Dairy Ingredients Market

Dairy Ingredients Market Size, Share & Trends Analysis Report by Type (Milk Powder, Whey Protein, Milk Protein, Third-Party Generations, Casein, and Others), by Form (Dry/Powder and Liquid), and by Application (Infant Formulas, Sports Nutrition, Dairy Products, Bakery & Confectionary, and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Dairy ingredients market is anticipated to grow at a CAGR of 4.5% during the forecast period. The growing demand for functional food among consumers is expected to drive the market growth during the forecast period. Functional foods contains extra nutrition beyond basic that may have a positive effect on health. Further, these foods can support optimal health and decreases the risk of disease. For instance, in December 2020, Nestle launched functional food supporting mobility during aging consisting of a unique combination of ingredients supporting the three pillars of mobility bone health, muscle strength, and joint functionality. In addition, the powdered beverage under the YIYANG Active brand has also been clinically proven to enhance mobility during aging and it is the first Nestle product with functional food approval in China.

Segmental Outlook

The global dairy ingredients market is segmented based on type, form, and application. Based on the type segment, the market is sub-segmented into milk powder, whey protein, milk protein, third-party generations, caseins, and others. Based on the form segment, the market is bifurcated into dry/powder and liquid. Based on the application, the market is further augmented into infant formulas, sports nutrition, dairy products, bakery and confectionery, and others. Among these, the dry/powder sub-segment is expected to grow at a substantial CAGR during the forecast period. Dry dairy ingredients are manufactured from either milk or whey. Milk and by-products of milk production are often dried to reduce weight, aid in shipping, extend shelf life, and provide a more useful form as an ingredient for other foods. The transportation cost and storage cost are also lower compared to liquid-based dairy ingredients which result in the cost reduction of the final product and are highly preferable by manufacturers and consumers.

Among the type, milk powder sub-segment is expected to hold a prominent share in the dairy ingredients market during the forecast period. Powdered milk has the same nutrition as fresh milk and provides bone-building nutrients such as protein, calcium, vitamin D and vitamin A. Powdered milk is a source of protein that helps to increase the amount of protein and energy. These health benefits associated with milk powder are accelerating market growth. Furthermore, the rising consumption of powdered milk is expected to drive market growth. For instance, according to the food and agriculture organization of the United Nations, the consumption of milk powder across the globe increased by 1.9 % in 2020 over 2019.

Regional Outlooks

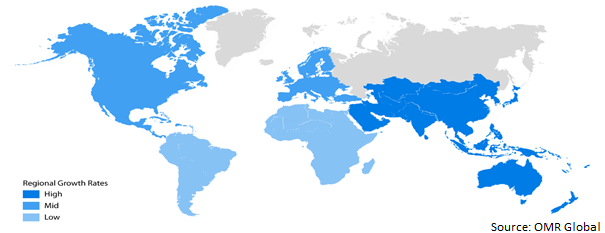

The global dairy ingredients market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The Europe region is expected to hold a substantial market share during the forecast period due to increasing urbanization and disposable income of the consumers in the region.

Global Dairy Ingredients Market Growth, by Region 2022-2028

The Asia-Pacific Region is Expected to Hold a Significant Share in the Global Dairy Ingredients Market

Among all the regions, the Asia-Pacific region is expected to hold a significant market share during the forecast period. The countries such as India is the largest consumer and producer of milk and has a large number of dairy cooperative societies at the village level. According to the food and agriculture organization of the United Nations (UN), India is the world’s largest milk producer, with 22% of the global production. Moreover, growth in the market is primarily attributed to the rapid urbanization and rising number of convenience stores which is contributing to the growth of the dairy ingredients market.

Market Players Outlook

The major companies serving the global dairy ingredients market include AMCO Proteins, Arla Foods Amba, Glanbia Plc, Gujrat Cooperative Milk Marketing Federation Ltd., Kerry Group Plc, Lactalis Group, Morinaga Milk Co., Ltd., Nestle S.A., Saputo Inc., Schreiber Foods Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in November 2020, Ingredia launched two milk proteins at FI Connect. First, Promilk Yogfluid was developed for high protein drinking yogurts and features unique properties which allow raising protein content in recipes up to 12% in the finished product. The company stated that the product offers a pleasant fluidity and keeps the creaminess out of an unctuous yogurt with a good natural milky taste. Moreover, the product meets consumers’ three key product demands: health, mobility, and pleasure. The second product, Promilk B Max, is a clean-label texturizer. Made from dairy, the texture enhancer enables companies to formulate products with 100% dairy ingredients. With the second product, it is possible to make a fresh cheese mousse without gelatin or a cream cheese without carrageenan.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global dairy ingredients market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Dairy Ingredients Market by Type

4.1.1. Milk Powder

4.1.2. Whey protein

4.1.3. Milk Protein

4.1.4. Third-Party Generations

4.1.5. Casein

4.1.6. Others

4.2. Global Dairy Ingredients Market by Form

4.2.1. Dry/Powder

4.2.2. Liquid

4.3. Global Dairy Ingredients Market by Application

4.3.1. Infant Formulas

4.3.2. Sports Nutrition

4.3.3. Dairy Products

4.3.4. Bakery & Confectionary

4.3.5. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AMCO Proteins

6.2. Agropur Cooperative

6.3. Arla Foods Amba

6.4. Cayuga Dairy Ingredients

6.5. Dairy Farmers of America, Inc.

6.6. Fonterra Co-Operative Group Ltd.

6.7. Glanbia Plc

6.8. Gujrat Cooperative Milk Marketing Federation Ltd.

6.9. Ingredia SA

6.10. Kerry Group Plc

6.11. Lactalis Group

6.12. Meiji Holdings Co., Ltd.

6.13. Mengniu Dairy Co., Ltd.

6.14. Morinaga Milk Co., Ltd.

6.15. Nestle S.A.

6.16. Royal FrieslandCampina N.V.

6.17. Saputo Inc.

6.18. Savencia SA

6.19. Schreiber Foods Inc.

6.20. Sodiaal International

6.21. Volac International Ltd.

6.22. Yili Group

1. GLOBAL DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBAL DAIRY INGREDIENTS OF MILK POWDER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL DAIRY INGREDIENTS OF WHEY PROTEIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL DAIRY INGREDIENTS OF MILK PROTEIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL DAIRY INGREDIENTS OF THIRD-PARTY GENERATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL DAIRY INGREDIENTS OF CASEIN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL DAIRY INGREDIENTS OF OTHER TYPES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

9. GLOBAL DRY/POWDER-BASED DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL LIQUID-BASED DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

12. GLOBAL DAIRY INGREDIENTS FOR INFANT FORMULAS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL DAIRY INGREDIENTS FOR SPORTS NUTRITION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL DAIRY INGREDIENTS FOR DAIRY PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL DAIRY INGREDIENTS FOR BAKERY & CONFECTIONARYMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. GLOBAL DAIRY INGREDIENTS FOR OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17. GLOBAL DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

18. NORTH AMERICAN DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. NORTH AMERICAN DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

20. NORTH AMERICAN DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

21. NORTH AMERICAN DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

22. EUROPEAN DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

23. EUROPEAN DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

24. EUROPEAN DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

25. EUROPEAN DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

28. ASIA-PACIFIC DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

29. ASIA-PACIFIC DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

30. REST OF THE WORLD DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

31. REST OF THE WORLD DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

32. REST OF THE WORLD DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY FORM, 2021-2028 ($ MILLION)

33. REST OF THE WORLD DAIRY INGREDIENTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL DAIRY INGREDIENTS MARKET SHARE BY TYPE, 2021 VS 2028 (%)

2. GLOBAL DAIRY INGREDIENTS OF MILK POWDER MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL DAIRY INGREDIENTS OF WHEY PROTEIN MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL DAIRY INGREDIENTS OF MILK PROTEIN MARKET SHARE BY REGION, 2021 VS 2028 (%)

5. GLOBAL DAIRY INGREDIENTS OF THIRD-PARTY GENERATIONS MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL DAIRY INGREDIENTS OF CASEIN MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL DAIRY INGREDIENTS OF OTHER TYPES MARKET SHARE BY REGION, 2021 VS 2028 (%)

8. GLOBAL DAIRY INGREDIENTS MARKET SHARE BY FORM, 2021 VS 2028 (%)

9. GLOBAL DRY/POWDER-BASED DAIRY INGREDIENTS MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL LIQUID-BASED DAIRY INGREDIENTS MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL DAIRY INGREDIENTS MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

12. GLOBAL DAIRY INGREDIENTS FOR INFANT FORMULAS MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL DAIRY INGREDIENTS MARKET FOR SPORTS NUTRITION SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL DAIRY INGREDIENTS FOR DAIRY PRODUCT MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL DAIRY INGREDIENTS FOR BAKERY & CONFECTIONARY MARKET SHARE BY REGION, 2021 VS 2028 (%)

16. GLOBAL DAIRY INGREDIENTS FOR OTHER MARKET SHARE BY REGION, 2021 VS 2028 (%)

17. GLOBAL DAIRY INGREDIENTS MARKET SHARE BY REGION, 2021 VS 2028 (%)

18. US DAIRY INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

19. CANADA DAIRY INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

20. UK DAIRY INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

21. FRANCE DAIRY INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

22. GERMANY DAIRY INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

23. ITALY DAIRY INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

24. SPAIN DAIRY INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF EUROPE DAIRY INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

26. INDIA DAIRY INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

27. CHINA DAIRY INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

28. JAPAN DAIRY INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

29. SOUTH KOREA DAIRY INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF ASIA-PACIFIC DAIRY INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)

31. REST OF THE WORLD DAIRY INGREDIENTS MARKET SIZE, 2021-2028 ($ MILLION)