Culinary Tourism Market

Culinary Tourism Market Size, Share & Trends Analysis Report by Activity Type (Culinary Trails, Cooking Classes, Restaurants, and Food Festivals), by Tourist Type (Domestic and International), and by Mode of Booking (OTA, Traditional Agents, and Direct Bookings), Forecast Period (2024-2031)

Culinary tourism market is anticipated to grow at a CAGR of 18.5% during the forecast period (2024-2031). Culinary tourism includes a variety of food and drink experiences like guided food tours, cooking classes, farm visits, culinary festivals, and wine tourism. It allows travelers to explore local cuisine, traditions, and engage with communities and producers. Culinary tourism offers immersive ways to discover the culture and heritage of a destination through its culinary offerings, making it popular for authentic and meaningful travel experiences.

Market Dynamics

Rising Disposable Income

The rise in disposable incomes has sparked a surge in culinary tourism, focusing on high-quality food experiences accessible to more people. Food festivals have emerged as popular destinations where visitors can explore indigenous flavors, learn about local cooking, and engage with producers and artisans. These events showcase native dishes while honoring the traditions and customs of different cultures. Attending such festivals allows for an affordable sampling of unique specialties, making them an attractive holiday option. Unlike other event types, food festivals significantly contribute to tourism growth by attracting global visitors seeking culinary experiences at reasonable prices.

Growing Online Platforms Driving Convenience in Culinary Tourism

Culinary tourism and technology have shifted paradigms allowing as never before connectedness between places where people eat globally. Not just that but also online platforms which are nowadays increasingly becoming popular can be used by anyone who needs such services for anything they may ever require regarding local cuisines; such information includes but is not limited to where best meals are found among other things like reviews about new eateries as well trips involving tasting dishes prepared by experts during cooking sessions in case there is need for enhancing culinary skills. According to their taste, food lovers can personalize their culinary tours, book activities in advance without any difficulty, and even share their eating interests on various online platforms.

Market Segmentation

- Based on activity type, the market is segmented into culinary trails, cooking classes, restaurants, food festivals, and others.

- Based on tourist type, the market is segmented into domestic and international.

- Based on the mode of booking, the market is segmented into online travel agencies (OTA), traditional agents, and direct bookings.

OTA dominates Activity Type Segment

The OTA segment is expected to hold the largest share of the market. OTA are crucial for booking culinary tourism due to their convenience and diverse offerings. They simplify the booking process, cater to tech-savvy travelers, and offer a wide range of activities and accommodations. User reviews and customizable packages enhance decision-making and flexibility. OTA play a key role in connecting travelers with gastronomic adventures globally.

Domestic Culinary Tourism Holds a Considerable Market Size

Domestic culinary tourism often dominates the market due to factors like population size, ease of travel, and familiarity with local culinary traditions. It is also more resilient during economic uncertainty or travel restrictions, as domestic travelers have greater flexibility. Promoting domestic culinary tourism supports local economies, encourages sustainable tourism, and fosters a deeper appreciation for the country's culinary heritage among its citizens.

Regional Outlook

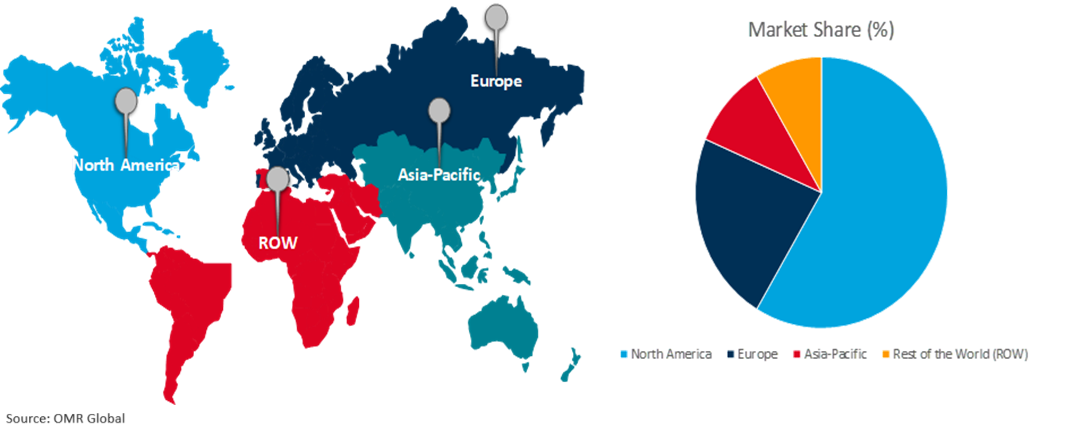

The global culinary tourism market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Europe dominates the Culinary Tourism Market

Its affluent culinary history, diverse cuisines and solid travel sector roots Europe as a culinary tourism powerhouse. Take France, Italy, Spain, and Greece for instance known for their great dishes attracting many culinary tourists yearly. Each provides a one-of-a-kind gastronomical journey, from the complex cuisine of France to the various regional Italian dishes, Spain’s tapas culture, and the Mediterranean diet in Greece. With famous restaurants, culinary tours, food events, among others. This adds more charm to Europe’s robust tourism that continues to draw epicureans, ensuring they are completely immersed in its taste and heritage.

Global Culinary Tourism Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Culinary traditions in Japan, Thailand, India, and China are making the Asia-Pacific region stand out as a culinary market leader, with countries like Japan, Thailand, India, and China offering a variety of choices. Countries like South Korea, Malaysia, Japan, Thailand, Vietnam, India, and many more provide a fusion of current society and their rich historical and cultural legacy. By allowing visitors to experience the local way of life, cuisine, and environment, the preservation of this distinctive identity also promotes market expansion. For example, Thailand boasts a plethora of Michelin-starred restaurants, award-winning pubs, world-class gourmet eateries, and cutting-edge cafes in major cities like Bangkok and Chiang Mai.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global culinary tourism market include Abercrombie & Kent, Classic Journeys LLC, Culinary Adventure Co., Epicurean Ways, and Viator Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in August 2020, Butterfield & Robinson Inc. launched the Singular Stays program, offering exclusive private trips for friends and families. Guests can enjoy bespoke stays in luxurious villas, castles, and lodges, with personalized itineraries tailored to their interests, providing unparalleled opportunities for exploration, relaxation, and cultural immersion in stunning destinations globally.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global culinary tourism market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Abercrombie & Kent

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Classic Journeys LLC

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Culinary Adventure Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. ITC Travel Group Limited

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. The Travel Corporation

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Culinary Tourism Market by Activity Type

4.1.1. Culinary Trails

4.1.2. Cooking Classes

4.1.3. Restaurants

4.1.4. Food Festivals

4.1.5. Others

4.2. Global Culinary Tourism Market by Tourist Type

4.2.1. Domestic

4.2.2. International

4.3. Global Culinary Tourism Market by Mode of Booking

4.3.1. Online Travel Agencies (OTA)

4.3.2. Traditional Agents

4.3.3. Direct Bookings

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Butterfield & Robinson Inc.

6.2. Culinary Backstreets

6.3. Culinary Institute of America

6.4. CULINARY TOURS LTDCulinary Tourism Alliance

6.5. Devour Tours

6.6. Eat ining Italy Food Tours

6.7. Eating Europe Food Tours

6.8. Epicurean Travel LLC

6.9. Epicurean Ways LLC

6.10. Secret Food ToursEssor Ltd.

6.11. Food N’ Wine Vacations, Inc.

6.12. G Adventures Inc.

6.13. Gourmet On Tour Ltd.

6.14. Greaves Travel Ltd

6.15. India Food Forum

6.16. International Culinary Tours

6.17. Local Montreal Food Tours

6.18. Taste Hungary

6.19. The FTC4Lobe Group

6.20. The International Kitchen

6.21. Topdeck Travel Limited

6.22. TourRadar

6.23. Viator Inc.

1. GLOBAL CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY ACTIVITY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL CULINARY TRAILS TOURISM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL COOKING CLASSES TOURISM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL RESTAURANTS TOURISM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL FOOD FESTIVALS TOURISM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL OTHERS CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY TOURIST TYPE, 2023-2031 ($ MILLION)

8. GLOBAL DOMESTIC CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL INTERNATIONAL CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY MODE OF BOOKING, 2023-2031 ($ MILLION)

11. GLOBAL CULINARY TOURISM VIA OTA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL CULINARY TOURISM VIA TRADITIONAL AGENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL CULINARY TOURISM VIA DIRECT BOOKINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY ACTIVITY TYPE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY TOURIST TYPE, 2023-2031 ($ MILLION)

18. NORTH AMERICAN CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY MODE OF BOOKING, 2023-2031 ($ MILLION)

19. EUROPEAN CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. EUROPEAN CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY ACTIVITY TYPE, 2023-2031 ($ MILLION)

21. EUROPEAN CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY TOURIST TYPE, 2023-2031 ($ MILLION)

22. EUROPEAN CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY MODE OF BOOKING, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY ACTIVITY TYPE, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY TOURIST TYPE, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY MODE OF BOOKING, 2023-2031 ($ MILLION)

27. REST OF THE WORLD CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY ACTIVITY TYPE, 2023-2031 ($ MILLION)

29. REST OF THE WORLD CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY TOURIST TYPE, 2023-2031 ($ MILLION)

30. REST OF THE WORLD CULINARY TOURISM MARKET RESEARCH AND ANALYSIS BY MODE OF BOOKING, 2023-2031 ($ MILLION)

1. GLOBAL CULINARY TOURISM MARKET SHARE BY ACTIVITY TYPE, 2023 VS 2031 (%)

2. GLOBAL CULINARY TRAILS TOURISM MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL COOKING CLASSES TOURISM MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL RESTAURANTS TOURISM MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL FOOD FESTIVALS TOURISM MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL OTHERS CULINARY TOURISM MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL CULINARY TOURISM MARKET SHARE BY TOURIST TYPE, 2023 VS 2031 (%)

8. GLOBAL DOMESTIC CULINARY TOURISM MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL INTERNATIONAL CULINARY TOURISM MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL CULINARY TOURISM MARKET SHARE BY MODE OF BOOKING, 2023 VS 2031 (%)

11. GLOBAL CULINARY TOURISM VIA OTA MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL CULINARY TOURISM VIA TRADITIONAL AGENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL CULINARY TOURISM VIA DIRECT BOOKINGS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL CULINARY TOURISM MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. US CULINARY TOURISM MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA CULINARY TOURISM MARKET SIZE, 2023-2031 ($ MILLION)

17. UK CULINARY TOURISM MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE CULINARY TOURISM MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY CULINARY TOURISM MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY CULINARY TOURISM MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN CULINARY TOURISM MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE CULINARY TOURISM MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA CULINARY TOURISM MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA CULINARY TOURISM MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN CULINARY TOURISM MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA CULINARY TOURISM MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC CULINARY TOURISM MARKET SIZE, 2023-2031 ($ MILLION)

28. LATIN AMERICA CULINARY TOURISM MARKET SIZE, 2023-2031 ($ MILLION)

29. MIDDLE EAST AND AFRICA CULINARY TOURISM MARKET SIZE, 2023-2031 ($ MILLION)