Dietary Supplement Contract Manufacturing Market

Dietary Supplement Contract Manufacturing Market Size, Share & Trends Analysis Report by Product Type (Proteins and Amino Acid Supplements, Multivitamin, Multi-Mineral, and Antioxidant Supplements, Weight Management and Meal Replacer Supplements, Other Supplements), by Dosage Form(Tablets, Capsules, Liquid Oral, Powder In Sachet / Jar, Gummies), Forecast Period (2024-2031)

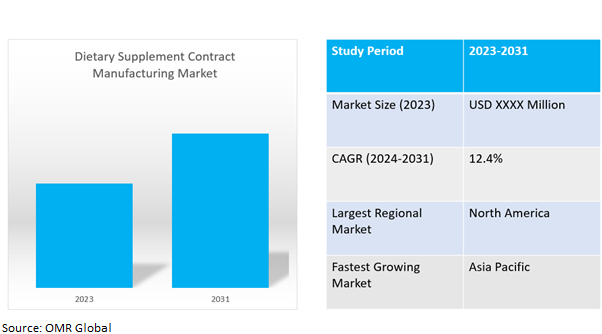

Dietary supplement contract manufacturing market is anticipated to grow at a significant CAGR of 12.4% during the forecast period (2024-2031). Dietary Supplement Contract Manufacturing (DSCM) is a business model in the dietary supplement industry, involving a partnership between a brand and a contract manufacturer. The brand develops, markets, and sells the supplement, while the contract manufacturer handles manufacturing, packaging, and labeling. The market growth is driven by convergence of technology, genomics, and nutrition enables a more personalized approach to dietary plans.

Market Dynamics

Surging Demand for Dietary Supplements

Consumers are increasingly health conscious and turning to dietary supplements to bridge nutritional gaps, manage chronic conditions, and boost overall well-being. This rising demand for supplements translates into a need for increased production capacity, which contract manufacturers fulfill. For instance, in April 2024 the global carotenoids market is growing due to increased consumer awareness, demand for natural food colorants, and expanding applications across industries.

A Focus on Innovation

Globally, contract manufacturers play a crucial role in innovation within the dietary supplement industry. They invest in R&D to create new formulations, delivery systems, and packaging solutions that meet evolving consumer preferences. For instance, in March 2024 CAPTEK Softgel International, a leading contract manufacturer of dietary supplements, opened a new 60,000 square foot facility in La Mirada, California. The facility offers turnkey gummy formulations, custom flavorings, and bottling solutions. It can produce 1.5 billion gummies annually in various shapes, including gummy bears, gumdrops, and cubes. The company is also working to obtain Organic, Kosher, and Halal certifications.

Market Segmentation

Our in-depth analysis of the global Dietary Supplement Contract Manufacturing market includes the following segments by type, product, and technology:

- Based on product type, the market is segmented into proteins and amino acid supplements, multivitamin, multi-mineral, and antioxidant supplements, weight management and meal replacer supplements, other supplements (bone & joint health supplements, beauty, digestive health)

- Based on the dosage form, the market is segmented into tablets, capsules, liquid oral, powder in sachet/jar, and gummies.

Tablets are Projected to Emerge as the Largest Segment

The tablet segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth is their versatility and formulation freedom. They can contain a wide range of ingredients, making them suitable for various supplement brands. Tablets also offer stability and extended shelf life, ensuring potency and efficacy.

Gummies Segment to Hold a Considerable Market Share

Gummies are gaining traction due to improved palatability, innovation in formulation, and a growing focus on functional gummy products. These factors are expected to lead to gummies capturing a significant market share alongside tablets, potentially causing tablets to lose their dominance. For instance, Power Gummies has partnered with DSG Consumer Partners to launch more dietary supplements, aiming to empower parents to prioritize their children's health and wellness. The plant has a manufacturing capability of 10,000 bottles per day and is launching Power Gummies Junior, a new product designed for kids

Additionally, in November 2023 Setu Nutrition partnered with MyMuse to launch Desire: Boost Gummies, a sexual wellness supplement, to address the issue of reduced desire and libido among customers.

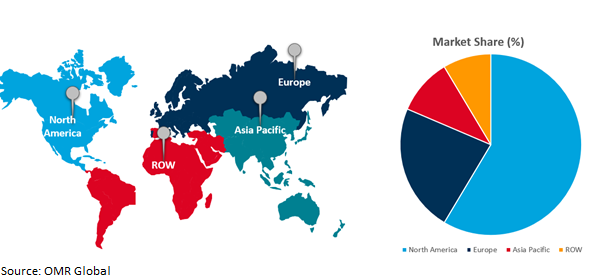

Regional Outlook

The global dietary supplement contract manufacturing market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Dietary Supplement Contract Manufacturing Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant market share owing to the presence of rising demand for the dietary supplement contract manufacturing. This is attributed to its established industry, high demand, and well-defined regulatory landscape. The adult segment, sports enthusiasts, and athletes are the primary end users, relying on supplements for a healthy lifestyle. The growing trend of personalized nutrition is expected to attract a wider range of users, as supplements tailored to individual needs.

Market Players Outlook

The major companies serving the global dietary supplement contract manufacturing market include Catalent, Inc., Trividia Manufacturing Solutions, Inc., Biotrex Nutraceuticals, and Martinez Nieto. , Menadiona, NutraScience Labs, Nutrivo LLC, and Biovencer Healthcare Pvt Ltd, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Dietary Supplement Contract Manufacturing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Ashland Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Glanbia plc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Lonza Group Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Dietary Supplement Contract Manufacturing Market by Type

4.1.1. Proteins and Amino Acid Supplements

4.1.2. Multivitamin, Multi-Mineral, and Antioxidant Supplements

4.1.3. Weight Management and Meal Replacer Supplements

4.1.4. Other Supplements (Bone & Joint Health Supplements, Beauty, Digestive Health)

4.2. Global Dietary Supplement Contract Manufacturing Market by Dosage Form

4.2.1. Tablets

4.2.2. Capsules

4.2.3. Liquid Oral

4.2.4. Powder In Sachet / Jar

4.2.5. Gummies

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Biovencer Healthcare Pvt Ltd

6.2. Biotrex Nutraceuticals

6.3. CAPTEK Softgel International Inc.

6.4. CAPTEK Softgel International Inc.

6.5. Catalent, Inc

6.6. DCC plc

6.7. Liquid Capsule

6.8. Martinez Nieto.

6.9. Menadiona

6.10. NutraScience Labs

6.11. Nutrivo LLC,

6.12. Rain Nutrience

6.13. Vantage Nutrition

1. GLOBAL DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

2. GLOBAL PROTEINS AND AMINO ACID SUPPLEMENTS DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL MULTIVITAMIN, MULTI-MINERAL, AND ANTIOXIDANT SUPPLEMENTS DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL WEIGHT MANAGEMENT AND MEAL REPLACER SUPPLEMENTS DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY DOSAGE FORM, 2023-2031 ($ MILLION)

5. GLOBAL OTHER SUPPLEMENTS DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

6. GLOBAL DIETARY SUPPLEMENT CONTRACT MANUFACTURING FOR TABLETS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL DIETARY SUPPLEMENT CONTRACT MANUFACTURING FOR CAPSULES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL DIETARY SUPPLEMENT CONTRACT MANUFACTURING FOR LIQUID ORAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL DIETARY SUPPLEMENT CONTRACT MANUFACTURING FOR POWDER IN SACHET / JAR ORAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL DIETARY SUPPLEMENT CONTRACT MANUFACTURING FOR GUMMIES ORAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY DOSAGE FORM, 2023-2031 ($ MILLION)

15. EUROPEAN DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

17. EUROPEAN DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY DOSAGE FORM, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY DOSAGE FORM, 2023-2031 ($ MILLION)

21. REST OF THE WORLD DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. REST OF THE WORLD DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

23. REST OF THE WORLD DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY DOSAGE FORM, 2023-2031 ($ MILLION)

1. GLOBAL DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SHARE BY TYPE, 2023 VS 2031 (%)

2. GLOBAL PROTEINS AND AMINO ACID SUPPLEMENTS DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL MULTIVITAMIN, MULTI-MINERAL, AND ANTIOXIDANT SUPPLEMENTS DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL WEIGHT MANAGEMENT AND MEAL REPLACER SUPPLEMENTS DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL WEIGHT MANAGEMENT AND MEAL REPLACER SUPPLEMENTS DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL OTHER SUPPLEMENTS DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SHARE BY DOSAGE FORM, 2023 VS 2031 (%)

8. GLOBAL DIETARY SUPPLEMENT CONTRACT MANUFACTURING FOR TABLETS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL DIETARY SUPPLEMENT CONTRACT MANUFACTURING FOR CAPSULES MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL DIETARY SUPPLEMENT CONTRACT MANUFACTURING FOR LIQUID ORAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL DIETARY SUPPLEMENT CONTRACT MANUFACTURING FOR POWDER IN SACHETS/JAR MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL DIETARY SUPPLEMENT CONTRACT MANUFACTURING FOR GUMMIES MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

16. UK DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICA DIETARY SUPPLEMENT CONTRACT MANUFACTURING MARKET SIZE, 2023-2031 ($ MILLION)