Corporate M-learning Market

Corporate M-learning Market Size, Share & Trends Analysis Report by Solutions (E-books, Portable Learning Management System Interactive Assessment, Mobile and Video-Based Courseware, M-Enablement, and Others), by Application (Simulation-Based Learning, Corporate Training, and On-the-Job Training), and by User Type (Large Organizations and Small & Mid-Size Organizations) Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Corporate m-learning market is anticipated to grow at a CAGR of 20.0% during the forecast period. The increasing demand for personalized learning and the growing demand for employee upskilling and reskilling are some of the factors driving the growth of the corporate m-learning market. The increasing use of adaptive learning software and other digital tools in personalized learning helps students learn at their own pace and can provide them with customized resources and support based on their requirements and progress. In order to cater to such demands the market players are launching new and innovative solutions. For instance, in May 2022, Ed-tech startup Camp K12 launched Hatch Kids. This platform supports people learning to code by making games and apps that make learning more interactive and case-based. It also offers free AR/VR curriculum modules for schools and teachers.

According to Coursera annual report 2022, the platform had more than 23 million new registered learners and expand its customer relationship with global brands, such as Belcorp, Fikes Wholesale, Ford Motor Company, Sanofi, and Unicomer. With new reskilling and upskilling programs for Dubai Police (UAE), NITDA (Nigeria), Governo do Espirito Santo (Brazil), and UNDP, Coursera for Government expanded its international customer base.

Segmental Outlook

The global corporate m-learning market is segmented based on the solutions, application, and user type. Based on the solutions, the market is segmented into e-books, portable LMS, interactive assessment, mobile and video-based courseware, m-enablement and others. Based on the application, the market is sub-segmented into simulation based learning, corporate training, and on-the-job training. Further, based on user type, the market is segmented into a large organizations and small & mid-size organizations. Among the users-type, the large organizations sub-segment is expected to hold a prominent share of the global corporate m-learning market across the globe. These large organizations have more budgets and resources to invest in training programs, skill development, and leadership development programs which can be effectively delivered by mobile learning platforms. Many large organization are focusing on technology-assisted learning, which allows employees to produce, preserve, and share new ideas which further boosts in productivity, as well as increases in employee innovation and loyalty. For instance, in January 2023, Tata motors inaugurated a digital literacy van and a computer literacy center for the students of Jojobera, Jamshedpur. This initiative helps to bridge the digital and gender gaps and encourage e-learning among younger generations in Jamshedpur.

Learning management platform (LMS) is anticipated to hold prominent share in the Global Corporate M-learning Market

Based on solutions, learning management platform (LMS) is expected to hold largest share in the corporate m-learning platform. LMS software tools assist in managing training programs including assigning, scheduling and tracking training activities and it also provides a centralized learning platform which further streamlines the learning management process. LearnWorlds, iSpring Solutions, Inc., 360Learning, BrainCert and others companies are using LMS software.

Regional Outlook

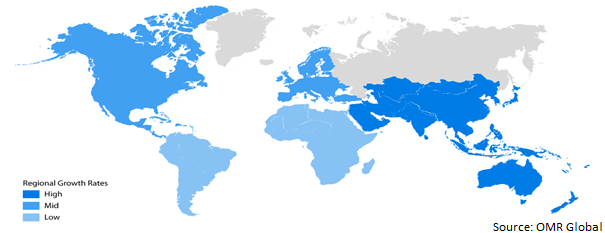

The global corporate m-learning market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The North American market for corporate m-learning is anticipated to grow significantly during the forecast period. The increasing adoption of mobile devices and the internet has made mobile learning a popular option and many companies shifted to remote work and online training which has created a demand for learning platforms and mobile platforms. The Europe market is also anticipated to cater to prominent growth over the forecast period. Strong telecom infrastructure in various European countries, such as France, Italy, Sweden, Austria, and Germany, allows for a better mobile learning experience since content can be streamed at a fast speed with no lags. Governments throughout Europe are promoting the use of mobile learning technologies to improve the educational system.

Global Corporate M-learning Market Growth, by Region 2023-2030

The Asia-Pacific Region is Expected to Register Prominent Share Growth in the Global Corporate M-learning Market

Among all regions, the Asia-Pacific region is expected to witness prominent share growth in corporate m-learning due to increasing demand for e-learning solutions in emerging countries such as India and China. Many companies are offering a wide range of courses, skill assessment training and development program which further drive the growth of corporate m-learning market. For instance, in December 2022, Reliance Industries Ltd. (RIL) offers Coursera course for employees’ families. The company employees will provide unlimited access to all Coursera for Business certifications from over 170 prestigious universities such as Carnegie-Mellon University, Yale University, University of Michigan, and Johns Hopkins University, as well as organisations such as Meta, Google, SAP and Microsoft.

Market Players Outlook

The major companies serving the global Corporate M-learning market include Adobe Inc., DominKnow Inc., NetDimensions Ltd, Citrix Systems Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in May 2022, eLearning Brothers, the learning services and technology company ac ired CoreAxis, a creative training design, development, and on-demand learning resource provider. This platform provides an agile, ON-demand, and flexible resource solution that enables learning and development initiatives to scale and deliver measurable results.

Additionally, in April 2022, the announcement of new education features by Zoom Video Communications Inc. enhanced the hybrid learning experience for educators and students. These features are intended to assist teachers to manage and engage students joining classes remotely or submitting homework assignments.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global corporate m-learning market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. DominKnow Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. NetDimensions Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Citrix Systems Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Corporate M-Learning Market by Solution

4.1.1. E-books

4.1.2. Portable Learning Management System

4.1.3. Interactive Assessment

4.1.4. Mobile and Video-Based Courseware

4.1.5. M-ENABLEMENT

4.1.6. Others

4.2. Global Corporate M-Learning Market by Application

4.2.1. Simulation-Based Learning

4.2.2. Corporate Training

4.2.3. On-the-job Training

4.3. Global Corporate M-Learning Market by User Type

4.3.1. Large Organizations

4.3.2. Small & Mid-size Organizations

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Adobe Inc.

6.2. Aptara Inc.

6.3. Articulate Global Inc.

6.4. Allen Interactions Inc.

6.5. AT&T Inc.

6.6. Certpoint Systems Inc.

6.7. Citrix Systems Inc.

6.8. DominKnow Inc.

6.9. NetDimensions Ltd.

6.10. Learning Pool Ltd.

6.11. Saba

6.12. SumTotal Systems, LLC

6.13. Upside Learning Solutions Pvt Ltd.

1. GLOBAL CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY SOLUTIONS, 2022-2030 ($ MILLION)

2. GLOBAL CORPORATE M-LEARNING BY E-BOOKS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL CORPORATE M-LEARNING BY PORTABLE LMS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL CORPORATE M-LEARNING BY INTERACTIVE ASSESSMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL CORPORATE M-LEARNING BY MOBILE AND VIDEO-BASED COURSEWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL CORPORATE M-LEARNING BY M-ENABLEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL CORPORATE M-LEARNING BY OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

9. GLOBAL SIMULATION-BASED CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL CORPORATE TRAINING M-LEARNING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL ON-THE-JOB TRAINING M-LEARNING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY USER TYPE, 2022-2030 ($ MILLION)

13. GLOBAL CORPORATE M-LEARNING FOR LARGE ORGANIZATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL CORPORATE M-LEARNING FOR SMALL & MID-SIZE ORGANIZATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. NORTH AMERICAN CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

17. NORTH AMERICAN CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY SOLUTIONS 2022-2030 ($ MILLION)

18. NORTH AMERICAN CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

19. NORTH AMERICAN CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY USER TYPE, 2022-2030 ($ MILLION)

20. EUROPEAN CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

21. EUROPEAN CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY SOLUTIONS, 2022-2030 ($ MILLION)

22. EUROPEAN CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

23. EUROPEAN CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY USER TYPE, 2022-2030 ($ MILLION)

24. ASIA-PACIFIC CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

25. ASIA-PACIFIC CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY SOLUTIONS, 2022-2030 ($ MILLION)

26. ASIA-PACIFIC CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

27. ASIA-PACIFIC CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY USER TYPE, 2022-2030 ($ MILLION)

28. REST OF THE WORLD CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

29. REST OF THE WORLD CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY SOLUTIONS, 2022-2030 ($ MILLION)

30. REST OF THE WORLD CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

31. REST OF THE WORLD CORPORATE M-LEARNING MARKET RESEARCH AND ANALYSIS BY USER TYPE, 2022-2030 ($ MILLION)

1. GLOBAL CORPORATE M-LEARNING MARKET SHARE BY SOLUTIONS, 2022 VS 2030 (%)

2. GLOBAL CORPORATE M-LEARNING BY E-BOOKS MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL CORPORATE M-LEARNING BY PORTABLE LMS MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL CORPORATE M-LEARNING BY INTERACTIVE ASSESSMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL CORPORATE M-LEARNING BY MOBILE AND VIDEO-BASED COURSEWARE MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL CORPORATE M-LEARNING BY M-ENABLEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL CORPORATE M-LEARNING BY OTHERS MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL CORPORATE M-LEARNING MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

9. GLOBAL SIMULATION BASED CORPORATE M-LEARNING LEARNING MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL CORPORATE TRAINING M-LEARNING MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL ON-THE-JOB TRAINING M-LEARNING MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL CORPORATE M-LEARNING MARKET SHARE BY USER TYPE, 2022 VS 2030 (%)

13. GLOBAL CORPORATE M-LEARNING FOR LARGE ORGANIZATIONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL CORPORATE M-LEARNING FOR SMALL & MID-SIZE ORGANIZATIONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. GLOBAL CORPORATE M-LEARNING MARKET SHARE BY REGION, 2022 VS 2030 (%)

16. US CORPORATE M-LEARNING MARKET SIZE, 2022-2030 ($ MILLION)

17. CANADA CORPORATE M-LEARNING MARKET SIZE, 2022-2030 ($ MILLION)

18. UK CORPORATE M-LEARNING MARKET SIZE, 2022-2030 ($ MILLION)

19. FRANCE CORPORATE M-LEARNING MARKET SIZE, 2022-2030 ($ MILLION)

20. GERMANY CORPORATE M-LEARNING MARKET SIZE, 2022-2030 ($ MILLION)

21. ITALY CORPORATE M-LEARNING MARKET SIZE, 2022-2030 ($ MILLION)

22. SPAIN CORPORATE M-LEARNING MARKET SIZE, 2022-2030 ($ MILLION)

23. REST OF EUROPE CORPORATE M-LEARNING MARKET SIZE, 2022-2030 ($ MILLION)

24. INDIA CORPORATE M-LEARNING MARKET SIZE, 2022-2030 ($ MILLION)

25. CHINA CORPORATE M-LEARNING MARKET SIZE, 2022-2030 ($ MILLION)

26. JAPAN CORPORATE M-LEARNING MARKET SIZE, 2022-2030 ($ MILLION)

27. SOUTH KOREA CORPORATE M-LEARNING MARKET SIZE, 2022-2030 ($ MILLION)

28. REST OF ASIA-PACIFIC CORPORATE M-LEARNING MARKET SIZE, 2022-2030 ($ MILLION)

29. REST OF THE WORLD CORPORATE M-LEARNING MARKET SIZE, 2022-2030 ($ MILLION)