERY OF GLOBAL COPD AND ASTHMA DEVICES MARKET, 2022-2028 (%)

4.GLOBAL COPD AND ASTHMA DEVICES MARKET SHARE BY PRODUCT TYPE, 2021 VS 2028 (%)

5.GLOBAL COPD AND ASTHMA DEVICES MARKET SHARE BY END-USER, 2021 VS 2028 (%)

6.GLOBAL RESPIRATORY INHALERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7.GLOBAL RESPIRATORY NEBULIZERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8.GLOBALRESPIRATORY HUMIDIFIERS AND DEHUMIDIFIER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9.GLOBAL RESPIRATORY OXYGEN CONCENTRATORS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10.GLOBAL OTHER RESPIRATORY PRODUCTS (RESPIRATORY MASKS)MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11.GLOBAL COPD AND ASTHMA DEVICES FOR HOSPITALS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12.GLOBAL COPD AND ASTHMA DEVICES FOR HOME CAREMARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13.US COPD AND ASTHMA DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

14.CANADA COPD AND ASTHMA DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

15.UK COPD AND ASTHMA DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

16.FRANCE COPD AND ASTHMA DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

17.GERMANY COPD AND ASTHMA DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

18.ITALY COPD AND ASTHMA DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

19.SPAIN COPD AND ASTHMA DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

20.REST OF EUROPECOPD AND ASTHMA DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

21.INDIA COPD AND ASTHMA DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

22.CHINA COPD AND ASTHMA DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

23.JAPAN COPD AND ASTHMA DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

24.SOUTH KOREA COPD AND ASTHMA DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

25.REST OF ASIA-PACIFIC COPD AND ASTHMA DEVICES MARKET SIZE, 2021-2028 ($ MILLION)

26.REST OF THE WORLD COPD AND ASTHMA DEVICES MARKET SIZE, 2021-2028 ($ MILLION)