Diesel Generator Market

Diesel Generator Market Size, Share & Trends Analysis Report by Power Rating (Up to 50 kW, 51 - 280 KW, 281-500 kW, 501 - 2,000 KW and Above 2,000 KW), by Source (Standby Power, Peak Shaving and Prime & Continuous Power), and by Application (Industrial, Commercial and Residential) Forecast Period (2024-2031)

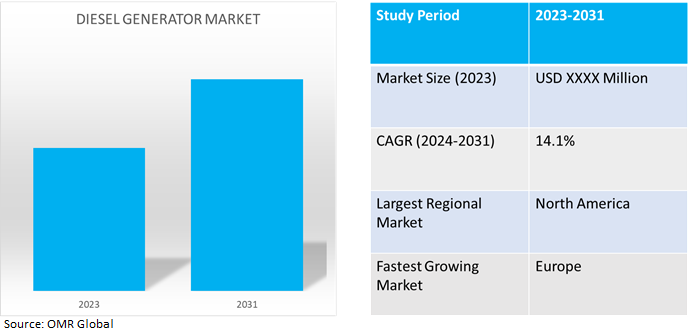

Diesel generator market is anticipated to grow at a significant CAGR of 14.1% during the forecast period (2024-2031). The market growth is attributed to the increasing investments in producing efficient energy management across various applications with backup power in industries and businesses. The demand for an uninterrupted power supply and frequent power outages in developing economies are accelerating the demand for diesel generators globally is driving the market growth. Among other verticals, the majority of these diesel generators are utilized to supply electricity to residences, factories, schools, hospitals, and construction sites. It serves as either a primary or backup power source in the event of a grid outage.

Market Dynamics

Increasing Adoption of Microgrids Powered Diesel Generators

Diesel generators are essential to the global electrification of rural areas as they provide dependable connectivity to the electrical grid. Diesel generator-powered microgrids have become a viable option for improving energy accessibility and stimulating socioeconomic growth in isolated regions. Diesel generators offer a consistent supply of electricity in case of emergencies, which enhances the dependability of microgrids. Diesel generators can produce electricity on their own, however other renewable energy sources, like solar panels and wind turbines, may depend on external variables.

Growing Integration of Advanced Control Systems

The increasing integration of Internet of Things technologies and sophisticated control systems boosts the dependability and efficiency of diesel generators. Additionally, while maintaining compliance with strict emission regulations, diesel generator makers are concentrating on enhancing fuel efficiency and load-taking capacity. Furthermore, generators have sophisticated engine management and innovative remote monitoring features that enable users to remotely monitor critical engine performance metrics and parameters in real-time. Notably, these new hyper-scale facilities require a significant amount of electricity owing to the exponential development in the number of data centers, and diesel generator provides a dependable backup system.

Market Segmentation

Our in-depth analysis of the global diesel generator market includes the following segments power rating, source, and application.

- Based on the power rating, the market is segmented into up to 50 kW, 51 - 280 KW, 281-500 kW, 501 - 2,000 KW, and above 2,000 KW.

- Based on the source, the market is segmented into standby power, peak shaving, and prime & continuous power.

- Based on the application, the market is segmented into industrial, commercial, and residential.

Standby Power is Projected to Hold as the Largest Market Share

Based on the source, the global diesel generator market is segmented into standby power, peak shaving, and prime & continuous power. Standby powers, segment is expected to hold the largest share of the market. The primary factors supporting the growth include the adoption of standby generators owing to an array of benefits that are fundamental to their performance. They provide a steady power source that maintains the functionality of critical appliances and systems, such as security and medical equipment, even in the event of an outage. For instance, in March 2024, Mitsubishi Heavy Industries Engine & Turbocharger, Ltd. (MHIET) introduced the MGS-R Series, a new standby generator set, developed for large commercial facilities such as data centers. The new series supports the digital economy's growing needs primarily targeting data centers across Asian and Middle Eastern markets, the new series also serves as a reliable backup power solution for commercial facilities such as shopping malls and office buildings.

Commercial Sub-segment to Hold a Considerable Market Share

Based on application, the global diesel generator market is segmented into industrial, commercial, and residential. The commercial segment is expected to hold a considerable share of the market. The increasing adoption of diesel generators in broad fields of use across multiple industries, including telecom, agriculture, data centers, government facilities, educational institutions, healthcare, and hotels is contributing towards segmental growth. For instance, JCB CEA offers an extensive range of high-specification diesel generators to meet customer requirements for any power application globally. Each JCB generator is built to the highest specification to deliver reliability, high performance, and increased efficiency.

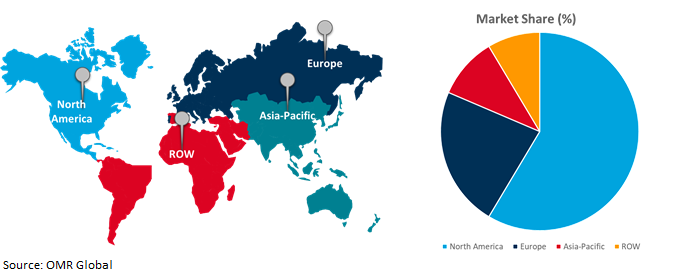

Regional Outlook

The global diesel generator market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Demand for Backup Power Sources Diesel Generators in Europe

- The regional growth is attributed to the increase in the number of manufacturing facilities and infrastructure projects and the growing usage of diesel generators drive the demand for continuous operations in areas vulnerable to frequent power outages.

- The growth of diesel generators in the region is driven by their increasing adoption in data centers, government buildings, educational institutions, healthcare facilities, hotels, telecom, agriculture, and other settings as a backup power source for sudden power interruptions like voltage fluctuations and electrical outages.

Global Diesel Generator Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent diesel generator companies such as Caterpillar Inc., Cummins Inc., and Generac Power Systems, Inc., Ingersoll Rand Inc. among others. The growth is mainly attributed to the increasing infrastructure activities, oil and gas exploration activities, and growth of the industrial sector. Market players offer a digital control panel, which provides all generator set controls and system indicators in a single, easy-to-access interface, as well as a Programmable Logic Controller (PLC) functionality that improves reliability and flexibility for accommodating changes in processes or application requirements. Additionally, it includes fully featured power metering, protective relaying, engine, and generator parameter viewing. For instance, in February 2023, Caterpillar Inc. introduced the Cat® XQ330 mobile diesel generator set, a new power solution for standby and prime power applications that meets the US EPA Tier 4 Final emission standards. The efficient Cat C9.3B diesel engine, the XQ330 is rated for up to 288 kW in standby and 264 kW in prime operation at 60 Hz, and up to 341 kVA in standby and 310 kVA in prime power applications at 50 Hz.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global diesel generator market include Caterpillar Inc., Cummins Inc., Mitsubishi Heavy Industries, Ltd., Wärtsilä Corp., and Yanmar Holdings Co., Ltd. among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in February 2024, Kanoo Power Solutions signed a strategic collaboration with VISA SpA for innovative diesel generators. As per the agreement, VISA SpA provides customized solutions, supported by a dedicated team of engineers specializing in tailoring efficient and bespoke answers to clients' specific needs.

Recent Development

- In November 2023, Yanmar Group Company HIMOINSA opened its newest factory in Europe, signaling a strategic move in its growth plan. The 5,000 m2 facility will produce lighting towers and battery energy storage and distribution systems (BESS). The company is committed to offering sustainable solutions alongside its range of traditional gas and diesel power generation systems.

- In March 2023, Kohler introduced three new KD series industrial generators. Kohler expands its industry-KD Series™ line of industrial generators with two new models, KD700 and KD750 for 60hz markets. These generators feature a new KOHLER 18L advanced diesel generator (KD18L06) that can also run on Hydrotreated Vegetable Oil (HVO) as a renewable fuel source.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global diesel generator market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Caterpillar

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Cummins Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Mitsubishi Heavy Industries, Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Wärtsilä Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Yanmar Holdings Co., Ltd.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Diesel Generator Market by Power Rating

4.1.1. Up to 50 kW

4.1.2. 51 - 280 KW

4.1.3. 281-500 kW

4.1.4. 501 - 2,000 kw

4.1.5. Above 2,000 KW

4.2. Global Diesel Generator Market by Source

4.2.1. Standby Power

4.2.2. Peak Shaving

4.2.3. Prime & Continuous Power

4.3. Global Diesel Generator Market by Application

4.3.1. Industrial

4.3.2. Commercial

4.3.3. Residential

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. The Middle East & Africa

6. Company Profiles

6.1. AB Volvo

6.2. Atlas Copco

6.3. Briggs & Stratton, LLC

6.4. CFC Holdings Pty Ltd (JCB CEA)

6.5. DEUTZ AG

6.6. FG Wilson

6.7. Generac Power Systems, Inc.

6.8. GENERAL POWER LIMITED, INC.

6.9. GENESAL ENERGY

6.10. HIMOINSA SL

6.11. Ingersoll Rand Inc.

6.12. Isuzu North America Corp.

6.13. John Deere Group

6.14. Kirloskar Oil Engines Ltd.

6.15. Kohler Co.

6.16. Mahindra & Mahindra Ltd.

6.17. Motorenfabrik Hatz GmbH & Co. KG

6.18. Perkins Engines Company Ltd.

6.19. Rolls-Royce plc

6.20. Teksan Generator Power Industries and Trade Co. Inc.

1. GLOBAL DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY POWER RATING, 2023-2031 ($ MILLION)

2. GLOBAL UP TO 50 KW DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL 51 - 280 KW DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL 281-500 KW DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL 501 - 2,000 KW DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL ABOVE 2,000 KW DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

8. GLOBAL STANDBY POWER DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL PEAK SHAVING DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL PRIME & CONTINUOUS POWER DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

12. GLOBAL DIESEL GENERATOR FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL DIESEL GENERATOR FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL DIESEL GENERATOR FOR RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. NORTH AMERICAN DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. NORTH AMERICAN DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY POWER RATING, 2023-2031 ($ MILLION)

18. NORTH AMERICAN DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

19. NORTH AMERICAN DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

20. EUROPEAN DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. EUROPEAN DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY POWER RATING, 2023-2031 ($ MILLION)

22. EUROPEAN DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

23. EUROPEAN DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY POWER RATING, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

29. REST OF THE WORLD DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY POWER RATING, 2023-2031 ($ MILLION)

30. REST OF THE WORLD DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY SOURCE, 2023-2031 ($ MILLION)

31. REST OF THE WORLD DIESEL GENERATOR MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL DIESEL GENERATOR MARKET SHARE BY POWER RATING, 2023 VS 2031 (%)

2. GLOBAL UP TO 50 KW DIESEL GENERATOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL 51 - 280 KW DIESEL GENERATOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL 281-500 KW DIESEL GENERATOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL 501 - 2,000 KW DIESEL GENERATOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL ABOVE 2,000 KW DIESEL GENERATOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL DIESEL GENERATOR MARKET SHARE BY SOURCE, 2023 VS 2031 (%)

8. GLOBAL STANDBY POWER DIESEL GENERATOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL PEAK SHAVING DIESEL GENERATOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL PRIME & CONTINUOUS POWER DIESEL GENERATOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL DIESEL GENERATOR MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

12. GLOBAL DIESEL GENERATOR FOR INDUSTRIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL DIESEL GENERATOR FOR COMMERCIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL DIESEL GENERATOR FOR RESIDENTIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL DIESEL GENERATOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. US DIESEL GENERATOR MARKET SIZE, 2023-2031 ($ MILLION)

17. CANADA DIESEL GENERATOR MARKET SIZE, 2023-2031 ($ MILLION)

18. UK DIESEL GENERATOR MARKET SIZE, 2023-2031 ($ MILLION)

19. FRANCE DIESEL GENERATOR MARKET SIZE, 2023-2031 ($ MILLION)

20. GERMANY DIESEL GENERATOR MARKET SIZE, 2023-2031 ($ MILLION)

21. ITALY DIESEL GENERATOR MARKET SIZE, 2023-2031 ($ MILLION)

22. SPAIN DIESEL GENERATOR MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF EUROPE DIESEL GENERATOR MARKET SIZE, 2023-2031 ($ MILLION)

24. INDIA DIESEL GENERATOR MARKET SIZE, 2023-2031 ($ MILLION)

25. CHINA DIESEL GENERATOR MARKET SIZE, 2023-2031 ($ MILLION)

26. JAPAN DIESEL GENERATOR MARKET SIZE, 2023-2031 ($ MILLION)

27. SOUTH KOREA DIESEL GENERATOR MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF ASIA-PACIFIC DIESEL GENERATOR MARKET SIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICA DIESEL GENERATOR MARKET SIZE, 2023-2031 ($ MILLION)

30. MIDDLE EAST AND AFRICA DIESEL GENERATOR MARKET SIZE, 2023-2031 ($ MILLION)