Dimer Acid-Based (DAB) Polyamide Resin Market

Dimer Acid-Based (DAB) Polyamide Resin Market Size, Share & Trends Analysis Report by Product Type (Benzene-soluble DAB Polyamide Resins and Alcohol-soluble DAB Polyamide Resins), and by Application (Decorative Coatings, Fabrics, Interlining, Shoe Stretch, Fold Plastic and Baotou Glue) Forecast Period (2024-2031)

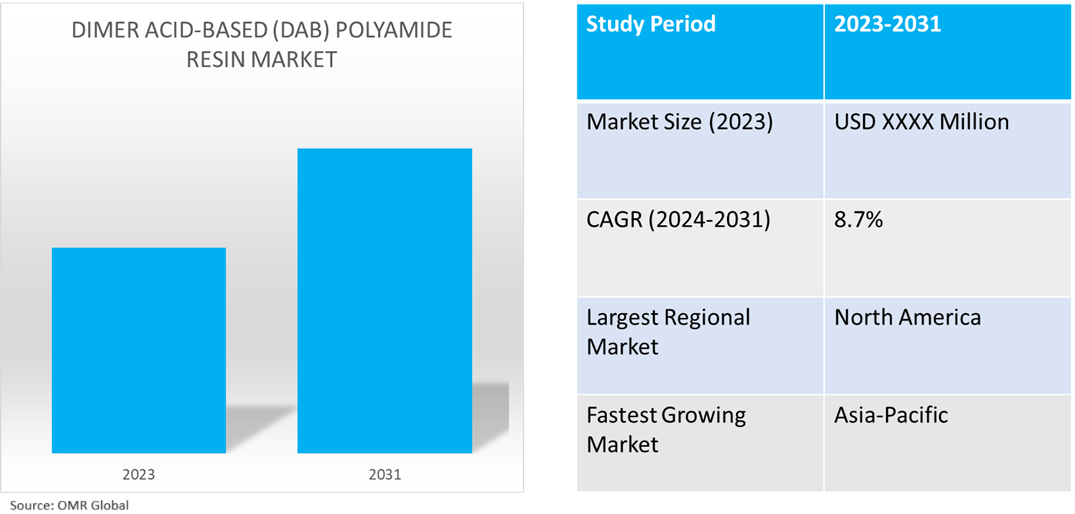

Dimer acid-based (DAB) polyamide resin market is anticipated to grow at a significant CAGR of 8.7% during the forecast period (2024-2031). The market growth is attributed to the growing demand for bio-based raw materials. The development of low-volatile organic compounds (VOC), and the customization of resin properties to meet specific application requirements, such as flexibility for textile coatings or toughness for industrial adhesives further aid the global dimer acid-based polyamide resin market.

Market Dynamics

Increasing Demand in End-Use Industries

The adaptability of DAB polyamide resins, which makes them appropriate for several applications across various end-use industries is promoting the market's expansion. The resins' capacity to improve coatings' toughness and functionality has led to an increase in their application in the building and automotive industries. To cater to the growing demand for this material, key players are offering products for specific applications. For instance, Kuraray Europe GmbH offers GENESTAR Polyamide resins and fibers. Kuraray markets polyamide fibers and resins for various applications. GENESTAR heat-resistant polyamide resin is a long-chain polyphthalamide (PPA) made from Kuraray’s C9-technology. It combines high-temperature performance with chemical resistance and low water absorption. This product is used in the automotive industry for demanding applications such as gears, fuel lines, and thermostat housings.

Growing Demand for Sustainable Chemicals

DAB polyamide resins are low toxicity and sourced from renewable resources, their popularity has been spurred by the increased need for sustainable and eco-friendly products. The growing demand for eco-friendly chemicals is a key contributor to the rising global market demand. The development of newer formulations with superior qualities may result from the increased focus on technological developments and research and development efforts, creating new growth opportunities. Furthermore, producers are investigating sustainable alternatives in response to growing consumer awareness of the negative environmental effects of conventional polymers, with DAB polyamide resins being positioned as a potential remedy.

Market Segmentation

- Based on the product type, the market is segmented into benzene-soluble DAB polyamide resins and alcohol-soluble DAB polyamide resins.

- Based on the application, the market is segmented into decorative coatings, fabrics, interlining, shoe stretch, fold plastic, and Baotou glue.

Benzene-soluble DAB Polyamide Resins is projected to hold the Largest Segment

The benzene-soluble DAB polyamide resins segment is expected to hold the largest share of the market. The primary factors supporting the growth include exceptional performance characteristics, including high chemical resistance, flexibility, and adhesion properties. A key attribute supporting its superiority is its broad range of uses. They are the perfect materials for various applications owing to their exceptional stickiness, ease of processing, and flexibility. These use cases include coatings, adhesives, and printing inks. Through their broad application and dependable manufacturing procedures, benzene-soluble DAB resins are widely utilized in the end-user industry.

Decorative Coatings Segment to Hold a Considerable Market Share

The decorative coatings segment is expected to hold a considerable share of the market. The factors supporting segment growth include increasing significance of durability and aesthetics for paints and coatings that align well with the characteristics of these resins. Increasing the adherence, flexibility, and chemical resistance of the material results in improved performance for the decorative uses of sporting and recreational goods. This makes DAB resins an appealing substitute for other finishes on many types of furniture, architectural coatings, and high-traffic locations. The DAB polyamide resin business is expected to expand mostly through decorative coatings owing to the growing demand for excellent visual quality and good durability finishing.

Regional Outlook

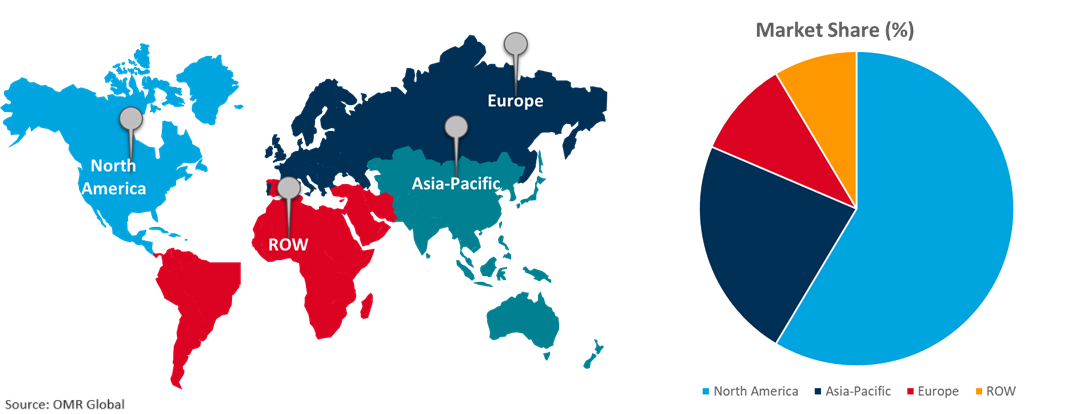

The global dimer acid-based polyamide resin market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Adoption of Dimer Acid-based Polyamide Resins in Asia-Pacific

- The regional growth is attributed to the growing adoption of DAB polyamide resins across the region. Urbanization and rising disposable income in various industries in this region are important contributors to the strong demand for sophisticated materials.

- Market players in the region offer high-performance polyamide resin with excellent heat resistance, high rigidity, and appearance. For instance, TOYOBO MC Corp. offers GLAMIDE thermoplastic polyamide resin, which was developed using advanced polymerization and compounding technologies. It is widely used in automotive parts and industrial machinery parts.

Global Dimer Acid-based Polyamide Resin Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant market share owing to numerous prominent DAB polyamide resin companies and providers such as Florachem Corp., Hexion Inc., Huntsman Corp., and Kraton Corp., in the region. The market growth is attributed to the expanding creativity and enhancing DAB resin compositions. As it develops new generations of premium materials with integrated functionalities, innovation is getting to work across the region. The regional market player’s specifically possible development of improvements such as heat resistance for powder coatings and chemical tolerance for industrial applications. This feature of customization could address industry-specific requirements and expand the range of target audiences of DAB resins. For instance, Huntsman Corp. provides VERSAMID 100 polyamide-curing agents a reactive polyamide resin based on dimerized fatty acid and polyamines designed for use with solid or liquid epoxy resins for room-temperature cure thermoset coating applications.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the dimer acid-based polyamide resin market include Arkema Group, Henkel AG & Co. KGaA, Cargill, Inc., Huntsman Corp., and Dow Chemical Co., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In June 2021, Evonik and SI Coatings developed a water-based primer for polyamide coatings. In addition, they must be resilient against external influences so that the coating provides lasting protection. Evonik's VESTOSINT polyamide 12 fluidized bed powders have proven their performance here for many years.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the dimer acid-based polyamide resin market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Arkema Group

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Henkel AG & Co. KGaA

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Huntsman Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. The Dow Chemical Co.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Dimer Acid-based (DAB) Polyamide Resin Market by Product Type

4.1.1. Benzene-Soluble DAB Polyamide Resins

4.1.2. Alcohol-Soluble DAB Polyamide Resins

4.2. Global Dimer Acid-based (DAB) Polyamide Resin Market by Application

4.2.1. Decorative Coatings

4.2.2. Fabrics

4.2.3. Interlining

4.2.4. Shoe Stretch

4.2.5. Fold Plastic

4.2.6. Baotou Glue

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Anqing Hongyu Chemical Co., Ltd.

6.2. Aturex Group

6.3. Croda International Plc

6.4. Emery Oleochemicals

6.5. Florachem Corp.

6.6. Haohua Industry Co., Ltd.

6.7. Harima Chemicals Group

6.8. Hexion Inc.

6.9. Hubei Phoenix Chemical Company Ltd.

6.10. Kraton Corp.

6.11. Kumar Organic Products Ltd.

6.12. Nouryon Chemicals Holding B.V.

6.13. Shandong Huijin Chemical Co., Ltd.

6.14. Sichuan Tianyu Oleochemical Co., Ltd.

6.15. Teknor Apex Company, Inc.

6.16. The Lubrizol Corp.

1. GLOBAL DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL BENZENE-SOLUBLE DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL ALCOHOL-SOLUBLE DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

5. GLOBAL DIMER ACID-BASED (DAB) POLYAMIDE RESIN FOR DECORATIVE COATINGS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL DIMER ACID-BASED (DAB) POLYAMIDE RESIN FOR FABRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL DIMER ACID-BASED (DAB) POLYAMIDE RESIN FOR INTERLINING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL DIMER ACID-BASED (DAB) POLYAMIDE RESIN FOR SHOE STRETCH MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL DIMER ACID-BASED (DAB) POLYAMIDE RESIN FOR FOLD PLASTIC MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL DIMER ACID-BASED (DAB) POLYAMIDE RESIN FOR BAOTOU GLUE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

15. EUROPEAN DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. EUROPEAN DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

17. EUROPEAN DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. REST OF THE WORLD DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

23. REST OF THE WORLD DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL BENZENE-SOLUBLE DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL ALCOHOL-SOLUBLE DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

5. GLOBAL DIMER ACID-BASED (DAB) POLYAMIDE RESIN FOR DECORATIVE COATINGS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL DIMER ACID-BASED (DAB) POLYAMIDE RESIN FOR FABRICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL DIMER ACID-BASED (DAB) POLYAMIDE RESIN FOR INTERLINING MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL DIMER ACID-BASED (DAB) POLYAMIDE RESIN FOR SHOE STRETCH MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL DIMER ACID-BASED (DAB) POLYAMIDE RESIN FOR FOLD PLASTIC MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL DIMER ACID-BASED (DAB) POLYAMIDE RESIN FOR BAOTOU GLUE MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. US DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET SIZE, 2023-2031 ($ MILLION)

14. UK DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA DIMER ACID-BASED (DAB) POLYAMIDE RESIN MARKET SIZE, 2023-2031 ($ MILLION)