Cryoablation Market

Global Cryoablation Market Size, Share & Trends Analysis Report By Application (Oncology, Cardiology, Others), and By End-User (Hospitals, Specialty Clinics, and Ambulatory Surgical Centers), Forecast Period 2021-2027 Update Available - Forecast 2025-2035

The global cryoablation market is expected to grow at an impressive CAGR of 11.2% during the forecast period. The major factors that are augmenting the growth of the cryoablation market include an increase in the prevalence of chronic diseases such as cancer and changing lifestyles. In addition, the acceptance of minimally invasive technology and increasing investments in R&D are other major factors augmenting the market growth. The emerging application of this therapy will turn out to be a huge opportunity for the cryoablation market.

Cryosurgery is used to treat several types of cancer and some precancerous conditions. In addition to cryosurgery, prostate, and liver tumors, cryoablation can be an effective treatment for retinoblastoma, early-stage skin cancers, actinic keratosis, and cervical cancer. Treatment is based on a 20–40 second application (multiple if needed) of a refillable metallic probe that is electrically heated to approximately 100 °C, most important to epithelial and stromal destruction. Cryotherapy ablation is providing by a diversity of healthcare professionals, including primary healthcare workers, and typically performed without anesthesia. Cryosurgery is also used to treat some types of low-grade cancerous and noncancerous tumors of the bone. Cryoablation moderates the risk of joint damage while compared with more extensive surgery and helps reduce the need for exclusion. The treatment is also used to treat AIDS-related Kaposi sarcoma when the skin injuries are small and confined.

However, certain factors are affecting the growth of the cryoablation market such as refrigerant gas (N2O or CO2) that are used in cryotherapy the gas containers are heavy and bulky to transport and in the emerging and low-income countries (LMICs) may have supply issues. Refilling freezing gas can be costly. Moreover, in July 2020, Healio announced the US FDA expands clearance of cryoablation technology for the treatment of head, kidney, liver, and neck tumors. In January 2020, IceCure Medical Ltd. announced the US FDA approval for its cryoablation technology, the approval enables the Company to market its solution for the treatment of cancerous and non-threatening tumors of the liver, Kidney, Ear, Nose, and Throat (ENT).

Segmental Outlook

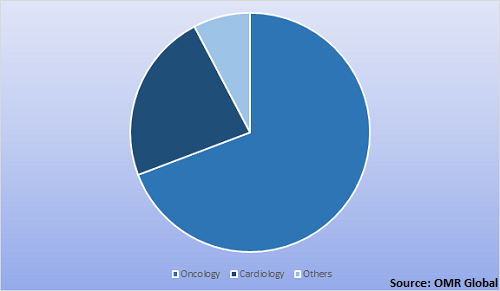

The global cryoablation market is segmented based on application and end-user. Based on application, the market is segmented into oncology, cardiology, and others. The oncology segment is projected for the largest share of the cryoablation market in 2020. The market is growing due to the rising prevalence of cancer, product enhancements, and increasing government funding for cancer research. and the increasing adoption of Yttrium-90 cardioembolic agents in developing countries. Further, based on end-user, the market is sub-segmented into hospitals, clinics, and ambulatory surgical centers.

Global Cryoablation Market Share by Application, 2020 (%)

Regional Outlook

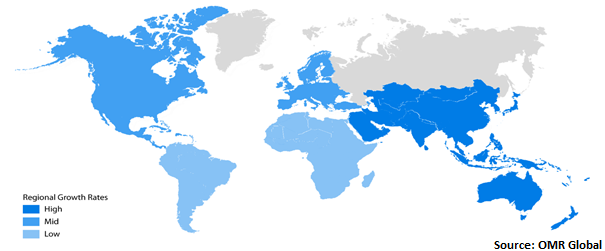

The global cryoablation market is analyzed based on the geographical regions that are contributing significantly to the growth of the market. The market report covers the analysis of four major regions including North America (the US and Canada), Europe (UK, Germany, Italy, Spain, France, and Rest of Europe), Asia-Pacific (China, Japan, India, and the Rest of Asia-Pacific) and Rest of the World (RoW). North America is estimated to be the leading region in the global cryoablation market. The prevalence of cancer is one of the major factors driving the growth of the market in the region. The Asia-Pacific is estimated to be the fastest-growing region during the forecast period 2021-2027.

Global Cryoablation Market Growth, by Region 2021-2027

Asia-Pacific to register considerable growth in the global cryoablation market

In Asia-Pacific, the cryoablation market is driven by various factors including an increased prevalence of cancer and cardiovascular disease and government funding on cancer research. China is expected to be one of the leading countries the due to rising prevalence of cardiac diseases such as heart stroke and the development of cardiovascular devices in the country.

Market Players Outlook

Key players of the global cryoablation market include Medtronic Inc., Boston Scientific Corp., Johnson & Johnson Services, Inc., AtriCure, Inc., and CooperSurgical. To survive in the market these players adopt different marketing strategies such as a merger, acquisitions, product launches, geographical expansion, charities so on. For instance, in February 2020, Boston Scientific Corp. received CE Mark for the POLARx Cryoablation System, which is designated for the treatment of patients with paroxysmal atrial fibrillation (AF), an intermittent form of AF which causes an irregular and often abnormally fast heart rate.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cryoablation market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Cryoablation Market by Application

5.1.1. Oncology

5.1.2. Cardiology

5.1.3. Other

5.2. Global Cryoablation Market by End-User

5.2.1. Hospitals

5.2.2. Specialty Clinics

5.2.3. Ambulatory Surgical Centers

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Adagio Medical, Inc.

7.2. AngioDynamics, Inc.

7.3. AtriCure, Inc.

7.4. ATS Medical, Inc.

7.5. BioSig Technologies, Inc.

7.6. Boston Scientific Corp.

7.7. CPSI Biotech

7.8. HealthTronics, Inc.

7.9. IceCure Medical

7.10. Johnson & Johnson Services, Inc.

7.11. Medtronic PLC.

7.12. Olympus Corp.

7.13. Sanarus Technologies, Inc.

7.14. Stryker Corp.

1. GLOBAL CRYOABLATION MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($ MILLION)

2. GLOBAL ONCOLOGY MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

3. GLOBAL CARDIOLOGY MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

4. GLOBAL OTHER MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

5. GLOBAL CRYOABLATION MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($ MILLION)

6. GLOBAL HOSPITALS MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

7. GLOBAL SPECIALTY CLINICS MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

8. GLOBAL AMBULATORY SURGICAL CENTERS MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

9. NORTH AMERICAN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($MILLION)

10. NORTH AMERICAN MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($MILLION)

11. NORTH AMERICAN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($MILLION)

12. EUROPEAN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($MILLION)

13. EUROPEAN MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($MILLION)

14. EUROPEAN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($MILLION)

15. ASIA-PACIFIC MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($MILLION)

16. ASIA-PACIFIC MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($MILLION)

17. ASIA-PACIFIC MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($MILLION)

18. REST OF THE WORLD MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2020-2027 ($MILLION)

19. REST OF THE WORLD MARKET RESEARCH AND ANALYSIS BY END-USER, 2020-2027 ($MILLION)

1. GLOBAL CRYOABLATION MARKET BY APPLICATION, 2020 VS 2027(%)

2. GLOBAL CRYOABLATION MARKET BY END-USER, 2020 VS 2027(%)

3. GLOBAL CRYOABLATION MARKET BY GEOGRAPHY, 2020 VS 2027(%)

4. GLOBAL ONCOLOGY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027(%)

5. GLOBAL CARDIOLOGY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027(%)

6. GLOBAL OTHER MARKET SHARE BY GEOGRAPHY, 2020 VS 2027(%)

7. GLOBAL HOSPITALS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027(%)

8. GLOBAL SPECIALTY CLINICS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027(%)

9. GLOBAL AMBULATORY SURGICAL CENTERS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027(%)

10. US CRYOABLATION MARKET SIZE, 2020-2027 ($ MILLION)

11. CANADA CRYOABLATION MARKET SIZE, 2020-2027 ($ MILLION)

12. UK CRYOABLATION MARKET SIZE, 2020-2027 ($ MILLION)

13. GERMANY CRYOABLATION MARKET SIZE, 2020-2027 ($ MILLION)

14. SPAIN CRYOABLATION MARKET SIZE, 2020-2027 ($ MILLION)

15. FRANCE CRYOABLATION MARKET SIZE, 2020-2027 ($ MILLION)

16. ITALY CRYOABLATION MARKET SIZE, 2020-2027 ($ MILLION)

17. REST OF EUROPE CRYOABLATION MARKET SIZE, 2020-2027 ($ MILLION)

18. INDIA CRYOABLATION MARKET SIZE, 2020-2027 ($ MILLION)

19. CHINA CRYOABLATION MARKET SIZE, 2020-2027 ($ MILLION)

20. JAPAN CRYOABLATION MARKET SIZE, 2020-2027 ($ MILLION)

21. REST OF ASIA-PACIFIC CRYOABLATION MARKET SIZE, 2020-2027 ($ MILLION)

22. REST OF THE WORLD CRYOABLATION MARKET SIZE, 2020-2027 ($ MILLION)