Digital Signage Market

Digital Signage Market Size, Share, and Trends Analysis Report by Type (Video Wall, Video Screen, Kiosk, Transparent LCD Screen, and Digital Poster), Component (Hardware-LCD/LED Display, OLED Display, Media Players, Projectors/Projection Screens; Software; and Services), Location (In-store and Outdoor), Application (Retail, Transportation, Hospitality, Corporate, Education, and Government), and Forecast Period (2023–2030) Update Available - Forecast 2025-2031

Digital signage market is anticipated to grow at a considerable CAGR of 7.9% during the forecast period. Digital signage offers numerous advantages over traditional printed signage, including greater flexibility, interactivity, and customization, which increases its demand in the market. As businesses and organizations seek to leverage digital technology to enhance their marketing and communication efforts, the demand for digital signage solutions has grown. The development of sophisticated software and content management systems has also made it easier for businesses to create and manage digital signage content and to deliver targeted messaging to specific audiences.Besides, the retail and hospitality industries have been early adopters of digital signage, using it to enhance customer experiences and increase sales. As these industries continue to grow, the demand for digital signage solutions is likely to increase as well.

Segmental Outlook

The global digital signage market is segmented by type, component, location, and application. Based on type, the market is sub-segmented into video wall, video screen, kiosk, transparent LCD screen, and digital poster. Based on component, the market is sub-segmented into hardware (LCD/LED display, OLED display, media players, projectors/projection screens), software, and services. Based on location, the market is sub-segmented into in-store and outdoor. Based on application, the market is sub-segmented into retail, transportation, hospitality, corporate, education, and government. Among components’ hardware sub-segments, OLED displaysare expected to witness the highest growth in the market. Since it combines improved reality with a dynamic shape, OLED is the only technology that overcomes the constraints of traditional displays. Based on self-emitting light sources, OLED delivers greater light and color expression. Its flexibility and transparency are the products of breakthrough OLED material development.

The Retail Sub-Segment Holds a Prominent Share in the Global Digital SignageMarket

Based on application, the market is sub-segmented into retail, transportation, hospitality, corporate, education, and government. Among these, the retail industry is expected to hold a significant share of the market. Digital signage can be used to display advertising and promotional messages, which can help grab customers' attention and drive sales. This can include product promotions, special offers, and new product launches. Additionally, digital signage can be used to provide wayfinding information, helping customers navigate through stores and find the products they are looking for. This can include maps, directional signage, and product location information. Interactive displays, such as touchscreens and kiosks, can be used to engage customers and provide them with a more immersive shopping experience. This can include product demos, virtual try-ons, and personalized recommendations. Such use cases of digital signage in the retail industry increase its demand, and the growing retail industry further supports the market's growth.

Regional Outlook

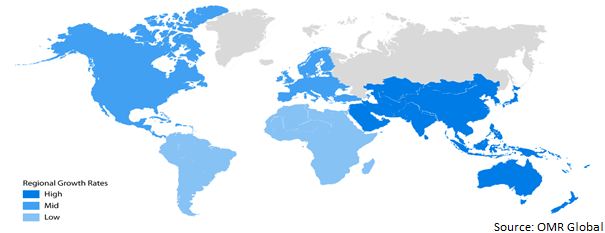

The global digital signage market is segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the rest of the world (the Middle East and Africa and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among the regions, the Asia-Pacific region is expected to generate the highest market share. However, the North American market is also expected to grow significantly in the forecast period owing to increased transportation activities, the retail sector, and educational institutes that use digital signage systems.For instance, in April 2022, Visix Inc. announced that Wichita State University had selected an AxisTV Signage Suite digital signage system for their Metroplex convention center, expanding its portfolio of higher education projects. The total system featured three nano digital signage players, a cloud-hosted CMS, and ten Electronic Paper Room (E-Paper) Signs, which dynamically show events and meetings as they occur.

Global Digital Signage Market Growth, by Region (2023-2030)

The Asia-PacificRegion is Expected to Dominate the Global Digital Signage Market

The retail and hospitality industries are among the fastest-growing users of digital signage in the Asia-Pacific region. Retailers are using digital signage for advertising and promotions, while hotels and restaurants are using it for wayfinding and information displays.Animportant factor contributing to retail shop growth in the region is urbanization. As more people move to cities, the demand for convenient and accessible retail options has increased. This has led to the development of large shopping malls and retail centers in urban areas, as well as the expansion of traditional retail outlets, resulting in enhanced use of digital signage.

According to the ASEAN (Association of Southeast Asian Nations) Secretariat, retail sales in ASEAN member states (Brunei Darussalam, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand, and Vietnam) reached $1.2 trillion in 2019, with an average annual growth rate of 5.9% between 2014 and 2019. Additionally, the Ministry of Economy, Trade and Industry in Japan reported that the retail market in Asia and the Pacific region is expected to reach $8.1 trillion by 2025, with the top five markets being China, Japan, South Korea, India, and Australia.

Besides, restaurantsand food outlets are another major user of digital signage, and the industry’s growth is further supporting the market’s growth. For instance, the Ministry of Culture, Sports and Tourism in South Korea reported that there were 23,152 accommodation establishments in the country as of 2020, representing a 1.8% increase from the previous year. The ministry also reported that there were 748,707 food and beverage service establishments in the country as of 2020, representing a 2.2% increase from the previous year. Additionally, the Ministry of Tourism in Indonesia reported that there were 4,925 star-rated hotels in the country as of December 2021, representing a 1.7% increase from the previous year. The ministry also reported that there were 143,800 restaurants in the country as of August 2021, representing a 4.6% increase from the previous year.

Market Players Outlook

The major companies serving the global digital signage market include BroadSign International, iSEMC (HHSD Technology), Koninklijke Philips N.V., LG Electronics, NEC Corp., and others. These companies are considerably contributing to the market’s growth through the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, investments, and new digital signage platform launches to stay competitive in the market. For instance, in March 2022, Quantela Inc. and Liquid Outdoor, a leading boutique outdoor advertising provider, announced a new agreement to develop a full digital signage solution to grow Liquid's lifestyle network. Quantela will provide overall program management as well as the technological platform for monitoring and managing the data acquired throughout the US lifestyle portfolio. Quantela will also contribute the initial $15 million in financing necessary for the project and its future growth potential based on results and support from critical investor Digital Alpha.

The Report Covers-

- Market value data analysis for 2023 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global digital signagemarket. Based on the availability of data, information related to new product launches and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who stands where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight and Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Digital signageMarket by Type

4.1.1. Video Wall

4.1.2. Video Screen

4.1.3. Kiosk

4.1.4. Transparent LCD Screen

4.1.5. Digital Poster

4.2. Global Digital signageMarket by Component

4.2.1. Hardware (LCD/LED Display, OLED Display, Media Players, Projectors/Projection Screens)

4.2.2. Software

4.2.3. Services

4.3. Global Digital signageMarket by Location

4.3.1. In-store

4.3.2. Outdoor

4.4. Global Digital signageMarket by Application

4.4.1. Retail

4.4.2. Transportation

4.4.3. Hospitality

4.4.4. Corporate

4.4.5. Education

4.4.6. Government

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AdMobilize LLC

6.2. Advantec Co., Ltd.

6.3. BroadSign International

6.4. iSEMC (HHSD Technology)

6.5. Koninklijke Philips N.V.

6.6. LG Electronics

6.7. NEC Corp.

6.8. Omnivex Corp.

6.9. Panasonic Corp.

6.10. Planar Systems

6.11. Quividi SARL

6.12. Samsung Electronics Co., Ltd.

6.13. Sharp Corp.

6.14. Sony Corp.

6.15. ViewSonic Corp.

6.16. Volanti Displays

1. GLOBAL DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

2. GLOBAL DIGITAL SIGNAGE FOR VIDEO WALL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL DIGITAL SIGNAGE FOR VIDEO SCREEN MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL DIGITAL SIGNAGE FOR KIOSK MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

6. GLOBAL HARDWARE FOR DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL LCD/LED DISPLAY FOR DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL OLED DISPLAY FOR DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL MEDIA PLAYERS FOR DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

10. GLOBAL PROJECTORS/PROJECTION SCREENS FOR DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL DIGITAL SIGNAGE SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL DIGITAL SIGNAGE SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY LOCATION, 2022-2030 ($ MILLION)

14. GLOBAL IN-STORE DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. GLOBAL OUTDOOR DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

16. GLOBAL DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

17. GLOBAL DIGITAL SIGNAGE FOR RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

18. GLOBAL DIGITAL SIGNAGE FOR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

19. GLOBAL DIGITAL SIGNAGE FOR HOSPITALITY MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

20. GLOBAL DIGITAL SIGNAGE FOR CORPORATE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

21. GLOBAL DIGITAL SIGNAGE FOR EDUCATION MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

22. GLOBAL DIGITAL SIGNAGE FOR GOVERNMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

23. GLOBAL DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

24. NORTH AMERICAN DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

25. NORTH AMERICAN DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

26. NORTH AMERICAN DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

27. NORTH AMERICAN DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY LOCATION, 2022-2030 ($ MILLION)

28. NORTH AMERICAN DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

29. EUROPEAN DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

30. EUROPEAN DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

31. EUROPEAN DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

32. EUROPEAN DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY LOCATION, 2022-2030 ($ MILLION)

33. EUROPEAN DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

34. ASIA-PACIFIC DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

35. ASIA-PACIFIC DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

36. ASIA-PACIFIC DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

37. ASIA-PACIFIC DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY LOCATION, 2022-2030 ($ MILLION)

38. ASIA-PACIFIC DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

39. REST OF THE WORLD DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

40. REST OF THE WORLD DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

41. REST OF THE WORLD DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

42. REST OF THE WORLD DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY LOCATION, 2022-2030 ($ MILLION)

43. REST OF THE WORLD DIGITAL SIGNAGE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL DIGITAL SIGNAGE MARKET SHARE BY TYPE, 2022 VS 2030 (%)

2. GLOBAL DIGITAL SIGNAGE FOR VIDEO WALL MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL DIGITAL SIGNAGE FOR VIDEO SCREEN MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL DIGITAL SIGNAGE FOR KIOSK BY MARKET SHARE REGION, 2022 VS 2030 (%)

5. GLOBAL DIGITAL SIGNAGE MARKET SHARE BY COMPONENT, 2022 VS 2030 (%)

6. GLOBAL HARDWARE FOR DIGITAL SIGNAGE MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL LCD/LED DISPLAY FOR DIGITAL SIGNAGE MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL OLED DISPLAY FOR DIGITAL SIGNAGE MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL MEDIA PLAYERS FOR DIGITAL SIGNAGE MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL PROJECTORS/PROJECTION SCREENS FOR DIGITAL SIGNAGE MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL SOFTWARE FOR DIGITAL SIGNAGE MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL SERVICES FOR DIGITAL SIGNAGE MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL DIGITAL SIGNAGE MARKET SHARE BY LOCATION, 2022 VS 2030 (%)

14. GLOBAL IN-STORE DIGITAL SIGNAGE MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. GLOBAL OUTDOOR DIGITAL SIGNAGE MARKET SHARE BY REGION, 2022 VS 2030 (%)

16. GLOBAL DIGITAL SIGNAGE MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

17. GLOBAL DIGITAL SIGNAGE FOR RETAIL MARKET SHARE BY REGION, 2022 VS 2030 (%)

18. GLOBAL DIGITAL SIGNAGE FOR TRANSPORTATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

19. GLOBAL DIGITAL SIGNAGE FOR HOSPITALITY MARKET SHARE BY REGION, 2022 VS 2030 (%)

20. GLOBAL DIGITAL SIGNAGE FOR CORPORATE MARKET SHARE BY REGION, 2022 VS 2030 (%)

21. GLOBAL DIGITAL SIGNAGE FOR EDUCATION MARKET SHARE BY REGION, 2022 VS 2030 (%)

22. GLOBAL DIGITAL SIGNAGE FOR GOVERNMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

23. GLOBAL DIGITAL SIGNAGE MARKET SHARE BY REGION, 2022 VS 2030 (%)

24. US DIGITAL SIGNAGE MARKET SIZE, 2022-2030 ($ MILLION)

25. CANADA DIGITAL SIGNAGE MARKET SIZE, 2022-2030 ($ MILLION)

26. UK DIGITAL SIGNAGE MARKET SIZE, 2022-2030 ($ MILLION)

27. FRANCE DIGITAL SIGNAGE MARKET SIZE, 2022-2030 ($ MILLION)

28. GERMANY DIGITAL SIGNAGE MARKET SIZE, 2022-2030 ($ MILLION)

29. ITALY DIGITAL SIGNAGE MARKET SIZE, 2022-2030 ($ MILLION)

30. SPAIN DIGITAL SIGNAGE MARKET SIZE, 2022-2030 ($ MILLION)

31. REST OF EUROPE DIGITAL SIGNAGE MARKET SIZE, 2022-2030 ($ MILLION)

32. INDIA DIGITAL SIGNAGE MARKET SIZE, 2022-2030 ($ MILLION)

33. CHINA DIGITAL SIGNAGE MARKET SIZE, 2022-2030 ($ MILLION)

34. JAPAN DIGITAL SIGNAGE MARKET SIZE, 2022-2030 ($ MILLION)

35. SOUTH KOREA DIGITAL SIGNAGE MARKET SIZE, 2022-2030 ($ MILLION)

36. REST OF ASIA-PACIFIC DIGITAL SIGNAGE MARKET SIZE, 2022-2030 ($ MILLION)

37. REST OF THE WORLD DIGITAL SIGNAGE MARKET SIZE, 2022-2030 ($ MILLION)