COVID-19 Diagnostics Market

Global COVID-19 Diagnostics Market Size, Share & Trends Analysis Report by Type (Instruments and Reagents & Kits), By Technology (Polymerase Chain Reaction (PCR), Antibody or Enzyme-Linked Immunosorbent Assay (ELISA), Serology, and Others), By End-User (Hospitals, Diagnostic Centers & Urgent Care Clinics, Research Labs), and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global COVID-19 diagnostics industry is estimated to register significant growth over the forecast period 2020-2026. Increased demand for point of care devices along with the availability of the advanced diagnosing systems are primarily driving the growth of the market. The outbreak of COVID-19 has largely impacted the overall diagnostics industry globally. There has been a steady increase in the demand for diagnostic systems since the initial time of the outbreak, as peoples are concerned about their health safety. Due to this, an upsurge in the demand for PCR kits, point-of-care kits, and other instruments has been observed globally.

The increased rate of spread of the disease is encouraging the market growth, as the global COVID-19 cases have reached around 7 million by June 2020, and still, no dedicated drug or vaccine has been discovered for the disease. An upsurge in the cases demands an accurate diagnosis to prevent the spread. For instance, there has been an upsurge in the demand for the 600 SARS-CoV-2 diagnostic tests in whichever phase, that is, approved or in the development for the clinical use.

Further, several government guidelines also propel the growth of the market during the forecast period. For instance, Emergency Use Authorization (EUA) was allotted by the US FDA to the first POC test-Xpert Xpress test designed and engineered by Cepheid-for COVID-19 diagnosis. Besides, Chembio Diagnostics Inc. along with Abbott Laboratories are among the key players prominently operating in the market and providing point-of-care devices and instruments. However, the higher prices of test kits and instruments along with the complex procedures of the test are the factors challenging the overall growth of the market during the forecast period.

Segmental Outlook

The global COVID-19 diagnostic market is segmented on the basis of type, technology, and end-user. Based on the type, the market is bifurcated into instruments and reagents & kits. Based on the technology, the market is segmented into polymerase chain reaction (PCR), antibody or enzyme-linked immunosorbent assay (ELISA), serology, and others such as portable or point-of-care testing. Based on the end-user, the market is sectioned into hospitals, diagnostic centers & urgent care clinics, research labs.

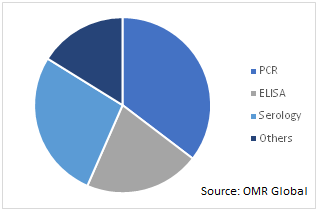

Global COVID-19 Diagnostics Market by Technology, 2019 (%)

Polymerase Chain Reaction (PCR) Segment to Grow Considerably in the Market

Amongst the technology segment of the market, the PCR technology is likely to grow significantly over the forecast period. The segmental growth of the market is attributed to the increased popularity of PCR technology in various fields of healthcare including tests, drug discovery, and diagnosis which has encouraged the manufacturers to more focus on the development and innovation of the PCR, and thereby, contributing to the market over the forecast period.

Additionally, the manufacturers are also engaged in enhancing PCR technology to provide accurate results, that is, integrating AI in the PCRs that results in increased accuracy, faster, lower costs, real-time QC, and ease compliance. For instance, a London-based biotechnology company, Diagnostics.ai, is focused on the development of AI-based advanced products that ensure safe and automated diagnostics. The company offers pcr.ai, that allows automation of PCR infection testing for the COVID-19 patients. Thus, such integration of AI in the devices is expected to provide opportunities to the market growth.

Regional Outlook

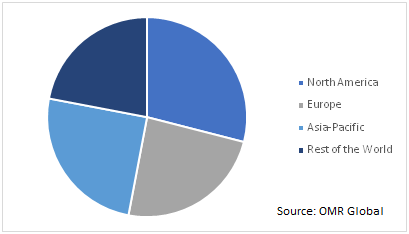

The global COVID-19 diagnostics market is geographically segmented into North America, Europe, Asia-Pacific, and the Rest of the World. Based on the regional viewpoint, the most affected regions include the US, Brazil, Russia, Spain, UK, India, Italy, and Germany. The regional demand for the COVID-19 diagnostics is attributed to the increased rate of spread of the virus along with the rapid research activities going-on to find the cure for the diseases. Thus, the demand for the COVID-19 diagnostics equipment is predicted to augment in various research and clinical laboratories coupled with the hospitals and medical centers across the globe.

Global COVID-19 Diagnostics Market by Region, 2019 (%)

Market Players Outlook

Some of the prominent players operating in the global COVID-19 diagnostics market include Abbott Laboratories Inc., biomérieux SA, Cellex Inc., Cepheid Inc., F. Hoffman-La Roche AG, Laboratory Corp. of America Holdings, Luminex Corp., PerkinElmer Inc., Mylab Discovery Solutions Pvt Ltd., Thermo Fisher Scientific Inc. among others. These are the key companies adopting several organic and inorganic growth strategies such as product launches & developments, partnerships, agreements, and acquisitions to strengthen their product portfolios and maintain a competitive position in the global COVID-19 diagnostics market.

- In May 2020, Roche announced that the US FDA has issued an Emergency Use Authorization (EUA)1 for its new Elecsys Anti-SARS-CoV-2 antibody test. The test is designed to help determine if a patient has been exposed to the SARS-CoV-2 virus and if the patient has developed antibodies against SARS-CoV-2.

- In May 2020, Thermo Fisher Scientific Inc. announced that the US FDA has further expanded emergency use authorization (EUA) for its multiplex real-time PCR test intended for the qualitative detection of nucleic acid from SARS?CoV?2, the virus that causes COVID-19.

- In March 2020, PerkinElmer, Inc. announced that the US FDA has provided Emergency Use Authorization (EUA) for the Company’s New Coronavirus RT-PCR test. Clinical laboratories certified under Clinical Laboratory Improvement Amendments (CLIA) can immediately begin using this kit to detect SARS-CoV-2.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global COVID-19 diagnostics market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints/Challenges

4.3. Opportunities

5. Market Segmentation

5.1. Global COVID-19 Diagnostics Market by Type

5.1.1. Instruments

5.1.2. Reagents & Kits

5.2. Global COVID-19 Diagnostics Market by Technology

5.2.1. Polymerase Chain Reaction (PCR)

5.2.2. Antibody or Enzyme-Linked Immunosorbent Assay (ELISA)

5.2.3. Serology

5.2.4. Others

5.3. Global COVID-19 Diagnostics Market by END-USER

5.3.1. Hospitals

5.3.2. Diagnostic Centers & Urgent Care Clinics

5.3.3. Research Labs

6. By Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories Inc.

7.2. ADT Biotech Sdn Bhd

7.3. Altona Diagnostics GmBH

7.4. Beckman Coulter Inc.

7.5. biomérieux SA

7.6. Cellex Inc.

7.7. Cepheid Inc.

7.8. Chembio Diagnostic Systems Inc.

7.9. Epitope Diagnostics, Inc.

7.10. F. Hoffman-La Roche Ltd.

7.11. Hologic Inc.

7.12. Laboratory Corp. of America Holdings

7.13. Luminex Corp.

7.14. Mylab Discovery Solutions Pvt Ltd.

7.15. PerkinElmer, Inc.

7.16. Quidel Corp.

7.17. Seegene Inc.

7.18. SureScreen Diagnostics Ltd.

7.19. Thermo Fisher Scientific Inc.

7.20. Veredus Laboratories

1. GLOBAL COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL COVID-19 DIAGNOSTICS INSTRUMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL COVID-19 DIAGNOSTICS REAGENTS & KITS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

5. GLOBAL POLYMERASE CHAIN REACTION (PCR) FOR COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL ANTIBODY OR ENZYME-LINKED IMMUNOSORBENT ASSAY (ELISA) FOR COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL SEROLOGY FOR COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL OTHER TECHNOLOGIES FOR COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

10. GLOBAL COVID-19 DIAGNOSTICS IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL COVID-19 DIAGNOSTICS IN DIAGNOSTIC CENTERS & URGENT CARE CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL COVID-19 DIAGNOSTICS IN RESEARCH LABS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. NORTH AMERICAN COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

16. NORTH AMERICAN COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

17. NORTH AMERICAN COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

18. EUROPEAN COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. EUROPEAN COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

20. EUROPEAN COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

21. EUROPEAN COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

25. ASIA-PACIFIC COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

26. REST OF THE WORLD COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

27. REST OF THE WORLD COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2019-2026 ($ MILLION)

28. REST OF THE WORLD COVID-19 DIAGNOSTICS MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

1. GLOBAL COVID-19 DIAGNOSTICS MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL COVID-19 DIAGNOSTICS MARKET SHARE BY TECHNOLOGY, 2019 VS 2026 (%)

3. GLOBAL COVID-19 DIAGNOSTICS MARKET SHARE BY END-USER, 2019 VS 2026 (%)

4. GLOBAL COVID-19 DIAGNOSTICS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US COVID-19 DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA COVID-19 DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

7. UK COVID-19 DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE COVID-19 DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY COVID-19 DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY COVID-19 DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN COVID-19 DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE COVID-19 DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA COVID-19 DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA COVID-19 DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN COVID-19 DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC COVID-19 DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD COVID-19 DIAGNOSTICS MARKET SIZE, 2019-2026 ($ MILLION)