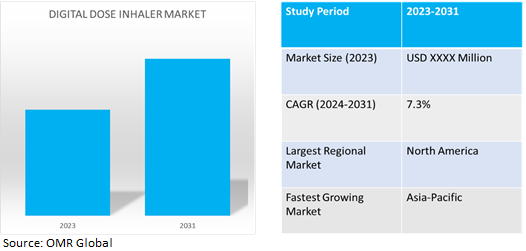

Digital Dose Inhaler Market

Digital Dose Inhaler Market Size, Share & Trends Analysis Report by Product (Dry Powder Inhalers, and Metered Dose Inhalers), by Application (Chronic Obstructive Pulmonary Disease, Asthma, and Others). by Type (Branded, and Generic). and by End Users (Hospitals, Homecare Settings, and Others). Forecast Period (2024-2031).

Digital dose inhaler market is anticipated to grow at a CAGR of 7.3% during the forecast period (2024-2031). Digital health technology has led to the development of digital dose inhalers, that offer features such as dose tracking and mobile app connectivity, improving medication adherence and patient outcomes. The increasing prevalence of respiratory diseases, patient-centric care, and government initiatives are driving investment in digital health technologies. Telemedicine and remote monitoring systems enable healthcare providers to monitor patients' inhaler usage, allowing for timely intervention and personalized treatment. The aging population additionally benefits from digital dose inhalers, offering convenient treatment options for older adults. The digital dose inhaler market is expanding owing to strategic partnerships and investment in research and development.

Market Dynamics

Increasing Prevalence Of And Morality Of Chronic Respiratory Diseases (CRDs)

The study highlights the increasing prevalence and mortality of CRDs, emphasizing the need for innovative solutions and advanced treatment modalities. According to the Institute for Health Metrics, in April 2023, the evaluation chronic respiratory disease (CRD) emerged as the third leading cause of mortality globally, resulting in approximately 4 million mortality globally in 2019. The study also revealed that chronic obstructive pulmonary disease (COPD) accounted for nearly 80.0% of CRD-related deaths. Furthermore, while the total mortality and prevalence of CRDs increased by 28.5% and 39.8% respectively, age-standardized rates experienced a decline of 41.7% and 16.9%, indicating an overall improvement in the management of these conditions.

Prevalence Of Chronic Respiratory Diseases

The demand for inhalation therapies, such as digital dosage inhalers, to manage symptoms and enhance quality of life, is rising as aging raises the risk of chronic respiratory diseases such as pneumonia, COPD, and asthma. According to the World Health Organization, in October 2022, the global population is projected to experience a significant shift in age demographics by 2030, with approximately 1 in 6 individuals being 60 years or older. Furthermore, the number of people in this age group is expected to increase from 1 billion in 2020 to 1.4 billion. Looking ahead to 2050, the population of individuals aged 60 years and older is set to double, reaching 2.1 billion, while the number of individuals aged 80 years or older is projected to triple, reaching 426.0 million.

Market Segmentation

Our in-depth analysis of the global digital dose inhaler Market includes the following segments by product, application, type, and end-user:

- Based on product, the market is sub-segmented into dry powder inhalers, and metered dose inhalers.

- based on application, the market is sub-segmented into chronic obstructive pulmonary disease, asthma, and others (pulmonary hypertension, and respiratory infections).

- Based on type, the market is bifurcated into branded, and generic.

- Based on end-users, the market is sub-segmented into hospitals, homecare settings, and others (research and clinical trials).

Dry Powder Inhalers is Projected to Emerge as the Largest Segment

Based on the business model, the global digital dose inhaler market is sub-segmented into dry powder inhalers, and metered dose inhalers. Among these, the dry powder inhalers sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes According to the National Center for Biotechnology Information, in September 2021, there has been a significant increase in publications on dry powder inhalers (DPIs) over the past decade, indicating a consistent growth in interest in inhaled medicines. Furthermore, the pulmonary administration route is projected to experience similar growth owing to a rise in respiratory disease incidence and the demand for more effective combination therapies. In terms of market leadership, the US is expected to reach a market value of $33,572.9 million by 2023.

Asthma Sub-segment to Hold a Considerable Market Share

The burden and prevalence of asthma across the globe indicate the need for efficient management techniques, and digital dosage inhalers offer innovative drug delivery technologies for improved symptom control. According to the World Health Organization, in May 2023, it is estimated that 262.0 million individuals globally were affected by asthma, a significant noncommunicable disease. Tragically, asthma also accounted for 455,000 mortality. However, with the help of inhaled medications, individuals with asthma can effectively manage their symptoms and live a fulfilling and active life.

Regional Outlook

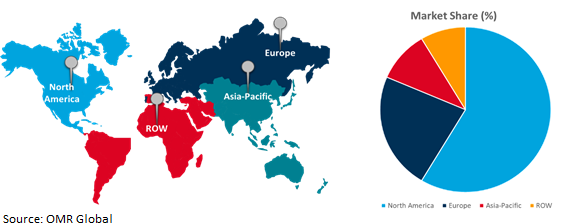

The global digital dose inhaler market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Rising Prevalence of Asthma In the Asia-Pacific Region

The high prevalence of asthma in India demands the use of efficient treatment alternatives. Digital dosage inhalers provide a sophisticated method of delivering medication to patients, improving asthma control, symptom relief, and quality of life. According to the Global Asthma Network, in May 2023, the prevalence of asthma in India is significant, with an estimated 35.0 million people affected. The study highlights the importance of addressing challenges such as underdiagnosis and inadequate treatment to effectively combat asthma in the country. Additionally, children in India are significantly impacted by asthma.

Global Digital Dose Inhaler Market Growth by Region 2024-2031

North America Holds Major Market Share

The rising prevalence of respiratory diseases, such as COPD, asthma, and cystic fibrosis, is driving the demand for advanced inhaler technologies. According to Chest.org, in November 2023, the medical costs associated with COPD in the US are distributed among different payer types. In 2019, private insurance bore the highest costs at $11.4 billion, followed by Medicare at $10.8 billion, and Medicaid at $3.0 billion. It is projected that by 2029, the national medical costs attributed to COPD will reach $60.5 billion.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global digital dose inhaler market include AstraZeneca plc, GlaxoSmithKline plc, Novartis AG, Koninklijke Philips N.V., and Merck & Co., Inc., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in January 2020, Aptar Pharma and Lupin Ltd. partnered to launch India's first connected device for metered-dose inhalers, ADHERO. This bluetooth-enabled smart device helps patients with chronic respiratory diseases track their MDI usage and improve adherence to therapy. Patients can access the data through the "MyAdhero" app, which sends reminders, provides health alerts, and allows physicians access.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global digital dose inhaler market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. AstraZeneca plc

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. GlaxoSmithKline plc

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Novartis AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Digital Dose Inhaler Market by Product

4.1.1. Dry Powder Inhalers (DPI)

4.1.2. Metered Dose Inhalers (MDI)

4.2. Global Digital Dose Inhaler Market by Application

4.2.1. Chronic Obstructive Pulmonary Disease (COPD)

4.2.2. Asthma

4.2.3. Others (Pulmonary Hypertension, and Respiratory infections)

4.3. Global Digital Dose Inhaler Market by Type

4.3.1. Branded

4.3.2. Generic

4.4. Global Digital Dose Inhaler Market by End-user

4.4.1. Hospitals

4.4.2. Homecare Settings

4.4.3. Others (Research and Clinical Trials)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. 3M

6.2. Amiko Digital Health Ltd.

6.3. APTARGROUP, INC.

6.4. Beximco Pharmaceuticals Ltd.

6.5. BreatheSuite Inc.

6.6. Glenmark Pharmaceuticals Ltd.

6.7. Insulet Corp.

6.8. Koninklijke Philips N.V.

6.9. Merck & Co., Inc.

6.10. Mundipharma International

6.11. OPKO Health, Inc.

6.12. PitchBook Data, Inc.

6.13. Presspart Verwaltungs-GmbH

6.14. Propeller Health

6.15. Sensirion AG

6.16. Teva Pharmaceutical Industries Ltd.

6.17. Trudell Medical International.

1. GLOBAL DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL DRY POWDER INHALERS DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL METERED DOSE INHALERS DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

5. GLOBAL DIGITAL DOSE INHALER IN CHRONIC OBSTRUCTIVE PULMONARY DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL DIGITAL DOSE INHALER IN ASTHMA MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL DIGITAL DOSE INHALER IN OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

9. GLOBAL BRANDED DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL GENERIC DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

12. GLOBAL DIGITAL DOSE INHALER FOR HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL DIGITAL DOSE INHALER FOR HOMECARE SETTINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL DIGITAL DOSE INHALER FOR OTHER END-USER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. NORTH AMERICAN DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. NORTH AMERICAN DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

18. NORTH AMERICAN DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

19. NORTH AMERICAN DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

20. NORTH AMERICAN DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

21. EUROPEAN DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. EUROPEAN DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY PRODUCT , 2023-2031 ($ MILLION)

23. EUROPEAN DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

24. EUROPEAN DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

25. EUROPEAN DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

29. ASIA-PACIFIC DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

30. ASIA-PACIFIC DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

31. REST OF THE WORLD DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

32. REST OF THE WORLD DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

33. REST OF THE WORLD DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

34. REST OF THE WORLD DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY TYPE, 2023-2031 ($ MILLION)

35. REST OF THE WORLD DIGITAL DOSE INHALER MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL DIGITAL DOSE INHALER MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL DRY POWDER DIGITAL DOSE INHALER MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL METERED DOSE DIGITAL DOSE INHALER MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL DIGITAL DOSE INHALER MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

5. GLOBAL DIGITAL DOSE INHALER IN CHRONIC OBSTRUCTIVE PULMONARY DISEASE MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL DIGITAL DOSE INHALER IN ASTHMA MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL DIGITAL DOSE INHALER IN OTHER APPLICATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL DIGITAL DOSE INHALER MARKET SHARE BY TYPE, 2023 VS 2031 (%)

9. GLOBAL BRANDED DIGITAL DOSE INHALER MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL GENERIC DIGITAL DOSE INHALER MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL DIGITAL DOSE INHALER MARKET SHARE BY END-USER, 2023 VS 2031 (%)

12. GLOBAL DIGITAL DOSE INHALER FOR HOSPITALS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL DIGITAL DOSE INHALER FOR HOMECARE SETTINGS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL DIGITAL DOSE INHALER FOR OTHER END-USER MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL DIGITAL DOSE INHALER MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. US DIGITAL DOSE INHALER MARKET SIZE, 2023-2031 ($ MILLION)

17. CANADA DIGITAL DOSE INHALER MARKET SIZE, 2023-2031 ($ MILLION)

18. UK DIGITAL DOSE INHALER MARKET SIZE, 2023-2031 ($ MILLION)

19. FRANCE DIGITAL DOSE INHALER MARKET SIZE, 2023-2031 ($ MILLION)

20. GERMANY DIGITAL DOSE INHALER MARKET SIZE, 2023-2031 ($ MILLION)

21. ITALY DIGITAL DOSE INHALER MARKET SIZE, 2023-2031 ($ MILLION)

22. SPAIN DIGITAL DOSE INHALER MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF EUROPE DIGITAL DOSE INHALER MARKET SIZE, 2023-2031 ($ MILLION)

24. INDIA DIGITAL DOSE INHALER MARKET SIZE, 2023-2031 ($ MILLION)

25. CHINA DIGITAL DOSE INHALER MARKET SIZE, 2023-2031 ($ MILLION)

26. JAPAN DIGITAL DOSE INHALER MARKET SIZE, 2023-2031 ($ MILLION)

27. SOUTH KOREA DIGITAL DOSE INHALER MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF ASIA-PACIFIC DIGITAL DOSE INHALER MARKET SIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICA DIGITAL DOSE INHALER MARKET SIZE, 2023-2031 ($ MILLION)

30. MIDDLE EAST AND AFRICA DIGITAL DOSE INHALER MARKET SIZE, 2023-2031 ($ MILLION)