Cyclosporine drugs Market

Global Cyclosporine drugs Market Size, Share & Trends Analysis Report, by Indication (Rheumatoid Arthritis, Psoriasis, Transplant Rejection Prophylaxis, Dry Eye, Autoimmune Myasthenia Gravis and Other), by Route of Administration (Oral and Parenteral) and Forecast Period, 2020-2026 Update Available - Forecast 2025-2031

The global cyclosporine drug market is estimated to grow at a CAGR of around 5% during the forecast period. A cyclosporine drug is a drug which used as medication during the organ transplant such as liver, kidney, heart. This prevents the new organ to function normally, where it works by weakening the immune system to assist the body to adapt the functionality of the body. Cyclosporine drug is an immunosuppressant class of drugs that is extracted from Tolypocladium fungus which prevents side effects on the immune system such as encephalomyelitis, graft diseases, allograft rejection, delayed hypersensitivity and experimental allergy.

Cyclosporine drugs are also used to treat autoimmune diseases such as rheumatoid arthritis and multiple sclerosis. This drug works by slowing down the functionality of the immune system. By decreasing the functionality, this drug helps to protect other healthy tissues from the newly transplanted organ. Additionally, recent developments also lead to an increase in cyclosporine drug market growth, where generic drugs increase therapeutic efficacy. Apart from this, many major players in this market are developing an efficient drug to provide therapies and to survive in the market.

Segmentation

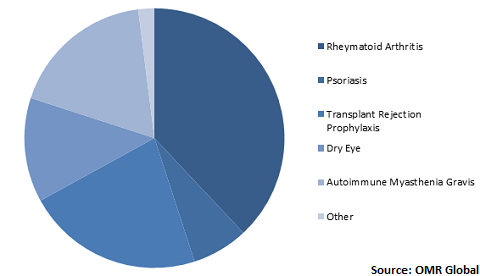

The global cyclosporine drugs market is segmented based on indication and route of administration. Based on indication, the market is classified into rheumatoid arthritis, psoriasis, transplant rejection prophylaxis, dry eye, and autoimmune myasthenia gravis and others. Transplant rejection prophylaxis (TRP) is expected to grow in the forecast period, due to a rise in demand for organ transplantation. According to the Health Resources & Services Administration (HRSA), the US around 36,500 organ transplants took place in 2018. Due to a decrease in the rejection of TRP, the usage of cyclosporine drugs is widely used globally. Based on the route of administration, the market is classified into oral and parenteral.

Cyclosporine drugs Find Its Significance by Indication in Rheumatoid Arthritis

Rheumatoid arthritis is one of the indicators of cyclosporine drug which is accounting the largest share due to an increase in the number of chronic diseases such as joint pain and stiffness. These diseases restrict a person to accomplish the daily task, if left untreated, the disease may lead to disorder in mobility and increases the risk of joint replacement. Moreover, the cyclosporine drug market is expected to increase owing to various factors such as easy availability, low operation cost, and fewer negative side effects.

Global Cyclosporine Drugs Market Share by Indication, 2019 (%)

Regional Outlook

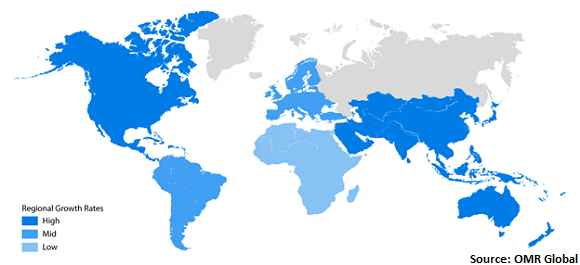

Geographically, the global cyclosporine drugs market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America is expected to witness the growth due to an increase in autoimmune diseases, the introduction of new product launch and technological advancement. North America is expected to hold a significant share in the cyclosporine drugs market due to an increase in the number of the older population in the region. According to the National Institute of Environmental Health Science (NIEHS), around 23.5 million population in the US region are affected by the autoimmune disease which leads to an increase in demand for cyclosporine drugs. Moreover, Asia-Pacific is estimated to grow significantly during the forecast period due to various factors such as an increase in awareness among the population, a rise in disposable income, and improved healthcare sector.

Global Cyclosporine Drugs Market Growth, by Region 2020-2026

Competitive Landscape

The major companies providing cyclosporine drugs include Allergan PLC, Sun Pharmaceuticals Industries, Ltd. Novartis AG, Teva Pharmaceuticals Industries, Ltd., Apotex Inc., Otsuka Pharmaceutical Co. Ltd., Regenerx Biopharmaceuticals, Inc., and Takeda Pharmaceutical Co. Ltd. These players are adopting various strategies in order to sustain in the global market. For instance, in October 2019, Sun Pharmaceuticals introduced a new product called CEQUA (cyclosporine ophthalmic solution), with approval by Food and Drug Administration (FDA), the US to treat dry eye disease in the US due to an increase in the number of keratoconjunctivitis sicca patients, which infected around 16 million population in the region.

The Report Covers

- Market value data analysis of 2020 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cyclosporine drugs market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Allergan PLC

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Sun Pharmaceuticals Industries, Ltd.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Novartis AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Teva Pharmaceuticals Industries, Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Apotex Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Cyclosporine Drugs Market by Indication

5.1.1. Transplant Rejection Prophylaxis

5.1.2. Rheumatoid Arthritis

5.1.3. Psoriasis

5.1.4. Dry Eye

5.1.5. Autoimmune Myasthenia Gravis

5.1.6. Others

5.2. Global Cyclosporine Drugs Market by Route of Administration

5.2.1. Oral

5.2.2. Parenteral

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AbbVie Inc.

7.2. Allergan PLC

7.3. Apotex, Inc.

7.4. Mayne Pharma Group Ltd.

7.5. Mckesson Medical Surgical Inc.

7.6. Novartis AG

7.7. Otsuka Pharmaceutical Co. Ltd.

7.8. Regenerx Biopharmaceuticals, Inc.

7.9. Santen Pharmaceuticals Co. Ltd.

7.10. Sun Pharmaceuticals Industries, Ltd.

7.11. Takeda Pharmaceutical Co. Ltd.

7.12. Teva Pharmaceuticals Industries, Ltd.

7.13. United Biotech Pvt. Ltd.

1. GLOBAL CYCLOSPORINE DRUGS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2019-2026 ($ MILLION)

2. GLOBAL RHEUTMATOID ARTHRITIS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL PSORIASIS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL TRANSPLANT REJECTION PROPHYLAXIS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL DRY EYE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL AUTOIMMUNE MYASTHENIA GRAVIS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL OTHER INDICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL CYCLOSPORINE DRUGS MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

9. GLOBAL ORAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL PARENTERAL MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL CYCLOSPORINE DRUGS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN CYCLOSPORINE DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN CYCLOSPORINE DRUGS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2019-2026 ($ MILLION)

14. NORTH AMERICAN CYCLOSPORINE DRUGS MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

15. EUROPEAN CYCLOSPORINE DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. EUROPEAN CYCLOSPORINE DRUGS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2019-2026 ($ MILLION)

17. EUROPEAN CYCLOSPORINE DRUGS MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC CYCLOSPORINE DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC CYCLOSPORINE DRUGS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC CYCLOSPORINE DRUGS MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

21. REST OF THE WORLD CYCLOSPORINE DRUGS MARKET RESEARCH AND ANALYSIS BY INDICATION, 2019-2026 ($ MILLION)

22. REST OF THE WORLD CYCLOSPORINE DRUGS MARKET RESEARCH AND ANALYSIS BY ROUTE OF ADMINISTRATION, 2019-2026 ($ MILLION)

1. GLOBAL CYCLOSPORINE DRUGS MARKET SHARE BY INDICATION, 2019 VS 2026 (%)

2. GLOBAL CYCLOSPORINE DRUGS MARKET SHARE BY ROUTE OF ADMINISTRATION, 2019 VS 2026 (%)

3. GLOBAL CYCLOSPORINE DRUGS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US CYCLOSPORINE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA CYCLOSPORINE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK CYCLOSPORINE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE CYCLOSPORINE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY CYCLOSPORINE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY CYCLOSPORINE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN CYCLOSPORINE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE CYCLOSPORINE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA CYCLOSPORINE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA CYCLOSPORINE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN CYCLOSPORINE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC CYCLOSPORINE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD CYCLOSPORINE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)