Diammonium Phosphate Market

Diammonium Phosphate Market Size, Share & Trends Analysis Report by Application (Fertilizers, Fire Extinguishing Powders, Emulsifiers, Food Additives, Metal Finishing, and Others), Forecast Period (2024-2031)

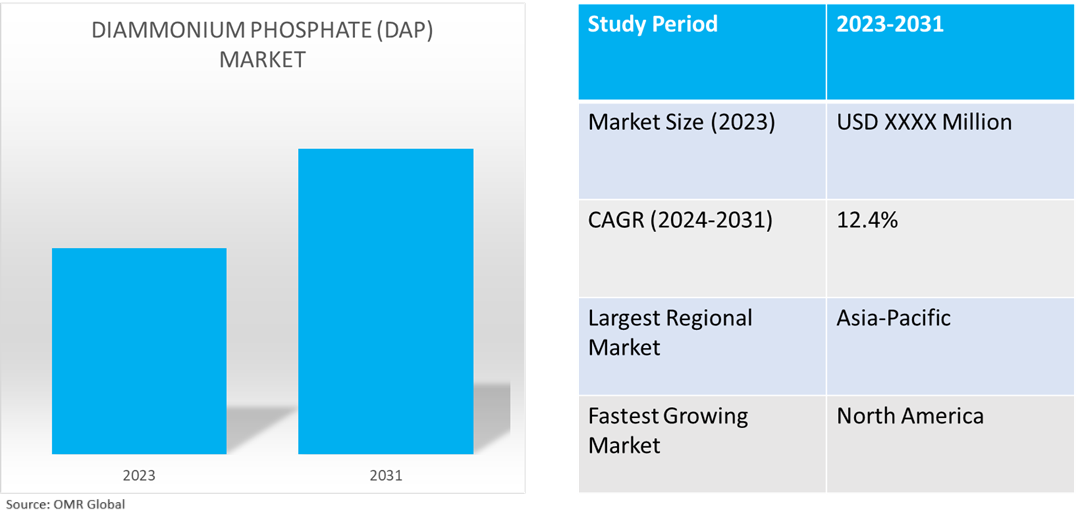

Diammonium phosphate (DAP) market is anticipated to grow at a significant CAGR of 12.4% during the forecast period (2024-2031). The market growth is attributed to the increased demand for DAP owing to high phosphorus content for agriculture practices and growing demand to enhance agriculture productivity to meet the food demand globally driving the market growth. On acidic soils, DAP helps to temporarily raise the pH of the soil solution surrounding the fertilizer granule, improving phosphorus uptake from the fertilizers. According to the US Geological Survey, Mineral Commodity Summaries, in January 2024, Global consumption of P2O5 contained in fertilizers was estimated to have been 45.7 million tons in 2023 compared with 43.8 million tons in 2022. Global consumption of P2O5 in fertilizers was projected to increase to 50 million tons by 2027. The leading regions for growth were expected to be Asia and South America.

Market Dynamics

Increasing Government Investment and Subsidies

The increasing investment and subsidies by the government related to fertilizer enhance the production and demand of diammonium phosphate in agriculture regions to provide farm productivity and food security a top priority. According to the US Department of Agriculture, in March 2022, the US Department of Agriculture (USDA) announced plans for a $250.0 million investment to support innovative American-made fertilizers to give US farmers more choices in the marketplace. Additionally, to address growing competition concerns in the agricultural supply chain, USDA launched a public inquiry seeking information regarding seeds and agricultural inputs, fertilizer, and retail markets.

Increasing Demand for High-Efficiency DAP Fertilizers

Farmers are looking for fertilizers with better nutritional content and release to improve crop yields while minimizing their environmental impact. This trend is driving demand for specialty blends, controlled-release fertilizers, and fertigation—the practice of delivering fertilizer through irrigation systems. DAP fertilizer encourages strong root growth to establish robust plants, boost yields, and accelerate ripening. For transplanting cuttings, flowers, trees, and shrubs, superphosphate is perfect. Fruit, root, and seed crops can be supported by it.

Market Segmentation

- Based on the application, the market is segmented into fertilizers, fire extinguishing powders, emulsifiers, food additives, metal finishing, and others (water treatment chemicals).

Fertilizers are Projected to Hold the Largest Segment

The fertilizers segment is expected to hold the largest share of the market. The primary factors supporting the growth include owing to increasing uses of DAP as plant nutrition, DAP fertilizer is an ideal source of P and nitrogen (N). As it dissolves quickly in soil owing to its high solubility, it releases ammonium and phosphate that are available to plants. The alkaline pH that surrounds the dissolving granule is one of DAP's distinctive features. According to the Fertiliser Association of India, Annual Review Of Fertilizer Production and Consumption 2022-23, DAP fertilizer at 10.5 million metric tons (MT) during 2022-23 recorded an increase of 13.0%. In terms of products, the production of DAP was at 4.4 million MT during 2022-23. Import of DAP increased from 5.5 million MT during 2021-22 to 6.6 million MT during 2022-23, representing a growth of 20.5%. Total production of food grains is estimated to be 330.5 million MT, about 14.9 million MT (4.7%) higher than the previous year’s level.

Regional Outlook

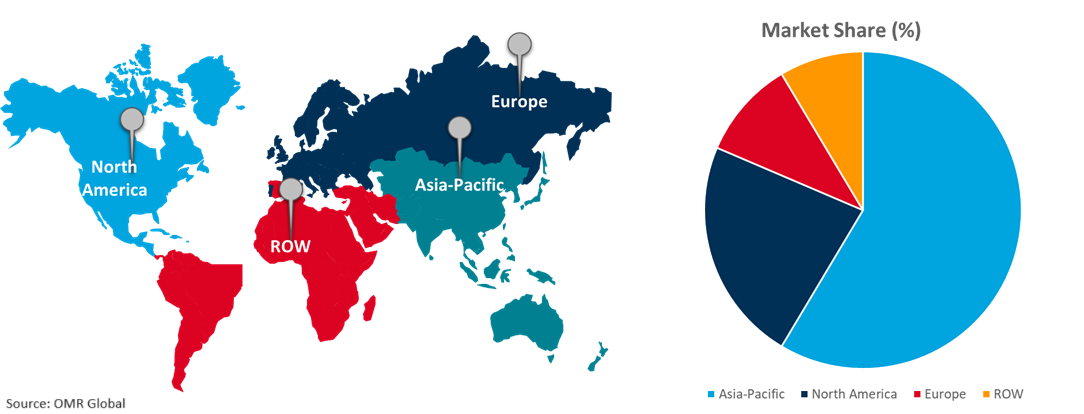

The global diammonium phosphate market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Diammonium Phosphate in North America

- The regional growth is attributed to the increased demand for DAP is anticipated to increase owing to its lower cost. In the region, phosphate rock was produced in Florida, Idaho, North Carolina, and Utah. According to the US Geological Survey, Mineral Commodity Summaries, in January 2024, about 25.0% of the wet-process phosphoric acid produced was exported in the form of upgraded granular diammonium phosphate (DAP), monoammonium phosphate (MAP) fertilizer, merchant-grade phosphoric acid, and other phosphate fertilizer products. In 2023, phosphate rock ore was mined by five companies at nine mines in four States and processed into an estimated 20 million tons of marketable product, valued at $2.0 billion, free on board (f.o.b.) mine.

- According to the US Department of Agriculture, in June 2022, fertilizer usage not only varied by country and by crop but also by the method of application. Most of the direct application of ammonia happens in North America. 14.0% of all US fertilizer applications are in the form of direct ammonia, which accounts for nearly one-quarter of all nitrogen fertilizer applications. Mexico and Canada apply 11.0% and 10.0% of their fertilizers as direct ammonia, respectively.

Global Diammonium Phosphate Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

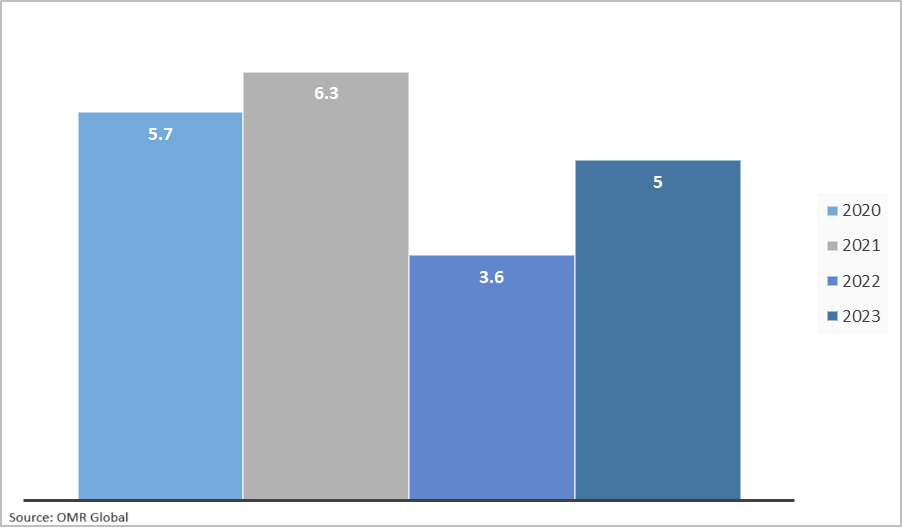

Asia-Pacific holds a significant share owing to numerous prominent Deepak Fertilisers and Petrochemicals Corporation Ltd. (DFPCL), Gujarat Narmada Valley Fertilizers & Chemicals Ltd. (GNFC), Indian Farmers Fertiliser Co., Ltd. (IFFCO), and Tianjin Crown Champion Industrial Co., Ltd. in the region. The main driver of the regional expansion is the rising demand for food in countries like India, China, Japan, and South Korea. As awareness of sustainable agricultural practices rises, DAP is growing increasingly in demand as a phosphorus fertilizer owing to its cost and efficiency. Technological advancements and innovations in DAP production techniques are increasing productivity and reducing adverse environmental effects. According to the International Food Policy Research Institute, in April 2023, China's DAP exports, rose 2023 over 2022, As China eased its export restrictions/licensing requirements in 2023, it had a 20.0% share of Brazil’s DAP imports, up from 14.0% in 2022, yet below the 2021 of 27.0%. China also dramatically increased its share of Indian DAP imports from 19.0% in 2022 to 39.0% in 2023, surpassing the 37.0% share it held in 2021. India’s DAP imports increased from 2% in 2021 to 10.0% in 2023.

China phosphate (Diammonium Phosphate (DAP) exports in (2020-23) Metric tons (mt)

Source: International Food Policy Research Institute

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the diammonium phosphate market include EuroChem Group, Koch Industries, Inc., Nutrien Ltd., OCP Group, and The Mosaic Company, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, and mergers and acquisitions to stay competitive in the market.

Recent Development

- In April 2023, IFFCO introduced Nano DAP Liquid Fertiliser to provide farmers with the means to boost productivity & help increase their income. The Nano DAP Liquid Fertiliser was to the service of the Nation at a ceremony held at IFFCO, New Delhi which was watched online by millions of Farmers and member Cooperatives societies throughout India & Abroad.

- In January 2023, OCP Group and India entered a strategic partnership to strengthen food security and confirm their common ambition for innovative and sustainable agriculture. The partnership includes the delivery of 1,000,000 tons of diammonium phosphate (DAP) to Indian farmers.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the diammonium phosphate market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. EuroChem Group

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Koch Industries, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Nutrien Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. OCP Group

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. The Mosaic Company

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Diammonium Phosphate Market by Application

4.1.1. Fertilizers

4.1.2. Fire Extinguishing Powders

4.1.3. Emulsifiers

4.1.4. Food Additives

4.1.5. Metal Finishing

4.1.6. Others (Water Treatment Chemical)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. AB LIFOSA

6.2. Aurepio Sp. z o.o.

6.3. Coromandel International Ltd.

6.4. Deepak Fertilisers and Petrochemicals Corporation Ltd. (DFPCL)

6.5. Eti Gübre A.?.

6.6. Graham Chemical

6.7. Gujarat Narmada Valley Fertilizers & Chemicals Ltd. (GNFC)

6.8. Hubei Xingfa Chemicals Group Co., Ltd.

6.9. Israel Chemical Limited (ICL Group)

6.10. Indian Farmers Fertiliser C., Ltd. (IFFCO)

6.11. Innophos Holdings, Inc.

6.12. Jordan Phosphate Mines Company (PLC)

6.13. The Saudi Arabian Mining Company (Ma'aden)

6.14. PhosAgro

6.15. Qatar Fertiliser Company (QAFCO)

6.16. Saudi Basic Industries Corp. (SABIC)

6.17. Star Grace Mining Co., Ltd.

6.18. Tianjin Crown Champion Industrial Co., Ltd.

6.19. Yara International ASA

1. GLOBAL DIAMMONIUM PHOSPHATE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

2. GLOBAL DIAMMONIUM PHOSPHATE FOR FERTILIZERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL DIAMMONIUM PHOSPHATE FOR FIRE EXTINGUISHING POWDERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL DIAMMONIUM PHOSPHATE FOR EMULSIFIERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL DIAMMONIUM PHOSPHATE FOR FOOD ADDITIVES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL DIAMMONIUM PHOSPHATE FOR METAL FINISHING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL DIAMMONIUM PHOSPHATE FOR OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL DIAMMONIUM PHOSPHATE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. NORTH AMERICAN DIAMMONIUM PHOSPHATE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

10. NORTH AMERICAN DIAMMONIUM PHOSPHATE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

11. EUROPEAN DIAMMONIUM PHOSPHATE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. EUROPEAN DIAMMONIUM PHOSPHATE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

13. ASIA-PACIFIC DIAMMONIUM PHOSPHATE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. ASIA-PACIFIC DIAMMONIUM PHOSPHATE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

15. REST OF THE WORLD DIAMMONIUM PHOSPHATE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. REST OF THE WORLD DIAMMONIUM PHOSPHATE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL DIAMMONIUM PHOSPHATE MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

2. GLOBAL DIAMMONIUM PHOSPHATE FOR FERTILIZERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL DIAMMONIUM PHOSPHATE FOR FIRE EXTINGUISHING POWDERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL DIAMMONIUM PHOSPHATE FOR EMULSIFIERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL DIAMMONIUM PHOSPHATE FOR FOOD ADDITIVES MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL DIAMMONIUM PHOSPHATE FOR METAL FINISHING MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL DIAMMONIUM PHOSPHATE FOR OTHER APPLICATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL DIAMMONIUM PHOSPHATE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. US DIAMMONIUM PHOSPHATE MARKET SIZE, 2023-2031 ($ MILLION)

10. CANADA DIAMMONIUM PHOSPHATE MARKET SIZE, 2023-2031 ($ MILLION)

11. UK DIAMMONIUM PHOSPHATE MARKET SIZE, 2023-2031 ($ MILLION)

12. FRANCE DIAMMONIUM PHOSPHATE MARKET SIZE, 2023-2031 ($ MILLION)

13. GERMANY DIAMMONIUM PHOSPHATE MARKET SIZE, 2023-2031 ($ MILLION)

14. ITALY DIAMMONIUM PHOSPHATE MARKET SIZE, 2023-2031 ($ MILLION)

15. SPAIN DIAMMONIUM PHOSPHATE MARKET SIZE, 2023-2031 ($ MILLION)

16. REST OF EUROPE DIAMMONIUM PHOSPHATE MARKET SIZE, 2023-2031 ($ MILLION)

17. INDIA DIAMMONIUM PHOSPHATE MARKET SIZE, 2023-2031 ($ MILLION)

18. CHINA DIAMMONIUM PHOSPHATE MARKET SIZE, 2023-2031 ($ MILLION)

19. JAPAN DIAMMONIUM PHOSPHATE MARKET SIZE, 2023-2031 ($ MILLION)

20. SOUTH KOREA DIAMMONIUM PHOSPHATE MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF ASIA-PACIFIC DIAMMONIUM PHOSPHATE MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF THE WORLD DIAMMONIUM PHOSPHATE MARKET SIZE, 2023-2031 ($ MILLION)

23. LATIN AMERICA DIAMMONIUM PHOSPHATE MARKET SIZE, 2023-2031 ($ MILLION)

24. MIDDLE EAST AND AFRICA DIAMMONIUM PHOSPHATE MARKET SIZE, 2023-2031 ($ MILLION)