Corrugated Board Packaging Market

Global Corrugated Board Packaging Market Size, Share & Trends Analysis Report by Application (Food & Beverages, Electronic Goods, Pharmaceuticals, Beauty & Personal Care, and Others), and Forecast 2020-2026 Update Available - Forecast 2025-2031

The global corrugated board packaging market is projected to grow at a CAGR of over 4% during the forecast period. The key factors that drive the growth of the market include the shift of preferences of the consumers for eco-friendly, economical, and lightweight packaging material. The rising e-commerce sector is further flourishing the growth of the market. Corrugated board is an eco-friendly option for the packaging of goods that mainly includes recyclable materials such as old newspapers, cardboard cartons, and others. These are some of the key factors that drive the growth of the market over the forecast period.

However, the demand for flexible packaging options in comparison with the corrugated board packaging is likely to challenge the growth of the market over the forecast period. For instance, as per the India Brand Equity Foundation (IBEF), flexible packaging is expected to grow at 25% per annum and rigid packaging to grow at 15% per annum. This represents that flexible packaging is one of the most dynamic and fastest-growing markets in India. An emerging shift from conventional rigid packaging to flexible packaging has been witnessed in the country owing to the several benefits offered by flexible packaging, including savings in transportation costs and convenience in handling and disposal. Hence, this may challenge the growth of the market over the forecast period.

Segmental Outlook

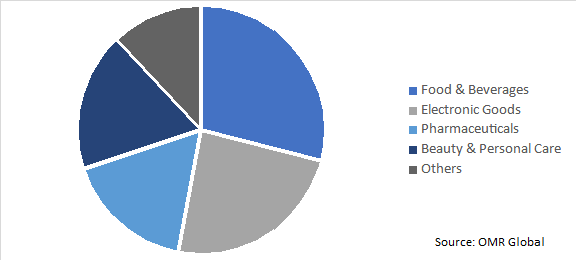

The global corrugated board packaging market has been segmented on the basis of application into food & beverages, electronic goods, pharmaceuticals, beauty & personal care, and others. One of the major applications of corrugated board packaging is in the food & beverage industry. In addition, personal care industry further plays a role in increasing the demand for corrugated board packaging

Global Corrugated Board Packaging Market, by Application 2019 (%)

Food & Beverage Segment to Contribute Significantly Register in the Market Growth

Amongst the application segment of the market, the food & beverage industry tends to contribute a significant share to the market growth. The driving forces behind the increasing use of corrugated board packaging for the food industry include the rising trends of food chain services, rapidly changing consumer preferences such as consumers are now shifting their interest towards personalized, convenient, healthier and affordable packaging products. Moreover, in today’s fast-paced lifestyle, people seek “on the go” food and beverage packaging, with user-friendly features such as ease and convenience, which further drives the market growth.

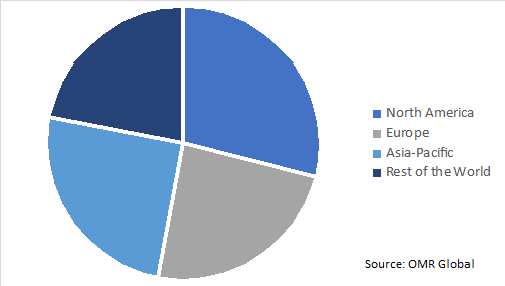

Regional Outlook

The global corrugated board packaging market is geographically segmented into North America, Europe, Asia-Pacific, and the Rest of the World. According to Plastics Europe, the global plastics production reached to 359 million tons in 2018, 348 million tons more as compared to that in 2017. China is the largest producer of plastics and is followed by Europe and North American countries. Total plastic converter demand in Europe was 51.2 million tons in 2018, led by packaging, building & construction and automotive industry.

North America region is estimated to grow significantly during the forecast period. The growth of the region is backed by several factors including the presence of the key players and rapid R&D activities conducted by them in order to contribute to the overall market growth. Further, the Asia-Pacific region is also projected to grow significantly in the market owing to the increased sales of processed food & beverages across the region. Strict regulations imposed by the government of several countries regarding the banning of plastic and non-biodegradable packaging materials will further continue to drive markets in the upcoming years.

Global Corrugated Board Packaging Market, by Region 2019 (%)

Market Players Outlook

Some of the prominent players operating in the global corrugated board packaging market include International Paper Co., Mondi Group, Smurfit Kappa Group, DS Smith Plc, Cascades Inc., Nippon Paper Industries Ltd., Sealed Air Corp., and others. These are the key companies adopting several organic and inorganic growth strategies such as product launches & developments, partnerships, agreements, and acquisitions to strengthen their product portfolios and maintain a competitive position in the global corrugated board packaging market.

In May 2019, Mondi Group invested $34.3 million in its innovative corrugated packaging plants. This strategic initiative of the company will aid in broadening the product portfolio, manufacture innovative products, and enhance product quality.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global corrugated board packaging market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. WestRock Co.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Mondi Group

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. International Paper Co.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Smurfit Kappa Group

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Corrugated Board Packaging Market by Application

5.1.1. Food & Beverages

5.1.2. Electronic Goods

5.1.3. Pharmaceuticals

5.1.4. Beauty &Personal Care

5.1.5. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Ariba & Co.

7.2. Cascades Inc.

7.3. DS Smith Plc

7.4. Georgia-Pacific LLC (Koch Industries Inc.)

7.5. International Paper Co.

7.6. Klabin SA

7.7. KlingelePapierwerke GmbH & Co. KG

7.8. Lee & Man Paper Manufacturing Ltd.

7.9. Mondi Group

7.10. Nine Dragons Paper (Holdings) Ltd.

7.11. Nippon Paper Industries Ltd.

7.12. Oji Holdings Corp.

7.13. Orora Packaging Australia Pty Ltd.

7.14. Packaging Corp. of America

7.15. Rengo Co. Ltd.

7.16. Sealed Air Corp.

7.17. Smurfit Kappa Group

7.18. Waterman (Box Makers) Ltd.

7.19. WestRock Co.

1. GLOBAL CORRUGATED BOARD PACKAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

2. GLOBAL CORRUGATED BOARD PACKAGING OF FOOD & BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL CORRUGATED BOARD PACKAGING OF ELECTRONIC GOODS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL CORRUGATED BOARD PACKAGING OF PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL CORRUGATED BOARD PACKAGING OF BEAUTY & PERSONAL CARE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL CORRUGATED BOARD PACKAGING OF OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL CORRUGATED BOARD PACKAGING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

8. NORTH AMERICAN CORRUGATED BOARD PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

9. NORTH AMERICAN CORRUGATED BOARD PACKAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

10. EUROPEAN CORRUGATED BOARD PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

11. EUROPEAN CORRUGATED BOARD PACKAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

12. ASIA-PACIFIC CORRUGATED BOARD PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. ASIA-PACIFIC CORRUGATED BOARD PACKAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

14. REST OF THE WORLD CORRUGATED BOARD PACKAGING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL CORRUGATED BOARD PACKAGING MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

2. GLOBAL CORRUGATED BOARD PACKAGING MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

3. US CORRUGATED BOARD PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

4. CANADA CORRUGATED BOARD PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

5. UK CORRUGATED BOARD PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

6. FRANCE CORRUGATED BOARD PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

7. GERMANY CORRUGATED BOARD PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

8. ITALY CORRUGATED BOARD PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN CORRUGATED BOARD PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

10. ROE CORRUGATED BOARD PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

11. INDIA CORRUGATED BOARD PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

12. CHINA CORRUGATED BOARD PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

13. JAPAN CORRUGATED BOARD PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

14. REST OF ASIA-PACIFIC CORRUGATED BOARD PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)