Digital Agriculture Market

Digital Agriculture Market Size, Share & Trends Analysis Report by Component (Hardware and Software & Services), by Deployment (Cloud and On-Premise), and by Application (Yield Monitoring, Field Mapping, Livestock Monitoring, Real-Time Safety Testing, Soil Monitoring, Precision Farming, and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Digital agriculture market is anticipated to grow at a CAGR of 9.6% during the forecast period. Precision farming is an approach to farm management that uses information technology (IT) to ensure that crops and soil receive exactly what they require for optimum health and productivity. The growing adoption of precision farming is pushing market players to offer new solutions and services to their customers which are expected to boost the market growth during the forecast period. For instance, in March 2022, Agribazaar launched a remote sensing crop model to aid in precision farming naturally. Currently, the services are being offered to over three lakh farmers registered with Agribazaar. Further, the Government of India has chosen Agribazaar as one of the partners alongside Microsoft India for its India agri-stack program, which will widely use this technology. The benefits associated with precision farming such as ensuring profitability, sustainability, and protection of the environment are further contributing to the growth of the market.

Segmental Outlook

The global digital agriculture market is segmented based on the component, deployment, and application. Based on the component, the market is segmented into hardware and software & services. Based on the deployment, the market is sub-segmented into the cloud and on-premise. Based on the application, the market is augmented into yield monitoring, livestock monitoring, real-time safety testing, soil monitoring, precision farming, and others including drone analytics and inventory management. The above-mentioned segments can be customized as per the requirements. The cloud-based segment is expected to hold a considerable market share due to the growing adoption of cloud computing across the globe. The factors such as ease of adoption, minimal requirement infrastructure, and easy installation are expected to accelerate the digital agriculture market.

Among the component segment, the hardware segment is expected to hold a considerable share in the market during the forecast period. The market players are continuously implementing new methods to bring innovative products and services to their customers. The market players are launching agricultural robots to increase efficiency and productivity. For instance, in February 2022, Verdant Robotics launched its multi-action autonomous farm robot for specialty crops which enables “superhuman farming”. The farm robot meets farmers' demand for more sustainable and profitable growing practices. The company expanded its robot-as-a-service (RaaS) model to ensure access for more specialty crop farmers. Thus, the efforts by market players to launch innovative products are driving the growth of the market during the forecast period.

Regional Outlooks

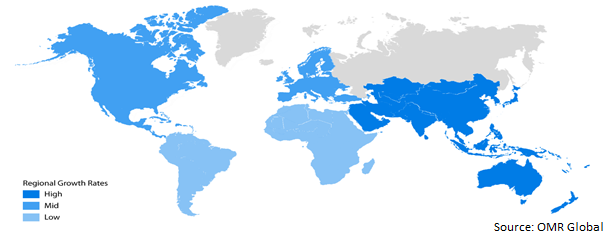

The global digital agriculture market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, North America is expected to hold a remarkable market share in the digital agriculture market during the forecast period due to the presence of well-developed technological infrastructure.

Global Digital Agriculture Market Growth, by Region 2022-2028

The Asia-Pacific Region is Expected to be a Fastest-Growing Region in the Global Digital Agriculture Market

Among all regions, the Asia-Pacific region is expected to be the fastest growing region in the market over the forecast period due to the growing initiatives by the government for digitalization in the region. For instance, In September 2021, Union Minister Narendra Singh Tomar announced the initiation of the ‘Digital Agriculture Mission 2021–2025’. The initiative will focus to leverage a wide range of technologies from AI, and blockchain along with drone technology to improve the overall performance of the agriculture sector. Thus, to improve the technological infrastructure, the government is taking initiatives to improve the overall industry’s performance which is contributing to the market growth.

Market Players Outlook

The major companies serving the global digital agriculture market include AGCO Corp., BASF SE, Bayer AG, Farmers Edge Inc., IBM Corp., Microsoft Corp., SAP SE, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in July 2022, Syngenta started focusing on digital agriculture in a big way in India. With India figuring among the top five of its priority countries, Syngenta planned to bring its latest seed and crop protection technology to India with a special focus on digital agriculture. The Switzerland-based firm, which operates in over 100 countries across the globe, is in particular keen on digitalizing a farmer-centric ecosystem. Moreover, when the company launches a product globally, it is done in India simultaneously.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global digital agriculture market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Digital Agriculture Market by Component

4.1.1. Hardware

4.1.2. Software & Services

4.2. Global Digital Agriculture Market by Deployment

4.2.1. Cloud

4.2.2. On-Premise

4.3. Global Digital Agriculture Market by Application

4.3.1. Yield Monitoring

4.3.2. Field Mapping

4.3.3. Livestock Monitoring

4.3.4. Real-Time Safety Testing

4.3.5. Soil Monitoring

4.3.6. Precision Farming

4.3.7. Others (Drone Analytics, Inventory Management)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AGCO Corp.

6.2. Agriwebb Pty Ltd.

6.3. BASF SE

6.4. Bayer AG

6.5. CNH Industrial America LLC

6.6. Deere & Co.

6.7. DTN, LLC

6.8. Farmers Edge Inc.

6.9. Gameya SA

6.10. Hummingbird Technologies Ltd.

6.11. IBM Corp.

6.12. Microsoft Corp.

6.13. Raven Industries, Inc.

6.14. SAP SE

6.15. Small Robot Co.

6.16. Trimble Inc.

6.17. Yare International ASA

1. GLOBAL DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2028 ($ MILLION)

2. GLOBAL DIGITAL AGRICULTURE BY HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL DIGITAL AGRICULTURE BY SOFTWARE AND SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2021-2028 ($ MILLION)

5. GLOBAL CLOUD-BASED DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL ON-PREMISE DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

8. GLOBAL DIGITAL AGRICULTURE FOR YIELD MONITORING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL DIGITAL AGRICULTURE FOR FIELD MAPPING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL DIGITAL AGRICULTURE FOR LIVESTOCK MONITORING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL DIGITAL AGRICULTURE FOR REAL-TIME SAFETY TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL DIGITAL AGRICULTURE FOR SOIL MONITORING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL DIGITAL AGRICULTURE FOR PRECISION FARMING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL DIGITAL AGRICULTURE FOR OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

16. NORTH AMERICAN DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. NORTH AMERICAN DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2028 ($ MILLION)

18. NORTH AMERICAN DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2021-2028 ($ MILLION)

19. NORTH AMERICAN DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

20. EUROPEAN DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. EUROPEAN DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2028 ($ MILLION)

22. EUROPEAN DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2021-2028 ($ MILLION)

23. EUROPEAN DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

28. REST OF THE WORLD DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

29. REST OF THE WORLD DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2021-2028 ($ MILLION)

30. REST OF THE WORLD DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2021-2028 ($ MILLION)

31. REST OF THE WORLD DIGITAL AGRICULTURE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. GLOBAL DIGITAL AGRICULTURE MARKET SHARE BY COMPONENT, 2021 VS 2028 (%)

2. GLOBAL DIGITAL AGRICULTURE BY HARDWARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL DIGITAL AGRICULTURE BY SOLUTION AND SERVICES MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL DIGITAL AGRICULTURE MARKET SHARE BY DEPLOYMENT, 2021 VS 2028 (%)

5. GLOBAL CLOUD-BASED DIGITAL AGRICULTURE MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL ON-PREMISE DIGITAL AGRICULTURE MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL DIGITAL AGRICULTURE MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

8. GLOBAL DIGITAL AGRICULTURE FOR YIELD MONITORING MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL DIGITAL AGRICULTURE FOR FIELD MAPPING MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL DIGITAL AGRICULTURE FOR LIVESTOCK MONITORING MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL DIGITAL AGRICULTURE FOR REAL-TIME SAFETY TESTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

12. GLOBAL DIGITAL AGRICULTURE FOR SOIL MONITORING MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL DIGITAL AGRICULTURE FOR PRECISION FARMING MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL DIGITAL AGRICULTURE FOR OTHER MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. GLOBAL DIGITAL AGRICULTURE MARKET SHARE BY REGION, 2021 VS 2028 (%)

16. US DIGITAL AGRICULTURE MARKET SIZE, 2021-2028 ($ MILLION)

17. CANADA DIGITAL AGRICULTURE MARKET SIZE, 2021-2028 ($ MILLION)

18. UK DIGITAL AGRICULTURE MARKET SIZE, 2021-2028 ($ MILLION)

19. FRANCE DIGITAL AGRICULTURE MARKET SIZE, 2021-2028 ($ MILLION)

20. GERMANY DIGITAL AGRICULTURE MARKET SIZE, 2021-2028 ($ MILLION)

21. ITALY DIGITAL AGRICULTURE MARKET SIZE, 2021-2028 ($ MILLION)

22. SPAIN DIGITAL AGRICULTURE MARKET SIZE, 2021-2028 ($ MILLION)

23. REST OF EUROPE DIGITAL AGRICULTURE MARKET SIZE, 2021-2028 ($ MILLION)

24. INDIA DIGITAL AGRICULTURE MARKET SIZE, 2021-2028 ($ MILLION)

25. CHINA DIGITAL AGRICULTURE MARKET SIZE, 2021-2028 ($ MILLION)

26. JAPAN DIGITAL AGRICULTURE MARKET SIZE, 2021-2028 ($ MILLION)

27. SOUTH KOREA DIGITAL AGRICULTURE MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF ASIA-PACIFIC DIGITAL AGRICULTURE MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD DIGITAL AGRICULTURE MARKET SIZE, 2021-2028 ($ MILLION)