Cryogenic Pump Market

Cryogenic Pump Market Size, Share & Trends Analysis Report by Type (Centrifugal Pumps, Positive Displacement Pumps, Kinetic Pumps, and Entrapment Pumps) by Gas (Nitrogen, Hydrogen, Helium, and LNG) and by End-Use Industry (Healthcare Industry, Energy & Power Generation Industry, Electricals & Electronics Industry, Metallurgy Industry, and Chemicals) Forecast Period (2024-2031).

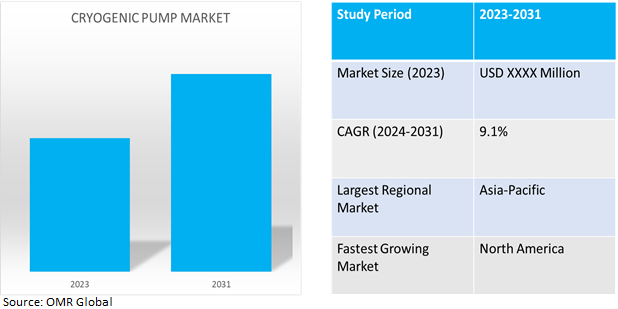

Cryogenic pump market is anticipated to grow at a CAGR of 9.1% during the forecast period (2024-2031). The increase in demand for cryogenic pumps across multiple end-use industries, including power generation and healthcare is one of the prime factors that drives the growth of the global market. Moreover, complex industrial processes incorporate the use of liquid gases, thus fueling the demand for cryogenic pumps at a rapid pace. In addition, an increase in demand for energy and power is expected to drive the overall demand for LNG, thus arrangements to handle its transportation boosts the cryogenic pump market growth.

Market Dynamics

Supportive Government Policies Create Myriad Opportunities for Cryogenic Pumps

In terms of efficiency, cryogenic pumps are considered a more viable option. Therefore, industries mostly prefer cryogenic pumps for their needs in the chemical and petrochemical sectors. Taking into consideration the need for gas extraction in chemical and petrochemical plants and the efficiency of cryogenic pumps, the government is supporting the use of cryogenic pumps. Various governments across the globe have understood the importance of gas extraction and have devised new policies to encourage factories to incubate cryogenic pumps. Along with this, the government has also declared subsidies and other financial benefits to the manufacturers and distributors of cryogenic pumps. This is proving to be an excellent step by the governing authority to cater to the needs of the chemical and petrochemical industry. With this, there are plenty of opportunities for manufacturers, distributors, and vendors of cryogenic pumps on the global platform.

Significant Technological Advancements

Globally, sophisticated cryogenic pumps are emerging because of developments in materials science and engineering. Modern pumps are evolving to become more reliable, strong, and efficient. They are easy for operators to use because of their sophisticated seals, computerized control systems, and other safety features. These improvements in technology not only prolong the life of the pumps but also save running costs. As a result, cryogenic pumps are used in different industries, including petrochemicals and aerospace. Moreover, according to the report presented by the Aerospace Industries Association (AIA), the aerospace and defense sector exports increased by 4.4% in 2022, reaching a total value of $104.8 billion.

Market Segmentation

Our in-depth analysis of the global cryogenic pump market includes the following segments by type, gas, and end-use industry:

- Based on type, the market is segmented into centrifugal pumps, positive displacement pumps, kinetic pumps, and entrapment pumps.

- Based on gas, the market is segmented into nitrogen, hydrogen, helium, and LNG.

- Based on the end-use industry, the market is segmented into the healthcare industry, energy & power, generation industry, electricals & electronics industry, metallurgy industry, and chemicals.

LNG is Projected to Emerge as the Largest Segment

The LNG segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth is attributed to the rise in R&D activities in oil & gas and the increase in demand for LNG. Cryogenic pumps are used for transfer in fuel gas systems, LNG or CNG stations, vehicle loading & trailer off-loading, bulk transfer, and bunkering. Some end-user industries employing these gases include construction & mining equipment, locomotives, and marine vessels. Liquid oxygen pumps are designed with extreme care, as liquid oxygen is not compatible with all components of the machines. In addition, LNG has a wide range of industrial and energy-related applications, which is expected to fuel its demand in the upcoming period. These factors altogether accelerate the growth of the market for the transfer and exchange of various gases for different applications.

Kinetic Segment to Hold a Considerable Market Share

The kinetic segment is expected to hold a considerable market share during the forecast period. In kinetic type 6, energy is added at regular intervals to raise the liquid’s pace within the product. The liquid discharged from the kinetic types is of greater value than within the product. Centrifugal and regenerative are two kinds of kinetic types. Approximately 95.0% of all installations are done by a centrifugal type, owing to their low cost and less maintenance. The kinetic segment is projected to witness a steady growth rate during the forecast period owing to the rapid increase in the demand for kinetic types from the energy & power industry.

Regional Outlook

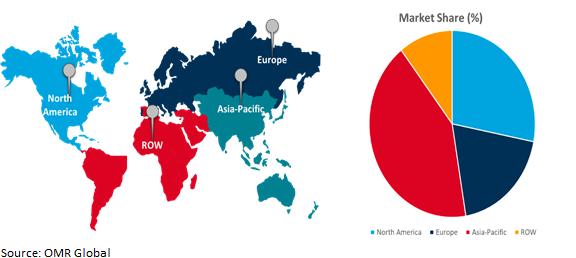

The global cryogenic pump market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America to Register High Growth Rate

The North American region, with the presence of major economies like the US and Canada, has achieved the highest level of development. The increase in the demand for cryogenic pumps in the region is anticipated mostly from the pharmaceuticals and fertilizers industry. Apart from this, the reliance on natural gas has increased the demand for cryogenic pumps required for the LNG terminals in the region. Hence, with the increasing number of natural gas-fired power plants, the need for cryogenic pumps is expected to increase during the forecast period.

Global Cryogenic Pump Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share and exhibits a clear dominance in the cryogenic pump industry due to increasing industrialization and urbanization, driving high energy needs, particularly for cleaner fuel alternatives like liquefied natural gas (LNG). Cryogenic pumps are vital for the efficient storage and distribution of LNG. Moreover, regulatory bodies are investing heavily in healthcare infrastructure. This is driving the demand for cryogenic pumps for storing biological samples at extremely low temperatures. Apart from this, the region is a hub for various manufacturing sectors, including petrochemicals, metallurgy, and electronics, where cryogenic pumps are used for handling liquid nitrogen and oxygen.

For instance, according to the Department of Chemicals & Petrochemicals of India, the chemical and petrochemical (CPC) industry of the country commands a notable global market value of $178.0 billion. This figure will rise to approximately $300.0 billion by 2025, indicating significant growth potential within the sector. Additionally, favorable government policies and incentives to promote clean energy and advanced healthcare services are propelling the market growth in the Asia Pacific region.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global cryogenic pump market include Cryostar Group, EBARA CORP., Fives Group, and Nikkiso Co., Ltd., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in January 2022, Cryostar company announced that it had received NeoVP vertical pumps for the Chinese market that will be installed in air separation units.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cryogenic pump market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Cryostar Group

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. EBARA CORP.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Fives Group

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Nikkiso Co., Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Cryogenic Pump Market by Type

4.1.1. Centrifugal Pumps

4.1.2. Positive Displacement Pumps

4.1.3. Kinetic Pumps

4.1.4. Entrapment Pumps

4.2. Global Cryogenic Pump Market by Gas

4.2.1. Nitrogen

4.2.2. Hydrogen

4.2.3. Helium

4.2.4. LNG

4.3. Global Cryogenic Pump Market by End-Use Industry

4.3.1. Healthcare Industry

4.3.2. Energy & Power Generation Industry

4.3.3. Electricals & Electronics Industry

4.3.4. Metallurgy Industry

4.3.5. Chemicals

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Beijing Long March Tianmin Hi-Tech Co. Ltd

6.2. Flowserve Corp

6.3. GemmeCotti Srl

6.4. HSR AG

6.5. KSB SE & Co. KGaA

6.6. PBS Velká Bíteš

6.7. PHPK Technologies Inc.

6.8. Ruhrpumpen Group

6.9. SHI Cryogenics Group

6.10. Sulzer Ltd

6.11. Sumitomo Heavy Industries Ltd

6.12. Technex Group

6.13. TRILLIUM FLOW TECHNOLOGIES™

6.14. Vanzetti Engineering S.p.A.

6.15. Weir Group PLC

1. GLOBAL CRYOGENIC PUMP MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL CRYOGENIC CENTRIFUGAL PUMPS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CRYOGENIC POSITIVE DISPLACEMENT PUMPS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CRYOGENIC KINETIC PUMPS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL CRYOGENIC ENTRAPMENT PUMPS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL CRYOGENIC PUMP MARKET RESEARCH AND ANALYSIS BY GAS, 2023-2031 ($ MILLION)

7. GLOBAL CRYOGENIC PUMP FOR NITROGEN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL CRYOGENIC PUMP FOR HYDROGEN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL CRYOGENIC PUMP FOR HELIUM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CRYOGENIC PUMP FOR LNG MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL CRYOGENIC PUMP MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2023-2031 ($ MILLION)

12. GLOBAL CRYOGENIC PUMP FOR HEALTHCARE INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL CRYOGENIC PUMP FOR ENERGY & POWER GENERATION INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL CRYOGENIC PUMP FOR ELECTRICALS & ELECTRONICS INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL CRYOGENIC PUMP FOR METALLURGY INDUSTRY MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL CRYOGENIC PUMP FOR CHEMICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL CRYOGENIC PUMP MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN CRYOGENIC PUMP MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. NORTH AMERICAN CRYOGENIC PUMP MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. NORTH AMERICAN CRYOGENIC PUMP MARKET RESEARCH AND ANALYSIS BY GAS, 2023-2031 ($ MILLION)

21. NORTH AMERICAN CRYOGENIC PUMP MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2023-2031 ($ MILLION)

22. EUROPEAN CRYOGENIC PUMP MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

23. EUROPEAN CRYOGENIC PUMP MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

24. EUROPEAN CRYOGENIC PUMP MARKET RESEARCH AND ANALYSIS BY GAS, 2023-2031 ($ MILLION)

25. EUROPEAN CRYOGENIC PUMP MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC CRYOGENIC PUMP MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC CRYOGENIC PUMP MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC CRYOGENIC PUMP MARKET RESEARCH AND ANALYSIS BY GAS, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC CRYOGENIC PUMP MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2023-2031 ($ MILLION)

30. REST OF THE WORLD CRYOGENIC PUMP MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

31. REST OF THE WORLD CRYOGENIC PUMP MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

32. REST OF THE WORLD CRYOGENIC PUMP MARKET RESEARCH AND ANALYSIS BY GAS, 2023-2031 ($ MILLION)

33. REST OF THE WORLD CRYOGENIC PUMP MARKET RESEARCH AND ANALYSIS BY END-USE INDUSTRY, 2023-2031 ($ MILLION)

1. GLOBAL CRYOGENIC PUMPS MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL CRYOGENIC CENTRIFUGAL PUMPS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CRYOGENIC POSITIVE DISPLACEMENT PUMPS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL CRYOGENIC KINETIC PUMPS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL CRYOGENIC ENTRAPMENT PUMPS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL CRYOGENIC PUMP MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL CRYOGENIC PUMP FOR NITROGEN MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL CRYOGENIC PUMP FOR HYDROGEN MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL CRYOGENIC PUMP FOR HELIUM MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL CRYOGENIC PUMP FOR LNG MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL CRYOGENIC PUMP MARKET SHARE BY END-USE INDUSTRY, 2023 VS 2031 (%)

12. GLOBAL CRYOGENIC PUMP FOR HEALTHCARE INDUSTRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL CRYOGENIC PUMP FOR ENERGY & POWER GENERATION INDUSTRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL CRYOGENIC PUMP FOR ELECTRICALS & ELECTRONICS INDUSTRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL CRYOGENIC PUMP FOR METALLURGY INDUSTRY MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL CRYOGENIC PUMP FOR CHEMICALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL CRYOGENIC PUMP MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. US CRYOGENIC PUMP MARKET SIZE, 2023-2031 ($ MILLION)

19. CANADA CRYOGENIC PUMP MARKET SIZE, 2023-2031 ($ MILLION)

20. UK CRYOGENIC PUMP MARKET SIZE, 2023-2031 ($ MILLION)

21. FRANCE CRYOGENIC PUMP MARKET SIZE, 2023-2031 ($ MILLION)

22. GERMANY CRYOGENIC PUMP MARKET SIZE, 2023-2031 ($ MILLION)

23. ITALY CRYOGENIC PUMP MARKET SIZE, 2023-2031 ($ MILLION)

24. SPAIN CRYOGENIC PUMP MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF EUROPE CRYOGENIC PUMP MARKET SIZE, 2023-2031 ($ MILLION)

26. INDIA CRYOGENIC PUMP MARKET SIZE, 2023-2031 ($ MILLION)

27. CHINA CRYOGENIC PUMP MARKET SIZE, 2023-2031 ($ MILLION)

28. JAPAN CRYOGENIC PUMP MARKET SIZE, 2023-2031 ($ MILLION)

29. SOUTH KOREA CRYOGENIC PUMP MARKET SIZE, 2023-2031 ($ MILLION)

30. REST OF ASIA-PACIFIC CRYOGENIC PUMP MARKET SIZE, 2023-2031 ($ MILLION)

31. LATIN AMERICA CRYOGENIC PUMP MARKET SIZE, 2023-2031 ($ MILLION)

32. MIDDLE EAST AND AFRICA CRYOGENIC PUMP MARKET SIZE, 2023-2031 ($ MILLION)