Digital Utility Market

Global Digital Utility Market Size, Share & Trends Analysis Report By Product Type (Hardware and Software & Services), By Network (Retail, Generation, Transmission and Distribution) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global digital utility market is estimated to grow at a significant CAGR of XX% during the forecast period. The market is mainly driven due to the increasing use of unpredictable renewable energy sources in power generation which has caused an imbalance of energy demand and supply. For managing this, utilities, independent power producers and other energy companies are exploring effective ways. The companies are leveraging digital technology for improving the accessibility and efficiency of renewable energy technologies. Moreover, growing smart city projects further provide substantial opportunity to market growth during the forecast period. However, the high initial cost of installation further expected to hinder the market growth.

Segmental Outlook

The global digital utility market is segmented on the basis of product type and network. Base on product type the global digital utility market is segmented into hardware and software & services. On the basis of network, the global digital utility market is segregated into retail, generation, transmission, and distribution. As per IFR, the estimated annual supply of industrial robots in the automotive industry has increased from 103,000 units in 2016 to 116,000 in 2018. Electrical and electronic held the second-largest position in industrial robots with 113,000 units’ installation in 2018. The rising demand for industrial robots and industry 4.0 further contributes to the growth of the hardware segment. On the basis of industry, the global digital utility market is segregated into automotive, aerospace & defense, electrical & electronics, energy & power, chemical industry, and others.

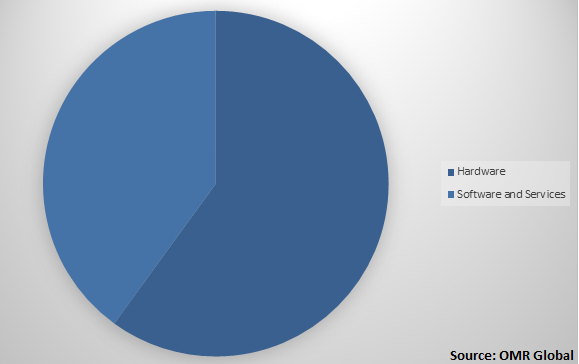

Global Digital utility Market Share by Product Type, 2018(%)

Global Digital utility market to be driven by Hardware Segment

The hardware segment is projected to have a considerable share in the market. The automobile industry constantly uses advanced technologies to bring innovative, efficient and safe vehicles to market, while constantly working to reduce manufacturing costs. Currently, these technologies comprise AI and high-performance computing. Over the decades, the industry has invested significantly in high-performance computing (HPC) systems to power modeling, design and simulation applications. The automotive manufacturers across the globe recognize that smart vehicles are the future where smart solutions are extensively used to increase its capabilities and offer a better driving experience. The automobile manufacturers are using smart systems in the manufacturing processes. These systems are used to manage workflows and create schedules as well as allow robots to work safely together with humans on factory assembly lines and floors.

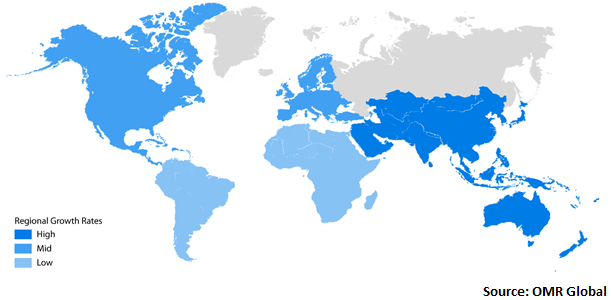

Regional Outlook

Geographically, the global digital utility market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. Asia-Pacific is estimated to have considerable market growth in the global market during the forecast period. The market in Asia-Pacific is largely driven by the investment from the private technology company towards smart technology development owing to the availability of economical workforces coupled with large volume and a broad range of data generated by the e-commerce companies and logistics companies.

Global Digital utility Market Growth, by Region 2019-2025

North America to hold a considerable share in the global Digital utility market

North America is projected to have a significant market share in the global market owing to R&D, and high expenditure by the government as well as a private organization for smart technology such as AI. The US and Canada are the major economies of North America. The region has well-developed information communication technology (ICT) and employs the adoption of a large number of connected devices. In February 2019, the President signed an Executive order 13859, Maintaining American Leadership in AI. The signing of the order was aimed to launch the American AI initiative in order to promote and protect AI technology in the US. The initiatives implement a whole-of-government strategy in collaboration and engagement with the private sector, academia, and major private manufacturers.

Market Players Outlook

The key players in the Digital utility market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include ABB Ltd., General Electric Co., IBM Corp., Siemens AG, Accenture PLCSchneider Electric SE, Capgemini Service SAS, Eaton Corp., and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. For instance, In June 2019 Schneider Electric SE launched the first Digital utility in the US to establish in real-time how its EcoStruxure architecture and related suite of offerings can enable increase operational efficiency and reduce costs for its customers.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global digital utility market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. ABB Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. General Electric Co.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. IBM Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Siemens AG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Accenture PLC

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Digital Utility Market by Product Type

5.1.1. Hardware

5.1.2. Software and Services

5.2. Global Digital Utility Market by Network

5.2.1. Retail

5.2.2. Generation

5.2.3. Transmission and Distribution

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB Ltd.

7.2. Accenture PLC

7.3. Capgemini Service SAS

7.4. Cisco Systems Inc.

7.5. Cognizant Technology Solutions Corp.

7.6. DXC Technology Co.

7.7. Eaton Corp.

7.8. General Electric Co.

7.9. FANUC Corp.

7.10. HCL Technologies Ltd.

7.11. IBM Corp.

7.12. Leidos, Inc.

7.13. Microsoft Corp.

7.14. NetScout Systems, Inc.

7.15. Oracle Corp.

7.16. SAP SE

7.17. Schneider Electric SE

7.18. Siemens AG

7.19. Salesforce.com, Inc.

7.20. Tieto Group

1. GLOBAL DIGITAL UTILITY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

2. GLOBAL HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL SOFTWARE AND SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL DIGITAL UTILITY MARKET RESEARCH AND ANALYSIS BY NETWORK, 2018-2025 ($ MILLION)

5. GLOBAL DIGITAL UTILITY IN RETAIL MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL DIGITAL UTILITY IN ELECTRICAL & ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL DIGITAL UTILITY IN TRANSMISSION AND GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL DIGITAL UTILITY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

9. NORTH AMERICAN DIGITAL UTILITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

10. NORTH AMERICAN DIGITAL UTILITY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

11. NORTH AMERICAN DIGITAL UTILITY MARKET RESEARCH AND ANALYSIS BY NETWORK, 2018-2025 ($ MILLION)

12. EUROPEAN DIGITAL UTILITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. EUROPEAN DIGITAL UTILITY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

14. EUROPEAN DIGITAL UTILITY MARKET RESEARCH AND ANALYSIS BY NETWORK, 2018-2025 ($ MILLION)

15. ASIA-PACIFIC DIGITAL UTILITY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. ASIA-PACIFIC DIGITAL UTILITY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC DIGITAL UTILITY MARKET RESEARCH AND ANALYSIS BY NETWORK, 2018-2025 ($ MILLION)

18. REST OF THE WORLD DIGITAL UTILITY MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

19. REST OF THE WORLD DIGITAL UTILITY MARKET RESEARCH AND ANALYSIS BY NETWORK, 2018-2025 ($ MILLION)

1. GLOBAL DIGITAL UTILITY MARKET SHARE BY PRODUCT TYPE, 2018 VS 2025 (%)

2. GLOBAL DIGITAL UTILITY MARKET SHARE BY NETWORK, 2018 VS 2025 (%)

3. GLOBAL DIGITAL UTILITY MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US DIGITAL UTILITY MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA DIGITAL UTILITY MARKET SIZE, 2018-2025 ($ MILLION)

6. UK DIGITAL UTILITY MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE DIGITAL UTILITY MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY DIGITAL UTILITY MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY DIGITAL UTILITY MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN DIGITAL UTILITY MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE DIGITAL UTILITY MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA DIGITAL UTILITY MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA DIGITAL UTILITY MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN DIGITAL UTILITY MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC DIGITAL UTILITY MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD DIGITAL UTILITY MARKET SIZE, 2018-2025 ($ MILLION)