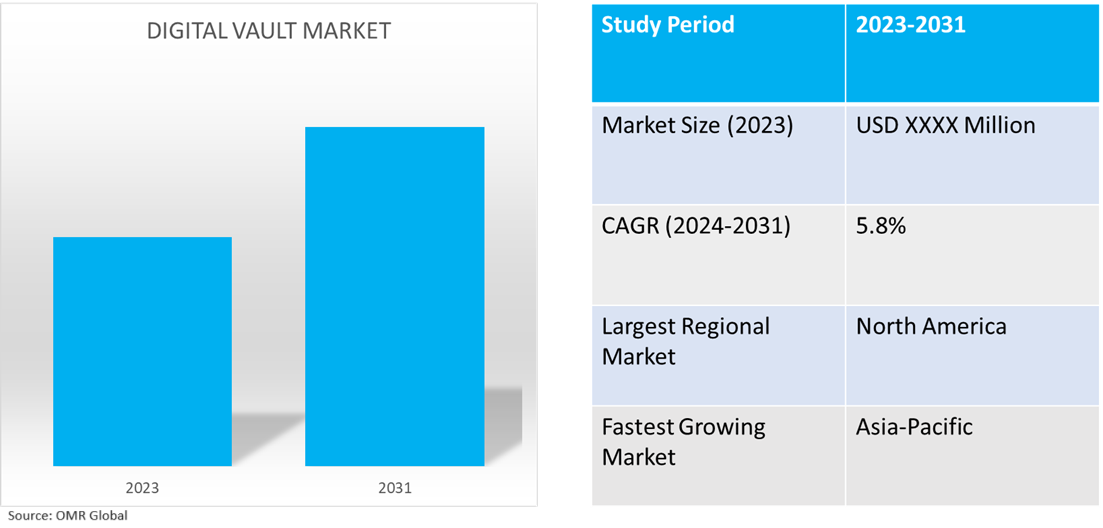

Digital Vault Market

Digital Vault Market Size, Share & Trends Analysis Report by Component (Software and Solutions, and Professional Services), by Deployment Mode (On-Premises, and Cloud-Based), by Organization Size (Large Enterprises, and Small and Medium-Sized Enterprises), by End-User (BFSI, IT and Telecom, Healthcare, Consumer Goods and Retail, Government and Defense, and Other End-User (Manufacturing)) Forecast Period (2024-2031)

Digital vault market is anticipated to grow at a CAGR of 5.8% during the forecast period (2024-2031). A digital vault is a digital repository specifically designed for securely storing and managing sensitive digital information through encryption, such as personal identification information (PII), financial records, legal documents, passwords, and other confidential information. The market growth is driven by the rising prevalence of cybercrimes such as ransomware and business email compromise (BEC), among others; a growing trend toward a remote work culture and bring your own device (BYOD); and an increase in digitization of data storage and payments. Further, expansion in the development of industry-specific digital vault solutions; and increasing efforts by state organizations to safeguard data privacy and security to contribute to industry growth.

Market Dynamics

Increasing Prevalence of Cyber-Crimes

Cybercrime has remained the core driver for the increased demand and deployment of digital vaults across businesses and public sector organizations. These vaults are specifically designed to resist several kinds of cyber threats, including malware, phishing, and ransomware attacks, by isolating sensitive data from less secure environments, making them a preferred choice for data security measures. Further, in recent years, the frequency and innovation in cybercrimes have exponentially increased, which is expected to create more scope for the solution type in the future. For instance, in the 2022 Internet Crime Report, the IC3 (Internet Crime Complaint Center) documented 21,832 complaints of business e-mail compromise (BEC), resulting in adjusted losses exceeding $2.7 billion. The report also highlighted investment scams as the most expensive scheme reported to the IC3, with investment fraud complaints soaring from $1.45 billion in 2021 to $3.31 billion in 2022, marking a 127% increase. The category of cryptocurrency investment fraud within those complaints surged from $907 million in 2021 to $2.57 billion in 2022, reflecting a substantial 183% uptick. Furthermore, the IC3 registered 2,385 complaints related to ransomware, leading to adjusted losses of over $34.3 million.

Change in Working Dynamics and Growing Trends for Remote Operations

The post-pandemic period has led to a rapid transformation in global work dynamics, with a surge in remote and hybrid business operations. This culture change has brought about innovative alterations to traditional practices, including the introduction of the BYOD concept and remote work using organizational devices. Additionally, this shift has opened possibilities for data breaches, insecure data transfers, data integrity issues, and the need for disaster recovery management, all of which can be effectively addressed by digital vault solutions and services offering audit trails and monitoring, access control, and secure sharing features, among other capabilities. For instance, as per the International Journal of Creative Research Thoughts (IJCRT) 2023 report, currently, 12.7% of full-time employees work from home, while 28.2% work in a hybrid model. Those working as full-time employees from home illustrate the rapid normalization of remote work environments. Simultaneously, a significant 28.2% of employees are adopting a hybrid work model. This model combines both in-office work and working from home. Further, it is expected that 32.6 million American citizens will work remotely by 2025, whereas in the Indian scenario, this figure may vary from 60 million to 90 million until 2025.

Segmental Outlook

- Based on components, the market is segmented into software and solutions, and professional services.

- Based on deployment mode, the market is segmented into on-premises and cloud-based.

- Based on organization size, the market is segmented into large enterprises and small and medium-sized enterprises.

- Based on end-users, the market is segmented into BFSI, IT and telecom, healthcare, consumer goods and retail, government and defense, and other end-user (manufacturing).

Cloud Based Digital Vault is the Most Preferred Digital Vault Deployment Mode

Cloud-based digital vaults remain the preferred deployment type owing to cost-effectiveness, expansion capabilities, lower in-house maintenance costs, higher applicability for small businesses, and adaptability to diverse physical environments. For instance, in June 2024, Veeam introduced Veeam Data Cloud Vault, a secure cloud storage solution based on Microsoft Azure and seamlessly incorporated into Veeam Backup & Replication. This provides a reliable and infinitely expandable cloud storage destination with transparent pricing while adhering to the principles of zero-trust data protection.

Large Enterprises are the Prominent Organization Size-Segment

Large enterprises are the preferred organization size catered to by the digital vault service provider owing to the vast amount of data management and security requirements, the longer scope for serving large enterprises, regulatory compliance, reputation management, and the higher risk of cyber threats. For instance, in April 2024, Siemens, a company specializing in industry, infrastructure, transport, and healthcare technology, selected Digital Vault Services to digitize guarantees, demonstrating its commitment to innovation and productivity. By incorporating Digital Vault Services' cutting-edge Guarantee Vault Platform (GVP), Siemens advances its digital transformation efforts in its Guarantee Business, utilizing technology to improve operations and boost customer satisfaction.

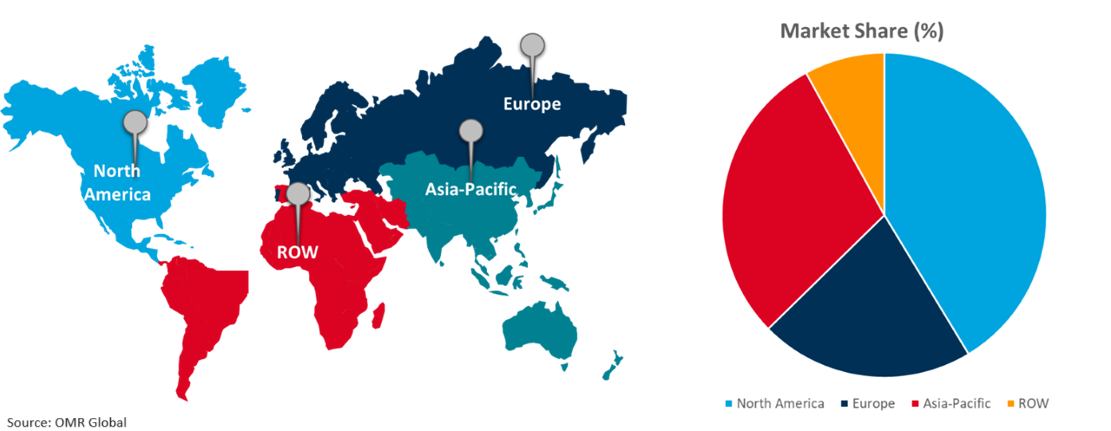

Regional Outlook

The global digital vault market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Holds a Significant Share in the Digital Vault Market

North America is predicted to demonstrate the highest growth rate in the future, attributed to substantial investment in IT infrastructure and cybersecurity, stringent regulatory requirements and efforts for data protection, the presence of a vast number of larger enterprises, a higher rate of digital transformation, and an increasing prevalence of cybercrimes. For instance, in February 2023, the Technology Modernization Fund (TMF) revealed new funding allocations aimed at enhancing cybersecurity and digital services for the Social Security Administration, the US Department of the Treasury, and the U.S. Agency for Global Media. An allocation of $23.3 million from the TMF will expedite the implementation of multi-factor authentication and bolster the security measures for an organization responsible for providing benefits to over 70 million individuals, which includes retirement and disability beneficiaries and their families.

Global Digital Vault Market Growth by Region 2024-2031

Asia-pacific is the Fastest Growing in Digital Vault Market

- The Asia-Pacific region exhibits ample scope for digital vault industry growth owing to substantial investment in cybersecurity and IT infrastructure.

- The region is also projected to demonstrate a substantial increase in the number of offices, organizations, and SMEs, which is expected to benefit the industry.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global digital vault market include IBM Corp., Oracle Corp., Hitachi Vantara, Johnson Control, Inc., Microsoft Corp., and Fiserv, Inc., among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in May 2023, BlueShore Financial revealed the launch of the BlueShore Digital Vault in partnership with FutureVault, a leading provider of secure document exchange and digital vault solutions. Through this initiative, BlueShore Financial aims to enhance its dedication to delivering an exceptional digital client experience.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global digital vault market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. IBM Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Hitachi Vantara LLC

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Microsoft Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Oracle Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Google, LLC.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Digital Vault Market by Component

4.1.1. Software and Solutions

4.1.2. Professional Services

4.2. Global Digital Vault Market by Deployment Mode

4.2.1. On-Premises

4.2.2. Cloud-Based

4.3. Global Digital Vault Market by Organization Size

4.3.1. Large Enterprises

4.3.2. Small and Medium-Sized Enterprises

4.4. Global Digital Vault Market by Organization Size

4.4.1. BFSI

4.4.2. IT and Telecom

4.4.3. Healthcare

4.4.4. Consumer Goods and Retail

4.4.5. Government and Defense

4.4.6. Other End-User (Manufacturing)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. CyberArk Software Ltd.

6.2. Digital Cloud Vault

6.3. Digital Vault Services GmbH

6.4. Fiserv, Inc.

6.5. FutureVault, Inc.

6.6. GoodTrust, Inc.

6.7. GTS Data B.V. (HYPERVAULT)

6.8. HashiCorp

6.9. Informatica, LLC

6.10. Johnson Controls, Inc.

6.11. Orange S.A.

6.12. Prisidio

6.13. ServiceNow, Inc.

6.14. SideDrawer Inc.

6.15. Skyflow, Inc.

6.16. Syncplicity LLC

6.17. Total Digital Security Corp.

6.18. Veeam Software Group GmbH

6.19. Veritas Technologies LLC

6.20. Virtual StrongBox

1. Global Digital Vault Market Research and Analysis by Component, 2023-2031 ($ Million)

2. Global Digital Vault Software and Solutions Market Research and Analysis by Region, 2023-2031 ($ Million)

3. Global Digital Vault Professional Services Market Research and Analysis by Region, 2023-2031 ($ Million)

4. Global Digital Vault Market Research and Analysis By Deployment Mode, 2023-2031 ($ Million)

5. Global On-Premises Digital Vault Market Research and Analysis by Region, 2023-2031 ($ Million)

6. Global Cloud-Based Digital Vault Market Research and Analysis by Region, 2023-2031 ($ Million)

7. Global Digital Vault Market Research and Analysis by Organization Size, 2023-2031 ($ Million)

8. Global Digital Vault for Large Enterprises Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Digital Vault Analysis for Small And Medium-Sized Enterprises Market Research And By Region, 2023-2031 ($ Million)

10. Global Digital Vault Market Research and Analysis by End-User, 2023-2031 ($ Million)

11. Global Digital Vault for BFSI Market Research and Analysis by Region, 2023-2031 ($ Million)

12. Global Digital Vault for IT And Telecom Market Research and Analysis by Region, 2023-2031 ($ Million)

13. Global Digital Vault for Healthcare Market Research and Analysis by Region, 2023-2031 ($ Million)

14. Global Digital Vault for Consumer Goods And Retail Market Research and Analysis by Region, 2023-2031 ($ Million)

15. Global Digital Vault for Government And Defense Market Research and Analysis by Region, 2023-2031 ($ Million)

16. Global Digital Vault for Other End-User Market Research and Analysis by Region, 2023-2031 ($ Million)

17. North American Digital Vault Market Research and Analysis by Country, 2023-2031 ($ Million)

18. North American Digital Vault Market Research and Analysis by Component, 2023-2031 ($ Million)

19. North American Digital Vault Market Research and Analysis by Deployment Mode, 2023-2031 ($ Million)

20. North American Digital Vault Market Research And Analysis End-User, 2023-2031 ($ Million)

21. North American Digital Vault Market Research and Analysis by Organization Size, 2023-2031 ($ Million)

22. European Digital Vault Market Research and Analysis by Country, 2023-2031 ($ Million)

23. European Digital Vault Market Research and Analysis by Component, 2023-2031 ($ Million)

24. European Digital Vault Market Research and Analysis by Deployment Mode, 2023-2031 ($ Million)

25. European Digital Vault Market Research and Analysis by Organization Size, 2023-2031 ($ Million)

26. European Digital Vault Market Research and Analysis by End-User, 2023-2031 ($ Million)

27. Asia-Pacific Digital Vault Market Research and Analysis by Country, 2023-2031 ($ Million)

28. Asia-Pacific Digital Vault Market Research and Analysis by Component, 2023-2031 ($ Million)

29. Asia-Pacific Digital Vault Market Research and Analysis by Deployment Mode, 2023-2031 ($ Million)

30. Asia-Pacific Digital Vault Market Research and Analysis by Organization Size, 2023-2031 ($ Million)

31. Asia-Pacific Digital Vault Market Research and Analysis by End-User, 2023-2031 ($ Million)

32. Rest of The World Digital Vault Market Research and Analysis by Region, 2023-2031 ($ Million)

33. Rest of The World Digital Vault Market Research and Analysis by Component, 2023-2031 ($ Million)

34. Rest of The World Digital Vault Market Research and Analysis by Deployment Mode, 2023-2031 ($ Million)

35. Rest of The World Digital Vault Market Research and Analysis by Organization Size, 2023-2031 ($ Million)

36. Rest of The World Digital Vault Market Research and Analysis by End-User 2023-2031 ($ Million)

1. Global Digital Vault Market Share by Component, 2023 Vs 2031 (%)

2. Global Digital Vault Software and Solutions Market Share by Region, 2023 Vs 2031 (%)

3. Global Digital Vault Professional Services Market Share by Region, 2023 Vs 2031 (%)

4. Global Digital Vault Market Share by Deployment Mode, 2023 Vs 2031 (%)

5. Global On-Premise Digital Vault Market Share by Region, 2023 Vs 2031 (%)

6. Global Cloud-Based Digital Vault Market Share by Region, 2023 Vs 2031 (%)

7. Global Digital Vault Market Share by Organization Size, 2023 Vs 2031 (%)

8. Global Digital Vault for Large Enterprises Market Share by Region, 2023 Vs 2031 (%)

9. Global Digital Vault for Small and Medium Sized Enterprises Market Share by Region, 2023 Vs 2031 (%)

10. Global Digital Vault Market Share by End-User, 2023 Vs 2031 (%)

11. Global Digital Vault for BFSI Market Share by Region, 2023 Vs 2031 (%)

12. Global Digital Vault for IT and Telecom Market Share by Region, 2023 Vs 2031 (%)

13. Global Digital Vault for Consumer Goods and Retail Market Share by Region, 2023 Vs 2031 (%)

14. Global Digital Vault for Government and Defense Market Share by Region, 2023 Vs 2031 (%)

15. Global Digital Vault for Healthcare Market Share by Region, 2023 Vs 2031 (%)

16. Global Digital Vault for Other End User Market Share by Region, 2023 Vs 2031 (%)

17. Global Digital Vault Market Share by Region, 2023 Vs 2031 (%)

18. US Digital Vault Market Size, 2023-2031 ($ Million)

19. Canada Digital Vault Market Size, 2023-2031 ($ Million)

20. UK Digital Vault Market Size, 2023-2031 ($ Million)

21. France Digital Vault Market Size, 2023-2031 ($ Million)

22. Germany Digital Vault Market Size, 2023-2031 ($ Million)

23. Italy Digital Vault Market Size, 2023-2031 ($ Million)

24. Spain Digital Vault Market Size, 2023-2031 ($ Million)

25. Rest of Europe Digital Vault Market Size, 2023-2031 ($ Million)

26. India Digital Vault Market Size, 2023-2031 ($ Million)

27. China Digital Vault Market Size, 2023-2031 ($ Million)

28. Japan Digital Vault Market Size, 2023-2031 ($ Million)

29. South Korea Digital Vault Market Size, 2023-2031 ($ Million)

30. Rest of Asia-Pacific Digital Vault Market Size, 2023-2031 ($ Million)

31. Latin America Digital Vault Market Size, 2023-2031 ($ Million)

32. Middle East And Africa Digital Vault Market Size, 2023-2031 ($ Million)