Dairy Packaging Market

Global Dairy Packaging Market Size, Share & Trends Analysis Report by Products (Milk, Cheese, Yogurt, and Other Products), By Material (Plastic, Paper & Paperboard, and Others), By Packaging Type (Rigid Packaging and Flexible Packaging), and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global dairy packaging market is projected to grow at a CAGR of over 4% during the forecast period. Packaging of dairy products develops continuously along with the advancement in material technologies, which in turn, responds to the ever-growing demands of consumers. The key factors that drive the market growth include the increased consumption of dairy products owing to the numerous health benefits associated with the dairy items. Further, the rising preferences of the customers for the eco-friendly products along with sustainable packaging are also driving the market growth during the forecast period.

Moreover, the advent of new and renewable packaging items fuels demand. Novel dairy packaging systems include new packaging technologies such as the modified atmosphere packaging (MAP) that is widely used nowadays, especially for dairy products such as cheese. Forms of active packaging relevant to dairy foods include oxygen scavenging, carbon dioxide absorbers, moisture, and flavor/ odor taints absorbers. Antimicrobial packaging is gaining interest from packaging scientists and industry due to its potential for providing quality and their safety benefits. However, biodegradable packaging and durability of the packaging correlated with a product shelf life as well as the ecological perspective act as a barrier for the market growth during the forecast period.

Segmental Outlook

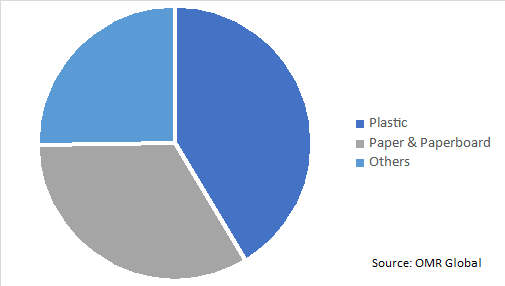

The global dairy packaging market is segmented on the basis of product, material, and packaging type. Based on the product, the market is segmented into milk, cheese, yogurt, and others such as frozen foods. Based on the material, the market is sectioned into plastic, paper & paperboard, and others such as metal. Based on the packaging type, the market is bifurcated into rigid packaging and flexible packaging.

Global Dairy Packaging Market by Material, 2019 (%)

Paper & Paperboard Segment to Exhibit Significant Growth During the Forecast Period

Amongst the material segment of the market, the paper & paperboard segment tends to exhibit significant growth during the forecast period. Paper-based packaging materials are resilient, strong, and food safe which is the primary reason for the segmental growth of the market. With the rise in population, per capita income and changing lifestyle, the food industry has seen massive growth and will continue to experience this growth. All these changes are contributing to the need for safe food packaging solution and paper-based packaging products are a natural choice here as these are made from 100% renewable fiber that is extracted from the forest that is responsibly managed. Additionally, the growing concerns towards the environment and increased adoption of paper-based and renewable products are likely to drive the market growth during the forecast period.

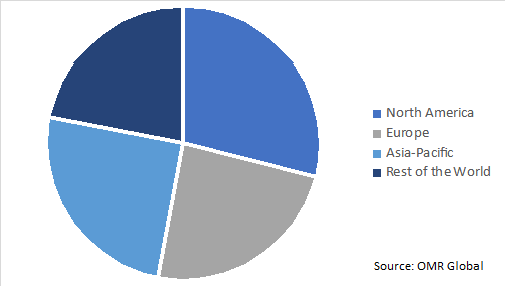

Regional Outlook

The global dairy packaging market is geographically segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America region is estimated to contribute a significant share in the market. The growth of the region is backed by several factors including the presence of the key global players operating in the region such as Berry Global Group, Inc., Ball Corp., Huhtamaki Group, The International Paper Co., and others. These key players continuously contribute to market growth by adopting several growth strategies.

Global Dairy Packaging Market by Region, 2019 (%)

Whereas the rapid growth of dairy-based products and its applications in developing countries such as India and China are the driving factors for the growth of the dairy packaging market in the Asia-Pacific region. In addition, the increased demand for packaged beverages and dairy-based drinks further fuels the regional growth of the market.

Market Players Outlook

Some of the prominent players operating in the global dairy packaging market include Amcor PLC, Berry Global Group, Inc., Ball Corp., Sealed Air Corp., Huhtamaki Group, The International Paper Co., Mondi Group, Tetra Pak International S.A., Winpak Ltd., and others. These companies adopting several organic and inorganic growth strategies such as product launches & developments, partnerships, agreements, and acquisitions to strengthen their product portfolios and maintain a competitive position in the global dairy packaging market.

In June 2019, Amcor completed the acquisition of Bemis Co. Inc., The combined company now operates as Amcor Plc (Amcor). The acquisition of Bemis brings additional scale, capabilities, and footprint strengthened Amcor’s value proposition and enables Amcor in generating significant value for shareholders.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global dairy packaging market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Huhtamaki Group

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Berry Global Group, Inc

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Sealed Air Corp.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Amcor PLC

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Dairy Packaging Market by Products

5.1.1. Milk

5.1.2. Cheese

5.1.3. Yogurt

5.1.4. Other Products

5.2. Global Dairy Packaging Market by Material

5.2.1. Plastic

5.2.2. Paper & Paperboard

5.2.3. Others

5.3. Global Dairy Packaging Market by Packaging Type

5.3.1. Rigid Packaging

5.3.2. Flexible Packaging

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Altium Packaging

7.2. Amcor PLC

7.3. Ardagh Group

7.4. Ball Corp.

7.5. Berry Global Group, Inc.

7.6. Delkor Systems, Inc.

7.7. Greiner Packaging international GmbH

7.8. Huhtamaki Group

7.9. Mondi Group

7.10. Nampack Ltd.

7.11. PACCOR GROUP

7.12. Saudi Basic Industries Corp.

7.13. Sealed Air Corp.

7.14. Sonoco Products Co.

7.15. Stora Enso Oyj

7.16. TetraPak International S.A.

7.17. The International Paper Co.

7.18. WestRock Co.

7.19. Winpak Ltd.

1. GLOBAL DAIRY PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

2. GLOBAL MILK PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL CHEESE PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL YOGURT PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL OTHER DAIRY PRODUCTS PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL DAIRY PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

7. GLOBAL PLASTIC PACKAGING FOR DAIRY PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL PAPER & PAPERBOARD PACKAGING FOR DAIRY PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL OTHER PACKAGING FOR DAIRY PRODUCTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL DAIRY PACKAGING MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE, 2019-2026 ($ MILLION)

11. GLOBAL RIGID PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL FLEXIBLE PACKAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

13. GLOBAL DAIRY PACKAGING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN DAIRY PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. NORTH AMERICAN DAIRY PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

16. NORTH AMERICAN DAIRY PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

17. NORTH AMERICAN DAIRY PACKAGING MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE, 2019-2026 ($ MILLION)

18. EUROPEAN DAIRY PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. EUROPEAN DAIRY PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

20. EUROPEAN DAIRY PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

21. EUROPEAN DAIRY PACKAGING MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC DAIRY PACKAGING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC DAIRY PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC DAIRY PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

25. ASIA-PACIFIC DAIRY PACKAGING MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE, 2019-2026 ($ MILLION)

26. REST OF THE WORLD DAIRY PACKAGING MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2019-2026 ($ MILLION)

27. REST OF THE WORLD DAIRY PACKAGING MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

28. REST OF THE WORLD DAIRY PACKAGING MARKET RESEARCH AND ANALYSIS BY PACKAGING TYPE, 2019-2026 ($ MILLION)

1. GLOBAL DAIRY PACKAGING MARKET SHARE BY PRODUCT, 2019 VS 2026 (%)

2. GLOBAL DAIRY PACKAGING MARKET SHARE BY MATERIAL, 2019 VS 2026 (%)

3. GLOBAL DAIRY PACKAGING MARKET SHARE BY PACKAGING TYPE, 2019 VS 2026 (%)

4. GLOBAL DAIRY PACKAGING MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US DAIRY PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA DAIRY PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

7. UK DAIRY PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE DAIRY PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY DAIRY PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY DAIRY PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN DAIRY PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE DAIRY PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA DAIRY PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA DAIRY PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN DAIRY PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC DAIRY PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD DAIRY PACKAGING MARKET SIZE, 2019-2026 ($ MILLION)