Diagnostic Imaging Services Market

Global Diagnostic Imaging Services Market Size, Share & Trends Analysis Report by Modality (X-Ray, Ultrasound, Computed Tomography, Magnetic Resonance Imaging (MRI), Mammography, and Others (Nuclear Imaging)), By Application (Oncology, Orthopedics, Cardiovascular, Neurology, Urology, Others (Fluoroscopy)) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global market for diagnostic imaging services is estimated to have a CAGR of around 5.5% during the forecast period. The increasing prevalence of chronic disease is estimated to be one of the major factors that are driving the growth of the global diagnostic imaging services market. Chronic disease includes arthritis, cardiovascular diseases, asthma, cancer, and chronic obstructive pulmonary disease (COPD). The imaging devices enable the diagnosis of chronic diseases and their cause. Imaging devices diagnose the causes of pain, swelling, and infection in the body’s internal organs. Further, it is used to examine a baby in pregnant women and the brain and hips of infants. Increasing prevalence of CVD has been significantly contributing to the market as ultrasound guides biopsies, diagnose heart conditions, and assess damage after a heart attack.

Segmental Outlook

The global diagnostic imaging services market is segmented based on modality and application. Based on the modality, the market is further classified into X-Ray, ultrasound, computed tomography, magnetic resonance imaging (MRI), mammography, and Others (Nuclear Imaging). The ultrasound segment is projected to have considerable growth owing to the growing application in imaging in various diseases such as cancer, CVD and others. Based on the application, the global diagnostic imaging services market is further segmented into oncology, orthopedics, cardiovascular, neurology, urology, others (fluoroscopy).

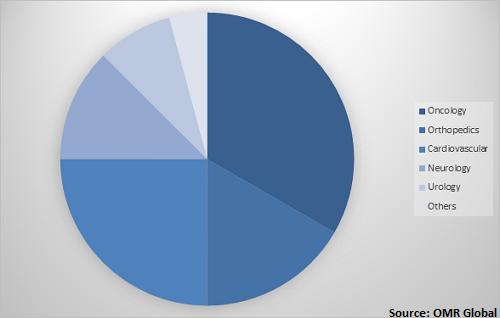

Global diagnostic imaging Services Market Share by Application, 2018(%)

Global diagnostic imaging Services Market to be driven by Oncology Application

The oncology segment held a considerable share in the market owing to the growing application of diagnostic imaging in various cancer types coupled with the increasing prevalence of cancer across the globe. As per the International Agency for Research on Cancer (IARC), in 2018 there were 17 million new cancer cases and 9.5 million cancer mortality across the globe. The rising number of cancer patients globally is the major factor for the growth of global diagnostic imaging services. National expenditures for cancer care in the US totaled nearly $125 billion in 2010 and it is estimated to reach $156 billion in 2020. An ultrasound may be used to diagnose a tumor (cancerous cell). It can also help a doctor to perform a biopsy as it enables them to locate the tumor’s in the body. High-intensity ultrasound is used to detect cancer cells as it has improved penetration to identify the cause of disease. Rising chronic diseases will directly increase the diagnostic imaging services across the globe.

Regional Outlook

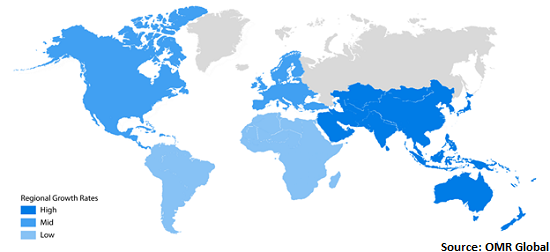

Geographically, the global diagnostic imaging Services market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. Asia-Pacific is estimated to have considerable market growth in the global market during the forecast period. The market growth in the region is increasing owing to the high prevalence of different types of cancer coupled with growing awareness towards diagnosis in emerging economies. The major countries which will have a significant market share during the forecast period are India, China, and Japan. Apart from these nations, South Korea and Singapore are some of the other major economies where considerable growth would be observed.

Global diagnostic imaging Services Market Growth, by Region 2019-2025

North America to hold a considerable share in the global diagnostic imaging Services market

Geographically, North America is projected to hold a significant market share in the global diagnostic imaging services market. Major economies which are anticipated to contribute to the North America diagnostic imaging market are the US and Canada. The imaging technology plays a significant role in the diagnosis of various cardiovascular diseases, cancer and other diseases along with having an application for pregnant women. According to WHO, the incidence and prevalence rate of heart attacks are highest in North America, which is responsible for 0.7 million fatalities each year. As an instance, according to the American Heart Association, about 510,000 cardiac arrests were observed in 2017 in the US. A high prevalence of diseases is augmenting the need for diagnostic imaging services in the region.

Market Players Outlook

The key players in the diagnostic imaging Services market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Center for Diagnostic Imaging, Inc., Dignity Health, Global Diagnostics, Healius Ltd., Healthcare Imaging Services Pty Ltd., InHealth Ltd., Novant Health, and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global diagnostic imaging services market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Diagnostic Imaging Services Market by Modality

5.1.1. X-Ray

5.1.2. Ultrasound

5.1.3. Computed Tomography

5.1.4. Magnetic Resonance Imaging (MRI)

5.1.5. Mammography

5.1.6. Others (Nuclear Imaging)

5.2. Global Diagnostic Imaging Services Market by Application

5.2.1. Oncology

5.2.2. Orthopedics

5.2.3. Cardiovascular

5.2.4. Neurology

5.2.5. Urology

5.2.6. Others (Fluoroscopy)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Alliance HealthCare Services

7.2. AdventHealth

7.3. Consensys Imaging Service, Inc.

7.4. Canada Diagnostic Centres

7.5. Center for Diagnostic Imaging, Inc.

7.6. Dignity Health

7.7. Global Diagnostics

7.8. Healius Ltd.

7.9. Healthcare Imaging Services Pty Ltd.

7.10. InHealth Ltd.

7.11. Novant Health

7.12. NovaMed Corp.

7.13. Premier Medical Group

7.14. RadNet, Inc.

7.15. Sonic Healthcare Ltd.

7.16. SimonMed

7.17. SSM Health

7.18. Unilabs AB

1. GLOBAL DIAGNOSTIC IMAGING SERVICES MARKET RESEARCH AND ANALYSIS BY MODALITY, 2018-2025 ($ MILLION)

2. GLOBAL X-RAY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL ULTRASOUND MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL COMPUTED TOMOGRAPHY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL MAGNETIC RESONANCE IMAGING MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL MAMMOGRAPHY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL OTHERS DIAGNOSTIC IMAGING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL DIAGNOSTIC IMAGING SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

9. GLOBAL DIAGNOSTIC IMAGING SERVICES IN ONCOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL DIAGNOSTIC IMAGING SERVICES IN ORTHOPEDICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL DIAGNOSTIC IMAGING SERVICES IN CARDIOVASCULAR MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

12. GLOBAL DIAGNOSTIC IMAGING SERVICES IN NEUROLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

13. GLOBAL DIAGNOSTIC IMAGING SERVICES IN UROLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

14. GLOBAL DIAGNOSTIC IMAGING SERVICES IN OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

15. GLOBAL DIAGNOSTIC IMAGING SERVICES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

16. NORTH AMERICAN DIAGNOSTIC IMAGING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

17. NORTH AMERICAN DIAGNOSTIC IMAGING SERVICES MARKET RESEARCH AND ANALYSIS BY MODALITY, 2018-2025 ($ MILLION)

18. NORTH AMERICAN DIAGNOSTIC IMAGING SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

19. EUROPEAN DIAGNOSTIC IMAGING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

20. EUROPEAN DIAGNOSTIC IMAGING SERVICES MARKET RESEARCH AND ANALYSIS BY MODALITY, 2018-2025 ($ MILLION)

21. EUROPEAN DIAGNOSTIC IMAGING SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

22. ASIA-PACIFIC DIAGNOSTIC IMAGING SERVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

23. ASIA-PACIFIC DIAGNOSTIC IMAGING SERVICES MARKET RESEARCH AND ANALYSIS BY MODALITY, 2018-2025 ($ MILLION)

24. ASIA-PACIFIC DIAGNOSTIC IMAGING SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

25. REST OF THE WORLD DIAGNOSTIC IMAGING SERVICES MARKET RESEARCH AND ANALYSIS BY MODALITY, 2018-2025 ($ MILLION)

26. REST OF THE WORLD DIAGNOSTIC IMAGING SERVICES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL DIAGNOSTIC IMAGING SERVICES MARKET SHARE BY MODALITY, 2018 VS 2025 (%)

2. GLOBAL DIAGNOSTIC IMAGING SERVICES MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

3. GLOBAL DIAGNOSTIC IMAGING SERVICES MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US DIAGNOSTIC IMAGING SERVICES MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA DIAGNOSTIC IMAGING SERVICES MARKET SIZE, 2018-2025 ($ MILLION)

6. UK DIAGNOSTIC IMAGING SERVICES MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE DIAGNOSTIC IMAGING SERVICES MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY DIAGNOSTIC IMAGING SERVICES MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY DIAGNOSTIC IMAGING SERVICES MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN DIAGNOSTIC IMAGING SERVICES MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE DIAGNOSTIC IMAGING SERVICES MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA DIAGNOSTIC IMAGING SERVICES MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA DIAGNOSTIC IMAGING SERVICES MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN DIAGNOSTIC IMAGING SERVICES MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC DIAGNOSTIC IMAGING SERVICES MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD DIAGNOSTIC IMAGING SERVICES MARKET SIZE, 2018-2025 ($ MILLION)