Craft Spirits Market

Craft Spirits Market Size, Share & Trends Analysis Report by Product Type (Whiskey, Vodka, Gin, Rum, Brandy and Liqueur) and by Distribution Channel (On-Trade Channel and Off-Trade Channel)Forecast Period (2024-2031)

Craft spirits market is anticipated to grow at a considerable CAGR of 8.6% during the forecast period (2024-2031).Craft spirits are the segment of the distilled spirits industry that consists of smaller, independent producers who focus on producing high-quality, handcrafted spirits that are typically produced in smaller batches using traditional methods and often emphasize unique flavours, local ingredients, and artisanal techniques and include various types of liquor such as whiskey, vodka, gin, rum, tequila, and others.

Market Dynamics

Elevating the Spirits Experience: Pernod Ricard's Strategic Investment in Código 1530

Consumers are willing to pay a premium for products that offer superior quality, unique flavours, and a sense of luxury or exclusivity. Craft distillers are capitalizing on this trend by focusing on quality, authenticity, and innovation, positioning their products as premium offerings that cater to discerning consumers seeking distinctive taste experiences. For instance, in October 2022, Pernod Ricard revealed its acquisition of majority stakes in the ultra-premium tequila brand, Código 1530, aiming to fortify its portfolio in the spirits industry. By integrating Código 1530 into its lineup, Pernod Ricard seeks to enhance its offerings and meet the evolving preferences of consumers seeking high-quality tequila options.

Craft Spirits: The Intersection of Authenticity and Artisanal Appeal

Authenticity and artisanal appeal are closely related concepts that play a significant role in driving consumer interest and demand for craft spirits. In December 2021, United Spirits Limited, a wholly-owned subsidiary of Diageo PLC, introduced Diageo's limited edition Epitome Reserve to the Indian market. This distinctive edition of Epitome Reserve features a peated single malt, with only 3,600 numbered bottles available, each personally signed by master blender Mahesh Patil. United Spirits' launch of Diageo's Epitome Reserve underscores its dedication to offering premium and exclusive spirits to discerning consumers in India.

Market Segmentation

Our in-depth analysis of the global craft spirits market includes the following segments by product type and distribution channel:

- Based on product type, the market is sub-segmented into whiskey, vodka, gin, rum, brandy and liqueur.

- Based on distribution channel, the market is sub-segmented into on-trade channel and off-trade channel.

Whiskey is Projected to Emerge as the Largest Segment

Based on the product type, the global craft spirits market is sub-segmented into whiskey, vodka, gin, rum, brandy and liqueur. Among these, the whiskey sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing consumer demand for premium and unique whiskey offerings and are renowned for their ability to produce small-batch, artisanal whiskeys that offer distinctive flavours, higher quality, and often reflect the local terroir or heritage. For instance, in March 2022, Diageo, the leading global beverage alcohol company, unveiled its plans for a new distillery, investing $245.0 million to bolster its Crown Royal Canadian Whisky brand's market momentum and growth objectives. The state-of-the-art facility will integrate resource efficiency technology and operate entirely on renewable energy sources, ensuring carbon neutrality and zero waste to landfill, underscoring Diageo's commitment to sustainable manufacturing practices.

Off-Trade Channel Sub-segment to Hold a Considerable Market Share

The Off-Trade Channel sub-segment holds a considerable market share due to the retail outlets such as supermarkets, liquor stores, and online platforms, that offer convenience and accessibility to consumers looking to purchase craft spirits. This channel provides a wide range of options, allowing consumers to explore and purchase craft spirits at their convenience, without the need to visit specialized bars or distilleries.The off-trade channel also enables craft spirit producers to reach a broader audience beyond their local markets.

Craft distilleries can expand their reach to national and even international markets, tapping into consumer demand in regions where their products may not be available through on-trade channels such as bars and restaurants. For instance, in March 2024, Barrell Craft Spirits (BCS) has recently unveiled its acclaimed range of spirits in the UK that is renowned for its exceptional, matured, cask-strength whiskey, the esteemed independent blender has partnered with Axiom Brands to spearhead brand-building efforts across both on-trade and off-trade channels.

Regional Outlook

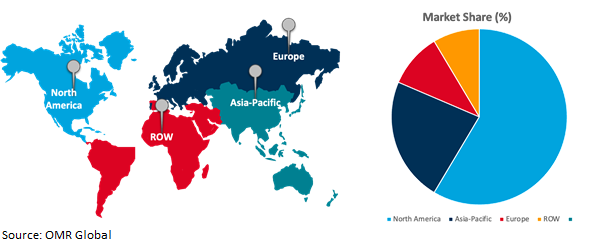

The globalcraft spiritsmarket is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Driving Forces Behind the Growth of the Craft Spirits Market in Asia-Pacific

The Asia-Pacific region is witnessing rapid due to economic expansion. Additionally, the adoption of Western lifestyles and consumption patterns, along with the influence of social media, has fueled interest in artisanal and high-quality spirits. The tourism industry further contributes to market growth, with travellers seeking unique experiences such as visits to craft distilleries. For instance, in March 2022, United Spirits, a prominent India-based beverages company, made a strategic investment of $31.50 million (Rs31.50 crore) in Nao Spirits and Beverages, a craft gin-maker. This move marks United Spirits' entry into the Indian provenance premium craft gin segment, complementing its existing portfolio of premium and luxury gin brands such as Gordon's and Tanqueray. The investment underscores United Spirits' commitment to diversifying its offerings and capturing opportunities in the growing craft spirits market.

Global Craft Spirits Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share due to its long history and tradition of spirits production, with a rich heritage of craft distillingand legacy that has cultivated a culture of appreciation for high-quality, artisanal spirits among consumers and innovative craft spirits industry, with a large number of small, independent distilleries producing a wide variety of unique and creative products that focuses on small-batch production, using locally-sourced ingredients and traditional techniques to create distinctive and premium spirits that appeal to discerning consumers. For instance, in March 2021, Eastside Distilling Inc., a US-based company unveiled its latest product, the Limited Edition series. These meticulously crafted limited-edition products are crafted using premium ingredients and distinctive manufacturing processes, offering customers a unique and exclusive experience. Often sought after by collectors and enthusiasts, these limited-edition releases exemplify Eastside Distilling's dedication to innovation and quality craftsmanship in the spirits industry.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global Craft Spiritsmarket includeSuntory Holdings Ltd., Diageo, Pernod Ricard, Constellation Brands, Campari Group andothers. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance,in November 2022, Diageo made a significant acquisition by purchasing Balcones Distilling, a distinguished craft distillery based in Texas and recognized as one of the foremost producers of American single malt whiskey in the US. This strategic move further solidifies Diageo's position in the spirits market and underscores its commitment to expanding its portfolio with high-quality and innovative offerings. By integrating Balcones into its lineup, Diageo aims to leverage the craft distiller's expertise and heritage to meet the evolving preferences of consumers and drive growth in the whiskey segment.

The Report Covers

- Market value data analysis of 2023and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global craft spiritsmarket. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Diageo

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Pernod Ricard

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Suntory Holdings Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Craft Spirits Market by Product Type

4.1.1. Whiskey

4.1.2. Vodka

4.1.3. Gin

4.1.4. Rum

4.1.5. Brandy

4.1.6. Liqueur

4.2. Global Craft Spirits Market by Distribution Channel

4.2.1. On-Trade Channel

4.2.2. Off-Trade Channel

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Bacardi Ltd.

6.2. Balcones Distilling

6.3. Black Button Distilling

6.4. Campari Group

6.5. Catoctin Creek Distilling Company, LLC

6.6. Constellation Brands

6.7. Copper Fox Distillery

6.8. Coppersea Distilling (COPPERSEA)

6.9. DRY FLY DISTILLING

6.10. Fifth Generation Inc.(Producer of Tito's Handmade Vodka)

6.11. FINGER LAKES DISTILLING COMPANY

6.12. Greenbar Distillery

6.13. Heaven Hill Brands

6.14. Highwood Distillers

6.15. HOTALING & CO.

6.16. Ian Macleod Distilleries Ltd

6.17. Iron Smoke Whiskey LLC.

6.18. Leopold Bros

6.19. New Holland Brewing & Distilling (New Holland Brewing Company, LLC)

6.20. New York Distilling Company

1. GLOBAL CRAFT SPIRITSMARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL WHISKEYMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL VODKA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL GIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL RUM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL BRANDY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL LIQUEUR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL CRAFT SPIRITS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

9. GLOBAL CRAFT SPIRITS VIA ON-TRADE CHANNELMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBALCRAFT SPIRITSVIA OFF-TRADE CHANNELMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CRAFT SPIRITSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN CRAFT SPIRITSMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN CRAFT SPIRITSMARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN CRAFT SPIRITSMARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

15. EUROPEAN CRAFT SPIRITSMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN CRAFT SPIRITSMARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

17. EUROPEAN CRAFT SPIRITSMARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC CRAFT SPIRITSMARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. ASIA-PACIFICCRAFT SPIRITSMARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

20. ASIA-PACIFICCRAFT SPIRITSMARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

21. REST OF THE WORLD CRAFT SPIRITSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. REST OF THE WORLD CRAFT SPIRITSMARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

23. REST OF THE WORLD CRAFT SPIRITSMARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2023-2031 ($ MILLION)

1. GLOBAL CRAFT SPIRITSMARKETSHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL WHISKEY MARKETSHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL VODKA MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL GIN MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL RUM MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL BRANDY MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL LIQUEUR MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL CRAFT SPIRITSMARKET SHAREBY DISTRIBUTION CHANNEL, 2023 VS 2031 (%)

9. GLOBAL CRAFT SPIRITSVIA ON-TRADE CHANNELMARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBALCRAFT SPIRITSVIA OFF-TRADE CHANNELMARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL CRAFT SPIRITSMARKETSHARE BY REGION, 2023 VS 2031 (%)

12. US CRAFT SPIRITSMARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA CRAFT SPIRITSMARKET SIZE, 2023-2031 ($ MILLION)

14. UK CRAFT SPIRITSMARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE CRAFT SPIRITSMARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY CRAFT SPIRITSMARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY CRAFT SPIRITSMARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN CRAFT SPIRITSMARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE CRAFT SPIRITSMARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA CRAFT SPIRITSMARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA CRAFT SPIRITSMARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN CRAFT SPIRITSMARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA CRAFT SPIRITSMARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC CRAFT SPIRITSMARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICACRAFT SPIRITSMARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICACRAFT SPIRITSMARKET SIZE, 2023-2031 ($ MILLION)