Digital Workplace Market

Global Digital Workplace Market Size, Share & Trends Analysis Report By Deployment (On-Premises and Cloud-Based), By Vertical (Telecommunication and IT-Enabled Services, BFSI, Healthcare & Pharmaceuticals, Retail & Consumer Goods, Media & Entertainment, and others) Forecast, 2021-2027 Update Available - Forecast 2025-2035

The global market for the digital workplace is projected to have a considerable CAGR of around 12.5% during the forecast period. The factors driving the growth of the global digital workplace market include the growing need to reduce operational costs, and the increasing adoption of cloud-based services in various sectors and industries. Moreover, the demand for remote work is increasing as a result of globalization, and the rising real estate costs. Digital workplaces will be becoming more accessible from any device and any location. Therefore, an increase in employee demand for remote working capabilities in terms of achieving work-life balance and ever-changing workplace culture will be the prominent factors driving the market. Further, increasing adoption of workplace transformation and enterprises mobility services among small and medium-sized enterprises (SME’s) are creating an opportunity for the growth of the digital workplaces market. However, the high cost involved in digitizing the workplace may be the restraining factor for the market.

Impact of COVID-19 on Digital Workplace market

The COVID-19 pandemic has had a significant impact on the market. The pandemic has influenced various organizations to accelerate digital adoption for the implementation of best practices. The spread of the COVID-19 along with the restrictions imposed for in-person meetings for non-essential business encouraged these adoptions tremendously.

Segmental Outlook

The global digital workplace market is segmented based on deployment, organization size, and vertical. Based on the deployment, the market is further classified into on-premises, and cloud. Further, based on the vertical the market is classified into telecommunication and IT-enabled services, BFSI, healthcare & pharmaceuticals, retail & consumer goods, media & entertainment, and others.

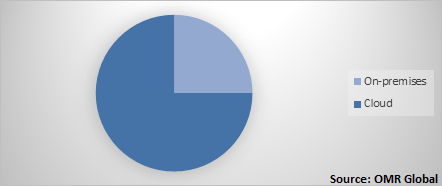

Global Digital Workplace Market Share by Deployment, 2020 (%)

Cloud-Based deployment is considered the dominating segment in the global Digital Workplace market

Among deployment, the cloud-based deployment is estimated as dominating segment during the forecast period owing to some benefits associated such as no need for manpower for hardware maintenance, the fast and more efficient delivery of results along with complete adaptability. The cloud-based deployment facilitates users to run data analytics in real-time from remote locations. Moreover, they also offer cost-saving advantages, increasing enterprise operational efficiency and lowering operational costs. Further, SMEs are largely adopting cloud computing services due to significant benefits such as no initial infrastructure setup costs involved and availability of on-demand compute services, therefore creating an opportunity for the growth of the market. However, as the business needs are changing, there’s an increase in data breaches and cyber-attacks that is resulting in the increase in the need to meeting regulatory and compliance requirements restraining the growth of the segment.

Regional Outlook

Geographically, the global Digital Workplace market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). North America is projected to have a significant share in the digital workplace market. The growth is attributed to the presence of a huge number of market players with massive technical expertise in the region. The rising adoption of advanced technologies such as Augmented Reality (AR), Robotic Process Automation (RPA), and Artificial Intelligence (AI) and a shift towards the secure Internet of Things (IoT) gateway communications, are expected to drive market growth in the region. Further, North America is anticipated to be the most promising region for various verticals including BFSI, manufacturing, and telecommunication.

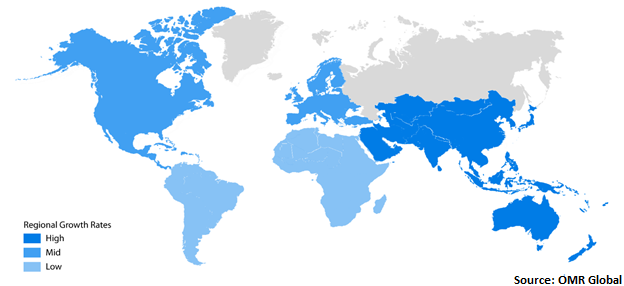

Global Digital Workplace Market Growth, by region 2021-2027

Asia-Pacific to hold a considerable CAGR in the global Digital Workplace market

Geographically, Asia-Pacific is projected to hold a significant CAGR in the global digital workplace market during the forecast period. The factors that are contributing to the growth of the market include the growth of the retail sector in China, Japan, and India, along with the presence of a large number of IT companies such as TCS, Infosys and others in the region. Additionally, the significant growth of remote working that focuses upon high-quality services for a better customer experience is also expected to drive market growth during the forecast period.

Market Players Outlook

The key players in the digital workplace market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include - IBM Corp, Accenture plc, Cognizant Technology Solutions Corp, Wipro Ltd, and Hewlett Packard Enterprise Co. among others. These market players adopt various strategies such as product launches, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. In May 2020, Amelia US LLC expanded its partnership with Unisys Corporation, where the collaboration's goal is to integrate cognitive AI capabilities into InteliServe of Unisys' widely used workplace automation platform that transforms how users interact with the service desk. Further, companies collaborate to provide a unified set of cognitive technology that addresses all workplace issues, right from technology and HR to legal and financial services.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global digital workplace market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying 'who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Digital Workplace Industry

• Recovery Scenario of Global Digital Workplace Industry

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Porter’s Analysis

2.2.3. Recommendations

2.2.4. Conclusion

2.3. Regulations

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. IBM Corp.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Accenture plc

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Cognizant Technology Solutions Corp

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Wipro Ltd

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Hewlett Packard Enterprise Co

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Digital Workplace Market by Deployment

5.1.1. On-Premises

5.1.2. Cloud-based

5.2. Global Digital Workplace Market by Vertical

5.2.1. Telecommunication And IT-Enabled Services

5.2.2. BFSI

5.2.3. Healthcare And Pharmaceuticals

5.2.4. Retail & Consumer Goods

5.2.5. Media & Entertainment

5.2.6. Other (Manufacturing, Government)

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Atos SE.

7.2. Infosys Ltd.

7.3. Fujitsu Ltd.

7.4. Citrix Systems, Inc

7.5. Capgemini SE

7.6. HCL Technologies Ltd.

7.7. DXC Technology Co.

7.8. NTT Data Corp.

7.9. Unisys Corp.

7.10. Tata Consultancy Services Ltd.

7.11. Sonda S. A.

7.12. Kissflow Inc.

7.13. Zensar Technologies Ltd.

1. GLOBAL DIGITAL WORKPLACEMARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2020-2027 ($ MILLION)

2. GLOBAL ON-PREMISES DIGITAL WORKPLACE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL CLOUD-BASED DIGITAL WORKPLACE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL DIGITAL WORKPLACE MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2020-2027 ($ MILLION)

5. GLOBAL DIGITAL WORKPLACE FOR TELECOMMUNICATION AND IT-ENABLED SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL DIGITAL WORKPLACE FOR BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL DIGITAL WORKPLACE FOR HEALTHCARE AND PHARMACEUTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL DIGITAL WORKPLACE FOR RETAIL & CONSUMER GOODS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL DIGITAL WORKPLACE FOR MEDIA & ENTERTAINMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL DIGITAL WORKPLACE FOR OTHER VERTICALS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL DIGITAL WORKPLACE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

12. NORTH AMERICAN DIGITAL WORKPLACE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

13. NORTH AMERICAN DIGITAL WORKPLACE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2020-2027 ($ MILLION)

14. NORTH AMERICAN DIGITAL WORKPLACE MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2020-2027 ($ MILLION)

15. EUROPEAN DIGITAL WORKPLACE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

16. EUROPEAN DIGITAL WORKPLACE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2020-2027 ($ MILLION)

17. EUROPEAN DIGITAL WORKPLACE MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2020-2027 ($ MILLION)

18. ASIA-PACIFIC DIGITAL WORKPLACE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

19. ASIA-PACIFIC DIGITAL WORKPLACE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2020-2027 ($ MILLION)

20. ASIA-PACIFIC DIGITAL WORKPLACE MARKET RESEARCH AND ANALYSIS BY VERTICAL SIZE, 2020-2027 ($ MILLION)

21. REST OF THE WORLD DIGITAL WORKPLACE MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2020-2027 ($ MILLION)

22. REST OF THE WORLD DIGITAL WORKPLACE MARKET RESEARCH AND ANALYSIS BY VERTICAL, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL DIGITAL WORKPLACEMARKET, 2020-2027 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL DIGITAL WORKPLACEMARKET BY SEGMENT, 2020-2027 (% MILLION)

3. RECOVERY OF GLOBAL DIGITAL WORKPLACE MARKET, 2020-2027 (%)

4. GLOBAL DIGITAL WORKPLACE MARKET SHARE BY DEPLOYMENT, 2020 VS 2027 (%)

5. GLOBAL DIGITAL WORKPLACE MARKET SHARE BY VERTICAL, 2020 VS 2027 (%)

6. GLOBAL ON-PREMISES DIGITAL WORKPLACE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL CLOUD-BASED DIGITAL WORKPLACE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL DIGITAL WORKPLACE FOR TELECOMMUNICATION AND IT-ENABLED SERVICES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL DIGITAL WORKPLACE FOR BANKING, FINANCIAL SERVICES, AND INSURANCE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL DIGITAL WORKPLACE FOR HEALTHCARE AND PHARMACEUTICALS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

11. GLOBAL DIGITAL WORKPLACE FOR RETAIL & CONSUMER GOODS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL DIGITAL WORKPLACE FOR MEDIA & ENTERTAINMENT MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL DIGITAL WORKPLACE FOR OTHER VERTICALS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

14. GLOBAL DIGITAL WORKPLACE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. US DIGITAL WORKPLACE MARKET SIZE, 2020-2027 ($ MILLION)

16. CANADA DIGITAL WORKPLACE MARKET SIZE, 2020-2027 ($ MILLION)

17. UK DIGITAL WORKPLACE MARKET SIZE, 2020-2027 ($ MILLION)

18. FRANCE DIGITAL WORKPLACE MARKET SIZE, 2020-2027 ($ MILLION)

19. GERMANY DIGITAL WORKPLACE MARKET SIZE, 2020-2027 ($ MILLION)

20. ITALY DIGITAL WORKPLACE MARKET SIZE, 2020-2027 ($ MILLION)

21. SPAIN DIGITAL WORKPLACE MARKET SIZE, 2020-2027 ($ MILLION)

22. ROE DIGITAL WORKPLACE MARKET SIZE, 2020-2027 ($ MILLION)

23. INDIA DIGITAL WORKPLACE MARKET SIZE, 2020-2027 ($ MILLION)

24. CHINA DIGITAL WORKPLACE MARKET SIZE, 2020-2027 ($ MILLION)

25. JAPAN DIGITAL WORKPLACE MARKET SIZE, 2020-2027 ($ MILLION)

26. ASEAN DIGITAL WORKPLACE MARKET SIZE, 2020-2027 ($ MILLION)

27. SOUTH KOREA DIGITAL WORKPLACE MARKET SIZE, 2020-2027 ($ MILLION)

28. REST OF ASIA-PACIFIC DIGITAL WORKPLACE MARKET SIZE, 2020-2027 ($ MILLION)

29. REST OF THE WORLD DIGITAL WORKPLACE MARKET SIZE, 2020-2027 ($ MILLION)