Cyclotron Market

Cyclotron Market Size, Share & Trends Analysis Report by Product (Cyclotron 10-12MeV, Cyclotron 16-18MeV, Cyclotron 19-24MeV, and Cyclotron above 24MeV), by Application (Medical, and Industrial), Forecast Period (2024-2031) Update Available - Forecast 2025-2035

Cyclotron market is anticipated to grow at a CAGR of 11.2% during the forecast period (2023-2030).The market growth is attributed to factors such as the growing prevalence of cancer and the increasing use of diagnostic imaging procedures. According to the World Health Organization, cancer is a leading cause of death around the globe, accounting for nearly 10 million deaths in 2020, or nearly one in six deaths. In terms of new cases of cancer in 2020 included breast (2.26 million cases); lung (2.21 million cases); colon and rectum (1.93 million cases). Several lifestyle factors contribute to the development of cancer such as a high intake of processed meats and low intake of fruits and vegetables, a sedentary lifestyle, obesity, smoking, and excessive alcohol consumption.

Segmental Outlook

The global cyclotron market is segmented on the product and application. Based on the product, the market is sub-segmented into cyclotron 10-12MeV, cyclotrons 16-18MeV, cyclotron 19-24MeV, and cyclotron above 24MeV.Further, based on application, the market is sub-segmented into medical, and industrial. Among the products, the cyclotron 10-12 MeV sub-segment is anticipated to hold a considerable share of the market, owing to the cyclotron 10-12 MeV range being instrumental in the production of radioisotopes used for medical imaging, particularly in positron emission tomography (PET).

Medical Sub-Segment is Anticipated to Hold a Considerable Share of the Global Cyclotron Market

Among the applications, the medical sub-segment is expected to hold a considerable share of the global cyclotron market. The segmental growth is attributed to the increasing use in radiopharmaceutical production in various medical imaging techniques, such as positron emission tomography (PET), and increasing demand in nuclear medicine procedures for accurate disease diagnosis. Nuclear medicine procedures are vital for detecting and monitoring various medical conditions. According to the World Nuclear Association, about 40 million procedures are carried out each year globally with nuclear medicines, with an annual growth rate of 5.0% per annum. Over 10,000 hospitals globally use radioisotopes in medicine, and about 90% of the procedures are for diagnosis. The most common radioisotope used in diagnosis is technetium-99 (Tc-99m), accounting for about 80% of all nuclear medicine procedures and 85% of diagnostic scans in nuclear medicine around the globe.

Regional Outlook

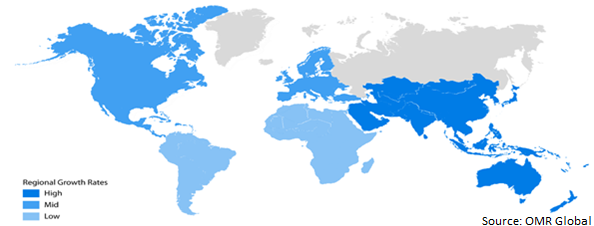

The global cyclotron market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America. Among these, Asia Pacific is anticipated to exhibit highest CAGR during the forecast period. The advancing medical technologies, rising disposable income, and improving healthcare infrastructure in emerging economies are driving the cyclotron market in the Asia-Pacific.

Global Cyclotron Market Growth, by Region 2024-2031

North America Held Considerable Share in the Global Cyclotrons Market

The rising prevalence of cancer, favorable government initiatives, and highly developed healthcare infrastructure is a key factor driving the regional market. According to the American Cancer Society'Cancer Facts & Figures 2022', around 1,918,030 new cancer cases and 609,360 mortalities due to cancers are estimated in the US in the year 2022. Such a high incidence of cancers in this region is anticipated to increase the adoption of pcyclotrons for the diagnosis of cancer, driving market growth in this region.

Market Players Outlook

The major companies serving the cyclotron market include Siemens Medical Solutions USA, Inc., IBA Radiopharma Solutions, GE HealthCare, Advanced Cyclotron Systems, Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in January 2023, Fusion Pharmaceuticals Inc., and BWXT Medical Ltd., a subsidiary of BWX Technologies, Inc. entered into a preferred partner agreement for the supply of actinium-225. Under the agreement, BWXT Medical offered predetermined amounts of Fusion's actinium supply needs at volume-based pricing.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global cyclotron market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Advanced Cyclotron Systems, Inc

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. GE HealthCare Technologies Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Ion Beam Applications SA (IBA)

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Siemens Medical Solutions USA, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global CyclotronMarket by Product

4.1.1. Cyclotron 10-12MeV

4.1.2. Cyclotron 16-18MeV

4.1.3. Cyclotron 19-24MeV

4.1.4. Cyclotron above 24MeV

4.2. Global Cyclotron Market by Application

4.2.1. Medical

4.2.2. Industrial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Alcen

6.2. Best Cyclotron Systems, Inc.

6.3. Covidien plc

6.4. Cyclotron Inc.

6.5. IONETIX Corp.

6.6. Isosolution Inc.

6.7. Nueclear Healthcare Ltd.

6.8. Samsung Medical

6.9. Stryker Corp.

6.10. Sumitomo Heavy Industries, Ltd.

6.11. TeamBest

6.12. Varian Medical Systems, Inc.

1. GLOBAL CYCLOTRON MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL CYCLOTRON 10-12MEV MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CYCLOTRON 16-18MEV MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CYCLOTRON 19-24MEV MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL CYCLOTRON ABOVE 24MEVMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL CYCLOTRON MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

7. GLOBAL CYCLOTRON FORMEDICALMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL CYCLOTRONFORINDUSTRIALMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL CYCLOTRON MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. NORTH AMERICAN CYCLOTRON MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

11. NORTH AMERICAN CYCLOTRON MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

12. NORTH AMERICAN CYCLOTRON MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

13. EUROPEAN CYCLOTRON MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. EUROPEAN CYCLOTRON MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

15. EUROPEAN CYCLOTRON MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

16. ASIA-PACIFIC CYCLOTRON MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC CYCLOTRON MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC CYCLOTRON MARKET RESEARCH AND ANALYSIS BY APPLICATION,2023-2031 ($ MILLION)

19. REST OF THE WORLD CYCLOTRON MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

20. REST OF THE WORLD CYCLOTRON MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL CYCLOTRON MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL CYCLOTRON 10-12MEVMARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CYCLOTRON 16-18MEV MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL CYCLOTRON 19-24MEVMARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL CYCLOTRON ABOVE 24MEVMARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL CYCLOTRON MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023 VS 2031 (%)

7. GLOBAL CYCLOTRON FOR MEDICALMARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL CYCLOTRON FOR INDUSTRIALMARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL CYCLOTRON MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. US CYCLOTRON MARKET SIZE, 2023-2031 ($ MILLION)

11. CANADA CYCLOTRON MARKET SIZE, 2023-2031 ($ MILLION)

12. UK CYCLOTRON MARKET SIZE, 2023-2031 ($ MILLION)

13. FRANCE CYCLOTRON MARKET SIZE, 2023-2031 ($ MILLION)

14. GERMANY CYCLOTRON MARKET SIZE, 2023-2031 ($ MILLION)

15. ITALY CYCLOTRON MARKET SIZE, 2023-2031 ($ MILLION)

16. SPAIN CYCLOTRON MARKET SIZE, 2023-2031 ($ MILLION)

17. REST OF EUROPE CYCLOTRON MARKET SIZE, 2023-2031 ($ MILLION)

18. INDIA CYCLOTRON MARKET SIZE, 2023-2031 ($ MILLION)

19. CHINA CYCLOTRON MARKET SIZE, 2023-2031 ($ MILLION)

20. JAPAN CYCLOTRON MARKET SIZE, 2023-2031 ($ MILLION)

21. SOUTH KOREA CYCLOTRON MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF ASIA-PACIFIC CYCLOTRON MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF THE WORLD CYCLOTRON MARKET SIZE, 2023-2031 ($ MILLION)