Diabetes Care Drugs Market

Global Diabetes Care Drugs Market Size, Share & Trends Analysis Report by Drug Class (Insulins, Non-Insulin Injectable Drugs, Oral Anti-Diabetic Drugs, and Combination Drugs), and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The global diabetes care drug market is projected to grow at a CAGR of over 4% during the forecast period. Diabetes is among the major health issues across the globe and it has reached alarming levels. The key factor that drives the growth of the market includes the increasing prevalence of diabetes across the globe. As per the International Diabetes Federation (IDF), around 463 million peoples had diabetes globally in 2019. The global prevalence of diabetes is projected to augment to 578 million by 2030, and 700 million by 2045. It is expected that around 4 million mortalities were observed in 2019 in the age range of 20–79 years;in addition to this, more than one million children and adolescents are living with type 1 diabetes.

As per IDF, the annual global health expenditure on diabetes was around $760 billion in 2019. It is further estimated to reach $825 billion by 2030 and $845 billion by 2045. The expenditure includes consulting services, drugs and device costs, and other additional costs. There are different ways to treat diabetes which include weight loss, healthy eating, regular exercise, diabetes medication, or insulin therapy.Thus, this is likely to enhance the adoption of diabetes care drugs and thereby drives the market growth during the forecast period. However, the availability of alternatives such as diabetes care devices such as insulin pumps and others is projected to hamper market growth during the forecast period.

Segmental Outlook

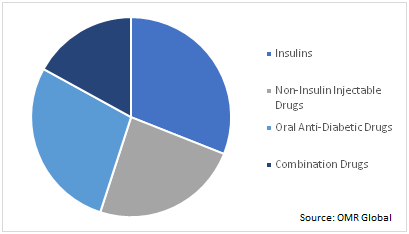

The global diabetes care drugs market is segmented on the basis of drug class as insulins, non-insulin injectable drugs, oral anti-diabetic drugs, and combination drugs. The insulin segment is projected to hold the most considerable share in the market growth. The segmental growth is attributed to the increased demand from patients suffering from diabetes type 1. Further, several benefits possessed by insulin, rapid development in insulin drugs delivery, along with an increase in the geriatric population is also estimated to increase its demand during the forecast period.

Global Diabetes Care Drugs Market by Drug Class, 2019 (%)

Regional Outlook

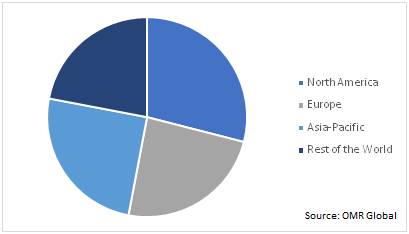

The global diabetes care drugs market is geographically segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America is projected to hold a considerable share in the market.The rise in several lifestyle disorders, rising awareness among the people towards diabetes care, are the crucial factors that lead to diabetes among the peoples who are expected to push the growth of the market in the near future.

Global Diabetes Care Drugs Market by Region, 2019 (%)

Further, Asia-Pacific is also projected to grow considerably during the forecast period, owing to the increased funding and investment in R&D by government bodies and pharmaceutical &biotechnology companies. For instance, the government of China is investing heavily in life science research, the 13th Five-year Plan (2015-2020) is one such instance, which further fuels the growth of the market as the plan focusses on the development of innovative medicines. This,in turn, creates the scope for market growth. Further, improving healthcare infrastructure and increasing geriatric population pool in the region further give a boost to the regional growth of the market.

Market Players Outlook

Numerous major players are operating in the industry and are contributing significantly to the market growth. Some of the prominent players operating in the global diabetes care drugs market include Boehringer Ingelheim International GmbH, Sanofi SA, Novo Nordisk A/S, Eli Lilly and Co., AstraZeneca PLC, Bayer AG, Bristol Myers Squibb Co., Johnson & Johnson Services Inc., Novartis International AG, Pfizer Inc., and Takeda Pharmaceuticals Co.Ltd., among others. These are the key companies adopting several organic and inorganic growth strategies such as product launches & developments, partnerships, agreements, and acquisitions to strengthen their product portfolios and maintain a competitive position in the global diabetes care drug market.

For instance, in September 2019, Novo Nordisk A/S announced that it has received the US FDA approval for its Rybelsus (semaglutide) oral tablets for adult patients with type-2 diabetes. With this approval, Rybelsus has become the first glucagon-like peptide (GLP-1) receptor protein treatment approved for use in the US that does not need to be injected.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global diabetes care drugs market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Novo Nordisk A/S

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Sanofi SA

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. AstraZeneca PLC

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Eli Lilly and Co.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Boehringer Ingelheim International GmbH

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Diabetes Care Drugs Market by Drug Class

5.1.1. Insulins

5.1.2. Non-Insulin Injectable Drugs

5.1.3. Oral Anti-Diabetic Drugs

5.1.4. Combination Drugs

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Astellas Pharma Inc.

7.2. AstraZeneca Plc

7.3. Bayer AG

7.4. Bausch Health Companies Inc.

7.5. Biocon Ltd.

7.6. Boehringer Ingelheim International GmbH

7.7. Bristol Myers Squibb Co.

7.8. Eli Lilly and Co.

7.9. Generex Biotechnology Corp.

7.10. Johnson & Johnson Services Inc.

7.11. Merck & Co. Inc.

7.12. Midatech Pharma Plc

7.13. Mylan NV

7.14. Novartis International AG

7.15. Novo Nordisk A/S

7.16. Oramed Pharmaceuticals Inc.

7.17. Pfizer Inc.

7.18. Sanofi SA

7.19. Takeda Pharmaceuticals Co.Ltd.

7.20. Teva Pharmaceuticals Industries Ltd.

1. GLOBAL DIABETES CARE DRUGS MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2019-2026 ($ MILLION)

2. GLOBAL INSULINS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL NON-INSULIN INJECTABLE DRUGS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL ORAL ANTI-DIABETIC DRUGS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL COMBINATION DRUGS FOR DIABETES MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL DIABETES CARE DRUGS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

7. NORTH AMERICAN DIABETES CARE DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

8. NORTH AMERICAN DIABETES CARE DRUGS MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2019-2026 ($ MILLION)

9. EUROPEAN DIABETES CARE DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

10. EUROPEAN DIABETES CARE DRUGS MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2019-2026 ($ MILLION)

11. ASIA-PACIFIC DIABETES CARE DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. ASIA-PACIFIC DIABETES CARE DRUGS MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2019-2026 ($ MILLION)

13. REST OF THE WORLD DIABETES CARE DRUGS MARKET RESEARCH AND ANALYSIS BY DRUG CLASS, 2019-2026 ($ MILLION)

1. GLOBAL DIABETES CARE DRUGS MARKET SHARE BY DRUG CLASS, 2019 VS 2026 (%)

2. GLOBAL DIABETES CARE DRUGS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

3. US DIABETES CARE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

4. CANADA DIABETES CARE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

5. UK DIABETES CARE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

6. FRANCE DIABETES CARE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

7. GERMANY DIABETES CARE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

8. ITALY DIABETES CARE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

9. SPAIN DIABETES CARE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

10. ROE DIABETES CARE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

11. INDIA DIABETES CARE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

12. CHINA DIABETES CARE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

13. JAPAN DIABETES CARE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

14. REST OF ASIA-PACIFIC DIABETES CARE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF THE WORLD DIABETES CARE DRUGS MARKET SIZE, 2019-2026 ($ MILLION)