Cryptocurrency Market

Global Cryptocurrency Market Size, Share & Trends Analysis Report, by Offering (Hardware, Software), by Application (Trading, Remittance, Payment) and Forecast Period, 2019-2025 Update Available - Forecast 2025-2031

The global cryptocurrency market is estimated to grow at a CAGR of over 7% during the forecast period. The global cryptocurrency market is boosting due to several factors including distributed ledger technology (DLT), an increase in money orders in developing countries, high cost of cross-border remittance, fluctuations in monetary regulations, and growth in venture capital investments. Transparency of DLT is a database that can be transferred among the available networks in various geographical regions. This technology controls all its information and transactions to the users and promotes transparency that assists in minimizing transaction time into minutes and also helps the organization by saving billions.

The technology also provides an increase in the efficiency of back-office and automation. However, this technology is decentralized to eliminate the need for a central authority or intermediary to process, validate or authentic transactions or other types of data exchanges. Commonly, these records are only created and stored in the ledger when unity has been created by the parties who are involved in the operation. Restraints factors such as uncertain regulatory status, lack of awareness and technical understanding cryptocurrency are influencing the growth and market. Few opportunities like acceptance of cryptocurrency across various industries and significant growth in emerging and developed markets.

Segmentation

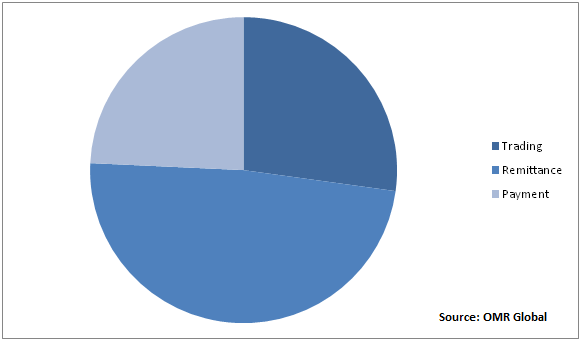

The global cryptocurrency market is segmented based on offering and application. Based on offering, the market is classified into hardware and software. Based on the application, the market is classified into trading, remittance, and payment. The growing demand of the cryptocurrency market consists high acceptance rate in developed nations, increasing fluctuation in monetary policy and expansion in the venture capital market connects the growing alertness surrounded by the investors especially in emerging or developing nations.

Cryptocurrency Finds Its Significant Application in Remittance

The global cryptocurrency market has helped to overcome a few basic threats associate to the interbank transaction and consent-free cross-border remittance that financial systems had experienced over the past years. While interbank activities generally take time for approval and settlements. Cryptocurrency transactions can be completed in lesser time. The rapid flow of transaction and settlement that can bring the audience to deal with ease by restricting the need for realizing the amount to mediators for conducting the required actions. This can assist the financial institutions by saving their labor-intensive procedures with their customers and exchanges.

Global Cryptocurrency Market Share by Application, 2018 (%)

Regional Outlook

Geographically, the global cryptocurrency market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. Europe is estimated to witness significant growth in the market and is expected to hold considerable market share in the coming years. In Europe, Germany has captured a significant share in the cryptocurrency market. Factors facilitating the European cryptocurrency market include increasing its acceptance of the digital currency by certain traders and the existence of the various number of a mining pool.

Europe has engaged with good participation in the market owing to the presence of major companies, such Bitstamp (Luxembourg), Bitcoin Suisse AG (Switzerland), Bitwala (Germany), Niko Technologies (Estonia), Cryptio (France), SEBA Bank AG (Switzerland)in the region. These companies are focusing to reduce the difference between conventional financial systems and the new digital economy to gain competitive advantage. Additionally, the bitcoin exchange websites are based on decentralized servers transmit globally by not restricting them in one location that reduces the chances of hacking.

Moreover, an increase in the number of users of the healthcare IT sector, Europe is availing the benefit of cryptocurrency. For instance, Estonia based startup company-Lympo is a health-focused platform that award users for their healthy behaviors by offering their cryptocurrency called LYM tokens. Users can redeem the token to purchase goods and services from the Lympo platform. The organization also offers users to invest their Lympo tokens in the emerging data-driven companies.

Competitive Landscape

The major companies providing cryptocurrency hardware and software include BitMain Technologies, Ltd, NVIDIA Corp., Xilinx, Inc., Intel Corp., BitFury Group, and BitGo, Inc.These companies are engaged in offering innovative software and hardware for cryptocurrency. For instance, in February 2018, AMD announced EPYC (x86-64 microprocessor) embedded 3000 series processor and AMD Ryzen Embedded V1000 processor that helps to deliver high performance, exceptional integration and on-chip security. In December 2017, NVIDIA introduced TITAN V, one of the most powerful GPU for PC, driven by one of the most advanced GPU architecture, NVIDIA Volta that accelerates 9 times that of its processor and extremely energy efficient. In May 2016, Bitmain launched Antminer S9, the world’s first commercially available Bitcoin miner based on a 16nm process chip.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cryptocurrency market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. BitMain Technologies, Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. NVIDIA Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Xilinx, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Intel Corp.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. BitFury Group

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Cryptocurrency Market by Offering

5.1.1. Hardware

5.1.2. Software

5.2. Global Cryptocurrency Market by Application

5.2.1. Trading

5.2.2. Remittance

5.2.3. Payment

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Advanced Micro Devices, Inc.

7.2. Algorand, LLC

7.3. AlphaPoint Corp.

7.4. BinanceHolidays

7.5. BitFury Group

7.6. BitGo, Inc.

7.7. BitMainTechnologies Ltd.

7.8. Bitstamp, Ltd.

7.9. Brave Software (Basic Attention Token)

7.10. Coinbase UK, Ltd.

7.11. Digital Currency Group, Inc.

7.12. Ethereum Foundation

7.13. Hyperledger (Linux Foundation)

7.14. Intel Corp.

7.15. IOTA Foundation

7.16. NVIDIA Corp.

7.17. Ocean Protocol Foundation, Ltd.

7.18. Ripple Labs, Inc.

7.19. Vault12, Inc.

7.20. Xilinx, Inc.

7.21. Zilliqa Research Pte. Ltd.

1. GLOBAL CRYPTOCURRENCY MARKET RESEARCH AND ANALYSIS BY OFFERING, 2018-2025 ($ MILLION)

2. GLOBAL CRYPTOCURRENCY HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL CRYPTOCURRENCY SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL CRYPTOCURRENCY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

5. GLOBAL CRYPTOCURRENCY IN TRADING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL CRYPTOCURRENCY IN REMITTANCE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL CRYPTOCURRENCY IN PAYMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL CRYPTOCURRENCY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

9. NORTH AMERICAN CRYPTOCURRENCY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

10. NORTH AMERICAN CRYPTOCURRENCY MARKET RESEARCH AND ANALYSIS BY OFFERING, 2018-2025 ($ MILLION)

11. NORTH AMERICAN CRYPTOCURRENCY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

12. NORTH AMERICAN CRYPTOCURRENCY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

13. EUROPEAN CRYPTOCURRENCY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. EUROPEAN CRYPTOCURRENCY MARKET RESEARCH AND ANALYSIS BY OFFERING, 2018-2025 ($ MILLION)

15. EUROPEAN CRYPTOCURRENCY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

16. EUROPEAN CRYPTOCURRENCY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC CRYPTOCURRENCY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC CRYPTOCURRENCY MARKET RESEARCH AND ANALYSIS BY OFFERING, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC CRYPTOCURRENCY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC CRYPTOCURRENCY MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

21. REST OF THE WORLD CRYPTOCURRENCY MARKET RESEARCH AND ANALYSIS BY OFFERING, 2018-2025 ($ MILLION)

22. REST OF THE WORLD CRYPTOCURRENCY MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

23. REST OF THE WORLD CRYPTOCURRENCY MARKET RESEARCH AND ANALYSIS BYAPPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL CRYPTOCURRENCY MARKET SHARE BY OFFERING, 2018 VS 2025 (%)

2. GLOBAL CRYPTOCURRENCY MARKET SHARE BY TYPE, 2018 VS 2025 (%)

3. GLOBAL CRYPTOCURRENCY MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

4. GLOBAL CRYPTOCURRENCY MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

5. US CRYPTOCURRENCY MARKET SIZE, 2018-2025 ($ MILLION)

6. CANADA CRYPTOCURRENCY MARKET SIZE, 2018-2025 ($ MILLION)

7. UK CRYPTOCURRENCY MARKET SIZE, 2018-2025 ($ MILLION)

8. FRANCE CRYPTOCURRENCY MARKET SIZE, 2018-2025 ($ MILLION)

9. GERMANY CRYPTOCURRENCY MARKET SIZE, 2018-2025 ($ MILLION)

10. ITALY CRYPTOCURRENCY MARKET SIZE, 2018-2025 ($ MILLION)

11. SPAIN CRYPTOCURRENCY MARKET SIZE, 2018-2025 ($ MILLION)

12. ROE CRYPTOCURRENCY MARKET SIZE, 2018-2025 ($ MILLION)

13. INDIA CRYPTOCURRENCY MARKET SIZE, 2018-2025 ($ MILLION)

14. CHINA CRYPTOCURRENCY MARKET SIZE, 2018-2025 ($ MILLION)

15. JAPAN CRYPTOCURRENCY MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF ASIA-PACIFIC CRYPTOCURRENCY MARKET SIZE, 2018-2025 ($ MILLION)

17. REST OF THE WORLD CRYPTOCURRENCY MARKET SIZE, 2018-2025 ($ MILLION)