Diagnostic Imaging Equipment Market

Global Diagnostic Imaging Equipment Market Size, Share & Trends Analysis Report by Modality (X-Ray, Ultrasound, Computed Tomography, Magnetic Resonance Imaging (MRI), Mammography, and Others (Nuclear Imaging)), By Application (Oncology, Orthopedics, Cardiovascular, Neurology, Urology, Others) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global market for diagnostic imaging equipment is estimated to have a significant CAGR during the forecast period. The increasing prevalence of chronic disease is estimated to be one of the major factors that are driving the growth of the global diagnostic imaging equipment market. Chronic disease includes arthritis, CVDs, asthma, cancer, and chronic obstructive pulmonary disease (COPD). The imaging devices enable the diagnosis of chronic diseases and their cause. Imaging devices diagnose the causes of pain, swelling, and infection in the body’s internal organs. CVDs are estimated to be one of the major causes of mortality globally. According to WHO, CVD accounts for more than 17.3 million mortalities per year. And the number of mortalities by cardiovascular diseases is further estimated to reach 23.6 million by 2030. According to the WHO, cancer is considered to be the second leading cause of mortalities in the year 2015. It is also estimated that that 1 out of 6 deaths was due to cancer. Rising number of cancer patients globally further raises the demand of early diseases diagnose that further propels the market growth.

Segmental Outlook

The global diagnostic imaging equipment market is segmented based on modality and application. Based on the modality, the market is further classified into X-Ray, ultrasound, computed tomography, magnetic resonance imaging (MRI), mammography, and Others (Nuclear Imaging). The ultrasound segment is projected to have considerable growth owing to the growing application in imaging in various diseases such as cancer, CVD and others. Based on the application, the global diagnostic imaging equipment market is further segmented into oncology, orthopedics, cardiovascular, neurology, urology, others.

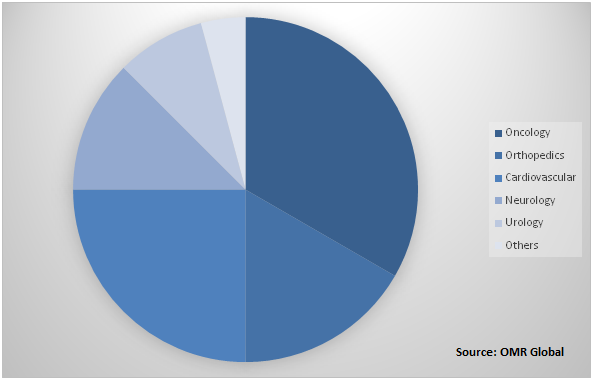

Global diagnostic imaging equipment Market Share by Application, 2018(%)

Global diagnostic imaging equipment Market to be driven by Oncology Application

The oncology segment held a considerable share in the market owing to the growing application of diagnostic imaging in various cancer types coupled with the increasing prevalence of cancer across the globe. As per the International Agency for Research on Cancer (IARC), in 2018 there were 17 million new cancer cases and 9.5 million cancer mortality across the globe. The rising number of cancer patients globally is the major factor for the growth of global diagnostic imaging equipment. National expenditures for cancer care in the US totaled nearly $125 billion in 2010 and it is estimated to reach $156 billion in 2020. Rising cancer cases will directly increase the demand of diagnostic imaging equipment across the globe. Various diagnostic imaging equipment are available for the diagnosis of the different type of cancer. For instance, the automated breast ultrasound (ABUS) system is used for screening women with dense breast tissue. It is used in combination with mammography, the system is clinically proven to increase cancer detection rate in women with dense breast tissue by 30%.

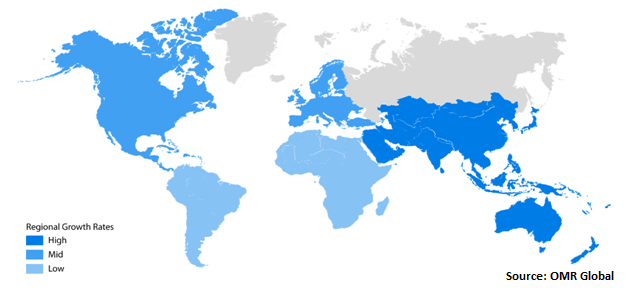

Regional Outlook

Geographically, the global diagnostic imaging equipment market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. Asia-Pacific is estimated to have considerable market growth in the global market during the forecast period. The market growth in the region is increasing owing to the high prevalence of different types of cancer coupled with growing awareness towards diagnosis in emerging economies. The major countries which will have a significant market share during the forecast period are India, China, and Japan. Apart from these nations, South Korea and Singapore are some of the other major economies where considerable growth would be observed.

Global diagnostic imaging equipment Market Growth, by Region 2019-2025

North America to hold a considerable share in the global diagnostic imaging equipment market

Geographically, North America is projected to hold a significant market share in the global diagnostic imaging equipment market. Major economies which are anticipated to contribute to the North America diagnostic imaging market are the US and Canada. The imaging technology plays a significant role in the diagnosis of various CVDs, cancer and other diseases along with having an application for pregnant women. In the US, the American Cancer Society has estimated that there will be more than 234,000 number of cases that will be related to that of lung and bronchus cancer during 2018. Whereas there will be more than 154,000 deaths related to these types of cancer. According to the American Cancer Society these incidences will be more than 10,000 in California, Florida & New York. Similarly, these states eventually will have a greater number of deaths due to these types of cancer which is estimated to be more than 8,000. A high prevalence of diseases is augmenting the need for diagnostic imaging equipment in the region.

Market Players Outlook

The key players in the diagnostic imaging equipment market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market includeFUJIFILM Corp., General Electric Co., Hitachi Ltd., Koninklijke Philips N.V., Siemens AG and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global diagnostic imaging equipment market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. FUJIFILM Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. General Electric Co.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Hitachi Ltd.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Koninklijke Philips N.V..

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Siemens AG

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Diagnostic Imaging Equipment Market by Modality

5.1.1. X-Ray

5.1.2. Ultrasound

5.1.3. Computed Tomography

5.1.4. Magnetic Resonance Imaging (MRI)

5.1.5. Mammography

5.1.6. Others (Nuclear Imaging)

5.2. Global Diagnostic Imaging Equipment Market by Application

5.2.1. Oncology

5.2.2. Orthopedics

5.2.3. Cardiovascular

5.2.4. Neurology

5.2.5. Urology

5.2.6. Others (Gastroenterology)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Allengers Medical Systems Ltd.

7.2. Butterfly Network, Inc.

7.3. Canon Inc.

7.4. Carestream Health, Inc.

7.5. Esaote S.p.A

7.6. FUJIFILM Corp.

7.7. Fukuda Denshi Co., Ltd.

7.8. General Electric Co.

7.9. Hitachi Ltd.

7.10. Hologic, Inc.

7.11. Konica Minolta, Inc.

7.12. Koninklijke Philips N.V.

7.13. Neusoft Corp.

7.14. NP JSC Amico

7.15. Siemens AG

7.16. Shimadzu Corp.

7.17. SonoScape Medical Corp.

7.18. Trivitron Healthcare Pvt. Ltd.

7.19. Terason Corp.

7.20. United Imaging Healthcare Co, Ltd.

1. GLOBAL DIAGNOSTIC IMAGING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY MODALITY, 2018-2025 ($ MILLION)

2. GLOBAL X-RAY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL ULTRASOUND MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL COMPUTED TOMOGRAPHY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL MAGNETIC RESONANCE IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL MAMMOGRAPHY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL OTHERS DIAGNOSTIC IMAGING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL DIAGNOSTIC IMAGING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

9. GLOBAL DIAGNOSTIC IMAGING EQUIPMENT IN ONCOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL DIAGNOSTIC IMAGING EQUIPMENT IN ORTHOPEDICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL DIAGNOSTIC IMAGING EQUIPMENT IN CARDIOVASCULAR MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL DIAGNOSTIC IMAGING EQUIPMENT IN NEUROLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL DIAGNOSTIC IMAGING EQUIPMENT IN UROLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL DIAGNOSTIC IMAGING EQUIPMENT IN OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL DIAGNOSTIC IMAGING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

16. NORTH AMERICAN DIAGNOSTIC IMAGING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. NORTH AMERICAN DIAGNOSTIC IMAGING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY MODALITY, 2018-2025 ($ MILLION)

18. NORTH AMERICAN DIAGNOSTIC IMAGING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

19. EUROPEAN DIAGNOSTIC IMAGING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

20. EUROPEAN DIAGNOSTIC IMAGING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY MODALITY, 2018-2025 ($ MILLION)

21. EUROPEAN DIAGNOSTIC IMAGING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC DIAGNOSTIC IMAGING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC DIAGNOSTIC IMAGING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY MODALITY, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC DIAGNOSTIC IMAGING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

25. REST OF THE WORLD DIAGNOSTIC IMAGING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY MODALITY, 2018-2025 ($ MILLION)

26. REST OF THE WORLD DIAGNOSTIC IMAGING EQUIPMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL DIAGNOSTIC IMAGING EQUIPMENT MARKET SHARE BY MODALITY, 2018 VS 2025 (%)

2. GLOBAL DIAGNOSTIC IMAGING EQUIPMENT MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL DIAGNOSTIC IMAGING EQUIPMENT MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US DIAGNOSTIC IMAGING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA DIAGNOSTIC IMAGING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

6. UK DIAGNOSTIC IMAGING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE DIAGNOSTIC IMAGING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY DIAGNOSTIC IMAGING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY DIAGNOSTIC IMAGING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN DIAGNOSTIC IMAGING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE DIAGNOSTIC IMAGING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA DIAGNOSTIC IMAGING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA DIAGNOSTIC IMAGING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN DIAGNOSTIC IMAGING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC DIAGNOSTIC IMAGING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD DIAGNOSTIC IMAGING EQUIPMENT MARKET SIZE, 2018-2025 ($ MILLION)