Cryogenic Equipment Market

Global Cryogenic Equipment Market Size, Share & Trends Analysis Report by Equipment (Tanks, Valves, Pumps & Vaporizers, Vacuum Jacketed Pipes), By Cryogenic Type (Oxygen, Nitrogen, Argon, Natural Gas) End-User Vertical (Oil & Gas, Energy & Power, Food & Beverages, Medical & Healthcare, Chemical, Marine & Aerospace), Forecast Period 2021-2027 Update Available - Forecast 2025-2031

The global cryogenic equipment market is anticipated to grow at a considerable CAGR of 5.8% during the forecast period (2021-2027). The significant rise in the trade of liquid natural gas (LNG) owing to increasing usage of LNG by the countries to phase out the non-renewable source of energy high cost of anticipated to drive the growth of cryogenic equipment market. The rising utility of cryogenic equipment in several end-user verticals for storage and distribution of liquefied gases at a lower temperature is expected to drive the market growth. However, the costly process of liquefaction for cryogenic gases is expected to hinder the cryogenic equipment market growth. The advancement and growing development of cryogenic technology in the field of healthcare is anticipated to create lucrative opportunities for the growth of the cryogenic equipment market during the forecast period.

The COVID-19 pandemic has significantly increased the demand for cryogenic equipment across the globe. Medical oxygen, a crucial resource in treating critically ill COVID-19 patients, has been in short supply with the second wave of the pandemic resulting in tremendously high demand across the country. In April 2021, the Tata Group from India announced to import 24 cryogenic containers to transport liquid oxygen to ease oxygen shortage amid a staggering surge in COVID-19 cases across the country. The significant increase in demand for liquid oxygen is anticipated to promote the demand for cryogenic tanks; which in turn is anticipated to drive the growth of the global cryogenic equipment market.

Segmental Outlook

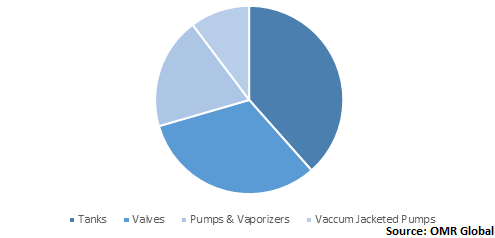

The global cryogenic equipment market is segmented based on equipment, cryogenic type, and end-user vertical. Based on equipment, the market is segmented into tanks, valves, pumps & vaporizers, and vacuum jacketed pipes. Based on cryogenic type, the market is segmented into oxygen, nitrogen, argon, and natural gas. Based on the end-user vertical, the market is segmented into oil & gas, energy & power, food & beverages, medical & healthcare, chemical, and marine & aerospace.

Global Cryogenic Equipment Market Share by Equipment, 2020 (%)

Tanks hold a significant share in the Market based on Equipment

Tanks to hold major market share based on equipment segment. Cryogenic tanks are used to store natural gases such as oxygen, argon, nitrogen, helium, hydrogen, and other materials at a lower temperature. According to the International Gas Union, in its sixth consecutive year of growth, the LNG trade increased by 13% to a total of 354.7 Metric Tonne. The significant rise in the cross-border trade of natural gases is a key factor contributing to the high share of this market segment.

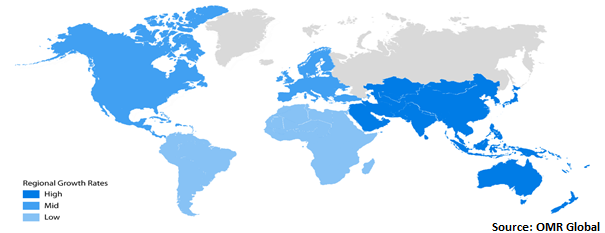

Regional Outlooks

The global cryogenic equipment market is further segmented based on geography including North America, Europe, Asia-Pacific, and the Rest of the World. North America held a significant share in the global market in 2020. In North America, the US contributes over 75.0% share in the North American cryogenic equipment market in 2020. The growth of the regional market is backed by the presence of major market players in the US such as CryoFab Inc., Emerson Electric Co., Honeywell International Inc. Adoption of cryogenic for various applications such as the medical sector, gas industry, and food preservation in the US market are some other motivators for the growth of the regional market.

Global Cryogenic Equipment Market Growth, by Region 2021-2027

Asia-Pacific is Projected to Have Considerable Share in the Global Cryogenic equipment Market

Asia-Pacific is anticipated to hold a considerable market share in the global cryogenic equipment market. The factors that are augmenting the market growth include the demand for cryogenic equipment in the different industrial verticals for cooling purposes. The escalating demand for oxygen cylinders across the region to support COVID-19 patients has been driving the regional market growth. The well-established food & beverage industry of India is anticipated to support the demand for cryogenic equipment is further anticipated to drive the growth of the regional market.

Market Players Outlook

The cryogenic equipment market is embodied by severe competition owing to the presence of well-established market players. CryoFab Inc., Emerson Electric Co., Herose GmbH, Honeywell International Inc., Linde PLC, and Thermo Fisher Scientific Inc. among others are the key players operating the global cryogenic equipment market. The companies operating in the cryogenic equipment market are adopting different growth strategies such as partnerships, agreements, and mergers & acquisitions among others to compete based on technology, price, and equipment design. Geographical expansion and innovation in cryogenic technology are some other strategies that are being adopted by key players in the market to remain competitive.

Recent Developments-

- In April 2021, the contract development manufacturing organization (CDMO) ‘Catalent’ has invested to expand cryogenic capabilities at its clinical supply services facility in Philadelphia to meet cell and gene therapy demand. In addition to the equipment necessary to handle, package and label cryogenic materials, Catalent will add five cryogenic freezers with enough capacity for tens of thousands of vials at very low temperatures of around 180°C.

- In April 2021, Inoxcva, the developer of the first indigenous LNG dispensers had entered into a partnership with the Japanese conglomerate Mitsui & Co to expand its LNG distribution business through tankers. The agreement also entails deploying small-scale LNG infrastructure, including supply logistics and receiving facilities at customer-ends who are not connected to the pipelines.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cryogenic equipment market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where in the market.

1. Report Summary

• Current Industry Analysis and Growth Opportunity Outlook

• COVID-19 Impact Analysis

• Recovery Scenarios

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Cryogenic Equipment Market by Equipment

5.1.1. Tanks

5.1.2. Valves

5.1.3. Pumps & Vaporizers

5.1.4. Vacuum Jacketed Pipes

5.2. Global Cryogenic Equipment Market by Cryogen Type

5.2.1. Oxygen

5.2.2. Nitrogen

5.2.3. Argon

5.2.4. Natural Gas

5.3. Global Cryogenic Equipment Market by End-User Vertical

5.3.1. OIL & GAS

5.3.2. Energy & Power

5.3.3. Food & Beverages

5.3.4. Medical & Healthcare

5.3.5. Chemical

5.3.6. Marine & Aerospace

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Acme CRYOGENIC, Inc.

7.2. Air Products and Chemicals, Inc.

7.3. Beijing Tianhai Industry Co., Ltd.

7.4. Chart Industries

7.5. CryoFab, Inc.

7.6. Cryolor

7.7. Emerson Electric Co.

7.8. Flowserve Corp.

7.9. Furuise Europe

7.10. Herose GmbH

7.11. Honeywell International Inc.

7.12. INOX India Pvt. Ltd. (INOXCVA)

7.13. IWI Cryogenic Vaporization Systems (India) Pvt. Ltd.

7.14. Linde PLC

7.15. Parker-Hannifin Corp.

7.16. PBS Group, A.S.

7.17. Shell-N-Tube Pvt. Ltd.

7.18. Sumitomo Heavy Industries, Ltd.

7.19. Taylor-Wharton

7.20. Thermo Fisher Scientific, Inc.

7.21. VRV S.p. A.

7.22. Wessington CRYOGENIC, Ltd.

1. GLOBAL CRYOGENIC EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2020-2027 ($ MILLION)

2. GLOBAL CRYOGENIC TANKS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL CRYOGENIC VALVES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL CRYOGENIC PUMPS & VAPORIZERS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL CRYOGENIC VACUUM JACKETED PIPES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL CRYOGENIC EQUIPMENT MARKET RESEARCH AND ANALYSIS BY CRYOGEN TYPE, 2020-2027 ($ MILLION)

7. GLOBAL OXYGEN CRYOGENIC MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL NITROGEN CRYOGENIC MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL ARGON CRYOGENIC MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL NATURAL GAS CRYOGENIC MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL CRYOGENIC EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER VERTICAL, 2020-2027 ($ MILLION)

12. GLOBAL CRYOGENIC EQUIPMENT IN OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL CRYOGENIC EQUIPMENT IN ENERGY & POWER MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL CRYOGENIC EQUIPMENT IN FOOD & BEVERAGES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

15. GLOBAL CRYOGENIC EQUIPMENT IN MEDICAL & HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

16. GLOBAL CRYOGENIC EQUIPMENT IN MARINE & AEROSPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

17. GLOBAL CRYOGENIC EQUIPMENT IN CHEMICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

18. NORTH AMERICAN CRYOGENIC EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

19. NORTH AMERICAN CRYOGENIC EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2020-2027 ($ MILLION)

20. NORTH AMERICAN CRYOGENIC EQUIPMENT MARKET RESEARCH AND ANALYSIS BY CRYOGEN TYPE, 2020-2027 ($ MILLION)

21. NORTH AMERICAN CRYOGENIC EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER VERTICAL, 2020-2027 ($ MILLION)

22. EUROPEAN CRYOGENIC EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

23. EUROPEAN CRYOGENIC EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2020-2027 ($ MILLION)

24. EUROPEAN CRYOGENIC EQUIPMENT MARKET RESEARCH AND ANALYSIS BY CRYOGEN TYPE, 2020-2027 ($ MILLION)

25. EUROPEAN CRYOGENIC EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER VERTICAL, 2020-2027 ($ MILLION)

26. ASIA-PACIFIC CRYOGENIC EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

27. ASIA-PACIFIC CRYOGENIC EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2020-2027 ($ MILLION)

28. ASIA-PACIFIC CRYOGENIC EQUIPMENT MARKET RESEARCH AND ANALYSIS BY CRYOGEN TYPE, 2020-2027 ($ MILLION)

29. ASIA-PACIFIC CRYOGENIC EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER VERTICAL, 2020-2027 ($ MILLION)

30. REST OF THE WORLD CRYOGENIC EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

31. REST OF THE WORLD CRYOGENIC EQUIPMENT MARKET RESEARCH AND ANALYSIS BY EQUIPMENT, 2020-2027 ($ MILLION)

32. REST OF THE WORLD CRYOGENIC EQUIPMENT MARKET RESEARCH AND ANALYSIS BY CRYOGEN TYPE, 2020-2027 ($ MILLION)

33. REST OF THE WORLD CRYOGENIC EQUIPMENT MARKET RESEARCH AND ANALYSIS BY END-USER VERTICAL, 2020-2027 ($ MILLION)

1. GLOBAL CRYOGENIC EQUIPMENT MARKET SHARE BY EQUIPMENT, 2020 VS 2027 (%)

2. GLOBAL CRYOGENIC EQUIPMENT MARKET SHARE BY CRYOGEN TYPE, 2020 VS 2027 (%)

3. GLOBAL CRYOGENIC EQUIPMENT MARKET SHARE BY END-USER VERTICAL, 2020 VS 2027 (%)

4. GLOBAL CRYOGENIC EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

5. GLOBAL CRYOGENIC TANKS MARKET SHARE BY REGION, 2020 VS 2027 (%)

6. GLOBAL CRYOGENIC VALVES MARKET SHARE BY REGION, 2020 VS 2027 (%)

7. GLOBAL CRYOGENIC PUMPS & VAPORIZERS MARKET SHARE BY REGION, 2020 VS 2027 (%)

8. GLOBAL CRYOGENIC VACUUM JACKETED PIPES MARKET SHARE BY REGION, 2020 VS 2027 (%)

9. GLOBAL OXYGEN CRYOGENIC MARKET SHARE BY REGION, 2020 VS 2027 (%)

10. GLOBAL NITROGEN CRYOGENIC MARKET SHARE BY REGION, 2020 VS 2027 (%)

11. GLOBAL ARGON CRYOGENIC MARKET SHARE BY REGION, 2020 VS 2027 (%)

12. GLOBAL NATURAL GAS CRYOGENIC MARKET SHARE BY REGION, 2020 VS 2027 (%)

13. GLOBAL CRYOGENIC EQUIPMENT IN OIL & GAS MARKET SHARE BY REGION, 2020 VS 2027 (%)

14. GLOBAL CRYOGENIC EQUIPMENT IN ENERGY & POWER MARKET SHARE BY REGION, 2020 VS 2027 (%)

15. GLOBAL CRYOGENIC EQUIPMENT IN FOOD & BEVERAGES MARKET SHARE BY REGION, 2020 VS 2027 (%)

16. GLOBAL CRYOGENIC EQUIPMENT IN MEDICAL & HEALTHCARE MARKET SHARE BY REGION, 2020 VS 2027 (%)

17. GLOBAL CRYOGENIC EQUIPMENT IN CHEMICAL MARKET SHARE BY REGION, 2020 VS 2027 (%)

18. GLOBAL CRYOGENIC EQUIPMENT IN MARINE & AEROSPACE MARKET SHARE BY REGION, 2020 VS 2027 (%)

19. US CRYOGENIC EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

20. CANADA CRYOGENIC EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

21. UK CRYOGENIC EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

22. FRANCE CRYOGENIC EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

23. GERMANY CRYOGENIC EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

24. ITALY CRYOGENIC EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

25. SPAIN CRYOGENIC EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

26. REST OF EUROPE CRYOGENIC EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

27. INDIA CRYOGENIC EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

28. CHINA CRYOGENIC EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

29. JAPAN CRYOGENIC EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

30. SOUTH KOREA CRYOGENIC EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

31. REST OF ASIA-PACIFIC CRYOGENIC EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)

32. REST OF THE WORLD CRYOGENIC EQUIPMENT MARKET SIZE, 2020-2027 ($ MILLION)