Diabetes Care Devices Market

Global Diabetes Care Devices Market Size, Share & Trends Analysis Report, By Product Type (Blood Glucose Monitoring Devices and Insulin Delivery Devices), By End-Use (Hospitals, Diagnostic Centers, Ambulatory Surgery Centers (ASCs), and Homecare) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global diabetes care devices market is estimated to grow significantly at a CAGR of 6.5% during the forecast period. Various pivotal factors are boosting the market growth which includes rising incidence and prevalence rate of diabetes across the globe, increasing awareness among the population towards diabetes and availability of a variety of diabetes care devices in the market. There is a wide range of blood glucose monitoring devices and insulin delivery devices commercially available in the industry.

However, there is a lack of reimbursement policies in some emerging economies such as Bulgaria; the Czech Republic and others which do not give so much priority to diabetes. In addition to policies, the risk of infections associated with some devices such as insulin pens and syringes acts as a restraint for the market growth. The adoption of oral insulin as an alternative to these devices, which is negatively impacting the segmental growth of the insulin delivery devices market. Besides, technological advancements in the field of diabetes and increased government initiatives for better awareness will further promise ample opportunities for market growth in the near future. Recent technological advancements have led to the emergence of advanced and innovative diabetes care devices such as smart insulin and artificial pancreas.

Segmental Outlook

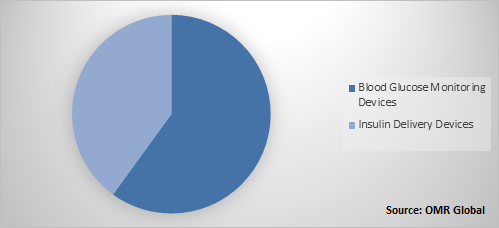

The global diabetes care devices market is segmented on the basis of product type, end-use, and region. On the basis of product type, the market is sub-segmented into blood glucose monitoring devices and insulin delivery devices. The blood glucose monitoring device segment is further classified into self-monitoring blood glucose meters, continuous glucose monitors, testing strips, and lancets. The insulin delivery device segment is further analyzed into insulin pumps, insulin pens, insulin syringes, and insulin jet injectors. Based on the end-use, the market is segmented into hospitals, diagnostic centers, ASCs, and homecare.

Global Diabetes Care Devices Market Share by Product Type, 2018 (%)

- In February 2019, the US Food and Drug Administration (FDA) announced the approval of Tandem Diabetes Care’s t: slim X2 pumps. These pumps can make a reliable and secure communication with digitally connected devices such as insulin dosing software, to receive, execute, and confirm command from these devices.

- In February 2019, Valeritas Holdings Inc. announced positive clinical outcomes for V-Go compared to insulin pen devices for treating people with type 2 diabetes prescribed basal-bolus insulin therapy. The company operates as a medical technology company and makes V-Go Wearable Insulin Delivery device. Upon successful approval of the product, the company could be able to capitalize on the future market growth in the global diabetes care devices market.

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global diabetes care devices market. Based on the availability of data, information related to products, pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Abbott Laboratories Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Eli Lilly and Co.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. B. Braun Melsungen AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Becton Dickinson and Co.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Medtronic PLC

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Diabetes Care Devices Market by Product Type

5.1.1. Blood Glucose Monitoring Devices

5.1.1.1. Self-Monitoring Blood Glucose Meters

5.1.1.2. Continuous Glucose Monitors

5.1.1.3. Testing Strips

5.1.1.4. Lancets

5.1.2. Insulin Delivery Devices

5.1.2.1. Insulin Pumps

5.1.2.2. Insulin Pens

5.1.2.3. Insulin Syringes

5.1.2.4. Insulin Jet Injectors

5.2. Global Diabetes Care Devices Market by End-Use

5.2.1. Hospitals

5.2.2. Diagnostic Centers

5.2.3. Ambulatory Surgery Centers (ASCs)

5.2.4. Homecare

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. Japan

6.3.3. India

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories Inc.

7.2. Arkray, Inc.

7.3. B. Braun Melsungen AG

7.4. Bayer Corp.

7.5. Becton Dickinson and Co.

7.6. Consort Medical PLC

7.7. Companion Medical Inc.

7.8. Dexcom Inc.

7.9. Eli Lilly and Co.

7.10. F. Hoffmann-La Roche AG

7.11. Insulet Corp.

7.12. Medtronic PLC

7.13. Nova Biomedical, Inc.

7.14. Novo Nordisk A/S

7.15. Sanofi SA

7.16. Sinocare, Inc.

7.17. Tandem Diabetes Care, Inc.

7.18. Valeritas Holdings Inc.

7.19. West Pharmaceutical Services, Inc.

7.20. Wockhardt Ltd.

7.21. Ypsomed Holding AG

1. GLOBAL DIABETES CARE DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

2. GLOBAL BLOOD GLUCOSE MONITORING DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL INSULIN DELIVERY DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL DIABETES CARE DEVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2018-2025 ($ MILLION)

5. GLOBAL DIABETES CARE DEVICES IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL DIABETES CARE DEVICES IN DIAGNOSTIC CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL DIABETES CARE DEVICES IN ASC MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL DIABETES CARE DEVICES IN HOMECARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL DIABETES CARE DEVICES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

10. NORTH AMERICAN DIABETES CARE DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN DIABETES CARE DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

12. NORTH AMERICAN DIABETES CARE DEVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2018-2025 ($ MILLION)

13. EUROPEAN DIABETES CARE DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

14. EUROPEAN DIABETES CARE DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

15. EUROPEAN DIABETES CARE DEVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2018-2025 ($ MILLION)

16. ASIA-PACIFIC DIABETES CARE DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC DIABETES CARE DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC DIABETES CARE DEVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2018-2025 ($ MILLION)

19. REST OF THE WORLD DIABETES CARE DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

20. REST OF THE WORLD DIABETES CARE DEVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2018-2025 ($ MILLION)

1. GLOBAL DIABETES CARE DEVICES MARKET SHARE BY PRODUCT TYPE, 2018 VS 2025 (%)

2. GLOBAL DIABETES CARE DEVICES MARKET SHARE BY END-USE, 2018 VS 2025 (%)

3. GLOBAL DIABETES CARE DEVICES MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US DIABETES CARE DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA DIABETES CARE DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

6. UK DIABETES CARE DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE DIABETES CARE DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY DIABETES CARE DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY DIABETES CARE DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN DIABETES CARE DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE DIABETES CARE DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

12. CHINA DIABETES CARE DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

13. JAPAN DIABETES CARE DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

14. INDIA DIABETES CARE DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC DIABETES CARE DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD DIABETES CARE DEVICES MARKET SIZE, 2018-2025 ($ MILLION)