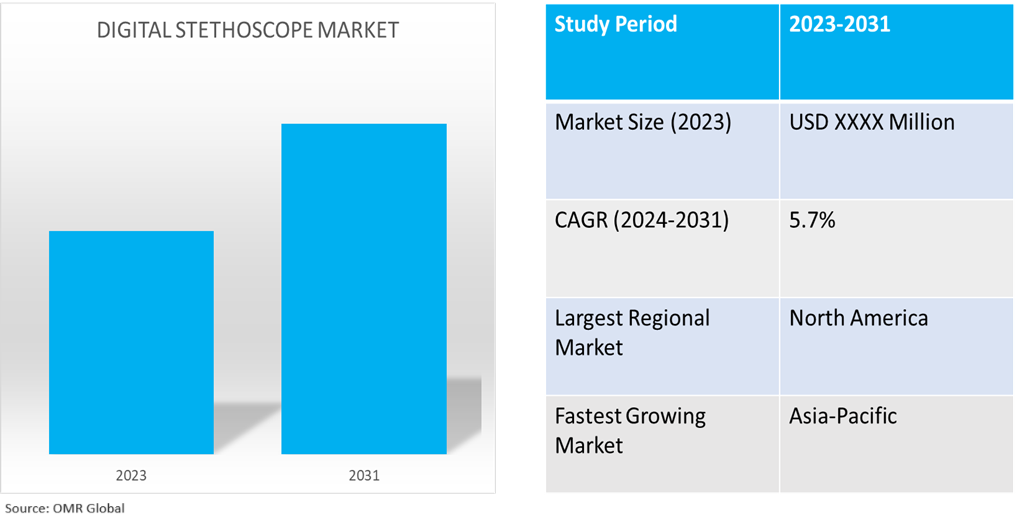

Digital Stethoscope Market

Digital Stethoscope Market Size, Share & Trends Analysis Report by Product Type (Amplifying Stethoscope, and Digitalization Stethoscope), by Technology (Integrated Chest-Piece System, Wireless Transmission System, and Integrated Receiver Head-Piece System), and by End User (Hospitals and Clinics, Ambulatory Surgery Centers, Diagnostic Centers, and Others), Forecast Period (2024-2031)

Digital stethoscope market is anticipated to grow at a CAGR of 5.7% during the forecast period (2024-2031). The growing prevalence of telemedicine, point-of-care diagnostics, the aging population, preventative healthcare, investments in healthcare infrastructure, advancing technology, and improvements in artificial intelligence and machine learning are all driving factors in the global market for digital stethoscopes. While telemedicine and AI-powered gadgets improve healthcare access and lower diagnostic errors, advanced digital stethoscopes improve sound quality, diagnostic capabilities, and recording.

Market Dynamics

Increasing Prevalence of Cardiovascular

The need for advanced diagnostic instruments, such as digital stethoscopes, has increased owing to the rising incidence of cardiovascular disorders globally. These instruments are essential for early detection and treatment. According to the World Heart Federation, in 2023 cardiovascular diseases continue to have a significant global influence, with over half a billion individuals affected, and 20.5 million deaths recorded in 2021. It is estimated that up to 80.0% of premature heart attacks and strokes could be prevented. Despite the availability of effective tools and knowledge in cardiovascular medicine, there remains a lack of access and equity in the distribution of these resources. This is evident by the fact that around 4 out of every 5 cardiovascular disease deaths occur in low- and middle-income countries, highlighting the urgent need to address this health inequity.

Growth of Remote Patient Monitoring and Telemedicine

Telemedicine and remote patient monitoring are expanding due to population density and healthcare demands, enhancing access to services and driving market adoption through digital stethoscope integration. According to the United Nations Department of Economic and Social Affairs, in 2022, the globe's population is expected to reach approximately 8.5 billion by 2030, 9.7 billion by 2050, and 10.4 billion by 2100. This increase in population is influenced by declining mortality rates and increased life expectancy, which reached 72.8 years globally in 2019, reflecting a significant improvement of nearly 9 years since 1990.

Market Segmentation

- Based on the product, the market is segmented into an amplifying stethoscope and a digitalization stethoscope.

- Based on technology, the market is segmented into integrated chest-piece systems, wireless transmission systems, and integrated receiver head-piece systems.

- Based on end-user, the market is segmented into hospitals and clinics, ambulatory surgery centers, diagnostic centers, and others (home healthcare settings, and military and emergency medical services (EMS)).

Digitalization Stethoscope is Projected to Emerge as the Largest Segment

The primary factor supporting the segment's growth includes digital stethoscopes are essential in preventing cardiovascular and respiratory conditions, that contribute significantly to global rising healthcare expenditures, thereby optimizing healthcare spending and improving health outcomes. According to the Institute of Medicine (IOM), preventive measures play an essential role in public health, with estimates that missed prevention opportunities result in an annual cost of $55.0 billion in the US, accounting for approximately 30 cents on every healthcare dollar. This contributes to the overall squandering of $750.0 billion in the healthcare system each year. Furthermore, when compared to other countries in the OECD, the US has the highest healthcare expenditures, highlighting the importance of preventive measures in assessing the quality of service at healthcare facilities and the overall well-being of citizens.

Wireless Transmission System Segment to Hold a Considerable Market Share

COVID-19 has accelerated the adoption of remote monitoring technologies, including wireless stethoscopes, driving the global digital stethoscope market growth. For instance, in September 2020, eKuore introduced a wireless stethoscope that minimizes COVID-19 infection risk among healthcare professionals by enabling remote auscultation via Bluetooth headphones, a response to the surge in telemedicine services during the pandemic.

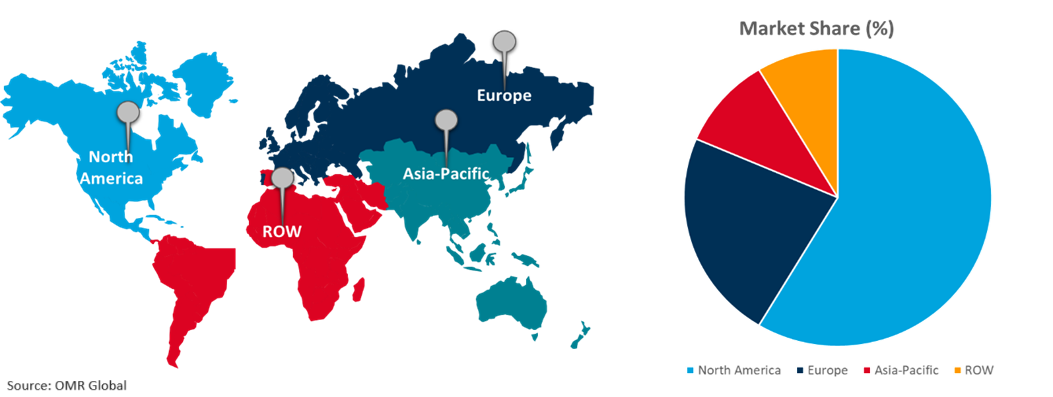

Regional Outlook

The digital stethoscope market is segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Government Support for Innovation in Asia-Pacific Region Helping Market with Fastest Growth

The Indian government is actively fostering innovation in healthcare through initiatives such as the Atal Innovation Mission and the National Health Innovation Portal, promoting institutions and boosting the digital stethoscope market. For instance, in April 2020, IIT-Bombay developed a digital stethoscope called "AyuSynk" to check COVID-19 patients, converting conventional stethoscopes into digital ones. The device is used for remote auscultation and can be connected to mobile or laptops via wire or Bluetooth.

Digital Stethoscope Market Growth by Region 2024-2031

North America Holds a Major Market Size

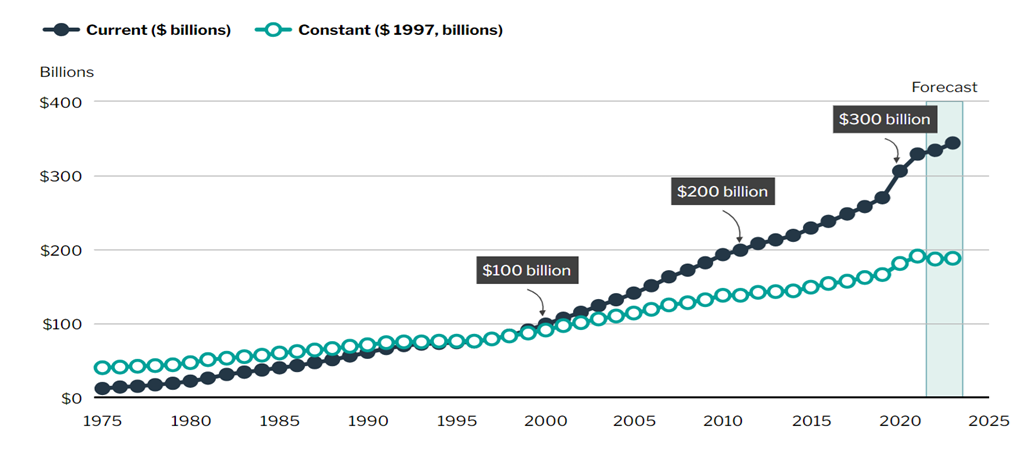

Canada's healthcare expenditure is projected to rise, necessitating cost-efficient solutions such as digital stethoscopes, The implementation of remote auscultation capabilities is a significant step towards improving healthcare delivery and reducing unnecessary expenses. According to the National Health Expenditure, in November 2023, the total health expenditure in Canada is projected to reach $344.0 billion in 2023, representing an increase of $9.0 billion compared to the previous year. The expected growth rate for total health spending in Canada is 2.8% in 2023, following a 1.5% increase in 2022. It reflects a more modest growth rate compared to the surge experienced during COVID-19, with growth rates of 13.2% in 2020 and 7.8% in 2021. In the five years preceding COVID-19 (2015-2019), annual growth in health spending averaged 4.3%.

Canada's Health Spending in 2023

Source: National health expenditure

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the digital stethoscope market such as 3M, Braun and Co. Ltd., Masimo Corp., Eko Health, Inc., and Thinklabs Medical LLC, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in July 2023, Astellas Pharma and Eko Health signed a license agreement for Eko's CORE 500™ digital stethoscope and AI-powered cardiovascular disease detection software, aiming to create a non-invasive device called Z1608.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global digital stethoscope market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. 3M Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Braun and Co. Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Masimo Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Digital Stethoscope Market by Product Type

4.1.1. Amplifying Stethoscope

4.1.2. Digitalization Stethoscope

4.2. Global Digital Stethoscope Market by Technology

4.2.1. Integrated Chest-Piece System

4.2.2. Wireless Transmission System

4.2.3. Integrated Receiver Head-Piece System

4.3. Global Digital Stethoscope Market by End-user

4.3.1. Hospitals and Clinics

4.3.2. Ambulatory Surgery Centers

4.3.3. Diagnostic Centers

4.3.4. Others (Home Healthcare Settings, and Military and Emergency Medical Services (EMS))

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. ADInstruments NZ Ltd.

6.2. American Diagnostic Corporation.

6.3. Aseptico Inc.

6.4. Ayu Devices Pvt. Ltd.

6.5. Cardionics Inc.

6.6. CONTEC MEDICAL SYSTEMS CO., LTD

6.7. American Academy of AudiologyEko Health, Inc.

6.8. eKuore

6.9. Hill-Rom Holdings, Inc.

6.10. iangsu Dengguan Medical Equipment Co., Ltd.

6.11. JFIGS, INC.

6.12. MDF Instruments Direct Inc.

6.13. Meditech Equipment Co., Ltd.

6.14. Medline Industries, Inc.

6.15. OMRON Healthcare, Inc.

6.16. Rudolf Riester GmbH

6.17. TeleSensi

6.18. Thinklabs Medical LLC

1. GLOBAL DIGITAL STETHOSCOPE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL AMPLIFYING DIGITAL STETHOSCOPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL DIGITALIZATION STETHOSCOPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL DIGITAL STETHOSCOPE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

5. GLOBAL DIGITAL STETHOSCOPE WITH INTEGRATED CHEST-PIECE SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL DIGITAL STETHOSCOPE WITH WIRELESS TRANSMISSION SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL DIGITAL STETHOSCOPE WITH INTEGRATED RECEIVER HEAD-PIECE SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL DIGITAL STETHOSCOPE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

9. GLOBAL DIGITAL STETHOSCOPE FOR HOSPITALS AND CLINICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL DIGITAL STETHOSCOPE FOR AMBULATORY SURGERY CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL DIGITAL STETHOSCOPE FOR DIAGNOSTIC CENTERS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL DIGITAL STETHOSCOPE FOR OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL DIGITAL STETHOSCOPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. NORTH AMERICAN DIGITAL STETHOSCOPE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. NORTH AMERICAN DIGITAL STETHOSCOPE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN DIGITAL STETHOSCOPE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

17. EUROPEAN DIGITAL STETHOSCOPE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN DIGITAL STETHOSCOPE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

19. EUROPEAN DIGITAL STETHOSCOPE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC DIGITAL STETHOSCOPE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC DIGITAL STETHOSCOPE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC DIGITAL STETHOSCOPE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

23. REST OF THE WORLD DIGITAL STETHOSCOPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

24. REST OF THE WORLD DIGITAL STETHOSCOPE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

25. REST OF THE WORLD DIGITAL STETHOSCOPE MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL DIGITAL STETHOSCOPE MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL AMPLIFYING DIGITAL STETHOSCOPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL DIGITALIZATION STETHOSCOPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL DIGITAL STETHOSCOPE MARKET SHARE BY TECHNOLOGY, 2023 VS 2031 (%)

5. GLOBAL DIGITAL STETHOSCOPE WITH INTEGRATED CHEST-PIECE SYSTEM MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL DIGITAL STETHOSCOPE WITH WIRELESS TRANSMISSION SYSTEM MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL DIGITAL STETHOSCOPE WITH INTEGRATED RECEIVER HEAD-PIECE SYSTEM MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL DIGITAL STETHOSCOPE MARKET SHARE BY END-USER, 2023 VS 2031 (%)

9. GLOBAL DIGITAL STETHOSCOPE FOR HOSPITALS AND CLINICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL DIGITAL STETHOSCOPE FOR AMBULATORY SURGERY CENTERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL DIGITAL STETHOSCOPE FOR DIAGNOSTIC CENTERS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL DIGITAL STETHOSCOPE FOR OTHER END-USER MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL DIGITAL STETHOSCOPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US DIGITAL STETHOSCOPE MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA DIGITAL STETHOSCOPE MARKET SIZE, 2023-2031 ($ MILLION)

16. UK DIGITAL STETHOSCOPE MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE DIGITAL STETHOSCOPE MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY DIGITAL STETHOSCOPE MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY DIGITAL STETHOSCOPE MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN DIGITAL STETHOSCOPE MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE DIGITAL STETHOSCOPE MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA DIGITAL STETHOSCOPE MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA DIGITAL STETHOSCOPE MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN DIGITAL STETHOSCOPE MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA DIGITAL STETHOSCOPE MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC DIGITAL STETHOSCOPE MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA DIGITAL STETHOSCOPE MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICA DIGITAL STETHOSCOPE MARKET SIZE, 2023-2031 ($ MILLION)