Digital Payments Market

Global Digital Payments Market Size, Share & Trends Analysis Report By Method (Account-to-Account Real-Time Payment (A2A RTP), Internet Banking, Mobile Payments, and Others), By Vertical (BFSI, Retail and E-commerce, IT and Telecommunications, and Others), Forecast 2020-2026 Update Available - Forecast 2025-2035

The digital payments market is anticipated to grow at a significant CAGR during the forecast period. The payment done via electronic mediums is considered as a digital payment. Digital payment modes provide faster, easier, and more convenient payment options. Additionally, digital banking services are available to customers on a 24/7 basis including bank holidays which is significantly driving the adoption of digital payment solutions. Digital payment methods are economical as most of them are transaction free since the providers do not charge any kind of service fee or processing fee for their services. This is anticipated to drive the digital payments market significantly during the forecast period. However, the increasing cyber-attacks and breaches are raising security concerns among the population which will restraint the growth of the digital payments market.

Segmental Outlook

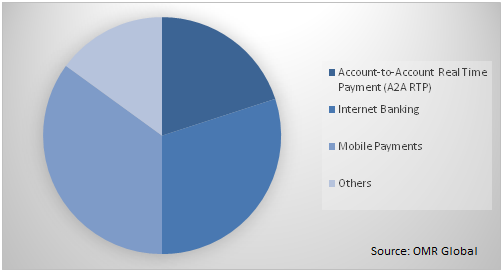

The global digital payments market is segmented based on method, type, and verticals. Based on the method, the market is sub-segmented into account-to-account real-time payment (A2A RTP), internet banking, mobile payments, and others. Based on vertical, the market is sub-segmented into BFSI, retail & e-commerce, IT & telecommunications, and others.

Global Digital payments Market Share by Type, 2020 (%)

The Mobile Payments to Exhibit Considerable Growth Rate During the Forecast Period

The mobile payment segment is anticipated to grow with a significant CAGR in the digital payments market owing to the ease of payment provided by the mobile payment solutions. Additionally, the increasing number of mobile users across the globe will also fuel the growth of the mobile payment segment. In addition to this, the increasing adoption of mobile payment solutions by the population across the globe is also significantly driving the digital payments market. Moreover, the increasing focus of market players in proving mobile-based payment solutions will also present growth opportunities to the mobile payment segment during the forecast period.

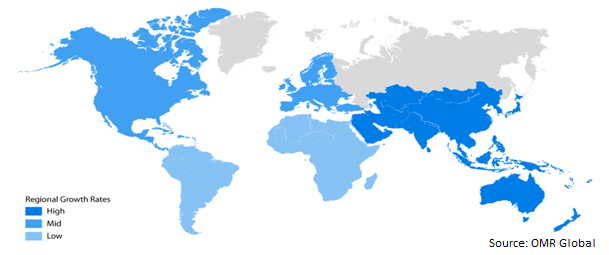

Regional Outlooks

The global digital payments market is further segmented based on geography into North America, Europe, Asia-Pacific, and the Rest of the World. North America is expected to hold significant share in digital payments during the forecast period. The growth of the market is attributed to the presence of a large number of global digital payment solution providers across the region. Additionally, reliable broadband and network infrastructure services across the region will also fuel the digital payments market significantly. Moreover, the customer willingness and preference for cashless payments are also considerably high in the region, which will also impact the market growth.

Global Digital Payments Market Growth by Region, 2020-2026

Asia-Pacific will Augment with Considerable Growth Rate in the Digital Payments Market

Asia-Pacific is anticipated to exhibit considerable growth rate in the digital payments market owing to the increasing number of mobile subscribers across the region. Additionally, the increasing initiatives by the government to promote the use of digital payments across the region will also grow the digital payments market. For instance, the Government of India’s digital India initiative to transform the country into a digitally empowered society is fuelling the digital payments market across the country.

Moreover, the advancements in digital technology with the introduction of 4G and 5G are also driving the demand for digital payment solutions. In addition to this, the increasing number of digital payment solution providers across the region will also fuel the digital payments market growth during the forecast period.

Market Players Outlook

Some of the key players of the Digital payments market include Visa Inc., Fiserv Inc., Wirecard AG, Net1 UEPS Technologies, Inc., YapStone, Inc., PayPal Holdings inc., PayU Payments Private Ltd., Mastercard International Incorporated, Amazon Payments, Inc., American Express Banking Corp., Worldline, BlueSnap, Inc., and others. The market players are considerably contributing to the market growth by adopting various strategies including new product launch, mergers, and acquisitions, collaborations to stay competitive in the market.

Recent Activities

- In February 2020, Worldline acquired Ingenico, a point-of-sale terminal provider in a deal of $8.6 billion. The acquisition will enable both the companies to compete with the small fintech companies that are raising in recent times.

- In July 2019, FIS acquired Worldpay Inc. to scale its portfolio and global footprint in the market. The acquisition will let both the companies to provide end-to-end payment solutions. Additionally, it will also enable them to cross-sell to each other’s clients and bring more efficiencies to payment execution.

- In July 2019, Fiserv completed its acquisition of First Data Corp. for $22 billion in an all-stock transaction. The acquisition of both companies will significantly benefit users with a wide range of services.

- In November 2018, Worldpay, Inc. and Paysafe Group entered into a strategic partnership, to establish a standard in iGaming and Sports Betting digital payments acceptance and security in the US. The partnership will enable seamless transactions, reduce operating costs, and allow universal payment acceptance leveraging both the companies.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global digital payments market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Strategy Analysis

3.2. Key Company Analysis

3.2.1. Visa Inc.

3.2.1.1. Overview

3.2.1.2. Financial Analysis

3.2.1.3. SWOT Analysis

3.2.1.4. Recent Developments

3.2.1.5. Wirecard AG

3.2.1.6. Overview

3.2.1.7. Financial Analysis

3.2.1.8. SWOT Analysis

3.2.1.9. Recent Developments

3.2.2. Fiserv, Inc.

3.2.2.1. Overview

3.2.2.2. Financial Analysis

3.2.2.3. SWOT Analysis

3.2.2.4. Recent Developments

3.2.3. PayPal Holdings Inc.

3.2.3.1. Overview

3.2.3.2. Financial Analysis

3.2.3.3. SWOT Analysis

3.2.3.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Digital Payments Market by Methods

5.1.1. Account-to-Account Real Time Payment (A2A RTP)

5.1.2. Internet Banking

5.1.3. Mobile Payments

5.1.4. Others

5.2. Global Digital Payments Market by Vertical

5.2.1. BFSI

5.2.2. Retail & E-commerce

5.2.3. IT & Telecommunications

5.2.4. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ACI Worldwide, Inc.

7.2. Adyen

7.3. Aliant Payments Inc.

7.4. Amazon Payments, Inc. (Amazon.com)

7.5. American Express Banking Corp.

7.6. BlueSnap, Inc.

7.7. Dwolla, Inc.

7.8. Financial Software & Systems Pvt. Ltd.

7.9. Fidelity National Information Services, Inc.

7.10. Fiserv, Inc.

7.11. Global Payments, Inc.

7.12. Google LLC (Alphabet Inc.)

7.13. Mastercard International Inc.

7.14. Net1 UEPS Technologies, Inc.

7.15. Novatti Group Ltd

7.16. PayPal Holdings, Inc.

7.17. Paysafe Holdings UK Ltd. (Paysafe Group)

7.18. Paytm Payment Bank Ltd.

7.19. Stripe, Inc.

7.20. Total System Services, LLC

7.21. Visa Inc.

7.22. Wirecard AG

7.23. Worldline

7.24. YapStone, Inc.

1. GLOBAL DIGITAL PAYMENTS MARKET RESEARCH AND ANALYSIS BY METHODS, 2019-2026 ($ MILLION)

2. GLOBAL ACCOUNT-TO-ACCOUNT REAL TIME PAYMENT (A2A RTP) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL INTERNET BANKING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL MOBILE PAYMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL OTHER DIGITAL PAYMENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL DIGITAL PAYMENTS MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019-2026 ($ MILLION)

7. GLOBAL DIGITAL PAYMENTS IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL DIGITAL PAYMENTS IN RETAIL & E-COMMERCE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL DIGITAL PAYMENTS IN IT & TELECOMMUNICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL DIGITAL PAYMENTS IN OTHER VERTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL DIGITAL PAYMENTS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN DIGITAL PAYMENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN DIGITAL PAYMENTS MARKET RESEARCH AND ANALYSIS BY METHODS, 2019-2026 ($ MILLION)

14. NORTH AMERICAN DIGITAL PAYMENTS MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019-2026 ($ MILLION)

15. EUROPEAN DIGITAL PAYMENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. EUROPEAN DIGITAL PAYMENTS MARKET RESEARCH AND ANALYSIS BY METHODS, 2019-2026 ($ MILLION)

17. EUROPEAN DIGITAL PAYMENTS MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC DIGITAL PAYMENTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC DIGITAL PAYMENTS MARKET RESEARCH AND ANALYSIS BY METHODS, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC DIGITAL PAYMENTS MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019-2026 ($ MILLION)

21. REST OF THE WORLD DIGITAL PAYMENTS MARKET RESEARCH AND ANALYSIS BY METHODS, 2019-2026 ($ MILLION)

22. REST OF THE WORLD DIGITAL PAYMENTS MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2019-2026 ($ MILLION)

1. GLOBAL DIGITAL PAYMENTS MARKET SHARE BY METHODS, 2019 VS 2026 (%)

2. GLOBAL DIGITAL PAYMENTS MARKET SHARE BY VERTICAL, 2019 VS 2026 (%)

3. GLOBAL DIGITAL PAYMENTS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US DIGITAL PAYMENTS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA DIGITAL PAYMENTS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK DIGITAL PAYMENTS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE DIGITAL PAYMENTS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY DIGITAL PAYMENTS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY DIGITAL PAYMENTS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN DIGITAL PAYMENTS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE DIGITAL PAYMENTS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA DIGITAL PAYMENTS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA DIGITAL PAYMENTS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN DIGITAL PAYMENTS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC DIGITAL PAYMENTS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD DIGITAL PAYMENTS MARKET SIZE, 2019-2026 ($ MILLION)