Crypto Asset Management Market

Crypto Asset Management Market Size, Share & Trends Analysis Report by Solution (Custodian Solution, Wallet Management), by Deployment Mode (Cloud, On-Premise), by Application (Mobile, Web-based), by End-User (Individual, Enterprise) Forecast Period (2023-2030) Update Available - Forecast 2025-2031

Crypto asset management market is anticipated to grow at a CAGR of 8.5% during the forecast period. The growing investment in digital assets has driven the growth of the global crypto asset management market. According to the European digital asset management firm CoinShares’ weekly fund report, in June 2023, crypto-based investment products recorded their largest single weekly inflows since July 2022. Per CoinShares, total inflows across crypto-based investment products hit $199 million; Bitcoin led the pack with inflows of $187 million. The total assets under management in crypto investment products also reached a yearly high, surpassing $37 billion and erasing the losses since Three Arrows Capital shook the crypto market with its bankruptcy in July 2022.

Further, in June 2023, CACEIS Bank, one of the largest asset management firms in Europe, has been granted the license by the financial market regulator Autorité des Marchés Financiers (AMF) to provide crypto custody services in France. Such developments are anticipated to drive the growth of the global crypto asset management market.

Segmental Outlook

The global crypto asset management market is segmented based on solution, deployment mode, application, and end-user. Based on solution, the market is bifurcated into custodian solution and wallet management. Based on deployment mode, the market is sub-segmented into cloud-based and on-premises. Further, based on the application, the market is sub-segmented into mobile and web-based. Based on the end-user, the market is divided into individual and enterprise. Among these, the mobile sub-segment is expected to hold a prominent share of the market owing to the exponential increase in the use and demand for smartphones.

Cloud-based Sub-Segment to Hold a Prominent Market Share in the Global Crypto Asset Management Market

Among the deployment mode, the cloud-based crypto asset management sub-segment is expected to hold a prominent share of the market globally. The increasing adoption of cloud-based technologies is the key factor driving the segmental growth. Furthermore, the widespread adoption of BYOD trend and the increase in the mobile workforce are expected to provide major growth opportunities for the crypto asset management market in the upcoming years. The cloud enables flexible deployment of numerous solutions and services, which allows organizations to manage their data efficiently and effectively. Moreover, cloud-based technologies are cost-effective and easy to deploy, which drives the demand for cloud crypto asset management platform among large as well as small & medium organizations. In addition, to manage IT infrastructure, the cloud solutions require very less IT hardware administrative resources, which further eradicates the need for additional hardware costs. Thus, organizations are deploying cloud-based technologies across their business processes. Hence, such factors combined driving the growth of this market segment.

Regional Outlooks

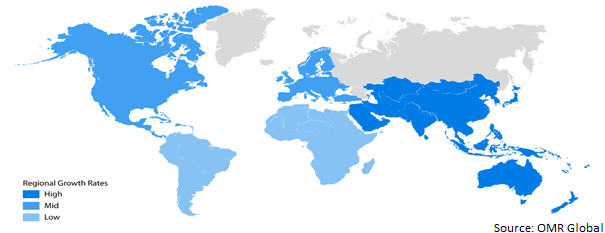

The global crypto asset management market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among these, the Asia-Pacific market is anticipated to cater to a considerable growth over the forecast period, owing to the several developing economies propelling the adoption of digital currencies.

Global Crypto Asset Management Market Growth by Region 2023-2030

North America is Expected to Hold a Considerable Share of the Global Crypto Asset Management Market

Among all the regions, North America is expected to hold a considerable share of the global crypto asset management market. Early adoption of bitcoin technology with significant rise in blockchain adoption among several industries is the key factor driving the regional market growth. Additionally, the presence of prominent vendors of crypto asset management platform market in the region is another factor contributing to the regional market growth. These market players are focusing on investing strategically in the market to stay competitive. For instance, in October 2022, American Bank and BNY Mellon, in collaboration announced that its Digital Asset Custody Platform is live in the US. The new platform is equipped with selected clients which is able to transfer and hold digital currencies including bitcoin and ether.

Market Players Outlook

The major companies serving the global crypto asset management market include BitGo, Inc., Coinbase, Inc., Gemini Trust Co., LLC, Cipher Technologies Management LP, and Metaco SA, among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in March 2023, Haru EU Ltd., a EU incorporated subsidiary of Haru Invest officially established as an authorized Virtual Asset Service Provider (VASP) for its EU operation-based in Lithuania.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global crypto asset management market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

4. Market Segmentation

4.1. Global Crypto Asset Management Market by Solution

4.1.1. Custodian Solution

4.1.2. Wallet Management

4.2. Global Crypto Asset Management Market by Deployment Mode

4.2.1. Cloud

4.2.2. On-Premises

4.3. Global Crypto Asset Management Market by Application

4.3.1. Mobile-Based

4.3.2. Web-Based

4.4. Global Crypto Asset Management Market by End-User

4.4.1. Individual

4.4.2. Enterprise

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. 3commas Technologies Oü

6.2. Anchor Labs, Inc.

6.3. Atomic Protocol Systems Oü

6.4. Bakkt Marketplace, LLC

6.5. Binance

6.6. Bitgo Inc.

6.7. Bitwise

6.8. Blox

6.9. Caspian, Ltd.

6.10. Cipher Assets

6.11. Coinbase

6.12. Crypto Finance AG

6.13. Cryptoslate

6.14. Delta Crypto Matrix Co.

6.15. Exodus Movement, Inc.

6.16. Gemini Trust Co., LLC

6.17. Iconomi Ltd.

6.18. Iesf Labs

6.19. Inomma LLC

6.20. Koinly

6.21. Kpmg LLP

6.22. Kubera Apps, Inc.

6.23. Ledger S.A.S.

6.24. Metaco SA

6.25. Mintfort

6.26. Nino Finance, Inc.

6.27. Paxos Trust Company, LLC

6.28. Softledger, Inc.

6.29. Wireswarm

6.30. Xapo Holdings Ltd.

1. GLOBAL CRYPTO ASSET MANAGEMENT MARKET BY SOLUTION, 2022-2030 ($ MILLION)

2. GLOBAL CUSTODIAN SOLUTION BY CRYPTO ASSET MANAGEMENT MARKET BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL WALLET MANAGEMENT BY CRYPTO ASSET MANAGEMENT MARKET BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL CRYPTO ASSET MANAGEMENT MARKET BY DEPLOYMENT MODE, 2022-2030 ($ MILLION)

5. GLOBAL CLOUD-BASED CRYPTO ASSET MANAGEMENT MARKET BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL ON-PREMISES CRYPTO ASSET MANAGEMENT MARKET BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL CRYPTO ASSET MANAGEMENT MARKET BY APPLICATION, 2022-2030 ($ MILLION)

8. GLOBAL CRYPTO ASSET MANAGEMENT FOR MOBILE MARKET BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL CRYPTO ASSET MANAGEMENT FOR WEB-BASED MARKET BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL CRYPTO ASSET MANAGEMENT MARKET BY END-USER, 2022-2030 ($ MILLION)

11. GLOBAL CRYPTO ASSET MANAGEMENT FOR INDIVIDUAL MARKET BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL CRYPTO ASSET MANAGEMENT FOR ENTERPRISE MARKET BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL CRYPTO ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. NORTH AMERICAN CRYPTO ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. NORTH AMERICAN CRYPTO ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2022-2030 ($ MILLION)

16. NORTH AMERICAN CRYPTO ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2022-2030 ($ MILLION)

17. NORTH AMERICAN CRYPTO ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

18. NORTH AMERICAN CRYPTO ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

19. EUROPEAN CRYPTO ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

20. EUROPEAN CRYPTO ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2022-2030 ($ MILLION)

21. EUROPEAN CRYPTO ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2022-2030 ($ MILLION)

22. EUROPEAN CRYPTO ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

23. EUROPEAN CRYPTO ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

24. ASIA-PACIFIC CRYPTO ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

25. ASIA-PACIFIC CRYPTO ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2022-2030 ($ MILLION)

26. ASIA-PACIFIC CRYPTO ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2022-2030 ($ MILLION)

27. ASIA-PACIFIC CRYPTO ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

28. ASIA-PACIFIC CRYPTO ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

29. REST OF THE WORLD CRYPTO ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2022-2030 ($ MILLION)

30. REST OF THE WORLD CRYPTO ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT MODE, 2022-2030 ($ MILLION)

31. REST OF THE WORLD CRYPTO ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

32. REST OF THE WORLD CRYPTO ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY END-USER, 2022-2030 ($ MILLION)

2. GLOBAL CUSTODIAN SOLUTION BY CRYPTO ASSET MANAGEMENT MARKET BY REGION, 2022 VS 2030 (%)

3. GLOBAL WALLET MANAGEMENT BY CRYPTO ASSET MANAGEMENT MARKET BY REGION, 2022 VS 2030 (%)

4. GLOBAL CRYPTO ASSET MANAGEMENT MARKET SHARE BY DEPLOYMENT MODE, 2022 VS 2030 (%)

5. GLOBAL CLOUD-BASED CRYPTO ASSET MANAGEMENT MARKET BY REGION, 2022 VS 2030 (%)

6. GLOBAL ON-PREMISE CRYPTO ASSET MANAGEMENT MARKET BY REGION, 2022 VS 2030 (%)

7. GLOBAL CRYPTO ASSET MANAGEMENT MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

8. GLOBAL CRYPTO ASSET MANAGEMENT FOR MOBILE MARKET BY REGION, 2022 VS 2030 (%)

9. GLOBAL CRYPTO ASSET MANAGEMENT FOR WEB-BASED MARKET BY REGION, 2022 VS 2030 (%)

10. GLOBAL CRYPTO ASSET MANAGEMENT MARKET SHARE BY END-USER, 2022 VS 2030 (%)

11. GLOBAL CRYPTO ASSET MANAGEMENT FOR INDIVIDUAL MARKET BY REGION, 2022 VS 2030 (%)

12. GLOBAL CRYPTO ASSET MANAGEMENT FOR ENTERPRISE MARKET BY REGION, 2022 VS 2030 (%)

13. GLOBAL CRYPTO ASSET MANAGEMENT MARKET SHARE BY REGION, 2022 VS 2030, (%)

14. US CRYPTO ASSET MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

15. CANADA MARKET CRYPTO ASSET MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

16. UK CRYPTO ASSET MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

17. GERMANY CRYPTO ASSET MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

18. SPAIN CRYPTO ASSET MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

19. FRANCE CRYPTO ASSET MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

20. ITALY CRYPTO ASSET MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

21. REST OF EUROPE CRYPTO ASSET MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

22. INDIA CRYPTO ASSET MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

23. CHINA CRYPTO ASSET MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

24. JAPAN CRYPTO ASSET MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

25. REST OFASIA-PACIFIC CRYPTO ASSET MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)

26. REST OF WORLD CRYPTO ASSET MANAGEMENT MARKET SIZE, 2022-2030 ($ MILLION)