Digital Oilfield Market

Digital Oilfield Market Size, Share & Trends Analysis Report by Process (Production Optimization, Drilling Optimization, Reservoir Optimization, Safety Management, and Asset Management).by Solution (Hardware Solutions, Software & Service Solutions, and Data Storage Solutions).and by Application (Onshore and Offshore).Forecast Period (2024-2031).

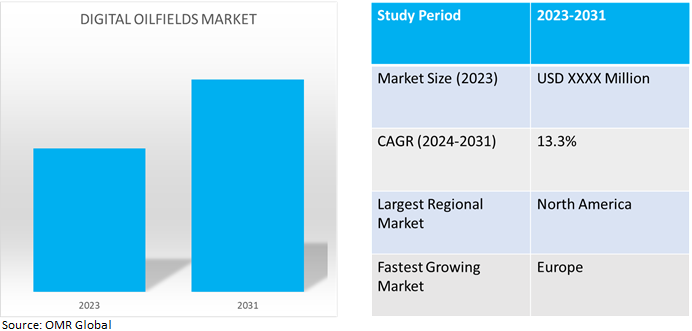

Digital oilfield market is anticipated to grow at a significant CAGR of 13.3% during the forecast period (2024-2031).The growth of the digital oilfield market is attributed to the increasing adoption of real-time data from oilfield operations, digital collaboration, and integration of IoT globally. By integrating modern digital technology with innovative workflows, the digital oilfield can avoid unplanned equipment and well shutdowns while increasing production and cutting operating expenses.

Market Dynamics

Data Analytics and AI

Traditional oilfields have transformed into digital oilfields owing to the rapid development of digital technologies including cloud computing, IoT, Big Data analytics, AI, and machine learning (ML). It is now simpler to integrate automation and AI-driven functionality into digital oilfields thanks to advancements in big data, artificial intelligence (AI), and the Internet of Things (IoT).By using data that has been intelligently filtered, the digital oilfield facilitates decision-making and aids in the efficient use of both human and machine resources. Furthermore, the technology optimizes hydrocarbon production, protects the environment, enhances overall safety, and minimizes resource waste. Using processes from wellbores, surface facilities, and reservoirs, as well as predictive analysis, the digital oilfields software portion replicates the functioning of an oil and gas field.

Growing Adoption of Remote Monitoring and Control

The increasing utilization of digital oilfields for remote monitoring, drilling, smart well sites, pipelines, and transportation operations enhancement. Oil companies effectively handle an increasing number of commercial and technical challenges to improve reservoirs, production, drilling operations, safety assurance, asset management, and maintenance. By capturing more data more frequently from every point of the oil and gas value chain and analyzing it almost instantly, digital technologies for remote monitoring and control of oil fields enable businesses to optimize the operation of their reservoirs, wells, and facilities. The extremely dependable data feeds, improved operating efficiency, asset visibility, safety, and environmental protection.

Market Segmentation

Our in-depth analysis of the global digital oilfield market includes the following segments byprocess, solution, and application.

- Based on process, the market is sub-segmented into production optimization, drilling optimization, reservoir optimization, safety management, and asset management.

- Based on solutions, the market is sub-segmented into hardware solutions, software & service solutions, and data storage solutions.

- Based on application, the market is sub-segmented into onshore and offshore.

Production Optimization is Projected to Emerge as the Largest Segment

Based on the process, the global digital oilfield market is sub-segmented into production optimization, drilling optimization, reservoir optimization, safety management, and asset management. Among these production optimization sub-segment is expected to hold the largest share of the market. The primary factors supporting the segment's growth include monitoring and analysis of real-time data from a variety of operations, such as exploration, drilling, reservoir management, and production. In digital oilfields, production optimization also helps to boost hydrocarbon recovery rates and prolong asset life.For instance, Corva LLCoffers digital transformation for drilling with the release of hydraulic fracturing data analysis tools, enabling oil & gas producers to optimize frac performance, avoid hazards, and cut costs using big data and real-time monitoring.

Onshore Sub-segment to Hold a Considerable Market Share

Based on the application, the global digital oilfield market is sub-segmented into onshore and offshore. Among these, the onshore sub-segment is expected to hold a considerable share of the market. The increasing demand for digital oilfield onshore reservoir solution that provides vertical seismic profiling, hydraulic fracture profiling, and production flow monitoring from a single system. Onshore operations usually take place in situations that are more stable and predictable. Onshore locations are naturally stable, they provide a favorable climate that makes it easier to implement hardware and software solutions consistently. Consequently, this leads to a rise in the requirement for digital oilfield technologies inside onshore operations.

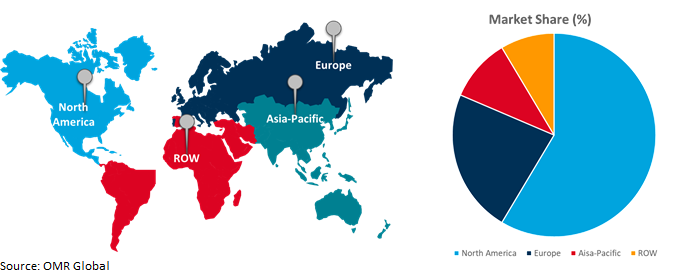

Regional Outlook

The global digital oilfield market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Digital Oilfield Adoption in Europe

- The regional growth is attributed to the increasing integration of modern technologies such as cloud services, automation, IoT, and analytics across businesses resulting in digital transformation for oil and gas organizations. According to the UK Offshore Energy Data and Digital Maturity Survey, in April 2024, Findings from 2023 data reveal progress in the pace and integration of digitalization with organizations recording an 8.0% improvement across key metrics relating to strategy, leadership, training, and capabilities. More than 30 oil, gas, and renewable operator companies contributed to the 2023 Offshore Energy Digital and Data Maturity Survey with input also provided by technology developers and supply chain companies supporting diverse offshore energies.

- For instance, in July 2023, According to the UK Offshore Energies Association Ltd., More than 30 oil, gas, and renewable operator companies contributed to the survey with input also provided by technology developers and supply chain companies supporting diverse offshore energies. Findings from 2023 data reveal progress in the pace and integration of digitalization with organizations recording an 8.0% improvement across key metrics relating to strategy, leadership, training, and capabilities.

Global Digital Oilfield Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent companies and digital oilfield providers such as Halliburton, Schlumberger, and Rockwell Automation Inc. The growth is attributed to the increasing integration of emerging technologies like cloud services, automation, IoT, and analytics across business functions driving the growth of digital oilfields in the region. Many energy companies develop technology groups to evaluate, trial, manage, and deploy digital technology solutions. Following a flurry of digital deployments, companies realized they had too many applications. According to the Energy Workforce & Technology Council, in August 2023, the pace of technology adoption is also stymied by widely utilized incumbent solutions built on aging technology infrastructure. Operating workflows and processes use decades-old tools that do not easily interface with modern, cloud-based digital solutions.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global digital oilfield market include Baker Hughes Company, General Electric Company, Microsoft Corp., SAP SE, and Siemens AG, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in October 2021,ABB Ltd. and Enovate Upstream collaborated to offer an onshore digital oilfield solution. Oilfield solutions provide real-time analysis to increase production and financial performance. Collaboration meets customer demand for enhanced digital automation.

Recent Development

- In August 2023, Halliburton and PTT Exploration and Production Public Company Ltd. (PTTEP) signed a memorandum of understanding (MoU) to co-innovate and market digital transformation solutions to build on Halliburton’s DecisionSpace® 365 suite of applications and are now extended for interested oil and gas operators in the selected countries.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global digital oilfield market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Baker Hughes Company

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. SAP SE

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Siemens AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Digital Oilfield Market by Process

4.1.1. Production Optimization

4.1.2. Drilling Optimization

4.1.3. Reservoir Optimization

4.1.4. Safety management

4.1.5. Asset management

4.2. Global Digital Oilfield Market by Solution

4.2.1. Hardware Solutions

4.2.2. Software & Service Solutions

4.2.3. Data Storage Solutions

4.3. Global Digital Oilfield Market by Application

4.3.1. Onshore

4.3.2. Offshore

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. ABB Ltd.

6.2. Accenture plc

6.3. ChampionX Corp.

6.4. Emerson Electric Co.

6.5. General Electric Company

6.6. Halliburton Energy Services, Inc.

6.7. Honeywell International Inc.

6.8. IBM Corp.

6.9. Infosys Ltd.

6.10. Intel Corp.

6.11. L&T Technology Services Ltd.

6.12. Microsoft Corp.

6.13. NOV Inc.

6.14. OleumTech

6.15. Perficient Inc,

6.16. Rockwell Automation Inc.

6.17. Schlumberger Ltd.

6.18. Weatherford International plc

1. GLOBAL DIGITAL OILFIELD MARKET RESEARCH AND ANALYSIS BY PROCESS, 2023-2031 ($ MILLION)

2. GLOBAL DIGITAL OILFIELD PRODUCTION OPTIMIZATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL DIGITAL OILFIELD DRILLING OPTIMIZATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL DIGITAL OILFIELD RESERVOIR OPTIMIZATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL DIGITAL OILFIELD SAFETY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL DIGITAL OILFIELD ASSET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL DIGITAL OILFIELD MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2023-2031 ($ MILLION)

8. GLOBAL DIGITAL OILFIELD HARDWARE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL DIGITAL OILFIELD SOFTWARE & SERVICE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL DIGITAL OILFIELD DATA STORAGE SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL DIGITAL OILFIELD MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

12. GLOBAL DIGITAL OILFIELD FOR ONSHORE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL DIGITAL OILFIELD FOR OFFSHORE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL DIGITAL OILFIELD MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN DIGITAL OILFIELD MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN DIGITAL OILFIELD MARKET RESEARCH AND ANALYSIS BY Process, 2023-2031 ($ MILLION)

17. NORTH AMERICAN DIGITAL OILFIELD MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2023-2031 ($ MILLION)

18. NORTH AMERICAN DIGITAL OILFIELD MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

19. EUROPEAN DIGITAL OILFIELD MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. EUROPEAN DIGITAL OILFIELD MARKET RESEARCH AND ANALYSIS BY Process, 2023-2031 ($ MILLION)

21. EUROPEAN DIGITAL OILFIELD MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2023-2031 ($ MILLION)

22. EUROPEAN DIGITAL OILFIELD MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC DIGITAL OILFIELD MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC DIGITAL OILFIELD MARKET RESEARCH AND ANALYSIS BY Process, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC DIGITAL OILFIELD MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC DIGITAL OILFIELD MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

27. REST OF THE WORLD DIGITAL OILFIELD MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD DIGITAL OILFIELD MARKET RESEARCH AND ANALYSIS BY Process, 2023-2031 ($ MILLION)

29. REST OF THE WORLD DIGITAL OILFIELD MARKET RESEARCH AND ANALYSIS BY SOLUTION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD DIGITAL OILFIELD MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL DIGITAL OILFIELD MARKET SHARE BY PROCESS, 2023 VS 2031 (%)

2. GLOBAL DIGITAL OILFIELD PRODUCTION OPTIMIZATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL DIGITAL OILFIELD DRILLING OPTIMIZATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL DIGITAL OILFIELD RESERVOIR OPTIMIZATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL DIGITAL OILFIELD SAFETY MANAGEMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL DIGITAL OILFIELD ASSET MANAGEMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL DIGITAL OILFIELD MARKET SHARE BY SOLUTION, 2023 VS 2031 (%)

8. GLOBAL DIGITAL OILFIELD HARDWARE SOLUTIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL DIGITAL OILFIELD SOFTWARE & SERVICE SOLUTIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL DIGITAL OILFIELD DATA STORAGE SOLUTIONS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL DIGITAL OILFIELD MARKET SHARE BY END-USERS, 2023 VS 2031 (%)

12. GLOBAL DIGITAL OILFIELD FOR ONSHORE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL DIGITAL OILFIELD FOR OFFSHORE MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US DIGITAL OILFIELD MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA DIGITAL OILFIELD MARKET SIZE, 2023-2031 ($ MILLION)

16. UK DIGITAL OILFIELD MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE DIGITAL OILFIELD MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY DIGITAL OILFIELD MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY DIGITAL OILFIELD MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN DIGITAL OILFIELD MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE DIGITAL OILFIELD MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA DIGITAL OILFIELD MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA DIGITAL OILFIELD MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN DIGITAL OILFIELD MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA DIGITAL OILFIELD MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC DIGITAL OILFIELD MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA DIGITAL OILFIELD MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICA DIGITAL OILFIELD MARKET SIZE, 2023-2031 ($ MILLION)